-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: Gimme Some Data, Cool, Cool Data

EXECUTIVE SUMMARY

- MNI: Fed Wants Taper Announcement Wiggle Room In Case Jobs Sour

- MNI BRIEF: US Budget Deficit Narrows to USD2.71T Thru August

- U.S. HOUSE WAYS AND MEANS COMMITTEE SAYS IT SEEKS TO RAISE U.S. CORPORATE TAX RATE TO 26.5%, Rtrs

US

FED: Federal Reserve officials meeting next week are likely to agree internally on a November announcement for a QE tapering plan while leaving wiggle room to delay that move if the job market sours, former officials told MNI.

- "An informal consensus is likely to emerge at this meeting that taper should be initiated soon," former Richmond Fed President Jeff Lacker told MNI. Officials in the closed FOMC meeting are likely opt for November to say, "if things go roughly as expected, we should taper at the next meeting."

- Another stumble in the jobs report for September could spur the FOMC to delay a tapering announcement until December or early next year, over concerns that the path to achieving the employment mandate has slowed, the ex-officials said. The 235,000 jobs created in August fell well short of market expectations as the Delta variant surged. For more see MNI Policy main wire at 0930ET.

- In the month of August alone, there was a shortfall of USD171 billion, below expectations of a deficit of USD302 billion. As the August budget deficit came in lower than market expectations, Treasury officials on a call with reporters declined to say whether the fiscal numbers would impact their projections under the debt limit, potentially pushing back how long so-called "extraordinary measures" could last, a prospect some market analysts have suggested. Receipts in August were USD268 billion, up USD45 billion, or 20%, compared with the year-ago month. Outlays were up USD16 billion, or 4%, compared with August 2020. For more see MNI Policy main wire at 1400ET.

US TSYS: Tsy Yields Dip Ahead Tuesday CPI

Tsy yields receded Monday, futures near the top end of the range on very light volumes, TYZ just cracking 700k by the bell with no economic data to trade off of, participants set sights on Tuesday's CPI:

- Wrightson ICAP penciling in at 0.4% / 0.3% M/M outturn in Aug CPI data for headline and core, respectively (exactly in line with Bloomberg survey).

- Deutsche expects an unrounded Aug CPI print of +0.40%, with core +0.22% - the latter slightly soft vs consensus.

- TD sees a below-consensus reading of +0.2% M/M for core August CPI (but are in-line on headline with +0.4%).

- White House says it remains prepared to engage with North Korea, National Post

- HU SAYS CHINA COULD FLY JETS OVER TAIWAN ON MISSION NAME CHANGE, Bbg

OVERNIGHT DATA

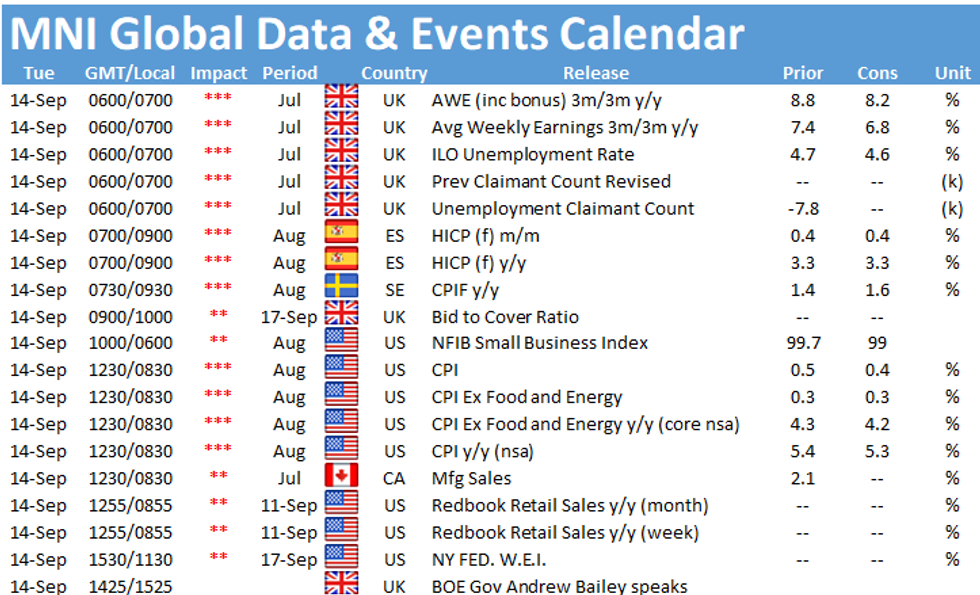

No economic data released Monday -- markets turn to CPI on Tuesday:- US Data/Speaker Calendar (prior, estimate)

