-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI ASIA OPEN - Fed Edging Closer To Liftoff

MNI ASIA OPEN - Fed Edging Closer To Liftoff

EXECUTIVE SUMMARY

- Evans Brings Forward Fed Rate Liftoff View to 2023

- Fed's Rosengren to Retire Thursday, Citing Health

- Any Fresh TLTRO Less Generous,No Cliff-Edge Fears

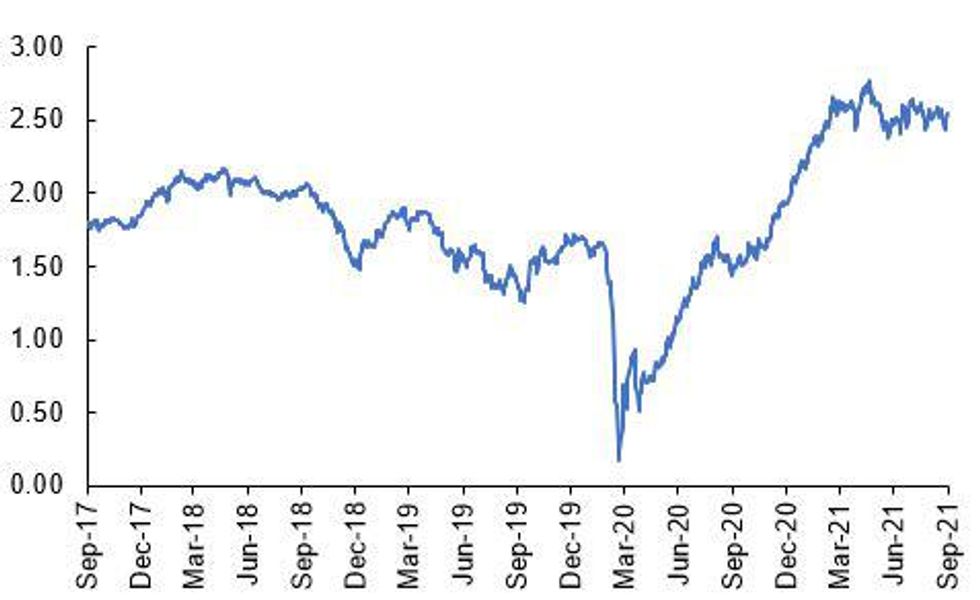

Fig 1. US 5-Year Breakeven Rate, %

NORTH AMERICA

MNI BRIEF: Evans Brings Forward Fed Rate Liftoff View to 2023

Chicago President Charles Evans on Monday brought forward his preference for a Federal Reserve rate liftoff to 2023 from 2024, calling for a gradual tightening from there as inflation looks set to hold around 2%.

"The economy will be on a stronger footing and hopefully we'll be looking at an environment where we can be looking to remove" some rate stimulus, he told reporters, adding the key is making sure the public buys into the Fed's longer-term inflation goals. "In that eventuality, raising rates in late 2023 is appropriate. And it's a very gradual increase."

MNI BRIEF: Fed's Rosengren to Retire Thursday, Citing Health

Boston Fed President Eric Rosengren announced Monday he will retire on Thursday because of a kidney ailment, moving up prior plans to leave next June when he would have reached the mandatory retirement age for the position. The role of interim president, while the search for a regular replacement ramps up, will be assumed by Kenneth Montgomery, the Bank's first vice president and chief operating officer.

MNI: Inflation Hasn't Met Fed's Overshoot Goal, Evans Says

The Federal Reserve's inflation overshooting criteria for raising interest rates won't be met until longer-run price expectations move up towards 2%, Chicago President Charles Evans said Monday, while indicating agreement with colleagues saying it is almost time to scale back bond purchases. "If the flow of employment improvements continues, it seems likely that those conditions will be met soon and tapering can commence," he said in the text of a speech. "Future decisions regarding the path of short-term policy rates seem much less clear to me at the moment."

EUROPE

MNI INSIGHT: Any Fresh TLTRO Less Generous,No Cliff-Edge Fears

Any fresh rounds of cheap loans to banks via the European Central Bank's TLTRO scheme are likely to be less generous, MNI understands. While targeted longer-term refinancing operations, which in their most recent iteration have been provided at 50 basis points below the deposit rate, or -1% to access funds for lending to eligible businesses, have been essential to maintaining the flow of credit to the economy during the pandemic, some officials would prefer banks to be less dependant on central bank credit. The ECB's main refinancing operations, providing loans at 0%, would also provide a fallback in the absence of further TLTROs, according to this reasoning, which crosses the eurozone's usual north-south divide.

