-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

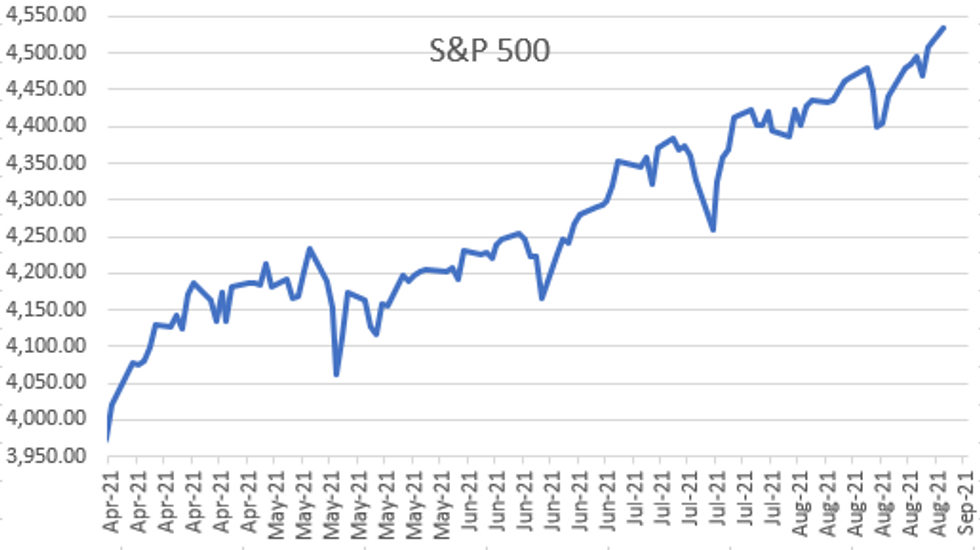

Free AccessMNI ASIA OPEN: Equities Make New Highs Despite Data Miss

EXECUTIVE SUMMARY

- MNI DATA BRIEF: Canada Has Best Current Acct Surplus Since '08

- EU To REIMPOSE Travel Restrictions on US

- JAPAN GOV'T IS CONSIDERING A PLAN TO HOLD GENERAL ELECTION ON OCT. 17-KYODO, Rtrs

- XI URGES CHINA TO STRENGTHEN ANTI-MONOPOLY WORK: CCTV, Bbg

- CHINA TO IMPROVE POLICY TRANSPARENCY, PREDICTABILITY: CCTV, Bbg

US

US: JP Morgan Quicktake on Pending Home Sales Miss; Monday's July pending home sales fell 1.8% -- a big miss when compared to +0.3-0.5 estimated gain (YoY -9.5% vs. -8.8% est).

- While disappointing, JP Morgan economists said the decline was still better than their own estimate of -3.0%.

- JPM notes "sales data have been a bit noisy in recent months, with an 8.3% jump in May being partially reversed by declines in the two months of data reported since then."

- Through some of the recent volatility, the pending home sales data for recent months have been noticeably softer than many of the figures reported earlier this year and late last year and many different housing have cooled off lately following an earlier period with much stronger levels of activity.

Telegraphed last week, Bbg headlines note "EU TO REIMPOSE TRAVEL CURBS ON U.S. AMID RISE IN COVID CASES."

- European Council/Council of the European Union:

- Following a review under the recommendation on the gradual lifting of the temporary restrictions on non-essential travel into the EU, the Council updated the list of countries, special administrative regions and other entities and territorial authorities for which travel restrictions should be lifted. In particular, Israel, Kosovo[1], Lebanon, Montenegro, the Republic of North Macedonia and the United States of America were removed from the list.

CANADA

CANADA: Canada's second-quarter current account surplus was the widest since 2008 at CAD3.6 billion, government figures showed Monday. Statistics Canada said the surplus widened from CAD1.8 billion on improved goods trade, and the country's habitual deficit in foreign travel services was erased by pandemic restrictions.

OVERNIGHT DATA

- US NAR JUL PENDING HOME SALES INDEX 110.7 V 112.7 IN JUN

- US AUG. DALLAS FED MANUFACTURING INDEX AT 9.0 VS 27.3

- U.S. AUG. DALLAS FED GENERAL BUSINESS ACTIVITY AT 9.0

MARKET SNAPSHOT

Key late session market levels:

- DJIA down 8.72 points (-0.02%) at 35446.83

- S&P E-Mini Future up 26.75 points (0.59%) at 4532

- Nasdaq up 157.2 points (1%) at 15286.4

- US 10-Yr yield is down 2.4 bps at 1.2835%

- US Sep 10Y are up 7.5/32 at 134-4

- EURUSD up 0.0004 (0.03%) at 1.1799

- USDJPY up 0.06 (0.05%) at 109.9

- WTI Crude Oil (front-month) up $0.42 (0.61%) at $69.16

- Gold is down $7.23 (-0.4%) at $1810.35

- EuroStoxx 50 up 7.82 points (0.19%) at 4198.8

- German DAX up 35.56 points (0.22%) at 15887.31

- French CAC 40 up 5.38 points (0.08%) at 6687.3

US TSYS: Rates Track New Highs in Equities

Tsys finished stronger, climbing back to near midmorning highs by the bell, tracking new all-time highs in equities (ESU1 4534.0). Rates see-sawed off mildly mixed levels after July pending home sales came out weaker than expected -1.8% vs. +0.3% est.

