-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA OPEN: Taper "Earlier and Faster" Not a Hike Signal

EXECUTIVE SUMMARY

- MNI: Fed Starts QE Taper And Expects Transitory Inflation

- FED: Prepared to Adjust Taper if Necessary

- FED: Powell Subtly Pushes Back Against 2022 Hike Expectations

- FED: Powell the "pandemic recession was the deepest and the recovery has been the fastest."

- FED: Powell "policy is well-positioned to address the range of plausible outcomes. That is what we need to do. I think it's premature to raise rates today."

- MNI INTERVIEW: US Service Price Gains Aren't Transitory-ISM

US

FED: The Federal Reserve said Wednesday it would begin reducing its QE program by USD15 billion per month, saying elevated inflation is expected to be transitory and offering few hints on the path of interest rates.

- "In light of the substantial further progress the economy has made toward the Committee's goals since last December, the Committee decided to begin reducing the monthly pace of its net asset purchases by USD10 billion for Treasury securities and USD5 billion for agency mortgage-backed securities," the Fed said in its post-meeting statement. "Similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook."

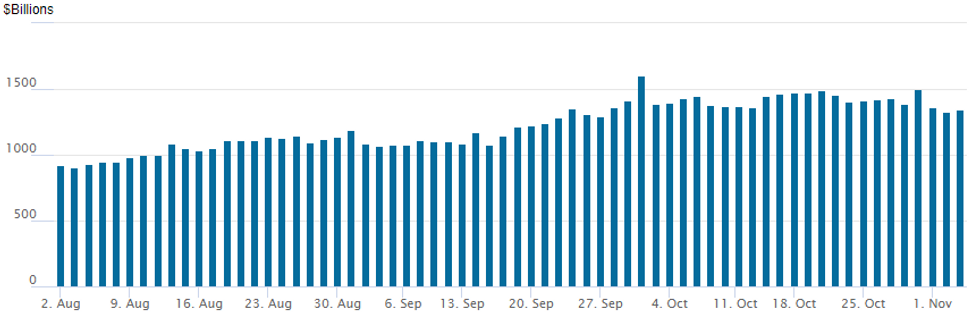

- The Fed's balance sheet grew to USD8.6 trillion from USD4.2 trillion under the QE program as it bought USD120 billion per month starting right after the pandemic struck the world economy. The taper process is set to last eight months according to the Fed's current indications. For more see MNI Policy main wire at 1412ET.

- "As the pandemic subsides supply bottlenecks will abate. As that happens, inflation will decline from elevated levels. The timing of that is uncertain. We should see inflation moving down by the second or third quarter."

- And "We have high inflation, and we have to balance that with what is going on in the employment market. So it's a complicated situation. We hope to achieve significantly greater clarity about where this economy is going and what the characteristics of the post pandemic economy are over the first half of next year."-

- Multiple comments pushed back on the idea that the Fed was thinking about hiking: "We have not focused on whether we meet the liftoff test, because we don't meet it now, because we are not at maximum employment." " I don't think we are behind the curve. "

- Also noted that while " the risk appears to be skewed toward higher inflation", "It's appropriate to be patient. It's appropriate for us to see what the labor market and what the economy look like when they heal further ... we think it will involve in a way that will mean low inflation. "

US ISM: U.S. service costs jumped again to a record high in October and will remain elevated until well into next year, pressures that Fed policy makers are underestimating, ISM survey chair Anthony Nieves told MNI Wednesday.

- "I don't want to contradict the Fed but I think that this is definitely longer than what they even anticipated," Nieves said in an interview.

- Prices in the monthly services survey rose 5.4 points to a 16-year high of 82.9 in October in the ISM survey. The gains may not level off until at least the second quarter of 2022, and there's almost no precedent in the last decade for any decline in overall price trends, he said.

US TSYS: FOMC Annc Taper, Tsy Cuts Coupon Sizes

Rates finished weaker after latest FOMC left rate steady while annc taper starting later in November as well as December. Nevertheless, the Fed is "prepared to adjust taper if necessary."

- Transitory inflation language tweaked, with some more explanatory text on why inflation is seen "transitory", but the word itself NOT removed (which would have been more hawkish).

- Extending session lows now after decent two-way post FOMC, Tsy futures saw sharp pick-up in selling with yields climbed (10YY 1.5981%H; 30YY 2.0175%H). Transitory "tweak" saw stocks climb to new all-time highs: ESZ1 4657.0.

- In line with yield curves bouncing steeper: sources reported mix of domestic real$ buying 2s, 3s and 5s, foreign real$ bought 5s, real$ bought 3s5s steepeners.

- First highlights: Rates weaker after better than expected Oct ADP showed private employment gain of 571k vs. +400k est. Quarterly Tsy refunding pared coupon auction sizes $2-$3B.

- Tsy is offering $120 billion of Treasury securities to refund approximately $75.9 billion of privately-held Treasury notes and bonds maturing on November 15, 2021. This issuance will raise new cash of appr $44.1 billion.

- The 2-Yr yield is up 2.6bps at 0.4758%, 5-Yr is up 3.9bps at 1.1865%, 10-Yr is up 4.2bps at 1.591%, and 30-Yr is up 3.6bps at 1.9951%.

