-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - ECB Set to Deliver Third Consecutive Cut

MNI China Daily Summary: Thursday, December 12

MNI ASIA OPEN: Transitory Inflation Transitory

EXECUTIVE SUMMARY

- MNI: Fed Edging Away From Message Inflation Is 'Transitory'

- MNI STATE OF PLAY: Lagarde Pushes Back Vs Rate Expectations

- $1.75T Spending Bill Draft Released

US

FED: The Federal Reserve appears to be gradually moving away from its description of the biggest burst in inflation in three decades as "transitory" now that price increases have lasted longer than originally forecast and may persist well into next year, former Fed officials and staffers told MNI.

- A communications shift could see the central bank put less emphasis on the word "transitory" in spoken remarks, though it might be too soon to remove it from the November FOMC statement in case this sends too hawkish a message and unsettles markets.

- "They do need to pivot from something like transitory to something like short-term. This was not something that was going to be just two or three months," former Fed Governor Randall Kroszner said in an interview. "I think they've been quite adept at finding ways to gradually change the language, change the perception of what they are likely to do, without jarring the markets." For more see MNI Policy main wire at 1216ET.

Wires note House Rules committee to meet at 1500ET to discuss further. No set time for vote, but wires have been reporting since Wednesday the President wants

EUROPE

ECB: European Central Bank President Christine Lagarde pushed back against expectations of a 20 basis-point rate hike in 2022, saying that markets have either failed to understand or believe the ECB's medium-term inflation projections.

- At the press conference following the Governing Council's October meeting, Lagarde accepted there was a disconnect between the central bank's analysis of inflation dynamics and those of financial institutions, and said she would continue to make the case against raising rates over the forecast period until the message had got through.

- "We have to ask ourselves where this disconnect lies in, and it's either a question of our forward guidance not being sufficiently clear so that it is understood, or it is a question of our inflation outlook not being believed by markets," she said, after the ECB left its major policy settings unchanged ahead of a crunch meeting in December. "We are convinced that our assessment and our projections at this point in time are correct. For more see MNI Policy main wire at 1201ET.

US TSYS: Ylds Climb After Mixed Data: Lower Claims/Weaker GDP, Weak 7Y Sale

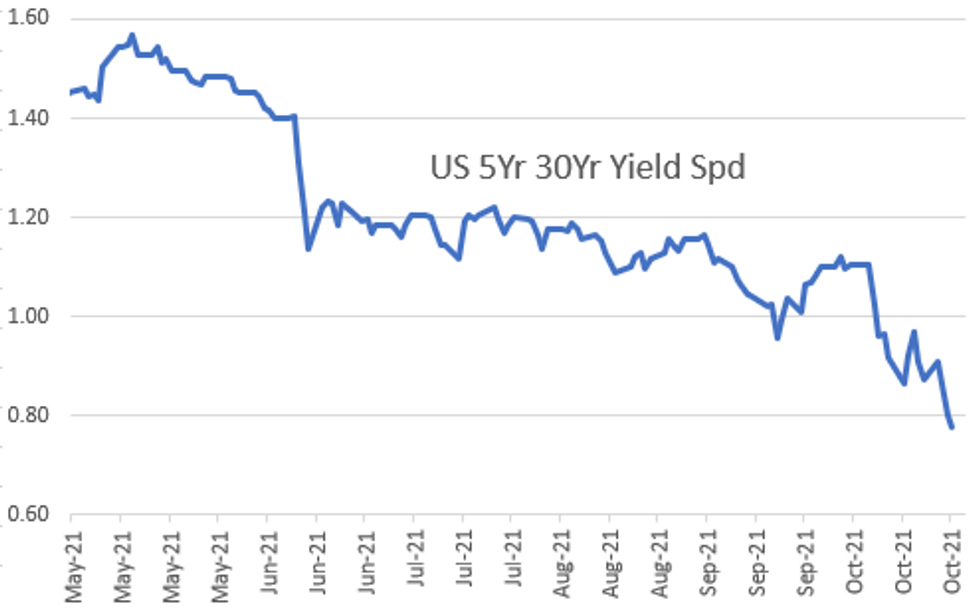

Treasury futures hold weaker levels on heavy volumes by the close Thursday, just off second half lows of the day with curves mixed after more broad based flattening in first half (5s30s dropped to 73.349, Mar 2020 low).- Focus on data after ECB kept refi/deposit/lending rates unchanged. Tsys held weaker/inside overnight range after better than exp wkly/continuing claims (281k vs. 288k est; 2.243m vs. 2.420m est) while first look at 3Q GDP came out weaker than est: 2.0% vs. 2.6%.

