-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - US Labour Shortages In Focus

EXECUTIVE SUMMARY:

- BOC May Adjust Target As Spending Pledges Mount

- US Labor Shortage To Persist Despite Back-To-School Boost

- BOJ To Be Cautious In Withdrawing Covid Measures

- US Retail Sales Beat Expected, July Revised Lower

NORTH AMERICA NEWS

MNI INTERVIEW: BOC May Adjust Target As Spending Pledges Mount

Canada's central bank may tweak its mandate towards the Fed's average inflation targeting regime after an election in which major parties have pledged to make life more affordable and to boost employment with deficit spending, a former adviser to the nation's biggest province told MNI.

MNI: US Labor Shortage To Persist Despite Back-To-School Boost

Hopes for a post-Labor Day reversal of worker shortages plaguing the U.S. recovery are fading as new research suggests workforce participation rates are less influenced by unemployment benefits and school reopenings than by concerns over catching Covid-19, and may only improve well after unemployment bottoms, current and former Fed economists told MNI. That would mean a more drawn-out timeline for reaching maximum employment even as the Fed faces pressure to raise interest rates to keep a lid on inflation running near a 13-year high.

ASIA NEWS

MNI INSIGHT: BOJ To Be Cautious In Withdrawing Covid Measures

The Bank of Japan will be careful not to unnerve markets when it attempts to scale back emergency pandemic measures to support corporate financing and liquidity after the government eases Covid restrictions as early as the fourth quarter this year, MNI understands.

MNI: Japan Govt Cuts Overall Econ View, Spending, Production

Japan's government has lowered its main economic assessment from the previous month for the first time since May and also lowered its assessment on private consumption and industrial production, the Cabinet Office said on Thursday. Japan's economy is picking up, "although the pace has weakened" because of the severe situation from the spread of the novel, or Delta variant, coronavirus, the government said.

MNI BRIEF: China Looks At Fresh Policies To Stabilise Growth

China will increase cross-cycle policy design, introduce new policies, prevent major volatility and keep the economy operating within a reasonable range, said Li Hui, an official from the National Development and Reform Commission at a briefing on Thursday, after the August economic indicators released yesterday weakened more than expected.

DATA:

MNI BRIEF: US Retail Sales Beat Expected, July Revised Lower

Retail sales in August were up 0.7%, far more than the 0.9% decline forecast by Bloomberg and rebounding from July's downward revised 1.8% drop.

Weakness in sales of motor vehicle (-3.6%), electronics (-3.1%), and sporting goods (-2.7%), was offset by unexpected strength in sales from non-store retailers (+5.3%), furniture stores (+3.7%), and general merchandise stores (+3.5%). Excluding vehicle sales, retail sales were up 1.8% through the month. Excluding both vehicle and gas station sales, retail sales were up 2%.

MNI: US JOBLESS CLAIMS +20K TO 332K IN SEP 11 WK

US CONTINUING CLAIMS -0.187M TO 2.665M IN SEP 04 WK

MNI: US JUL BUSINESS INVENTORIES +0.5%; SALES +0.5%

US JUL RETAIL INVENTORIES +0.4%

US EIA: NAT GAS STORAGE +83 BCF TO 3,006 BCF SEP 10 WK

US TSYS SUMMARY: Retail Sales & AUKUS Security Pact Steal The Limelight

Treasuries have traded weaker while the S&P and Nasdaq recovered most of the losses posted earlier in the session.

- UST cash yields are now 1-4bp higher on the day with slight underperformance in the belly of the curve. TYZ1 trades at 133-02, towards the bottom end of the day's range (L: 132-30 / H: 133-14+).

- US retail sales data for August surprised higher with Advance reading coming in at 0.7% M/M vs -0.7% expected and the Ex Auto figure printing 1.8% M/M vs the 0% consensus.

- The US, UK and Australia earlier announced a new security pact in a bid to counter Chinese naval power in the South China Sea. Under the new AUKUS agreement, the US and UK will assist Australia in building nuclear submarines. The move was warmly received by Taiwan and Japan, while being swiftly rebuked by China as well as France, which has now lost a previous submarine deal struck with Canberra.

