-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Chairman Powell Calms Hawkish Tempo

EXECUTIVE SUMMARY

- MNI: POWELL: COULD BE APPROPRIATE TO START TAPER 'THIS YEAR'

- KAPLAN: WANTS ASSET-PURCHASE ADJUSTMENTS STARTING SOON, Bbg

- Bostic: Expect First Increase Hike to Happen at the End of 2022, Bbg

- FED'S BOSTIC SAYS `REASONABLE' TO TRIM BOND-BUYING IN OCT, RTRS

- MESTER WOULD LIKE FED TO START TAPERING THIS YEAR, Bbg

- MESTER WOULD LIKE TAPER TO END IN THE MIDDLE OF 2022, Bbg

- FED HARKER: SUPPORTS TAPERING SOONER RATHER THAN LATER BUT THE DELTA VARIANT AND OTHER VARIANTS ARE A CAVEAT, Reuters

- BULLARD: IF PRICES DON'T MODERATE, MIGHT HAVE TO APPLY PRESSURE, Bbg

- BULLARD NOW SEES CORE PCE INFLATION 2.5% OR HIGHER IN 2022, Bbg

- BULLARD SAYS FED ASSET PURCHASES 'DON'T HAVE MUCH VALUE' NOW, Bbg

- CLARIDA: EXPECT HIGH INFLATION TO BE LARGELY TRANSITORY, Bbg

- CLARIDA: EXPECT ROBUST JOB GAINS IN THE FALL, Bbg

- EU MOVES TO REINTRODUCE COVID TRAVEL CURBS ON U.S.: REUTERS

FED CHAIRMAN POWELL: Instant Answers

- Does Powell say it could be appropriate to start the taper "this year"? YES. "At the FOMC's recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year."

- Does Powell say it could be appropriate to start the taper "soon" or "relatively soon"? NO.

- Does Powell say the economy is close to or nearing or approaching "substantial further progress" on the max employment goal? NO. "My view is that the 'substantial further progress' test has been met for inflation. There has also been clear progress toward maximum employment."

- Does Powell clarify the meaning of the term "advance notice"? NO.

- Does Powell refer to rising risks to the economic outlook from the Delta Covid variant? YES, but very lightly. "While the Delta variant presents a near-term risk, the prospects are good for continued progress toward maximum employment. ... For now, I believe that policy is well positioned; as always, we are prepared to adjust policy as appropriate to achieve our goals."

- Does Powell say that rate hikes are likely to begin only after the taper process is complete? NO. "The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test."