- Robust volumes amid two-way in 2s-7s, carry-over buying in long end from bank and insurance portfolios. More steepener stop-outs for leveraged accts.

- Rates whipsawed midmorning: following Bund lead -- Tsys surged to session highs briefly only to extend session lows less than an hour later after ECB Lagarde press brief. Lagarde pushed somewhat back on market rate hike pricing, calling it inconsistent with ECB fwd guidance/infl forecasts, though "not for her to say" if markets had got ahead of themselves.

- Tsy futures back near lows after mediocre $62B 7Y note auction (91282CDF5) drew 1.461% high yield vs. 1.447% WI; 2.25x bid-to-cover in-line with Sep's 2.24x. Indirect take-up climbs to 63.89% (highest since Jan).

- Still no vote on bill, draft of Pres Biden's $1.75T social spending package leaked: Link: HR 5376

- The 2-Yr yield is down 0.6bps at 0.497%, 5-Yr is up 3.6bps at 1.1864%, 10-Yr is up 2.5bps at 1.5659%, and 30-Yr is up 1bps at 1.9603%.

OVERNIGHT DATA

- US JOBLESS CLAIMS -10K TO 281K IN OCT 23 WK

- US PREV JOBLESS CLAIMS REVISED TO 291K IN OCT 16 WK

- US CONTINUING CLAIMS -0.237M to 2.243M IN OCT 16 WK

- US Q3 GDP +2.0%

- US NAR SEP PENDING HOME SALES INDEX 116.7 V 119.4 IN AUG

- U.S. OCT. KANSAS CITY FED MANUFACTURING ACTIVITY AT 31.0

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 140.45 points (0.4%) at 35631.26

- S&P E-Mini Future up 35 points (0.77%) at 4579

- Nasdaq up 181.2 points (1.2%) at 15417.35

- US 10-Yr yield is up 2.5 bps at 1.5659%

- US Dec 10Y are down 13/32 at 130-24.5

- EURUSD up 0.008 (0.69%) at 1.1683

- USDJPY down 0.37 (-0.33%) at 113.46

- WTI Crude Oil (front-month) up $0.03 (0.04%) at $82.69

- Gold is up $4.32 (0.24%) at $1801.08

- EuroStoxx 50 up 12.99 points (0.31%) at 4233.87

- FTSE 100 down 3.8 points (-0.05%) at 7249.47

- German DAX down 9.48 points (-0.06%) at 15696.33

- French CAC 40 up 50.7 points (0.75%) at 6804.22

US TSY FUTURES CLOSE

- 3M10Y +2.539, 151.093 (L: 147.005 / H: 152.673)

- 2Y10Y +2.876, 106.518 (L: 97.646 / H: 107.528)

- 2Y30Y +1.419, 145.928 (L: 136.702 / H: 149.032)

- 5Y30Y -2.879, 77.029 (L: 73.349 / H: 81.76)

- Current futures levels:

- Dec 2Y down 0.75/32 at 109-19.875 (L: 109-15.625 / H: 109-22)

- Dec 5Y down 6.25/32 at 121-23.5 (L: 121-18 / H: 121-31.5)

- Dec 10Y down 13/32 at 130-24.5 (L: 130-19.5 / H: 131-02.5)

- Dec 30Y down 13/32 at 160-18 (L: 160-09 / H: 161-08)

- Dec Ultra 30Y down 20/32 at 195-24 (L: 195-03 / H: 197-02)

US EURODOLLAR FUTURES CLOSE

- Dec 21 -0.005 at 99.790

- Mar 22 -0.020 at 99.750

- Jun 22 -0.030 at 99.565

- Sep 22 -0.030 at 99.370

- Red Pack (Dec 22-Sep 23) -0.025 to -0.015

- Green Pack (Dec 23-Sep 24) -0.015 to -0.01

- Blue Pack (Dec 24-Sep 25) -0.005 to +0.015

- Gold Pack (Dec 25-Sep 26) steady to +0.010

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00413 at 0.07363% (+0.00013/wk)

- 1 Month -0.00062 to 0.08638% (-0.00150/wk)

- 3 Month +0.00300 to 0.13163% (+0.00675/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01400 to 0.19363% (+0.02163/wk)

