-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, November 29

MNI US OPEN - Le Pen Sets Deadline for Further Concessions

MNI ASIA OPEN: Big Week Ahead w/FOMC, Oct Jobs Report

EXECUTIVE SUMMARY

- MNI STATE OF PLAY: Fed To Taper QE As Risk of Inflation Rises

- MNI INTERVIEW: US Mfg Price Bounce Dents Buyer Demand - ISM

- MNI INTERVIEW: Pitfalls Seen in BOC Apr Rate Hike- Ex Staffer

- MNI BRIEF: US Treasury Raises Q4 Borrowing Estimate by USD312B

- SEN MANCHIN SAYS TIME TO VOTE ON BIPARTISAN INFRASTRUCTURE BILL, Bbg

- YELLEN OPEN TO DEFUSING DEBT CEILING WITHOUT GOP VOTES, Washington Post/Bbg

- The Biden administration will publish vaccine mandate rules 'in the coming days, NY Times

US

FED: The Federal Reserve at its meeting Wednesday will start a rapid wind-down of its pandemic-era asset purchase program, beginning the countdown to potential interest rate hikes next year amid the growing risk that high inflation won't soon subside.

- Having notched substantial progress toward a full labor market recovery, the FOMC is expected to announce a tapering of net purchases of Treasuries by USD10 billion a month and mortgage securities by USD5 billion a month, ending the USD120 billion monthly QE program by mid-2022.

- Tapering will continue on auto-pilot as long as the economy evolves in line with the Fed's outlook, the FOMC is expected to say, but the bar will be high for altering course. Markets are pricing in more than two rate hikes next year, but the order of the Fed's exit plans may prevent rate rises from moving much earlier into 2022, former staffers told MNI. For more see MNI Policy main wire at 0858ET.

- The Institute for Supply Management's price index jumped 4.5 points to 85.7 in October, the 17th consecutive month of expansion, and matching the highest level since July. The "double bounce" in the index for manufacturing prices also broke prior months' trend that indicated a softening in price pressures. The survey showed 72.3%% of firms reporting higher prices, up from 69.5%% in September, and 1% registered declining prices, down from 7.1% the prior month.

- Treasury is assuming a cash balance of approximately USD650 billion at the end of December, down USD150 billion from the assumption made in August. For the first quarter in 2022, Treasury plans to borrow USD476 billion, assuming an end-of-March cash balance of USD650 billion. The Treasury's quarterly refunding, which is expected to show coupon cuts, will be released at 8:30 a.m. November 3.

- The Treasury estimates, however, come with more uncertainty than normal. Congress is still debating how it will resolve the year's spending bills that need to be addressed by December 3 or face a government shutdown, and the next debt ceiling fix that needs to be addressed in December or January. As of Friday, Treasury has USD288 billion of USD375 billion in "extraordinary measures" remaining and has a USD260 billion cash balance.

CANADA

BOC: he Bank of Canada will wait until July before raising the record low 0.25% interest rate because moving sooner as the market expects would risk undoing a recovery strained by unemployment and consumer debt, former central bank and finance department economist Charles St-Arnaud told MNI.

- Rate hikes will also stick to a quarter-point pace rather than accelerated half-point moves mirroring the reductions made as the pandemic took hold, he said. That approach gives policy makers time to assess the drag from consumer debts exceeding 100% of GDP and job growth that will slow as the recovery advances beyond easier early gains. For more see MNI Policy main wire at 1504ET.

US TSYS: Tsy Ylds Resume Climb Ahead Midweek FOMC Annc

Tsys yields gained as November got underway, levels back near middle of Friday's range, yield curves steeper on moderate volumes.- Sights set on Wed's FOMC policy annc where $15B/month taper is expected with particular attention on inflation dynamics. Last but not least: Friday's October employment data: +450k median estimate up from +400k job gains last Friday.

- Session flow largely two-way position squaring ahead the Fed and jobs data risk events. Nevertheless, Tsy futures held weaker levels/off lows by the close, equities higher/off new all-time highs from the first half (ESZ1 4619.5). US$ pared some of Fri's strong gains (DXY -.235 at 93.888).

