-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS-Ireland Election Preview

MNI POLITICAL RISK - Trump Tariffs Initiate Talks With Mexico

MNI ASIA OPEN: Default Contagion Fears Cool

EXECUTIVE SUMMARY

- MNI STATE OF PLAY: Fed Nears Taper, Dots to Skew Hawkish

- MNI: Fed Reluctant To Mark Neutral Rate Lower - Ex-Officials

- MNI: Analysts Eyeing Fed Taper Signal And Projections At Wednesday's FOMC

- MNI INTERVIEW: Worker Rights Key Biden Goal With China, Mexico

- U.S. IN PROCESS OF CONFRONTATION WITH CHINA: FRENCH MINISTER, Bbg

- EVERGRANDE MISSED PAYMENTS DUE MONDAY TO AT LEAST TWO BANKS, Bbg

- FDA EXPECTED TO ANNOUNCE DECISION ON PFIZER BOOSTER WEDNESDAY, Bbg

US

FED: The Federal Reserve on Wednesday is expected to affirm its commitment to start winding down pandemic-era stimulus policies this year by paring its USD120 billion monthly asset purchase program, while fresh economic projections could also signal a more aggressive approach to eventual interest rate hikes.

- Policymakers are unlikely to take any policy action at the September meeting, but they may agree internally on a November announcement for a QE tapering plan unless the job market sours.

- The FOMC will also keep the benchmark fed funds rate at a rock-bottom 0% to 0.25% range, but surprisingly high inflation since June could stir up growing support for raising interest rates next year. The surge in Delta variant Covid cases acts as a countervailing force, however, and the uncertainty could see some FOMC members holding off from advancing rate hike dots, former Fed officials said. For more see MNI Policy main wire at 0605ET.

- There's widespread expectation that the Statement will include a change to the language implying that a taper will be announced later this year, but falling short of specifying November's meeting.

- The vast majority of analysts expect a November taper announcement, with a tapering pace of $15B per meeting (proportional between $10B Tsy / $5B MBS), with rate liftoff in 2023.

- On the projections, most anticipate 2021 GDP growth to be revised down with inflation revised up, but there are only minor changes foreseen to the rest of the economic forecasts.

- But expectations for the Fed funds rate 'dot plot' vary: only a few (JPMorgan, Citi, Danske) see a rate hike in the 2022 median dot, while cumulative 25bp hikes by end-2024 in the dot plot range from 4 (to 1.125%), to 7 (NatWest, to 1.875%).

- The 'median of median' expectations are 0.75% in 2023 (between 2 and 3 hikes by end-2023), and 1.625% in 2024 (representing 3 to 4 2024 hikes).

- The release on Wednesday of the Fed's SEP projections, which will extend through 2024, will probably continue to show a median expectation among FOMC members for longer-run rates of 2.5%, even though markets have been pricing in a terminal rate a full percentage point lower, the former officials noted. For more see MNI Policy main wire at 1257ET.

- "The U.S. government needs to exert more leverage in its relationship with China and to put at the center of our diplomatic and economic conversations workers' rights," said Thea Lee, deputy undersecretary for international affairs at Labor. "This administration is willing to elevate workers' rights to being a core part of that conversation."

US TSYS: Focus Back on FOMC, Steady Rate Expected

Monday's risk-off/safe-haven bid for rates as global equities sold off sharply eased Tuesday as contagion angst tied to potential default risk of China's Evergrande cooled. Tsys traded weaker but off lows by the close, equities mildly higher (ESZ1 +14.0 at 4362.0). Focus turned back to Wed's FOMC annc -- for the most part.- There was a brief risk-off react to latest Evergrande headlines in early trade

- that were not unexpected: Tsys blipped higher briefly after latest Evergrande headline stirred default angst after China's second largest real-estate developer missed payments to two banks. China, however, said this may be the case Monday while it appeared to be a knee-jerk react recently as Tsy futures pared losses but reversed move just as quickly.