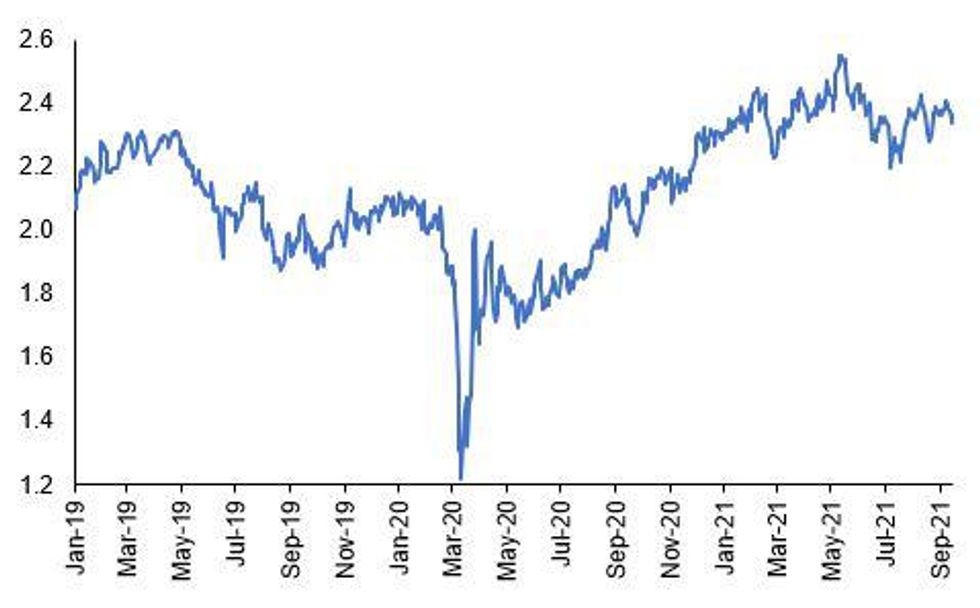

FOREX: Greenback Bounces To Three-Week Highs

- The US dollar was back in favour on Thursday as a strong US retail sales report fuelled an already buoyant greenback. The dollar index rose to its highest level since August 27, just shy of 93.00.

- Prior to the data, dollar sentiment had recovered following pressure on commodities and a short-term break lower in EURUSD.

- EURUSD maintains a weaker tone and Thursday's sell-off has confirmed a resumption of bearish pressure. After clearing horizontal support through 1.1800 the pair extended through Monday's low of 1.1770 and has tested below 1.1758, 61.8% of the Aug 20 - Sep 3 rally. Further weakness would open 1.1735, Aug 27 low ahead of the key support at 1.1664, the Aug 20 low.

- With the majority of the euro move witnessed before the US data, USDJPY was most impacted in the retail sales aftermath, rising around 40 pips from 109.40 to 109.80. This extends the bounce from yesterday's noted support at 109.11.

- Elsewhere dollar gains were broad based with GBP, AUD, NZD, CAD and CNH all falling close to 0.5%. The offshore Yuan move represents the biggest drop in nearly a month as concerns on China Evergrande Group's debt crisis and Beijing's latest push to rein in private industries exacerbates market sentiment.

- Notable weakness was seen in the Swiss franc, losing 0.75% against the dollar. USDCHF hovers just beneath the July highs of 0.9275 which if breached would see the pair trading at it's best levels since April. Interestingly the downtrend drawn from the 2020 highs looks to intersect around 0.9280, strengthening the importance of this area.

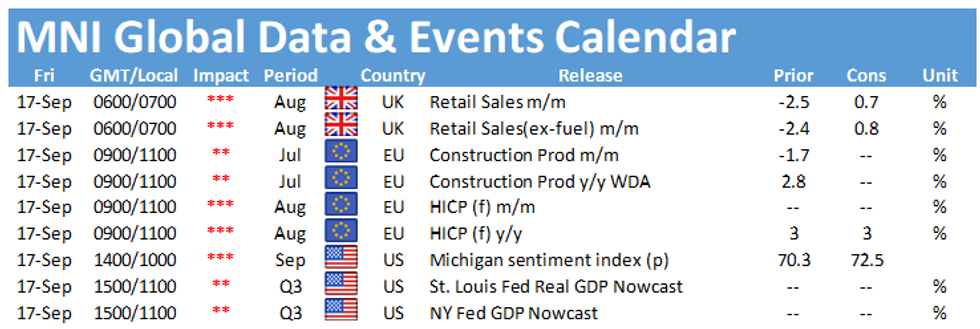

- UK Retail Sales will kick off a light calendar on Friday before final readings for Eurozone CPI are released. The week will be capped off with US consumer sentiment data from the University of Michigan.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.