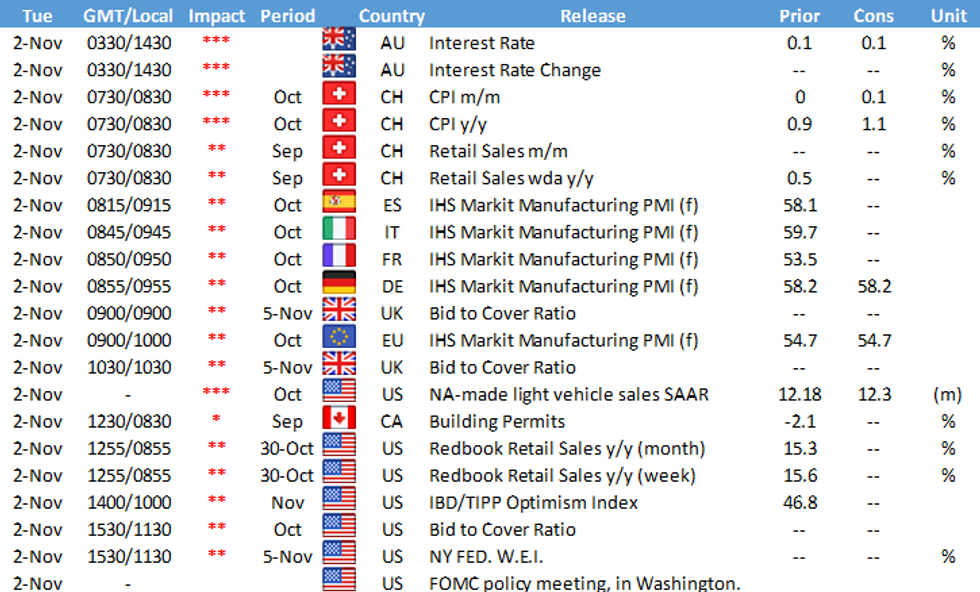

- Data remains muted Tuesday but picks up early Wednesday with ADP private employ figures at 0815ET (+400k est vs. +568k prior), and Tsy quarterly refunding at 0830ET.

- The 2-Yr yield is up 1bps at 0.5071%, 5-Yr is up 0.7bps at 1.1896%, 10-Yr is up 1.6bps at 1.568%, and 30-Yr is up 3bps at 1.9631%.

OVERNIGHT DATA

- U.S. IHS MARKIT OCT. MANUFACTURING PMI AT 58.4 VS 60.7 PRIOR

- US SEP CONSTRUCT SPENDING -0.5%

- US SEP PRIVATE CONSTRUCT SPENDING -0.5%

- US SEP PUBLIC CONSTRUCT SPENDING -0.7%

- US ISM PURCHASING MANAGERS INDEX 60.8 SEP VS 61.1 SEP

- US ISM PRICES PAID INDEX 85.7 OCT VS 81.2 SEP (NSA)

- US ISM NEW ORDERS INDEX 59.8 OCT VS 66.7 SEP

- US ISM EMPLOYMENT INDEX 52.0 OCT VS 50.2 SEP

- US ISM PRODUCTION INDEX 59.3 OCT VS 59.4 SEP

- US ISM SUPPLIER DELIVERY INDEX 75.6 OCT VS 73.4 SEP

- US ISM ORDER BACKLOG INDEX 63.6 OCT VS 64.8 SEP (NSA)

- US ISM INVENTORIES INDEX 57.0 OCT VS 55.6 SEP

- US ISM CUSTOMER INV INDEX 31.7 OCT VS 31.7 SEP (NSA)

- US ISM EXPORTS INDEX 54.6 OCT VS 53.4 SEP (NSA)

- US ISM IMPORTS INDEX 49.1 OCT VS 55.9 SEP (NSA)

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 73.4 points (0.2%) at 35889.29

