-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

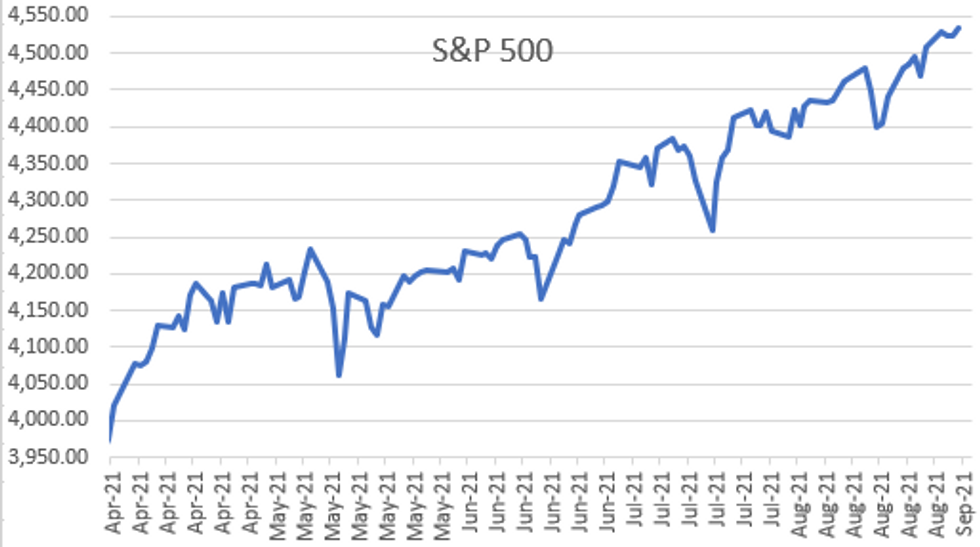

MNI ASIA OPEN:Stocks Near All-Time Highs Ahead Non-Farm Payrolls

EXECUTIVE SUMMARY

MNI REALITY CHECK: US Employers Undeterred by Delta Surge

MNI BRIEF: US Jobless Claims Hit Post-Covid Low

US

US: The pace of hiring slowed in August as firms struggled to fill vacancies despite elevated demand for labor, recruiters and industry experts told MNI. But business confidence held steady, despite the rapid spread of the Delta variant of Covid-19 and even unvaccinated consumers through the month weren't likely to pull back on spending or demand for goods and services, they noted.

- Job growth in August slowed pretty much across the board, said Nick Bunker, a labor economist at online jobs marketplace Indeed, although much of that slowdown occurred in industries that aren't "pandemic constrained." Manufacturers and construction companies have struggled in recent months to find qualified and available workers for open positions.

- MNI has reported Fed economists are downplaying the prospect of a rapid workforce rebound this fall as the delta variant and vaccine hestiancy complicate a return to normalcy.