- Sep-14 0600 NFIB Small Business Optimism

- Sep-14 0830 CPI MoM (0.5%, 0.4%); YoY (5.4%, 5.3%)

- Sep-14 0830 CPI Ex Food & Energy MoM (0.3%, 0.3%); YoY (4.3%, 4.2%)

- Sep-14 0830 CPI Index NSA (273.003, 273.835)

- Sep-14 0830 CPI Core Index SA (279.054, 279.74)

- Sep-14 0830 Real Avg Hourly Earning YoY (-1.2%, --)

- Sep-14 0830 Real Avg Weekly Earning YoY (-0.7%, -0.9% rev)

- Sep-14 1500 NY Fed updated buy-op schedule

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 195.12 points (0.56%) at 34795.34

- S&P E-Mini Future down 0.25 points (-0.01%) at 4448

- Nasdaq down 37.2 points (-0.2%) at 15075.92

- US 10-Yr yield is down 2 bps at 1.3208%

- US Dec 10Y are up 5/32 at 133-10

- EURUSD down 0.0007 (-0.06%) at 1.1807

- USDJPY up 0.07 (0.06%) at 110.01

- WTI Crude Oil (front-month) up $0.75 (1.08%) at $70.47

- Gold is up $6 (0.34%) at $1793.45

- EuroStoxx 50 up 19.18 points (0.46%) at 4189.53

- FTSE 100 up 39.23 points (0.56%) at 7068.43

- German DAX up 91.61 points (0.59%) at 15701.42

- French CAC 40 up 13.16 points (0.2%) at 6676.93

US TSY FUTURES CLOSE

- 3M10Y -2.03, 127.769 (L: 126.754 / H: 129.97)

- 2Y10Y -2.043, 110.592 (L: 110.115 / H: 112.944)

- 2Y30Y -3.078, 168.751 (L: 168.48 / H: 172.109)

- 5Y30Y -1.779, 109.766 (L: 109.334 / H: 111.702)

- Current futures levels:

- Dec 2Y up 0.375/32 at 110-5.125 (L: 110-04.375 / H: 110-05.375)

- Dec 5Y up 2/32 at 123-19.5 (L: 123-15.75 / H: 123-21.25)

- Dec 10Y up 4.5/32 at 133-9.5 (L: 133-02.5 / H: 133-12.5)

- Dec 30Y up 14/32 at 163-5 (L: 162-18 / H: 163-09)

- Dec Ultra 30Y up 1-6/32 at 198-8 (L: 196-28 / H: 198-13)

US EURODOLLAR FUTURES CLOSE

- Sep 21 final settle at 99.884 (3M LIBOR set' 0.11600%, +0.00025)

- Dec 21 steady at 99.825

- Mar 22 -0.005 at 99.850

- Jun 22 steady at 99.810

- Sep 22 +0.005 at 99.725

- Red Pack (Dec 22-Sep 23) +0.005 to +0.010

- Green Pack (Dec 23-Sep 24) +0.010 to +0.020

- Blue Pack (Dec 24-Sep 25) +0.015 to +0.020

- Gold Pack (Dec 25-Sep 26) +0.020

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N +0.00175 at 0.07338% (+0.00088 total last wk)

- 1 Month -0.00013 to 0.08375% (+0.00100 total last wk)

- 3 Month +0.00025 to 0.11600% (+0.00025 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00075 to 0.14863% (+0.00100 total last wk)

- 1 Year +0.00063 to 0.22313% (-0.00025 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $67B

- Daily Overnight Bank Funding Rate: 0.07% volume: $277B

- Secured Overnight Financing Rate (SOFR): 0.05%, $891B

- Broad General Collateral Rate (BGCR): 0.05%, $396B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $359B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $3.770B submission

- NY Fed releases updated operational purchase schedule Tuesday at 1500ET

FED: REVERSE REPO OPERATION

NY Fed reverse repo usage slips to 1,087.108B from 77 counter-parties vs. $1,099.323B Friday. Record high holds at $1,189.616B set Tuesday, Aug 31.

