-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: Midweek Focus: FOMC, ADP, Tsy Qrtr Refunding

EXECUTIVE SUMMARY

- SEN SCHUMER: AGREEMENT REACHED TO LOWER RX DRUG COSTS, Bbg

- SEN SCHUMER SAYS SINEMA BACKS DRUG-PRICING AGREEMENT, Bbg

- DEMOCRATS ARE EYING A FIVE-YEAR STATE AND LOCAL TAX DELAY THROUGH 2025 - POLITICO

US TSYS: Rate-Hike Bets Cool Slightly Ahead Next FOMC Policy Annc

Firmer by the close, Tsy futures recover a fraction of Monday's sell-off, settling in to near middle of the session range, yield curves mildly steeper as markets awaited Wednesday's FOMC policy annc.- FOMC is expected to announce a tapering of net purchases of Treasuries by USD10 billion a month and mortgage securities by USD5 billion a month, ending the USD120 billion monthly QE program by mid-2022. Note: decent short end bid from accts paring rate-hike bets (Eurodlr Reds (EDZ2-EDU3) up 0.105-0.110 late)

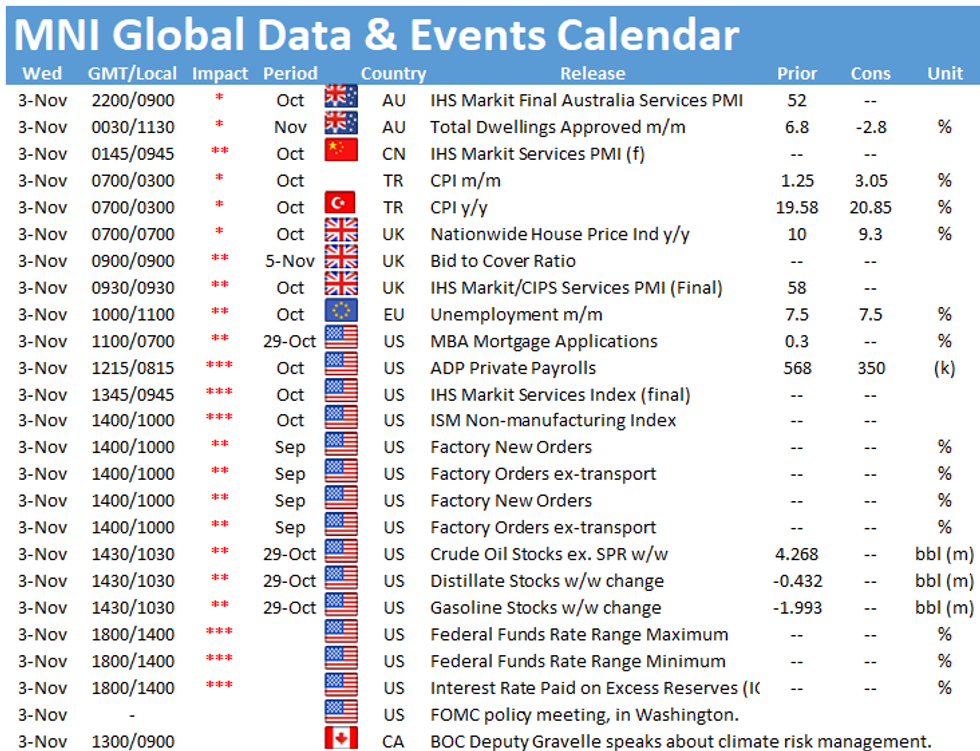

- Second half of week makes up for lack of data in first half: ADP private employ data early Wed (+400k est) followed by Tsy quarterly refunding at 0830ET. Last but not least: Friday's October employment data: +450k mean estimate.

- Early bid on foreign support: Rates traded firmer with the exception of steady 30Y ultra-bonds on the open, yield curves steeper (5s30s over 80.0 after see-sawing near low 70.0s since Friday). Sources report decent foreign real money buying in 2s-5s overnight vs. light deal-tied selling, Asian real$ buying out the curve.