- As to the FOMC, steady rate and policy announcement widely expected, most sell-side analysts anticipating a taper annc at the November FOMC meeting.

- Aside from two-way positioning, trade included option-tied hedging ahead Fri's Oct Tsy option expiry and vs. decent pick-up in corporate issuance: $12.5B.

- Tsys steady/mixed after $24B 20Y Bond auction re-open (912810TA6) stops through: drawing a high yield of 1.795% (1.850% last month) vs. 1.800% WI. Bid-to-cover 2.36 vs. 2.44 in August.

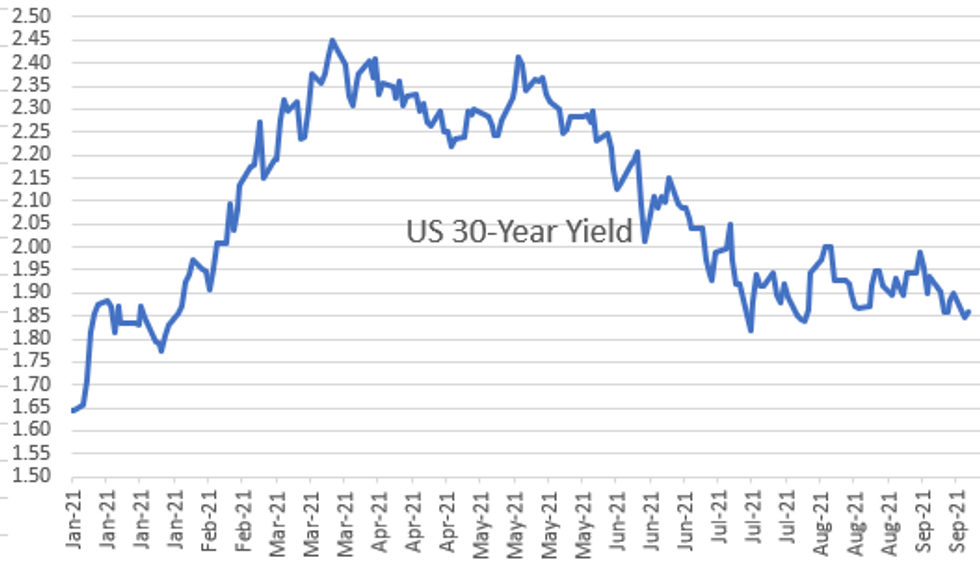

- After the bell the 2-Yr yield is down 0.4bps at 0.2118%, 5-Yr is up 0.5bps at 0.8292%, 10-Yr is up 1.4bps at 1.3243%, and 30-Yr is up 1.2bps at 1.8591%.

OVERNIGHT DATA

- US AUG HOUSING STARTS 1.615M; PERMITS 1.728M

- US JUL STARTS REVISED TO 1.554M; PERMITS 1.630M

- US AUG HOUSING COMPLETIONS 1.330M; JUL 1.392M (REV)

- US SEP PHILADELPHIA FED NONMFG INDEX 9.6

- US Q2 CURRENT ACCOUNT GAP -$190.3

- US Q1 CURRENT ACCOUNT REVISED TO -$189.4

- US REDBOOK: SEP STORE SALES +16.3% V YR AGO MO

- US REDBOOK: STORE SALES +17.1% WK ENDED SEP 18 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 69.52 points (0.2%) at 34038.37

- S&P E-Mini Future up 12 points (0.28%) at 4360

- Nasdaq up 89.5 points (0.6%) at 14803

- US 10-Yr yield is up 1.2 bps at 1.3226%

- US Dec 10Y are down 2.5/32 at 133-6

- EURUSD up 0.0002 (0.02%) at 1.1728

- USDJPY down 0.23 (-0.21%) at 109.21

- WTI Crude Oil (front-month) up $0.27 (0.38%) at $70.56

- Gold is up $11.38 (0.65%) at $1775.53

- EuroStoxx 50 up 53.88 points (1.33%) at 4097.51

- FTSE 100 up 77.07 points (1.12%) at 6980.98

- German DAX up 216.47 points (1.43%) at 15348.53

- French CAC 40 up 96.92 points (1.5%) at 6552.73

US TSY FUTURES CLOSE

- 3M10Y +2.625, 130.15 (L: 127.356 / H: 130.833)