MNI BRIEF: BOE Bailey: Recent Data Strengthen Tightening Case

Bank of England Governor Andrew Bailey offers no direct guidance to try and shift market expectations over the timing of the first hike in the released text of a speech due later Monday. He says in the speech that recent evidence had strengthened the case for modest tightening but he stressed that views were divided on the Monetary Policy Committee and that uncertainty was high. Speaking to the Society of Professional Economists he underscored the point that earnings growth was become more dispersed rather than uniformly accelerating.

ASIA

MNI BRIEF: PBOC To Safeguard Homebuyers' Rights

The People's Bank of China will ensure the continued healthy development of the real estate market and safeguard the legitimate rights of homebuyers, according to a statement on its website following the Q3 meeting of the central bank's Monetary Policy Committee. Overall monetary policy will remain prudent and flexible, maintain sufficient liquidity and enhance the stability of total credit growth, as well as keep the macro-leverage ratio basically stable, the statement added.

MNI BRIEF: China Should Set Up National Green Fund

China should establish a national-level fund to help with the green transformation, so to minimize possible contagion to the financial sector as many high-carbon industries and enterprises will face severe pressures amid the green push, according to a report by the Green Finance Committee of China Society for Finance and Banking sent to MNI.

MNI BRIEF: BOJ Kuroda Sees High Commodity Prices Transitory

The recent rise in international commodity prices will be transitory and will not last for too long, Bank of Japan Governor Haruhiko Kuroda said Monday, noting that higher prices were due mainly to supply restrictions that will end later this year or early next year.

US TSYS SUMMARY: Fed Edging Closer To Tapering

USTs have traded weaker alongside a broader sell-off in European sovereign bonds earlier in the day.

- UST cash yields are 1-3bp higher on the day with the blly of the curve underperforming.

- TYZ trades at 131-25+, towards the lower end of the day's range (L: 131-19+ / 132-05+)

- Comments from several Fed speakers hit the wires earlier. Chicago Fed President Charles Evans argued: "I see the economy as being close to meeting the 'substantial further progress' standard we laid out last December" and further that "If the flow of employment improvements continues, it seems likely that those conditions will be met soon and tapering can commence."

- These comments were echoed by New York Fed President John Williams: "Assuming the economy continues to improve as I anticipate, a moderation in the pace of asset purchases may soon be warranted" and by Governor Lael Brainard: "Employment is still a bit short of the mark on what I consider to be substantial further progress. But if progress continues as I hope, it may soon meet the mark".

- Preliminary Durable Goods Orders for August came in above expectations (headline: 1.8% M/M vs 0.6% survey), while the Dallas Fed Manf. Activity Index update for September missed (4. vs 11.0 expected).

FOREX: G10FX Confined To Narrow Ranges, Cross/JPY Extending Bounce

- G10 FX price action failed to spark interest on Monday with fairly contained ranges to start the week, evidenced by an unchanged dollar index.

- Initial Euro weakness was seen following the poor showing from the German conservative bloc in their Federal elections. EURUSD traded from 1.1720 down to 1.1685, falling just one pip shy of the post-FOMC lows. The selling pressure slowly dissipated throughout the day with the single currency drifting a little higher throughout the US session, back above 1.1800.

- Bearish technical conditions were reinforced last week, opening up key support at 1.1664, Aug 20 low and an important bear trigger.

- Beneficiaries of the relentless bid in crude markets were AUD and CAD, rising between 0.28-0.4%. USDCAD support at the 50-day EMA intersection of 1.2609 has held today. However, with Brent futures narrowing the gap with $80, a clear breach of this average may signal scope for a deeper pullback, potentially exposing the 200-day at 1.2523.

- The weaker Japanese Yen helped extend the strong bounce for cross/JPY from the September 21 lows with AUDJPY and CADJPY rising close to 0.6% for today's session.

- Australian retail sales data is due overnight before a fairly heavy slate of speakers. These include ECB's Lagarde and MPC's Mann, followed by FOMC Chair Powell and members Evans, Bowman and Bostic.

DATA

MNI: US AUG DURABLE NEW ORDERS +1.8%; EX-TRANSPORTATION +0.2%

US AUG NONDEF CAP GDS ORDERS EX-AIR +0.5% V JUL +0.3%

US JUL DURABLE GDS NEW ORDERS REV TO +0.5%

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.