-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Gov Waller: May Need More Than Taper In '22

EXECUTIVE SUMMARY

- MNI: Fed's Waller-- More Than Taper May Be Needed in 2022

- MNI INTERVIEW: Jobs 'Mismatch' a Misnomer--Rich. Fed Economist

- MNI BRIEF: Fed's Barkin Warns Labor Shortages Could Last

- MNI: Bowman Sees Lasting Job Hit as Pandemic Sidelines Women

- GENSLER: BITCOIN REMAINS A HIGHLY SPECULATIVE ASSET CLASS, Bbg

- China and Russia send warships between Japanese islands, The Times

US

FED: The Federal Reserve needs to finish tapering QE by the middle of next year, giving policy makers room to hike rates soon afterwards if needed to deal with stronger-than-expected inflation, Governor Christopher Waller said Tuesday.

- "I do not expect liftoff to occur soon after tapering is completed," he said in prepared remarks to a Stanford University conference. "The two policy actions are distinct."

- "The pace of continued improvement in the labor market will be gradual, and I expect inflation will moderate, which means liftoff is still some time off," he said. For more see MNI Policy main wire at 1501ET.

FED: The notion of a widespread U.S. labor market 'mismatch' is misleading because most new job openings require relatively little prior training or credentials, Richmond Fed economist Claudia Macaluso told MNI, adding that firms may simply not be offering enough pay.

- "There are a couple of measures that try to get directly at how much mismatch there is in the labor market and most of those don't point to an increase," said Macaluso, whose research focuses specifically on labor market dynamics, in an interview.

- While measures of labor supply imbalance focus on occupational change and how easily skills can be transferred from one job to another, much of the jump in employment openings in recent months to a record 11 million in July falls into the so-called "low-skill" category in areas like hospitality and food service, she said.

- "If you look at historical pattern, people who used to be employed in jobs with those skills could transfer relatively easily to similar jobs. The skills don't take that long to acquire." For more see MNI Policy main wire at 0836ET.

- Despite a recovery in the unemployment rate to 4.8%, roughly 100 million Americans over age 16 aren't working or looking for work, disproportionately women and those without a college degree, he said. Roughly 16% of them would need to return to the workforce to get the U.S. back to its peak employment-to-population level seen in 2000. For more see MNI Policy main wire at 1228ET.

- There are 2 million fewer women in the labor force now than before the pandemic, a larger drop than that of men. In particular, women living with children under the age of six saw a higher exit rate. For more see MNI Policy main wire at 1315ET.