- 2Y10Y +1.748, 111.045 (L: 108.81 / H: 112.136)

- 2Y30Y +1.461, 164.394 (L: 162.465 / H: 166.478)

- 5Y30Y +0.579, 102.693 (L: 101.646 / H: 105.238)

- Current futures levels:

- Dec 2Y up 0.25/32 at 110-5.125 (L: 110-04.375 / H: 110-05.5)

- Dec 5Y down 1.25/32 at 123-15.25 (L: 123-11.25 / H: 123-18.75)

- Dec 10Y down 3/32 at 133-5.5 (L: 132-30.5 / H: 133-11.5)

- Dec 30Y down 6/32 at 163-22 (L: 163-06 / H: 164-01)

- Dec Ultra 30Y down 13/32 at 199-26 (L: 198-30 / H: 200-17)

US EURODOLLAR FUTURES CLOSE

- Dec 21 -0.005 at 99.810

- Mar 22 -0.005 at 99.845

- Jun 22 steady at 99.815

- Sep 22 steady at 99.730

- Red Pack (Dec 22-Sep 23) -0.005 to steady

- Green Pack (Dec 23-Sep 24) -0.01 to steady

- Blue Pack (Dec 24-Sep 25) -0.01 to -0.005

- Gold Pack (Dec 25-Sep 26) -0.01 to -0.01

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N -0.00513 at 0.06675% (-0.00400/wk)

- 1 Month -0.00175 to 0.08175% (-0.00175/wk)

- 3 Month +0.00300 to 0.12838% (+0.00450/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00088 to 0.15338% (+0.00113/wk)

- 1 Year -0.00200 to 0.22413% (-0.00025/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $258B

- Secured Overnight Financing Rate (SOFR): 0.05%, $928B

- Broad General Collateral Rate (BGCR): 0.05%, $385B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $356B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $3.042B submission

- Next scheduled purchases

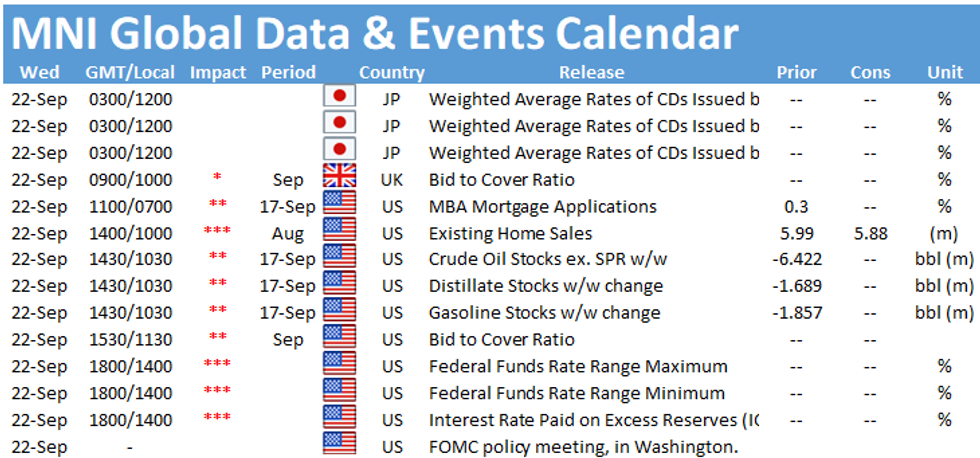

- Wed 9/22 No buy operation scheduled due to FOMC

- Thu 9/23 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 9/24 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED: Reverse Repo Operation, Third Consecutive Record High

NY Fed reverse repo usage climbs to new record high of 1,240.494B from 78 counter-parties vs. Monday's record $1,224.289B.