- Early trade turned two-way in the short end as rates pare modest gains: central bank selling 3s and separately buying 5s. Out the curve: leveraged acct selling 20s while central bank buy 30s. Ultra-bond futures managed gains after trading weaker much of the first half.

- The 2-Yr yield is down 4.7bps at 0.4519%, 5-Yr is down 2.9bps at 1.1476%, 10-Yr is down 1bps at 1.5453%, and 30-Yr is down 0.1bps at 1.9569%.

OVERNIGHT DATA

- US REDBOOK: OCT STORE SALES +15.7% V YR AGO MO

- US REDBOOK: STORE SALES +16.9% WK ENDED OCT 30 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 141.5 points (0.39%) at 36052.57

- S&P E-Mini Future up 15.75 points (0.34%) at 4621.25

- Nasdaq up 31.7 points (0.2%) at 15626.74

- US 10-Yr yield is down 1 bps at 1.5453%

- US Dec 10Y are up 10/32 at 130-31

- EURUSD down 0.0025 (-0.22%) at 1.1581

- USDJPY down 0.05 (-0.04%) at 113.95

- WTI Crude Oil (front-month) down $0.51 (-0.61%) at $83.51

- Gold is down $5.93 (-0.33%) at $1787.34

- EuroStoxx 50 up 15.75 points (0.37%) at 4296.22

- FTSE 100 down 13.81 points (-0.19%) at 7274.81

- German DAX up 148.16 points (0.94%) at 15954.45

- French CAC 40 up 33.74 points (0.49%) at 6927.03

US TSY FUTURES CLOSE

- 3M10Y -1.141, 149.107 (L: 147.278 / H: 151.739)

- 2Y10Y +3.723, 108.985 (L: 105.261 / H: 109.336)

- 2Y30Y +4.911, 150.357 (L: 145.417 / H: 150.633)

- 5Y30Y +3.185, 80.95 (L: 77.046 / H: 81.99)

- Current futures levels:

- Dec 2Y up 4.375/32 at 109-23.375 (L: 109-19.25 / H: 109-23.875)

- Dec 5Y up 9.5/32 at 121-31.75 (L: 121-22 / H: 122-03)

- Dec 10Y up 11.5/32 at 131-0.5 (L: 130-20.5 / H: 131-04.5)

- Dec 30Y up 13/32 at 160-25 (L: 160-11 / H: 161-05)

- Dec Ultra 30Y up 16/32 at 195-18 (L: 194-16 / H: 196-09)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.780

- Mar 22 +0.030 at 99.760

- Jun 22 +0.065 at 99.60

- Sep 22 +0.080 at 99.410

- Red Pack (Dec 22-Sep 23) +0.090 to +0.095

- Green Pack (Dec 23-Sep 24) +0.025 to +0.070

- Blue Pack (Dec 24-Sep 25) -0.015 to +0.015

- Gold Pack (Dec 25-Sep 26) -0.03 to -0.02

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00450 at 0.07213% (+0.00000/wk)

- 1 Month -0.00025 to 0.08088% (-0.00662/wk)

- 3 Month +0.00412 to 0.14500% (+0.01275/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00988 to 0.22075% (+0.01975/wk)

- 1 Year -0.00887 to 0.35838% (-0.00275/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $78B

- Daily Overnight Bank Funding Rate: 0.07% volume: $266B

- Secured Overnight Financing Rate (SOFR): 0.05%, $959B

- Broad General Collateral Rate (BGCR): 0.05%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $329B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.001B accepted vs. $5.458B submission

- Next scheduled purchases

- Wed 11/03 No buy operation due to FOMC annc, two on Thu:

- Thu 11/04 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 11/04 1100-1120ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 11/05 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