- 1 Year +0.03838 to 0.37063% (+0.05375/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $78B

- Daily Overnight Bank Funding Rate: 0.07% volume: $267B

- Secured Overnight Financing Rate (SOFR): 0.05%, $865B

- Broad General Collateral Rate (BGCR): 0.05%, $356B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $325B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.401B accepted vs. $40.273B submission

- Next scheduled purchase

- Fri 10/29 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

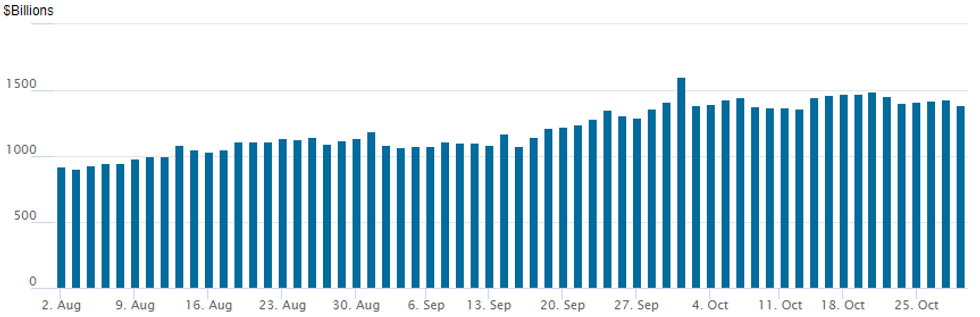

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,384.684B from 78 counterparties from $1,433.370B on Wednesday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: $4B Peru 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/28 $4B #Rep of Peru $2.25B 12Y +150, $750M 2051 Tap +150, $1B 50Y +180

- 10/28 $1.75B #Capital One $1.25B 6NC5 fix/FRN +70, $500M 11NC10 fix/FRN +105

- 10/28 $1.25B #Rio Tinto 30Y +85

- 10/28 $700M #Ares Capital 10Y +170

- 10/28 $600M #Kimberly-Clark WNG 10Y +48

- 10/28 $500M *Fifth Third 6NC5 +53

EGBs-GILTS CASH CLOSE: Volatile Session As ECB Debates Inflation

Thursday saw a very volatile session across the European FI space, highlighted by soaring Bund first futures volumes (1.2+mn, near March 2020 levels, eclipsed only by heavy Feb 2021 trading), and the 2nd highest daily BTP futures volume ever.

- But direction, while overall bearish, not entirely decisive. The morning saw a large short-end sell-off with global rate hikes brought forward, then the start of the ECB press conference saw Bunds sell off sharply, only to reverse higher and then lower again. BTPs underperformed.

- While the ECB (as expected) took no action and kept communications largely unchanged, Lagarde pushed somewhat back on market rate hike pricing, calling it inconsistent with ECB fwd guidance/infl forecasts, though "not for her to say" if markets had got ahead of themselves.

- BBG/Rtrs sources articles post-meeting highlighted an internal debate over the inflation outlook, with some on the GC sceptical of a fall below target in 2023.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.6bps at -0.624%, 5-Yr is up 2bps at -0.445%, 10-Yr is up 3.5bps at -0.143%, and 30-Yr is up 1.2bps at 0.167%.

- UK: The 2-Yr yield is up 8.6bps at 0.645%, 5-Yr is up 5.5bps at 0.763%, 10-Yr is up 1.7bps at 1.003%, and 30-Yr is down 2.7bps at 1.108%.

- Italian BTP spread up 6.4bps at 118.6bps / Spanish up 0.5bps at 65.4bps

FOREX: Dollar Index Slides 0.5%, Weakness Extends Through October Lows

- The dollar has been under pressure throughout the latter half of Thursday's session and selling momentum in the dollar index has accelerated following the break of short-term support below the October lows.

- The DXY (-0.5%) has consolidated near the lows, having reached the first area of support for the index. The selling coincides with sell-side month-end models uniformly pointing to USD sales into the October fix, with some models noting the signal is strongest against the JPY.

- The main beneficiaries of the greenback weakness were the Euro and the Swiss Franc, both rising around 0.7%. EURUSD price activity picked up following during the ECB press conference where there was only a mild rates pushback, adding a marginal tailwind for the single currency.