OVERNIGHT DATA

- U.S. AUG. KANSAS CITY FED MANUFACTURING ACTIVITY AT 29.0

MARKET SNAPSHOT

Key late session market levels

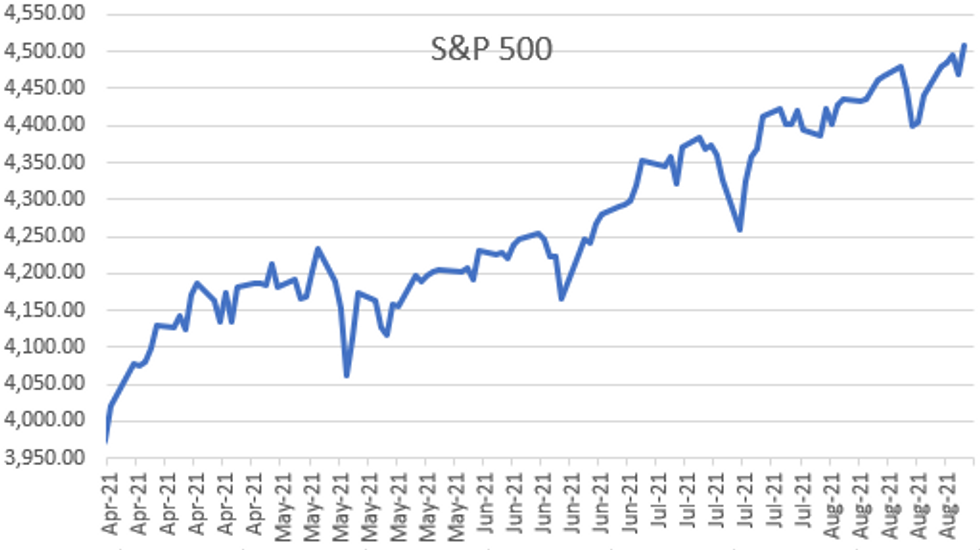

- DJIA up 229.13 points (0.65%) at 35441.63

- S&P E-Mini Future up 39 points (0.87%) at 4505.25

- Nasdaq up 185.9 points (1.2%) at 15131.23

- US 10-Yr yield is down 3.9 bps at 1.3104%

- US Sep 10Y are up 10/32 at 133-29

- EURUSD up 0.0043 (0.37%) at 1.1795

- USDJPY down 0.25 (-0.23%) at 109.84

- WTI Crude Oil (front-month) up $1.34 (1.99%) at $68.77

- Gold is up $24.98 (1.39%) at $1817.44

- EuroStoxx 50 up 21.11 points (0.51%) at 4190.98

- FTSE 100 up 23.03 points (0.32%) at 7148.01

- German DAX up 58.13 points (0.37%) at 15851.75

- French CAC 40 up 15.89 points (0.24%) at 6681.92

US TSYS: Calming Tones of Fed Chair Powell, Equities New Highs

Quiet finish to week and an eagerly awaited session focused on KC Fed's Jackson Hole economic symposium. Hawkish buildup -- six generally hawkish Fed speakers interviewed on CNBC, Bbg prior to the Fed chair speech: Macroeconomic Policy in an Uneven Economy (not to mention KC Fed's George, StL's Bullard and Dallas' Kaplan on Thu).- Rates pared losses/marched higher after Fed Chair Powell's calming/dovish tones: modest pace of tapering, hikes on hold, inflation transitory. Improved risk appetite: S&P eminis made new all-time highs, ESU1 4509.75 +42.75; Gold surged over 25.0, Crude climbed to 69.5 high, while US$ weakened: DXY index -3.98 to 92.664 after the rates close.

- Heavy futures volume: Sep/Dec Tsy rolling nearly complete before Dec takes lead next Tuesday, while Sep option expiry generated decent two-way trade as TYU neared strike with appr 160k open interest.

- Eurodollar futures: over -80,000 EDM2/EDU2 (Jun/Red Sep'22) spds sold at +0.090 to 0.085 last few minutes. Traders note that Reds (EDU2-EDM3) and Greens (EDU3-EDM4) were trading higher pre-Fed chair comments on rate hike positioning -- are scaling back gains with Greens-Blues (EDU3-EDM5) outperforming on unwinds of hike positioning in general. "Market now feels caught" one desk offered.

- The 2-Yr yield is down 2.6bps at 0.2151%, 5-Yr is down 5bps at 0.7995%, 10-Yr is down 3.9bps at 1.3104%, and 30-Yr is down 3.1bps at 1.9154%.

MONTH-END EXTENSIONS: UPDATED Barclays/Bbg Extension Estimates for US

UPDATED forecast summary compared to avg increase for prior year and same time in 2020. Noted gain in MBS extension to 0.14 from 0.10 prelim estimate. US Gov linker 0.13Y.

| SECURITY | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.12 | 0.09 | 0.16 |

| Agencies | 0.05 | 0.05 | 0.14 |

| Credit | 0.09 | 0.12 | 0.12 |

| Govt/Credit | 0.11 | 0.1 | 0.14 |

| MBS | 0.14 | 0.06 | 0.08 |

| Aggregate | 0.11 | 0.09 | 0.12 |

| Long Gov/Cr | 0.13 | 0.09 | 0.09 |

| Iterm Credit | 0.06 | 0.1 | 0.07 |

| Interm Gov | 0.1 | 0.08 | 0.11 |

| Interm Gov/Cr | 0.09 | 0.09 | 0.09 |

| High Yield | 0.09 | 0.11 | 0.13 |

US TSY FUTURES CLOSE

- 3M10Y -3.873, 125.971 (L: 125.803 / H: 130.697)