US TSYS: Fed Gov Waller: May Need More Than Taper in 2022

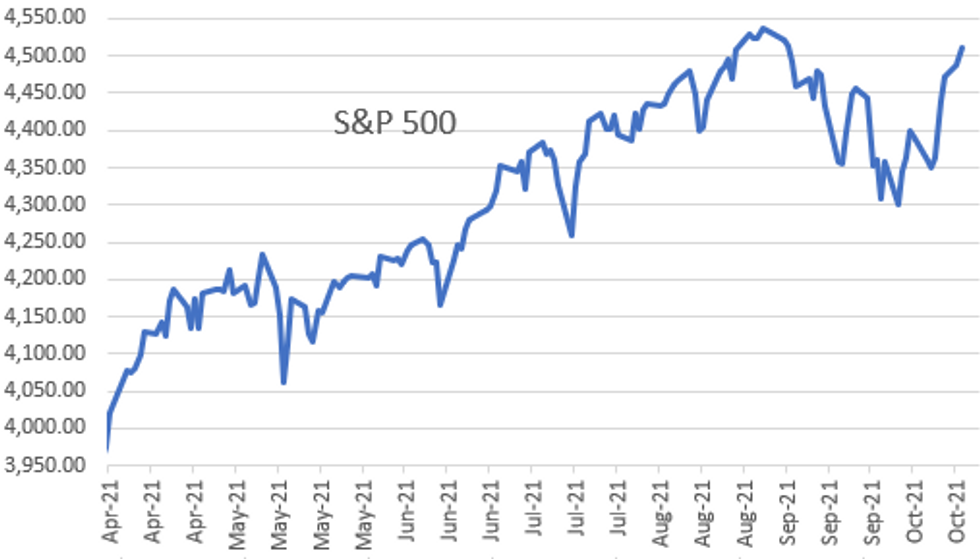

The week opener support for bonds was nowhere to be seen Tuesday, yield curves rebounding (5s30s still below 100.0 at 93.13) with the long end near late session lows (30YY +0.0547 to 2.0883%) after the closing bell; equities continuing to make new highs for the month: ESZ1 +31.5 at 4509.0.- Surprising little react to late session Fed Gov Waller statement: more than tapering may be needed in 2022 though intermediate-long end rates held lows.

- Early buying: Tsy futures climbed off pre-data lows after Sep housing starts data comes out lower than estimated (1.555M vs. 1.613M est) with fast$ and program buying lows. Short end rates continued to outperform throughout the session while bonds drifted steadily lower.

- Contributing flow: Large 2s10s steepener Block: +20,790 TUZ1 109-23.87 now, post-time offer at 1000:37ET vs. -10,687 TYZ1 130-20, sell through 130-22 post-time bid (DV01 on steepener appr $875k).

- BLOCK, Conditional 10s30s Near Curve Steepener: -8,576 TYZ 131 puts, 57 post-time bid vs. +7,500 USZ 157 puts, 108 post-time offer -- adjusting for delta the NOB spd very near CME's 5:2 inter-commodity ratio.

- Corporate and supra sovereign debt issuance continued: $5.8B Thermo Fisher 5pt and $4B China 4pt generated some two-way hedging.

- By the close, 2-Yr yield is down 3.6bps at 0.3892%, 5-Yr is down 1.6bps at 1.1537%, 10-Yr is up 3bps at 1.6301%, and 30-Yr is up 5bps at 2.084%.

OVERNIGHT DATA

US SEP HOUSING STARTS 1.555M; PERMITS 1.589M

US AUG STARTS REVISED TO 1.580M; PERMITS 1.721M

US SEP HOUSING COMPLETIONS 1.240M; AUG 1.300M (REV)

US REDBOOK: OCT STORE SALES +15.1% V YR AGO MO

US REDBOOK: STORE SALES +15.4% WK ENDED OCT 16 V YR AGO WK

US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 135.53 points (0.38%) at 35394.61

- S&P E-Mini Future up 26.25 points (0.59%) at 4503.75

- Nasdaq up 85.1 points (0.6%) at 15107.35

- US 10-Yr yield is up 3 bps at 1.6301%

- US Dec 10Y are down 5.5/32 at 130-19

- EURUSD up 0.003 (0.26%) at 1.164

- USDJPY down 0.03 (-0.03%) at 114.29

- WTI Crude Oil (front-month) up $0.38 (0.46%) at $82.79

- Gold is up $5.74 (0.33%) at $1770.60

- EuroStoxx 50 up 15.43 points (0.37%) at 4166.83

- FTSE 100 up 13.7 points (0.19%) at 7217.53

- German DAX up 41.36 points (0.27%) at 15515.83

- French CAC 40 down 3.25 points (-0.05%) at 6669.85

US TSY FUTURES CLOSE

- 3M10Y +3.627, 158.573 (L: 149.945 / H: 158.573)

- 2Y10Y +7.091, 124.367 (L: 116.235 / H: 124.569)

- 2Y30Y +8.89, 169.441 (L: 159.92 / H: 169.643)

- 5Y30Y +6.907, 93.108 (L: 85.83 / H: 93.273)

- Current futures levels:

- Dec 2Y up 1.625/32 at 109-24.25 (L: 109-22.125 / H: 109-24.75)

- Dec 5Y up 1.25/32 at 121-28.75 (L: 121-25.5 / H: 122-01)

