-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Fed Blackout, Countdown To Taper Annc

EXECUTIVE SUMMARY

- FED: Powell Reiterates Taper Timeline But Doesn't Push Back Against Hike Pricing

- MNI INTERVIEW: Earlier Fed Runoff May Avoid Yield Inversion

- MNI INTERVIEW: Andolfatto Says Fed Must Be Ready to Hike

- MNI:BOC Seen Going To QE Reinvestment Wed, No Future Bond Sale

- EU CONSIDERS TERMINATING BREXIT TRADE DEAL IF U.K. RIFT DEEPENS, Bbg (Unattributed and unconfirmed)

- SF Fed DALY: IF FED RAISES INTEREST RATE, IT WON'T SOLVE SUPPLY CHAIN PROBLEMS, BUT COULD KEEP THE FED FROM ACHIEVING FULL EMPLOYMENT … IF INFLATION IS HIGH NEXT YEAR, WE CAN RAISE THE INTEREST RATE, Rtrs

US

FED: The Federal Reserve should consider beginning to shrink its balance sheet before raising interest rates or at least reducing it at a faster pace to forestall yield curve inversion as it tightens policy, a Kansas City Fed economist told MNI.

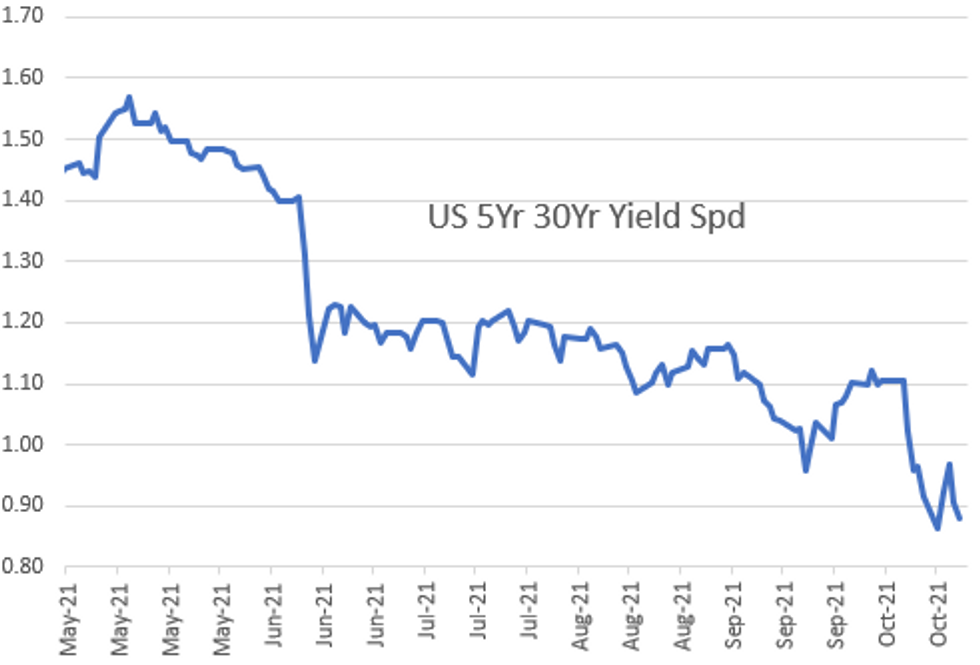

- Market behavior in the aftermath of the Great Recession highlights that the order in which policymakers normalize monetary policy matters, said Karlye Dilts Stedman in an interview. Her research with co-author Chaitri Gulati indicates that raising the interest rate before reducing the size of the balance sheet could cause a flattening or inversion of the yield curve that can materially affect firms that profit from the spread between short- and long-term interest rates. For more see MNI Policy main wire at 1202ET.

- "If this inflation turns out to be more persistent than what we thought, I think that might motivate the FOMC to act to raise rates" in 2022, he said in an interview.

- Policymakers are right to begin tapering bond purchases soon, Andolfatto said, as they are expected to do as early as next month's meeting. For more see MNI Policy main wire at 1228ET.

- Powell said the Fed is "on track" to begin and complete the taper by mid-2022.

- Sees inflation pressures as transitory, though likely to last longer than had previously been expected, with supply constraints lasting well into next year; risks are clearly now to longer and more persistent, too high inflation; they have the tools to deal with persistent inflation if necessary. On the dovish side, says job growth could take later than they previously thought, and noting that a winter COVID spike can't be ruled out.