- 2Y10Y -1.127, 109.337 (L: 108.583 / H: 111.136)

- 2Y30Y -0.329, 169.901 (L: 167.428 / H: 171.496)

- 5Y30Y +2.05, 111.655 (L: 106.706 / H: 113.088)

- Current futures levels:

- Sep 2Y up 1.625/32 at 110-9.75 (L: 110-07.75 / H: 110-09.875)

- Sep 5Y up 7.25/32 at 124-1.25 (L: 123-22.75 / H: 124-01.75)

- Sep 10Y up 10/32 at 133-29 (L: 133-13.5 / H: 133-30)

- Sep 30Y up 15/32 at 164-17 (L: 163-26 / H: 164-17)

- Sep Ultra 30Y up 1-1/32 at 199-13 (L: 198-03 / H: 199-13)

US TSY FUTURES: Quarterly Futures Roll Nearly Complete

Last roll update -- nearly complete before Dec futures take lead quarterly position next Tuesday. Current lvls:

- TUU/TUZ 332,600 from 5.0 to 5.5, 5.12 last; 89% complete

- FVU/FVZ 465,900 from 15.0-15.75, 15.0 last; 95% complete

- TYU/TYZ 1,125,700 from 18.75 to 19.75, 19.0 last; 90% complete

- UXYU/UXYZ 181,700, 1-27.5 last; 91% complete

- USU/USZ 122,700 from 1-17.5 to 1-18, 1-17.75 last; 92% complete

- WNU/WNZ 96,700, 1-24 last; 89% complete

US EURODOLLAR FUTURES CLOSE

- Sep 21 +0.005 at 99.878

- Dec 21 +0.010 at 99.815

- Mar 22 +0.015 at 99.855

- Jun 22 +0.010 at 99.810

- Red Pack (Sep 22-Jun 23) +0.025 to +0.035

- Green Pack (Sep 23-Jun 24) +0.040 to +0.055

- Blue Pack (Sep 24-Jun 25) +0.045 to +0.050

- Gold Pack (Sep 25-Jun 26) +0.030 to +0.040

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N +0.00038 at 0.07613% (-0.00125/wk)

- 1 Month +0.00137 to 0.08600% (+0.00012/wk)

- 3 Month -0.00087 to 0.11988% (-0.00850/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00313 to 0.15475% (+0.00213/wk)

- 1 Year -0.00025 to 0.23513% (-0.00150/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $246B

- Secured Overnight Financing Rate (SOFR): 0.05%, $864B

- Broad General Collateral Rate (BGCR): 0.05%, $377B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $350B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $3.845B submission