- S&P E-Mini Future up 0.25 points (0.01%) at 4596.5

- Nasdaq up 32.9 points (0.2%) at 15529.23

- US 10-Yr yield is up 1.6 bps at 1.568%

- US Dec 10Y are down 0.5/32 at 130-22

- EURUSD up 0.0046 (0.4%) at 1.1604

- USDJPY up 0.06 (0.05%) at 114.01

- WTI Crude Oil (front-month) up $0.42 (0.5%) at $83.99

- Gold is up $9.75 (0.55%) at $1793.23

- EuroStoxx 50 up 29.91 points (0.7%) at 4280.47

- FTSE 100 up 51.05 points (0.71%) at 7288.62

- German DAX up 117.52 points (0.75%) at 15806.29

- French CAC 40 up 62.95 points (0.92%) at 6893.29

US TSY FUTURES CLOSE

- 3M10Y +3.734, 152.863 (L: 148.981 / H: 155.249)

- 2Y10Y +1.066, 106.184 (L: 103.704 / H: 108.253)

- 2Y30Y +2.81, 145.993 (L: 140.558 / H: 147.616)

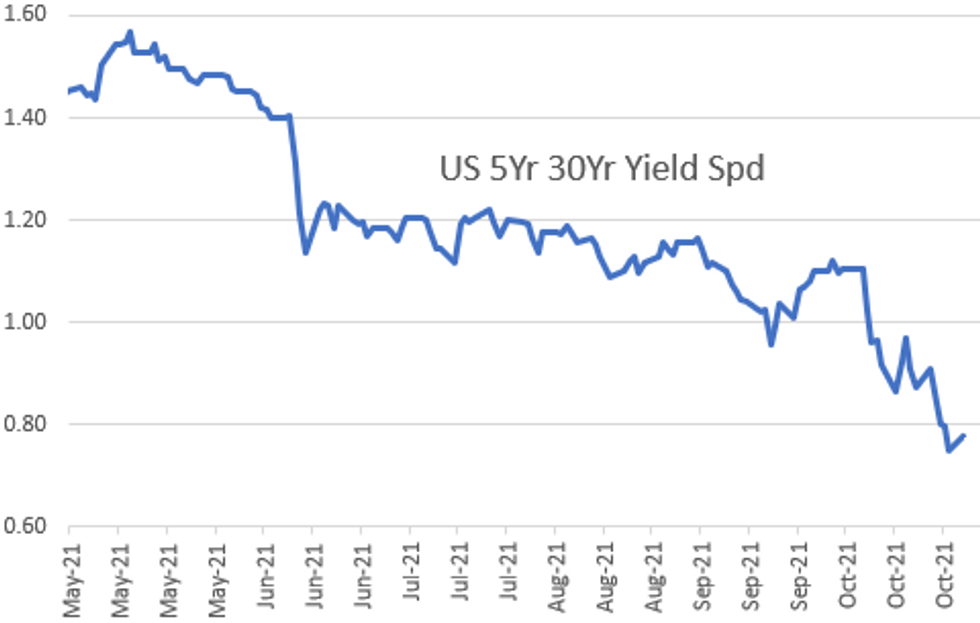

- 5Y30Y +2.981, 77.623 (L: 71.636 / H: 78.78)

- Current futures levels:

- Dec 2Y down 1.125/32 at 109-18.875 (L: 109-17.625 / H: 109-20)

- Dec 5Y down 2.5/32 at 121-21.5 (L: 121-17.5 / H: 121-25.75)

- Dec 10Y down 3/32 at 130-19.5 (L: 130-12.5 / H: 130-25.5)

- Dec 30Y down 18/32 at 160-9 (L: 159-26 / H: 161-00)

- Dec Ultra 30Y down 1-20/32 at 194-25 (L: 194-02 / H: 196-25)

US EURODOLLAR FUTURES CLOSE

- Dec 21 -0.015 at 99.780

- Mar 22 -0.015 at 99.725

- Jun 22 -0.025 at 99.535

- Sep 22 -0.030 at 99.330

- Red Pack (Dec 22-Sep 23) -0.04 to -0.035

- Green Pack (Dec 23-Sep 24) -0.045 to -0.04

- Blue Pack (Dec 24-Sep 25) -0.035 to -0.03

- Gold Pack (Dec 25-Sep 26) -0.035 to -0.03

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00450 at 0.06763% (-0.00138 total last wk)

- 1 Month -0.00637 to 0.08113% (-0.00038 total last wk)