- Dec 10Y down 7.5/32 at 130-17 (L: 130-16.5 / H: 130-31)

- Dec 30Y down 1-12/32 at 158-6 (L: 158-06 / H: 159-25)

- Dec Ultra 30Y down 2-22/32 at 190-30 (L: 190-29 / H: 193-28)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.805

- Mar 22 +0.005 at 99.795

- Jun 22 +0.020 at 99.690

- Sep 22 +0.035 at 99.530

- Red Pack (Dec 22-Sep 23) +0.040

- Green Pack (Dec 23-Sep 24) +0.035 to +0.015

- Blue Pack (Dec 24-Sep 25) +0.005 to -0.025

- Gold Pack (Dec 25-Sep 26) -0.035 to -0.065

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00038 at 0.07175% (-0.00138/wk)

- 1 Month +0.00000 to 0.08563% (+0.00525/wk)

- 3 Month -0.00200 to 0.12950% (+0.00587/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00125 to 0.16750% (+0.00700/wk)

- 1 Year -0.01000 to 0.29213% (+0.01250/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $277B

- Secured Overnight Financing Rate (SOFR): 0.05%, $879B

- Broad General Collateral Rate (BGCR): 0.05%, $377B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $352B

- (rate, volume levels reflect prior session)

- Tsys 2.25Y-4.5Y, $8.401B accepted vs. $32.147B submission

- TIPS 1Y-7.5Y, $2.001B accepted vs. $5.485B submission

- Next scheduled purchases

- Wed 10/20 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

- Thu 10/21 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 10/22 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED Reverse Repo

NY Fed reverse repo usage recedes slightly -- to $1,470.739B from 76 counterparties vs. $1,477.114B on Monday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: $5.8B Thermo Fisher 5Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/19 $5.8B #Thermo Fisher $750M 1.5NC.5 FRN/SOFR+35, $1.35B 2NC1+40, $500M 2NC1 FRN/SOFR+39, $2.5B 3NC1+50, $500M 3NC1 FRN/SOFR+53

- 10/19 $4B #Peoples Rep of China $1B 3Y+6, $1.5B 5Y+12, $1B 10Y+23, $500M 30Y+53

- 10/19 $1.25B #Kommunalbanken 5Y SOFR +23

- 10/19 $1B *NRW Bank (German-North Rhine-Westphalia) WNG 3Y SOFR+18

- 10/19 $1B *PSP Capital 7Y +18

- 10/19 $1B #CAF (Corporacion Andina de Fomento) 3Y SOFR +67

- 10/19 $750M #AngloGold Ashanti Holdings 7Y +195

- 10/19 $Benchmark Lukoil +5Y 2.875%a, 10Y 3.62%a

- 10/19 $Benchmark US Bancorp PerpNC5 4%a

EGBs-GILTS CASH CLOSE: Great Rate Debate Continues

Tuesday's theme was reassessing Monday's hawkish BoE and ECB rate hike repricings.

- The morning session saw a retracement higher in Short Sterling contracts (with yields in the Gilt curve short-end retreating), but this reversed over the course of the session.

- Indeed, front Euribor contracts moved to post-2020 lows, until ECB Chief Econ Lane pushed back against market hike pricing, saying it was challenging to reconcile w ECB forward guidance.

- While the long-end was not impacted, front Euribor jumped a few ticks and 2Y German yields fell 1.8bp following the comments.

- Also Tuesday, 30-year gilt yields dropped as DMO said the 30-year green gilt syndication will not take place today but later in the week (MNI now sees it Thursday).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.2bps at -0.625%, 5-Yr is up 2.1bps at -0.44%, 10-Yr is up 4.2bps at -0.106%, and 30-Yr is up 5.9bps at 0.296%.

- UK: The 2-Yr yield is up 1bps at 0.733%, 5-Yr is up 1.7bps at 0.86%, 10-Yr is up 3.3bps at 1.169%, and 30-Yr is down 0.1bps at 1.372%.