- EURUSD had some clear levels of resistance to rip through, including multiple daily highs between 1.1665-69. The rally was capped at 1.1692, however, the move represents the largest daily range for EURUSD since mid-June of 110 pips. There is a key resistance at 1.1711, the top of a bear channel drawn from the Jun 1 high. Broader trend conditions remain bearish below this channel resistance.

- Gains in GBP, AUD and NZD were smaller in magnitude, although provide solid extensions of short-term bullish trends throughout October.

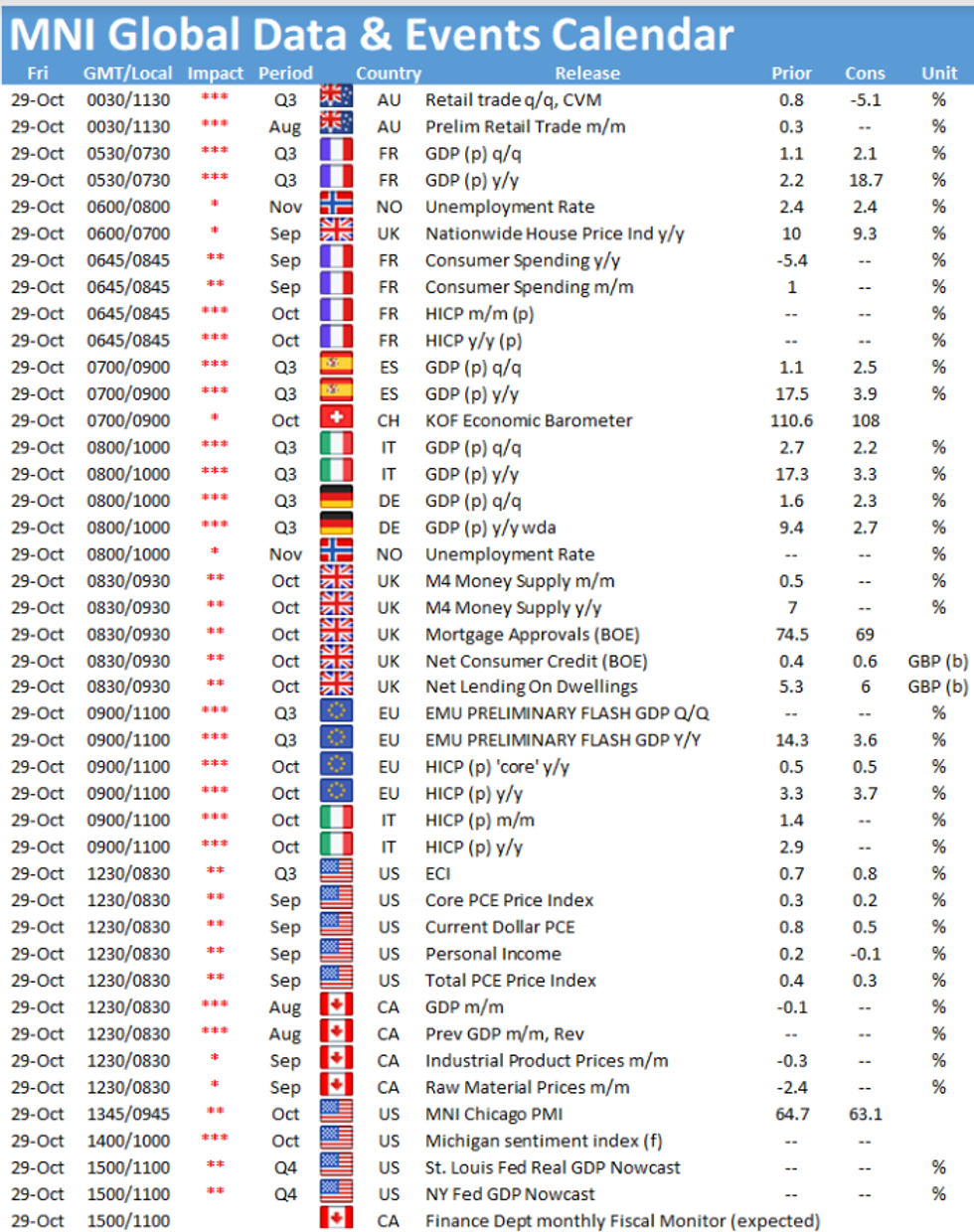

- European Flash GDP readings will precede Eurozone HICP Flash CPI Estimates. The US session will focus on Canadian GDP as well as US Core PCE Price Index. The week's calendar will conclude with the MNI Chicago PMI.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.