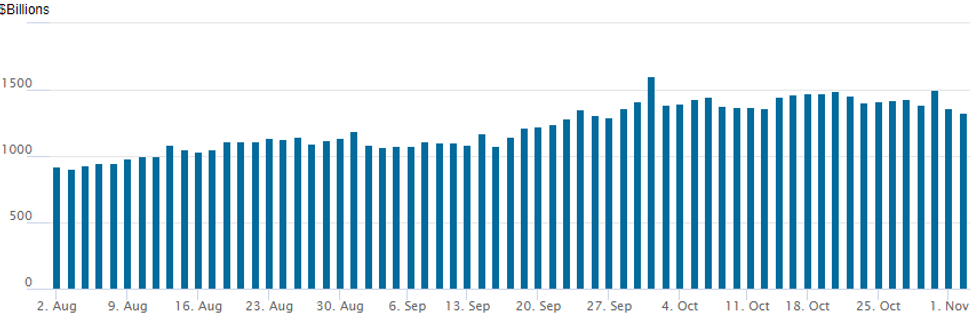

FED Reverse Repo Operation

NY Fed reverse repo usage declines to $1,329.913B from 77 counterparties vs. Monday's $1,358.606B. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: Corporate Debt Issuance Over $16.15B Ahead FOMC

$4.7B to Price Tuesday; $16.15B/wk

- Date $MM Issuer (Priced *, Launch #)

- 11/02 $2.5B #Deutsche Bank $1.75B 2Y +52, $750M 2Y FRN/SOFR+50

- 11/02 $850M #Walgreens Boots 2NC.5 +50

- 11/02 $750M #Arthur J Gallagher $400M 10Y +90, $350N +30Y +115

- 11/02 $600M *BOCGI (Bank of China Green) 5Y +75

- Reverse Yankees priced earlier:

- 11/02 E1B *Goldman Sachs 7.5Y +80

- 11/02 E400M *General Mills 4Y +30

EGBs-GILTS CASH CLOSE: BTPs Soar

EGB yields dropped by some of the most since early 2020 in a cross-asset rally (Eurostoxx hit all-time highs). Gilts underperformed Bunds. Bellies outperformed on the curve.

- Some short-cover and profit taking was noted, with central bank rate hike pricing becoming a little less aggressive after a dovish RBA outcome and ahead of key Fed and BoE meetings.

- Particularly notable were big rallies in periphery EGBs (BTP spreads tightened ~7bp) and semi-core (OATs in particular). Albeit on lighter volumes than seen in last week's sharp drops.

- Not much on the calendar today: Italian PMIs impressed, while Spain's disappointed.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.5bps at -0.664%, 5-Yr is down 7.3bps at -0.474%, 10-Yr is down 6.1bps at -0.163%, and 30-Yr is up 0.7bps at 0.177%.

- UK: The 2-Yr yield is down 2.4bps at 0.673%, 5-Yr is down 3bps at 0.814%, 10-Yr is down 2.2bps at 1.04%, and 30-Yr is up 3.4bps at 1.177%.

- Italian BTP spread down 6.8bps at 124.7bps / Spanish down 3.4bps at 69.9bps

FOREX: AUD and NZD Close Near The Lows, EURNOK Extends Bounce

- Supportive greenback price action saw AUDUSD (-1.34%) and NZDUSD (-1.11%) continue their slump to the worst levels in two weeks.

- Price action in AUD largely a reflection of the broadly dovish central bank overnight, exacerbated by the consistent grind higher in the dollar index (+0.21%) ahead of tomorrow's fed decision.

- With US equity indices continuing to probe record highs and broad technical conditions for AUDUSD remaining bullish, we note firm support is still seen at 0.7393, the 50-day EMA. AUDJPY has fallen an even more dramatic 1.42% and worth noting pivot support residing at 84.26, the late June and July highs.

- The Norwegian Krone extended a correction on Tuesday after a relentless rally against the euro, with this week's Norges Bank meeting likely to have minimal effect. EURNOK surged through last week's highs at 9.80, rising around 1.11% for the session. The April lows reflect the first level of pivotal resistance for the pair, residing around 9.90.

- USDCHF also gained a solid 0.58% after bouncing from trendline support across the 2021 lows at 0.9090.

- EURGBP continued its relief rally, spending the majority of the day back above the 0.85 handle.

- In emerging markets, USDILS reversed early weakness after falling to its lowest level since 1996.

- US ADP employment change and ISM Services PMI are scheduled for Wednesday, however, all eyes will be on the November FOMC decision. New Zealand employment data will kick-off the APAC session.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.