- Powell didn't express concern over / push back significantly on very hawkish market rate repricing in the past couple of weeks. He only went so far as to say it would be "premature" to raise rates, but of course the question is about liftoff timing and hike pace, not whether they are going to start now.

- Powell said he thought Fed policy is in "a good place" and that he thought "the market generally understands where we are" so while "not blessing every asset price", feels taper communications have avoided a "taper tantrum so far". So, not really pushing back much on market rate pricing in that regard.

CANADA

BOC: Canada's central bank is set to hold federal bonds purchased under QE until they mature and keep its balance sheet elevated through the economic recovery, former government officials and advisers told MNI, with Governor Tiff Macklem seen moving to the "reinvestment" phase at the BOC's meeting on Wednesday.

- Bond buying should slow from CAD2 billion a week to either CAD1 billion a week or between CAD4 billion and CAD5 billion a month, keeping the balance sheet four times larger than it was before the pandemic, the sources said. Most also saw Macklem sticking to his earlier view about staying in reinvestment mode at least until he raises interest rates, even as some are questioning whether hot inflation could force him to hike ahead of forward guidance for no move before the second half of 2022.

US TSYS: Fed Chair Powell Has Last Word On Likely Nov Taper Annc Ahead Blackout

Back to the flattener. Tsys traded mildly weaker early Friday, gradually rebounding ahead mixed Markit PMIs: Mfg softer (59.2 vs. 60.5est and 60.7 in Sep) while Services picked up (58.2 vs. 55.2 est and 54.9 in Sep).

- Tsy futures that had pared gains/traded weaker in 2s-10s after Fed chair started speaking at a SARB event, staying on script despite a surge in market rate hike pricing.

- Powell said Fed is "on track" to begin and complete the taper by mid-'22; inflation pressures as transitory, though likely to last longer than had previously been expected, with supply constraints lasting well into next year. Equities pared gains after chairman Powell said inflation "well above target."

- Focus on Powell quickly ebbed as Tsys surged on back of EU Brexit headlines -- unattributed and unconfirmed on wires and social media stating the EU will consider terminating the Brexit trade agreement (TCA) with the UK if the rift between Brussels and Westminster deepens. Tsy futures surged to session highs but have scaled back support slightly as well, Yield curve broadly flatter in near end, while 5s30s are off 18 month low tapped Monday:

- The 2-Yr yield is up 0.7bps at 0.4615%, 5-Yr is down 3.3bps at 1.2072%, 10-Yr is down 4.9bps at 1.6518%, and 30-Yr is down 5.9bps at 2.0883%.

OVERNIGHT DATA

- US FLASH OCT MFG PMI 59.2; SEP 60.7; SURVEY 60.5

- US FLASH AUG SVCS PMI 58.2; SEP 54.9; SURVEY 55.2

- US FLASH AUG COMP PMI 57.3; SEP 55.0

- U.S. POSTS $2.77 TRLN BUDGET DEFICIT FOR 2021 FISCAL YEAR

- CANADIAN AUG RETAIL SALES +2.1%; SALES EX-AUTOS/PARTS +2.8%

- CANADA AUG RETAIL SALES EX-AUTOS/PARTS-GASOLINE +2.7%

- CANADA FLASH SEPT FACTORY SALES -1.9%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 95.73 points (0.27%) at 35699.43

- S&P E-Mini Future down 4.5 points (-0.1%) at 4537.25

- Nasdaq down 119.7 points (-0.8%) at 15096.11

- US 10-Yr yield is down 4.8 bps at 1.6536%

- US Dec 10Y are up 5/32 at 130-11

- EURUSD up 0.0014 (0.12%) at 1.1637

- USDJPY down 0.55 (-0.48%) at 113.44

- Gold is up $11.39 (0.64%) at $1794.28

European bourses closing levels:

- EuroStoxx 50 up 33.08 points (0.8%) at 4188.81

- FTSE 100 up 14.25 points (0.2%) at 7204.55

- German DAX up 70.42 points (0.46%) at 15542.98

- French CAC 40 up 47.52 points (0.71%) at 6733.69

US TSY FUTURES CLOSE

- 3M10Y -7.123, 157.156 (L: 156.473 / H: 163.68)

- 2Y10Y -6.957, 117.496 (L: 116.449 / H: 124.404)

- 2Y30Y -7.995, 161.088 (L: 159.793 / H: 169.227)

- 5Y30Y -3.34, 87.102 (L: 85.001 / H: 91.532)

- Current futures levels:

- Dec 2Y down 1.125/32 at 109-20 (L: 109-17.875 / H: 109-21.125)

- Dec 5Y steady at 121-19.5 (L: 121-12.75 / H: 121-22.5)

- Dec 10Y up 5/32 at 130-11 (L: 129-31.5 / H: 130-16)

- Dec 30Y up 17/32 at 158-9 (L: 157-08 / H: 158-24)

- Dec Ultra 30Y up 1-11/32 at 191-2 (L: 189-00 / H: 191-29)

US EURODOLLAR FUTURES CLOSE

- Dec 21 +0.005 at 99.810

- Mar 22 -0.025 at 99.755

- Jun 22 -0.045 at 99.60

- Sep 22 -0.050 at 99.425

- Red Pack (Dec 22-Sep 23) -0.045 to -0.025

- Green Pack (Dec 23-Sep 24) -0.01 to +0.015

- Blue Pack (Dec 24-Sep 25) +0.020 to +0.035

- Gold Pack (Dec 25-Sep 26) +0.035 to +0.050

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00075 at 0.07350% (+0.00038/wk)

- 1 Month -0.00137 to 0.08788% (+0.00750/wk)

- 3 Month +0.00100 to 0.12488% (+0.00125/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00175 to 0.17200% (+0.01150/wk)

- 1 Year +0.02038 to 0.31688% (+0.03725/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $75B

- Daily Overnight Bank Funding Rate: 0.07% volume: $284B

- Secured Overnight Financing Rate (SOFR): 0.03%, $879B

- Broad General Collateral Rate (BGCR): 0.05%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $332B

- (rate, volume levels reflect prior session)

- Tsys 4.5Y-7Y, $6.001B accepted vs. $20.799B submission

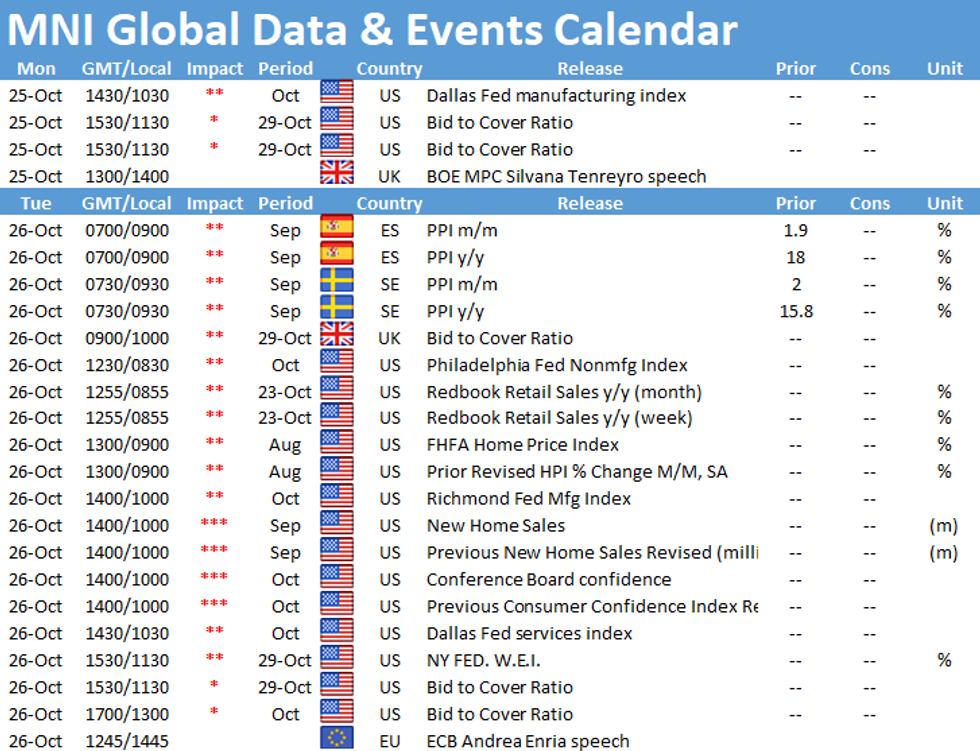

- Next scheduled purchases

- Mon 10/25 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Tue 10/26 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 10/27 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Thu 10/28 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Fri 10/29 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