OVERNIGHT DATA

- US JOBLESS CLAIMS -14K TO 340K IN AUG 28 WK

- US PREV JOBLESS CLAIMS REVISED TO 354K IN AUG 21 WK

- US CONTINUING CLAIMS -0.160M to 2.748M IN AUG 21 WK

- US Q2 REV NONFARM PRODUCTIVITY +2.1%; Y/Y +1.8%

- US Q2 UNIT LABOR COSTS +1.3%; Y/Y +0.2%

- US JUL FACTORY ORDERS +0.4%; EX-TRANSPORT NEW ORDERS +0.8%

- US JUL DURABLE ORDERS -0.1%

- US JUL NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.1%

- US JUL TRADE GAP -$70.1B VS JUN -$73.2B

- CANADIAN JUL BUILDING PERMITS -3.9% MOM

- CANADA RESIDENTIAL BUILDING PERMITS -3.1%; NON-RESIDENTIAL -5.6%

- CANADIAN JUL TRADE BALANCE +0.8 BILLION CAD

- CANADA JUL EXPORTS 53.7 BLN CAD, IMPORTS 53.0 BLN CAD

- CANADA REVISED JUN MERCHANDISE TRADE BALANCE +2.6 BLN CAD

MARKET SNAPSHOT

Key late session market levels

- DJIA up 102.85 points (0.29%) at 35414.89

- S&P E-Mini Future up 9.75 points (0.22%) at 4531

- Nasdaq up 12.1 points (0.1%) at 15322.05

- US 10-Yr yield is down 0.2 bps at 1.2919%

- US Dec 10Y are up 2.5/32 at 133-17

- EURUSD up 0.0034 (0.29%) at 1.1873

- USDJPY down 0.03 (-0.03%) at 109.98

- WTI Crude Oil (front-month) up $1.33 (1.94%) at $69.92

- Gold is down $4.56 (-0.25%) at $1809.36

- EuroStoxx 50 up 4.83 points (0.11%) at 4232.1

- FTSE 100 up 14.06 points (0.2%) at 7163.9

- German DAX up 16.3 points (0.1%) at 15840.59

- French CAC 40 up 4.39 points (0.07%) at 6763.08

US TSYS: Initial Claims Inching Lower

Tsys trade steady to mildly higher late Thu, very near the middle of narrow session range on modest volumes (TYZ<775k). Equities mildly higher (ESU1 +9.0), US$ weaker (DXY -.232 at 92.217), generally quiet in the lead-up to August employ data Fri morning.- August nonfarm payroll survey change median is +725k on a range of 400k to 1M, with average 707k and standard deviation 137k (suggesting a 570k to 844k figure would be roughly within expectations).

- Tsys gained early but scaled back support after lower than estimated weekly claims (340k vs. 345k), and continuing claims (2.748M vs. 2.808M), rates making session lows by midmorning (10YY 1.3037%H; 30YY 1.9228%H).

- Swappable corporate debt issuance and option related hedging generated two-way trade.

- The 2-Yr yield is up 0.2bps at 0.2115%, 5-Yr is up 0.2bps at 0.774%, 10-Yr is down 0.2bps at 1.2919%, and 30-Yr is down 0.9bps at 1.9045%.

US TSY FUTURES CLOSE

- 3M10Y -0.335, 124.632 (L: 123.284 / H: 125.895)

- 2Y10Y -0.544, 107.846 (L: 107.399 / H: 109.249)

- 2Y30Y -1.092, 169.1 (L: 168.964 / H: 171.329)

- 5Y30Y -0.885, 112.891 (L: 112.823 / H: 114.842)

- Current futures levels:

- Dec 2Y steady at at 110-5 (L: 110-04.875 / H: 110-05.5)

- Dec 5Y up 1/32 at 123-22.75 (L: 123-21.75 / H: 123-25.25)

- Dec 10Y up 2/32 at 133-16.5 (L: 133-14 / H: 133-20.5)

- Dec 30Y up 6/32 at 163-14 (L: 163-04 / H: 163-20)

- Dec Ultra 30Y up 14/32 at 198-3 (L: 197-13 / H: 198-10)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.880

- Dec 21 steady at 99.825

- Mar 22 -0.005 at 99.850

- Jun 22 -0.005 at 99.810

- Red Pack (Sep 22-Jun 23) steady to +0.010

- Green Pack (Sep 23-Jun 24) +0.010 to +0.015

- Blue Pack (Sep 24-Jun 25) +0.010 to +0.015

- Gold Pack (Sep 25-Jun 26) +0.010 to +0.015

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N +0.00062 at 0.07350% (-0.00262/wk)

- 1 Month -0.00037 to 0.08288% (-0.00313/wk)

- 3 Month -0.00125 to 0.11763% (-0.00225/wk) ** New Record Low

- 6 Month -0.00425 to 0.14763% (-0.00712/wk)

- 1 Year -0.00488 to 0.22275% (-0.01238/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $266B

- Secured Overnight Financing Rate (SOFR): 0.05%, $936B

- Broad General Collateral Rate (BGCR): 0.05%, $391B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $360B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $4.230B submission

- Fri 9/03 no buy operation ahead holiday, resume Tuesday Sep 7

FED: REVERSE REPO OPERATION

NY Fed reverse repo usage recedes to 1,066.987B from 70 counter-parties vs. $1,084.115B Wednesday. Record high of $1,189.616B set Tuesday, Aug 31.

PIPELINE: $7.025B to Price Thursday

- Date $MM Issuer (Priced *, Launch #)

- 09/02 $5B *World Bank 7Y +6

- 09/02 $1.025B #Japan Tobacco $625M 10Y +97.5, $400M 30Y 3.3%

- 09/02 $Benchmark Ahli United Bank 5Y +200a

- 09/02 $500M *Contemporary Amperex Tech 5Y +85

- 09/02 $500M *China Development Bank 3Y Green +23

EGBs-GILTS CASH CLOSE: Peripheries Outperform With One Eye On U.S. Jobs

Bund and Gilt yields came off session lows in Thursday afternoon trade, ending with modest bull flattening, with little decisiveness ahead of Friday's much-anticipated US jobs report.

- Periphery spreads compressed slightly, in accordance with stronger equities and a weaker dollar pointing to an uptick in risk appetite.

- Heavy supply again this morning, with Spain selling E4bln of Bono/Obli + E0.4bln linker, and France E10.5bln of OAT (incl Green OAT). That's it for the week.