PIPELINE: Prospective Issuers Hit Sidelines After Mon's Stock Rout

Issuance that was expected to be relatively light this week, around $25B (near a third of last week's total debt issuance) as issuers hit the sidelines ahead Wednesday's FOMC annc.

- However, Monday's global stock rout on China's Evergrande default fears has sent prospective issuers to the sidelines as yields fell. Total high-grade corporate and supra-sovereign debt issuance has dropped under $10B and likely comprised of supra-sovereigns like Nigeria's three-tranche:

- 09/21 $4B #Nigeria $1.25B 7Y 6.125%, $1.5B 12Y 7.375%, $1.25B 30Y 8.25%

- 09/21 $Benchmark MetLife 3Y +45a, 3Y FRN/SOFR

- 09/21 $1.5B Rocket Mortgage $750M each: 5NC2, 12NC6

- 09/21 $1B Brookfield Property 5.5NC2

- 09/21 $850M Mondelez WNG 3Y +55a, 5Y +65a

- 09/21 $800M JM Smucker WNG +10Y +105a, 20Y +115a

- 09/21 $800M Tempur Sealy 10NC5

EGBs-GILTS CASH CLOSE: Greece Shines

Bunds pared early losses to finish flat on the session, with Gilts underperforming and bear steepening Tuesday. It was a risk-on atmosphere for most of the session, with equities bouncing sharply from Monday's sell-off, driving cross-asset price action.

- The standout though was Greece, with 10Y spreads falling 5+bp vs Germany after ECB's Stournaras said he expects the ECB to buy GGBs post-PEPP.

- No impactful data today but plenty of supply: syndication of inaugural Green gilt (GBP10bln size on books > GBP100bln) was the highlight but also sold were 3bln of 7Y Bund and E1bln of Finnish RFGB.

- Focus turns to the Fed decision Wednesday and the BoE /PMI data Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.6bps at -0.712%, 5-Yr is up 0.2bps at -0.633%, 10-Yr is up 0.3bps at -0.317%, and 30-Yr is up 0.1bps at 0.173%.

- UK: The 2-Yr yield is up 2.3bps at 0.279%, 5-Yr is up 2.2bps at 0.485%, 10-Yr is up 1.3bps at 0.807%, and 30-Yr is up 1.7bps at 1.119%.

- Italian BTP spread down 2.2bps at 101.3bps / Greek down 5.2bps at 109bps

FOREX: Dollar Indices Consolidate, CHF Remains Well Bid

- US Dollar Indices held expectedly narrow ranges on Tuesday as market participants await the September FOMC decision/statement due on Wednesday.

- With the bounce in equities waning throughout the latter half of the trading day, safe haven currencies remained well supported. Notably the Swiss Franc continued its recovery, resulting in USDCHF (-0.40%) sliding a full 100 pips from Monday's highs to around 0.9235.

- Antipodean FX extended on Monday's decline with AUDJPY and NZDJPY losing just shy of 0.5% and closely tracking downside momentum in the Bloomberg commodity index.

- Much more limited price action for the likes of EUR, GBP and CNH which remain close to unchanged. USDCAD also remains closely tied to the 1.2800 mark and flat for the day despite a more pronounced near 1% range following yesterday's election.

- The pair continues to display a stronger bullish short-term outlook following the recovery from 1.2494, Sep 3 low. Furthermore, moving average conditions are in bull mode reinforcing this theme, opening up the potential for a move towards the 1.2949 bull trigger, Aug 20 high.

- Overnight, the Bank of Japan kick off a busy central bank schedule over the next 48 hours.

- The main event comes later in the day with the Federal reserve meeting. Eagerly anticipated, the FOMC will likely set up a taper start in late 2021, increasingly likely in November.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.