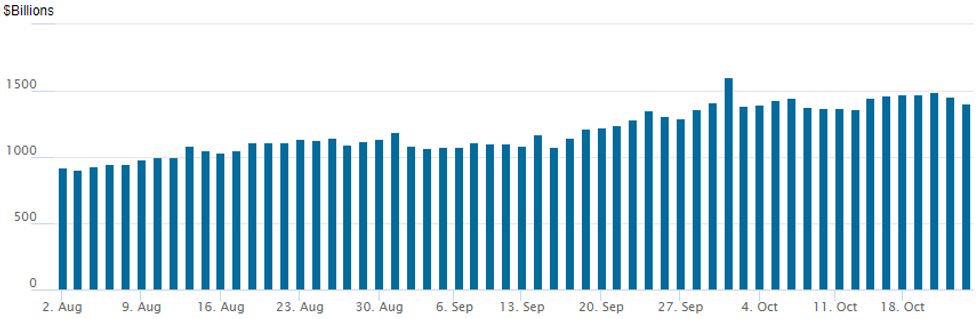

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,403.020B from 79 counterparties from $1,458.605B on Thursday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: $21B AerCap Pushed Total Oct Issuance To $120.7B

$24.5B Priced Thursday, puts total for week at $63.25B, $120.7B/month

- Date $MM Issuer (Priced *, Launch #)

- 10/21 $21B *AerCap 9-tranche jumbo: $1.75B 2Y +70, $500M 2Y FRN/SOFR+68, $3.25B 3Y +90, $1B 3NC1 +100, $3.75B 5Y +125, $3.75B 7Y +150, $4B 10Y +165, $1.5B 12Y +175, $1.5B 20Y +175

- 10/21 $3B *CADES (Caisse d'Amortissement de la Dette Sociale) 5Y LIBOR+5

- 10/21 $500M *Santander Chile 10Y +150

EGBs-GILTS CASH CLOSE: Last-Minute Brexit Surprise Cements Gilt Gains

Gilts closed the week on a strong note, with the long end rallying on a Bloomberg article out just minutes before the cash close: "EU Considers Terminating Brexit Trade Deal If UK Rift Deepens".

- The move cemented Gilt outperformance of Bunds and Treasuries on the day, but perhaps notably, the short-end didn't react much (perhaps the news is not seen impacting near-term BoE hike odds).

- Both the German and UK curves flattened Friday. Periphery spreads widened slightly.

- Data was mixed: UK retail sales disappointed in September, though UK PMI impressed while Eurozone numbers were generally on the weak side of expectations.

- After hours ratings reviews include Greece, Italy, and the UK.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.9bps at -0.637%, 5-Yr is up 0.9bps at -0.423%, 10-Yr is down 0.3bps at -0.105%, and 30-Yr is down 3.3bps at 0.239%.

- UK: The 2-Yr yield is down 4.8bps at 0.661%, 5-Yr is down 3.4bps at 0.829%, 10-Yr is down 5.7bps at 1.145%, and 30-Yr is down 8.1bps at 1.361%.

- Italian BTP spread up 1.1bps at 110.4bps / Spanish up 0.7bps at 63.3bps

FOREX: USDJPY Falls For Third Consecutive Session, GBP Reverts Lower

- Fed Chair Powell's stance doesn't seem to have changed significantly in recent weeks despite a surge in market rate hike pricing. While his comments initially lent support to the greenback, this price action quickly reversed and USDJPY made fresh weekly lows.

- USDJPY has now fallen for three days, edging back towards 113.50, consolidating on the sharp rally from 109 in late September. Dips are still considered technically corrective with initial firm support seen at 112.08, Sep 30 high and a recent breakout level.

- GBP was the worst G10 performer on Friday and the weakness was exacerbated as headlines dropped suggesting the EU could weigh terminating the post-Brexit trade deal if the U.K. government pulls out of its commitments over Northern Ireland.

- An already weak GBPUSD, shot to fresh lows of 1.3836 before stabilising into the close. Interestingly, for the sixth day in a row, EURGBP has made lows between 0.8422-24 before finding support. While the price action has remained broadly GBP supportive, today's rally marks the most meaningful bounce in the cross, rising back above the August lows to a high of 0.8468.

- In emerging markets, USDTRY continued its ascent, rising close to 1% and breaching 9.60 and printing fresh all-time highs of 9.6625. RUB bucked the trend following the surprise 75bp hike from the CBR prompting an extension of USDRUB weakness. After briefly breaching the 70.00 mark, the pair approaches the close down close to 1% at 70.35.

- A busy central bank schedule for next week, with monetary policy decisions from the Bank of Canada, the Band of Japan and the European central Bank.

- German IFO on Monday and AUD CPI Tuesday are early data points of note.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.