- Italian BTP spread up 0.6bps at 105.4bps / Spanish down 0.2bps at 63.4bps

FOREX: Positive Sentiment Buoys Antipodean FX, USDCNH Lowest Since June

- A clean break of the September lows prompted a strong rally in the Chinese Yuan on Tuesday. USDCNH (-0.91%) declined to fresh multi-month, narrowing the gap with 6.3525, the late May high. The run higher in CNH/JPY has been even more notable, with the cross topping 17.90 - the highest level since January 2016. The cross has rallied 6.5% off the late September low.

- In USD/CNY, some analysts noted the significance of the Beijing closing print below 6.40 (official close was 6.3998), which may be an indication that the pullback in the pair has been endorsed on an official basis.

- AUD and NZD led G10 gains against the greenback, further proof of the enhanced global risk appetite. Spot NZDUSD (+1.20%) cleared the 200-DMA/descending trendline drawn off Feb 2021 high, which coincided at $0.7101 today, and rallied to a fresh four-month high above 0.7170.

- The dollar index fell around a quarter of a percent, extending its losing streak to five days amid the reduced demand for safe haven currencies.

- Elsewhere, GBPUSD traded above resistance at 1.3795, extending bullish technical conditions. EURGBP resumed the recent decline to lows of 0.8423, the lowest since February 2020.

- The cross has recently cleared 0.8450, the Oct 10 low and a key support, reinforcing a bearish theme. This paves the way for an extension lower, opening 0.8392 next, a vol based support. Further out, there is scope too for an extension toward 0.8356, the Feb 26, 2020 low.

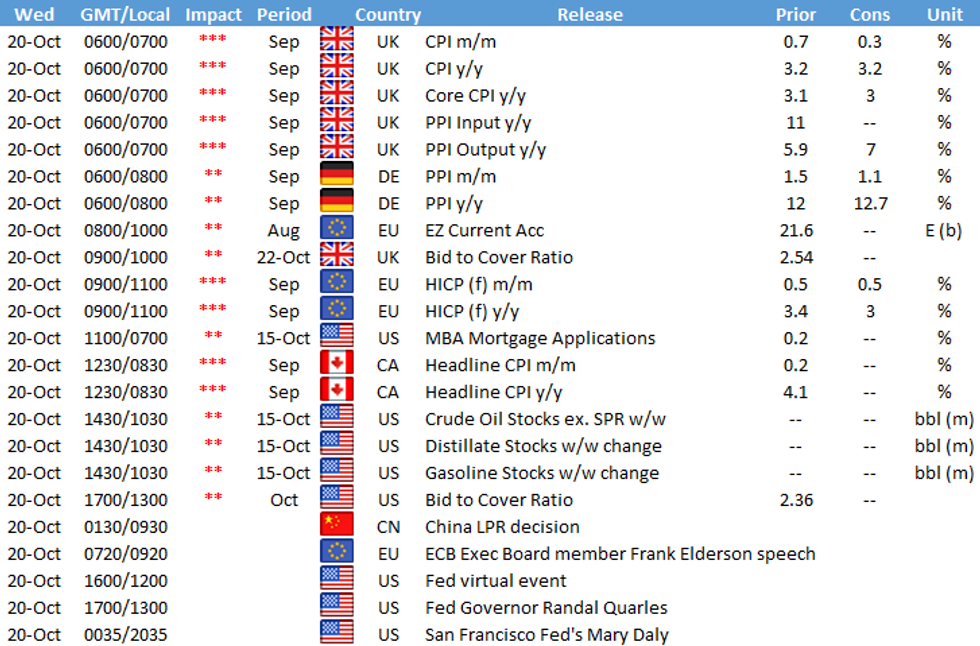

- UK inflation data due tomorrow morning is the focus, with CPI seen slowing to +0.4% M/M from +0.7% prior. This will be the last look at inflation ahead of the November 4th BoE decision.

- Canadian CPI and crude oil inventories highlight tomorrow's US session data docket.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.