- While disappointing, JP Morgan economists said the decline was still better than their own estimate of -3.0%. JPM notes "sales data have been a bit noisy in recent months, with an 8.3% jump in May being partially reversed by declines in the two months of data reported since then."

- Support evaporates following 30Y Block sale: -7,753 USZ 163-11, sell through 163-13 post-time bid at 1016:41ET, 163-07 last. Tsy regained footing, see-sawing higher with 30Y bonds extending highs after the closing bell.

- Large Eurodollar flow: +25,000 EDZ1 99.82 (+0.005); Large Green Sep/Dec spd buy: +50,000 EDU3/EDZ3 at 0.115 and bid for another 40,000.

- Focus on Friday's Aug employ report, +750k est vs. +943k prior.

- The 2-Yr yield is down 1.2bps at 0.2033%, 5-Yr is down 2.9bps at 0.7707%, 10-Yr is down 2.4bps at 1.2835%, and 30-Yr is down 1.8bps at 1.8984%.

MONTH-END EXTENSIONS: UPDATED Barclays/Bbg Extension Estimates for US

UPDATED forecast summary compared to avg increase for prior year and same time in 2020. Noted gain in MBS extension to 0.14 from 0.10 prelim estimate. US Gov linker 0.13Y.

| SECURITY | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.12 | 0.09 | 0.16 |

| Agencies | 0.05 | 0.05 | 0.14 |

| Credit | 0.09 | 0.12 | 0.12 |

| Govt/Credit | 0.11 | 0.1 | 0.14 |

| MBS | 0.14 | 0.06 | 0.08 |

| Aggregate | 0.11 | 0.09 | 0.12 |

| Long Gov/Cr | 0.13 | 0.09 | 0.09 |

| Iterm Credit | 0.06 | 0.1 | 0.07 |

| Interm Gov | 0.1 | 0.08 | 0.11 |

| Interm Gov/Cr | 0.09 | 0.09 | 0.09 |

| High Yield | 0.09 | 0.11 | 0.13 |

US TSY FUTURES CLOSE

- 3M10Y -1.846, 123.789 (L: 123.282 / H: 126.31)

- 2Y10Y -0.981, 107.823 (L: 107.039 / H: 109.675)

- 2Y30Y -0.392, 169.313 (L: 168.461 / H: 171.059)

- 5Y30Y +1.272, 112.607 (L: 110.956 / H: 113.333)

- Current futures levels:

- Sep 2Y up 0.75/32 at 110-10.375 (L: 110-09.375 / H: 110-10.375)

- Sep 5Y up 4.5/32 at 124-5.5 (L: 124-01 / H: 124-06.25)

- Sep 10Y up 7.5/32 at 134-4 (L: 133-27.5 / H: 134-05)

- Sep 30Y up 17/32 at 165-1 (L: 164-14 / H: 165-04)

- Sep Ultra 30Y up 23/32 at 200-3 (L: 198-31 / H: 200-04)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.878

- Dec 21 +0.010 at 99.825

- Mar 22 +0.005 at 99.860

- Jun 22 steady at 99.815

- Red Pack (Sep 22-Jun 23) +0.005 to +0.035

- Green Pack (Sep 23-Jun 24) +0.040 to +0.045

- Blue Pack (Sep 24-Jun 25) +0.040 to +0.045

- Gold Pack (Sep 25-Jun 26) +0.030 to +0.035

Short Term Rates

US DOLLAR LIBOR: No settles due to London summer bank holiday

STIR: FRBNY EFFR for prior session:- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $257B

- Secured Overnight Financing Rate (SOFR): 0.05%, $920B

- Broad General Collateral Rate (BGCR): 0.05%, $383B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $354B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $4.029B submission

- Next scheduled purchases

- Tue 8/31 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 9/01 1100-1120ET: Tsy 7Y-10Y, appr $3.225B

- Thu 9/02 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 9/03 no buy operation ahead holiday, resume Tuesday Sep 7

FED: REVERSE REPO OPERATION, Nears Record High

NY Fed reverse repo usage climbs to 1,140.711B from 79 counter-parties vs. $1,120.015B on Friday. Record high of $1,147.089B set Wednesday, Aug 25.

PIPELINE: Corporate Debt Issuance

August high-grade corporate debt issuance running total: $93.62B/M

- Date $MM Issuer (Priced *, Launch #)

- 08/30 $Benchmark IFC +5Y +21a -- rolled to Tuesday

- 08/26-27 No new corporate or supra-sovereign issuance Thu/Fri; $8.85B/wk

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.