- 3 Month +0.00863 to 0.14088% (+0.00738 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00988 to 0.21088% (+0.02900 total last wk)

- 1 Year +0.00612 to 0.36725% (+0.04425 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $70B

- Daily Overnight Bank Funding Rate: 0.06% volume: $222B

- Secured Overnight Financing Rate (SOFR): 0.05%, $847B

- Broad General Collateral Rate (BGCR): 0.05%, $336B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $317B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $1.999B accepted vs. $4.601B submission

- Next scheduled purchases

- Tue 11/02 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Wed 11/03 No buy operation due to FOMC annc

- Thu 11/04 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 11/04 1100-1120ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 11/05 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

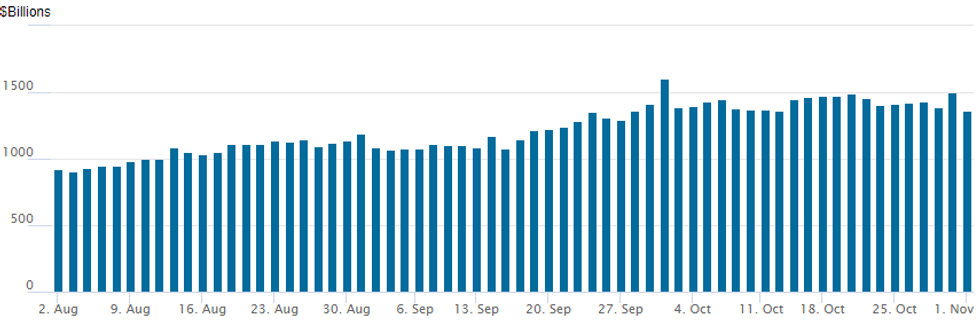

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage declines as November gets underway: at $1,358.606B from 74 counterparties vs. Friday's second highest usage on record of $1,502.296B. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: $11.45B To Price Monday

- Date $MM Issuer (Priced *, Launch #)

- 11/01 $3B #JP Morgan 11NC10 fix/FRN +97

- 11/01 $3B #American Express $800M 2Y +25, $600M 2Y FRN/SOFR+23, $1.1B 5Y +50, $500M 5Y FRN/SOFR+65

- 11/01 $2.1B #Raytheon Tech $1B +10Y +80, $1.1B +30Y +105

- 11/01 $1B #Invitation Homes $600M 7Y +87, $400M 12Y +115

- 11/01 $700M #Republic Services 11Y +83 (upsized from $600M)

- 11/01 $650M #Southwestern Electric Power 30Y +130

- 11/01 $500M #Duke Realty +10Y +82

- 11/01 $500M Jane Street Group 8NC3

FOREX: Swiss Franc and Swedish Krona Shine As Greenback Fades

- The greenback started the week on the backfoot after Friday's strong near 1% rally. The dollar index (-0.26%) slipped back below the 94.00 mark with EURUSD also regaining the 1.16 handle.

- Of note throughout the session were strong performances for both the Swiss Franc and the Swedish krona.

- EURCHF (-0.27%) and USDCHF (-0.70%) have continued recent trajectories lower, with both pairs approaching support areas worth noting. For EURCHF, 1.0505/10 represents an area of multiple lows between April-May 2020.

- On a slightly shorter-term note, USDCHF right around 0.9100 horizontal support across the mid-August lows. Additionally, an upward sloping trendline across the 2021 lows intersects near 0.9085. A break of this technical point could have the potential to accelerate CHF strength and would target the August and June lows at 0.9019 and 0.8926 respectively.

- USDSEK finds itself 0.81% lower on the session as EURSEK accelerates recent weakness below the 10.00 handle. Following the breach of the 2021 lows and a period of consolidation, EURSEK now trades below 9.90 and the lowest levels since February 2018.

- Elsewhere, EURGBP (+0.58%) enjoyed a relief rally, completing a full point bounce from the 0.84 lows made last week.

- In emerging markets, MXN and ZAR extended recent weakness and were particular underperformers both falling roughly 1.2% versus the dollar.

- Markets will focus on the RBA decision due overnight ahead of Swiss data to kickstart the European session.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.