- Next scheduled purchases

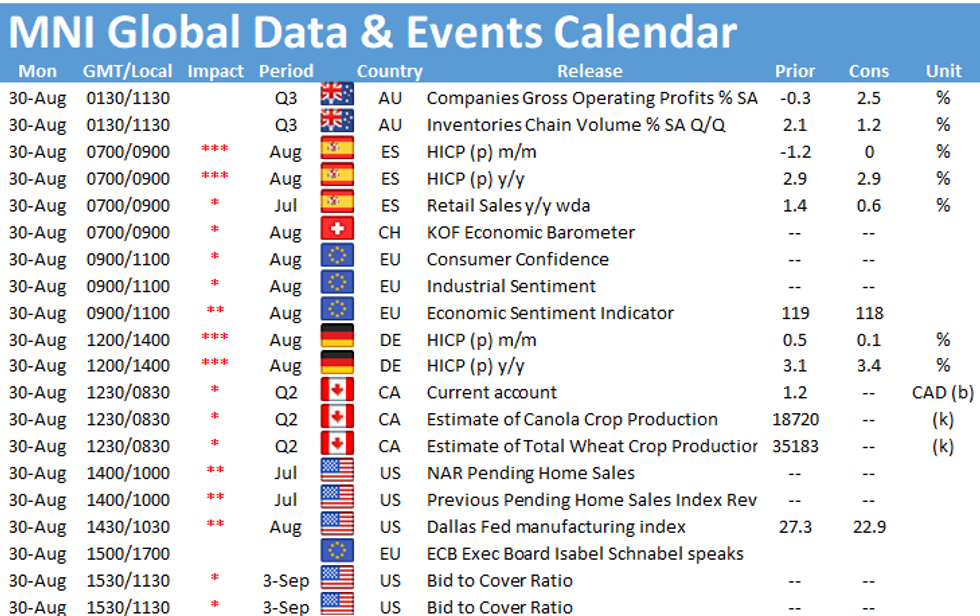

- Mon 8/30 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B

- Tue 8/31 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 9/01 1100-1120ET: Tsy 7Y-10Y, appr $3.225B

- Thu 9/02 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 9/03 no buy operation ahead holiday, resume Tuesday Sep 7

FED: REVERSE REPO OPERATION

NY Fed reverse repo usage climbs to 1,120.015B from 76 counter-parties vs. $1,091.792B on Thursday. Record high of $1,147.089B set Wednesday, Aug 25.

FOREX

US$ weakened after Fed Chair Powell comments today from remote Jackson Hole eco-summit event: modest pace of tapering, hikes on hold, inflation transitory. DXY index -3.70 to 92.692 after the rates close.

- USDJPY still trades in a range. Despite recent gains, the pair appears vulnerable and attention remains on the key support at 108.72, Aug 4 low. A breach of this level would strengthen a bearish case and expose the 108.47 Fibonacci retracement. For bulls, key near-term resistance is unchanged at 110.80, Aug 11 high. A break would ease bearish concerns and instead open key resistance at 111.66, Jul 2 high.

EGB/Gilt: Drifting higher after Powell, back to domestic next week

EGBs and gilts waited patiently for Fed's Powell to speak, moving little through the European morning and early US session before drifting higher.

- Bund futures hit their low of the day just ahead of Powell's speech (175.66 - the lowest in over a month) but at the time of writing had recovered to a high of 176.10 (close to yesterday's low of 176.14) and are now trading around 176.00.

- Gilt futures moved to a high of 129.74, above yesterday's high but a long way from Wednesday's high above 130.

- With equities generally moving higher post-Powell, Eurozone spreads have generally tightened on the day, led by 10-year BTP spreads coming in 2.2bp and Portuguese 10-year spreads 1.3bp. The exception in peripheral space was Greek spreads which have widened 0.5bp, continuing yesterday's widening.

- With Powell's speech out of the way, and with the caveat of geopolitical risk lingering with Afghan events, European markets can go back to focusing on more domestic events. Supply is due to pick up next week after the summer lull while the ECB meets the following week and markets are already looking ahead to 6-months time when PEPP is scheduled to end and what that means for the APP and markets more generally.

- Gilt futures are up 0.13 today at 128.66 with 10y yields down -2.3bp at 0.577% and 2y yields down -2.6bp at 0.113%.

- Bund futures are up 0.02 today at 175.95 with 10y Bund yields down -1.7bp at -0.425% and Schatz yields down -0.4bp at -0.748%.

- BTP futures are up 0.42 today at 154.18 with 10y yields down -3.8bp at 0.631% and 2y yields down -1.4bp at -0.501%.

- OAT futures are up 0.05 today at 161.60 with 10y yields down -1.7bp at -0.70% and 2y yields up 0.2bp at -0.719%.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.