PIPELINE: $23.9B to Price Monday, Sumitomo Mitsui Leads

- Date $MM Issuer (Priced *, Launch #)

- 09/13 $5.85B #Sumitomo Mitsui $2B 5Y +60, $2B 7Y +80, $1B 10Y +90, $850M 20Y +110 (+$2.25B last Wed: $750M each: 3Y +40, 3Y FRN/SOFR +44, 5Y +55)

- 09/13 $3B *Morgan Stanley 15NC10 fix/FRN +117

- 09/13 $2.25B #Turkey $750M 2028 tap 5.75%, $1.5B 12Y 6.5%

- 09/13 $2B #Lowe's Cos $1B 7Y +63, $1B 20Y +98

- 09/13 $1.85B #Nissan $500M 3Y +70, $1B 5Y +105, $350M 7Y +135

- 09/13 $2.9B #Bank of Nova Scotia $1.1B 2Y +23, $600M 2Y SOFR+26, $900M 5Y +50, $300M 5Y SOFR+61

- 09/13 $1.5B Gap $750M each: 8NC3 3.75%, 10NC5 4.0%

- 09/13 $1.2B Cheniere Energy WNG 10.5NC5.5 +10

- 09/13 $1.25B #Indonesia $600M 2031 Tap 2.18%, $650M 40Y +3.28%

- 09/13 $600M #Extra Space +10Y +105

- 09/13 $500M *Kimco +10Y +98

- 09/13 $500M #Tennessee Valley Auth 10Y green +18

- 09/13 $500M #Johnson Controls WNG 10Y +77

- 09/13 $Benchmark Industrial Bank of Korea 3Y +20

- Later in week:

- 09/14 $1.5B Coinbase 7NC3, 10NC5

- 09/14 $1B Nordic Investment Bank 3Y -2

- 09/14 $Benchmark Ontario Teachers Fnc Trust5Y +14a

- 09/?? $Benchmark Hungary 10Y, 30Y in addition to Eur 7Y and/or 20Y

EGBs-GILTS CASH CLOSE: Periphery Spreads Quietly Tighten

GIlts outperformed Bunds in a fairly quiet session to open the week, with periphery spreads quietly tightening to multi-week lows.

- Italy 10Y BTP spreads fell to a fresh 1-month low, with Spain closing at the tightest spread since July. No real catalyst, but rather follow-through from last week's ECB meeting.

- No data out today, no bond supply, and little central bank commentary of note (we heard from the ECB's Schnabel and BOE's Hauser but little market reaction to either).

- Most attention remains on US CPI data Tuesday, and large supply: still looking for E36.0bln of gross issuance this week, with tomorrow's slate featuring the Netherlands, Italy, and Germany tomorrow, and EU NGEU syndication (announced today).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.1bps at -0.705%, 5-Yr is down 0.3bps at -0.641%, 10-Yr is down 0.1bps at -0.331%, and 30-Yr is up 0.8bps at 0.166%.

- UK: The 2-Yr yield is down 0.5bps at 0.228%, 5-Yr is down 0.6bps at 0.414%, 10-Yr is down 1.3bps at 0.745%, and 30-Yr is down 2.2bps at 1.056%.

- Italian BTP spread down 1.4bps at 101.7bps / Spanish down 0.3bps at 66bps

FOREX: USDCHF Tests August Highs, NOK Firms Amid Oil Strength

- Lower equities and US yields worked against the greenback throughout NY trading hours. Dollar indices reversed earlier gains, briefly turning negative on the day before stabilising ahead of tomorrow's US CPI figures.

- The Norwegian Krone tops the G10 pile on the back of firmer oil prices, rising 0.35% against the euro.

- The Swiss Franc is the notable underperformer, retreating 0.55% against the dollar with USDCHF briefly testing the August highs at 0.9242. Despite the broad dollar strength abating, the pair holds onto the majority of the day's gains.

- CHF positioning deteriorated according to latest CFTC data, erasing the market's net long amid further evidence that the SNB are intervening ahead of the September policy decision.

- Elsewhere, EURUSD breached short-term support at 1.1802 overnight, prompting some single currency weakness and fresh lows for September at 1.1770. The move reinforces short-term bearish conditions and initially opens 1.1758, a Fibonacci retracement and 1.1735, the Aug 27 low.

- Expect to hear from RBA's Lowe and Ellis overnight before UK employment data early on Tuesday.

- Market focus will be firmly on US CPI data, scheduled for 1330BST/0830ET.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.