- The only major data of the day showed Eurozone producer prices hit levels in July last seen in the early 1980s (+12.1% Y/Y). US data failed to have an impact.

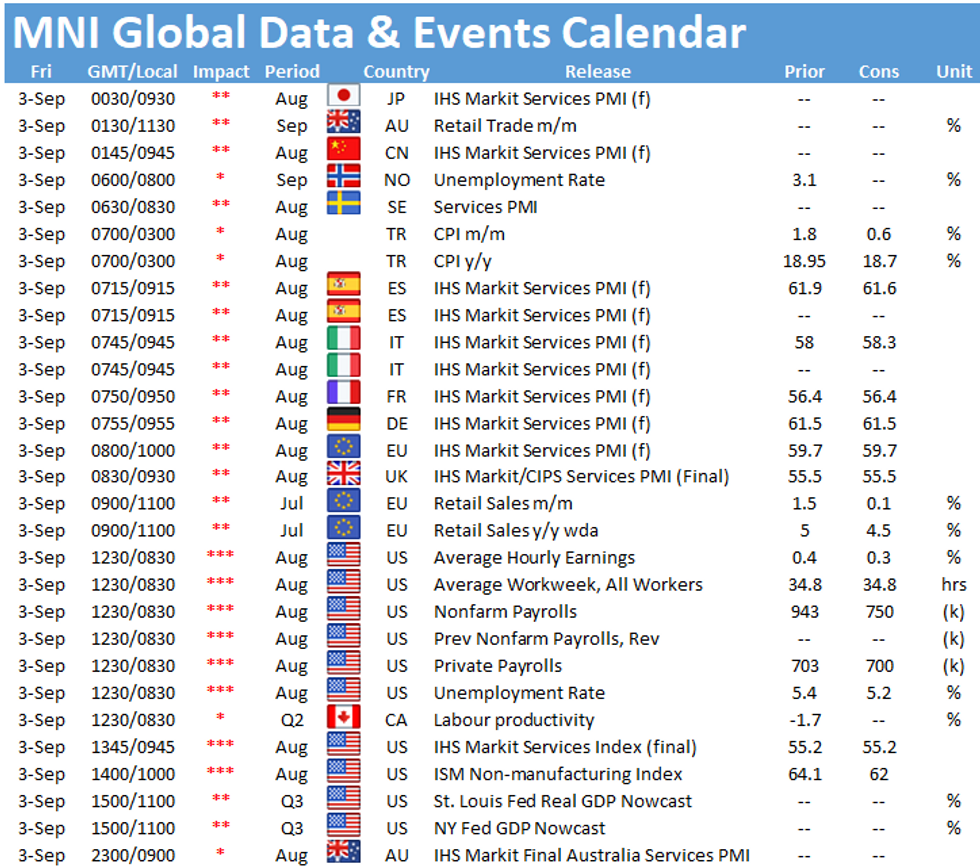

- Final (and only, for Italy and Spain) Europe services PMIs eyed Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.8bps at -0.719%, 5-Yr is down 1bps at -0.691%, 10-Yr is down 1.1bps at -0.384%, and 30-Yr is unchanged at 0.117%.

- UK: The 2-Yr yield is down 0.8bps at 0.193%, 5-Yr is down 1bps at 0.356%, 10-Yr is down 1.1bps at 0.682%, and 30-Yr is down 1.1bps at 1.023%.

- Italian BTP spread down 1.2bps at 105.2bps / Spanish down 1.2bps at 69.8bps

FOREX: AUD, NZD and CAD Receive Commodity-Tied Boost, Greenback Pressured

- The dollar index is likely to close in the red for Thursday, extending a 5-day slide for the greenback.

- With the Bloomberg commodity index up 0.75% and a strong 2.5% boost for oil prices, commodity tied FX were among the best performers in the penultimate session before the August US employment report.

- NZDUSD leads G10 gains, rising 0.6% and above 0.71 for the first time since July 6. Today's peak matches closely with the 200-day moving average and represent fresh 2 and a half month highs.

- AUDUSD pierced the 50-day EMA and the 0.74 handle, maintaining a firmer technical tone with a key resistance at 0.7427 (Aug. 4 high) well in sight. The Canadian dollar took a little longer to react to the oil move, but eventually caught up firming 0.5% to 1.2557 as of writing.

- EURUSD continued to grind higher, slowly taking out Wednesday's 1.1857 highs and inching closer towards 1.19 resistance. Cable price action was a little more interesting with a sharp move from 1.3790 to 1.3836 approaching the WMR fix as EURGBP found resistance around the 0.86 handle.

- Friday's market focus clearly on US non-farm payrolls where the current Bloomberg estimate for headline change is +725k. Australian retail sales will be also be published overnight.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.