OVERNIGHT DATA

- ADP RESEARCH INSTITUTE SAYS U.S. ADDED 571,000 JOBS IN OCT

- U.S. IHS MARKIT OCT. SERVICES PMI AT 58.7 VS 54.9 LAST MONTH

- FINAL U.S. OCT COMPOSITE PMI 57.6 (57.3 FLASH)

- US SEP FACTORY ORDERS +0.2%; EX-TRANSPORT NEW ORDERS +0.7%

- US SEP DURABLE ORDERS -0.3%

- US SEP NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.8%

- US OCT ISM SERVICES PMI 66.7 VS 61.9 SEP

- US ISM SERVICES BUSINESS INDEX 69.8 OCT VS 62.3 SEP

- US ISM SERVICES PRICES 82.9 OCT VS 77.5 SEP

- US ISM SERVICES EMPLOYMENT INDEX 51.6 OCT VS 53.0 SEP

- US ISM SERVICES NEW ORDERS 69.7 OCT VS 63.5 SEP

- US ISM SERVICES SUPPLIER DELIVERIES 75.7 OCT VS 68.8 SEP (NSA)

- US ISM SERVICES ORDER BACKLOG 67.3 OCT VS 61.9 SEP (NSA)

- US ISM SERVICES EXPORT ORDERS 62.3 OCT VS 59.5 SEP (NSA

- US ISM SERVICES IMPORTS INDEX 53.3 OCT VS 47.7 SEP (NSA)

- US ISM SERVICES INVENTORIES 42.2 OCT VS 46.1 SEP (NSA)

- US ISM SERVICES INVENT SENTIMENT 37.3 OCT VS 46.3 SEP (NSA)

- US MBA: REFIS -4% SA; PURCH INDEX -2% SA THRU OCT 29 WK

- US MBA: UNADJ PURCHASE INDEX -9% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.24% VS 3.30% PREV

- US MBA: MARKET COMPOSITE -3.3% SA THRU OCT 29 WK

MARKET SNAPSHOT

Key late session market levels:- DJIA up 60.48 points (0.17%) at 36132.48

- S&P E-Mini Future up 21.75 points (0.47%) at 4646.75

- Nasdaq up 131 points (0.8%) at 15783.18

- US 10-Yr yield is up 4.2 bps at 1.591%

- US Dec 10Y are down 9.5/32 at 130-21.5

- EURUSD up 0.0018 (0.16%) at 1.1602

- USDJPY up 0.07 (0.06%) at 114.03

- WTI Crude Oil (front-month) down $3.63 (-4.33%) at $80.23

- Gold is down $19.17 (-1.07%) at $1770.38

- EuroStoxx 50 up 13.39 points (0.31%) at 4309.61

- FTSE 100 down 25.92 points (-0.36%) at 7248.89

- German DAX up 5.53 points (0.03%) at 15959.98

- French CAC 40 up 23.62 points (0.34%) at 6950.65

US TSY FUTURES CLOSE

- 3M10Y +3.072, 152.373 (L: 145.65 / H: 154.485)

- 2Y10Y +2.016, 111.505 (L: 105.824 / H: 112.694)

- 2Y30Y +2.252, 152.757 (L: 144.083 / H: 153.268)

- 5Y30Y +0.949, 81.76 (L: 73.806 / H: 82.201)

- Current futures levels:

- Dec 2Y down 0.75/32 at 109-22.375 (L: 109-19.125 / H: 109-23.75)

- Dec 5Y down 3.5/32 at 121-27.5 (L: 121-18.5 / H: 122-01.75)

- Dec 10Y down 5.5/32 at 130-25.5 (L: 130-15.5 / H: 131-05.5)

- Dec 30Y down 15/32 at 160-10 (L: 159-30 / H: 161-14)

- Dec Ultra 30Y down 1-11/32 at 194-7 (L: 193-26 / H: 196-27)

US EURODOLLAR FUTURES CLOSE

- Dec 21 +0.015 at 99.790

- Mar 22 +0.005 at 99.755

- Jun 22 steady00 at 99.595

- Sep 22 -0.005 at 99.40

- Red Pack (Dec 22-Sep 23) -0.02 to -0.005

- Green Pack (Dec 23-Sep 24) -0.04 to -0.015

- Blue Pack (Dec 24-Sep 25) -0.05 to -0.045

- Gold Pack (Dec 25-Sep 26) -0.05 to -0.045

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00162 at 0.07775% (+0.00162/wk)

- 1 Month +0.00462 to 0.08550% (-0.00200/wk)

- 3 Month -0.00525 to 0.13975% (+0.00750/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00225 to 0.21850% (+0.01750/wk)

- 1 Year -0.00075 to 0.35762% (-0.00350/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $78B

- Daily Overnight Bank Funding Rate: 0.07% volume: $264B

- Secured Overnight Financing Rate (SOFR): 0.05%, $910B

- Broad General Collateral Rate (BGCR): 0.05%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $338B

- (rate, volume levels reflect prior session)

- No buy operation due to FOMC annc, two on Thursday

- Next scheduled purchases

- Thu 11/04 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 11/04 1100-1120ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 11/05 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED Reverse Repo Operation

NY Federal Reserve

NY Fed reverse repo usage climbs to $1,343.985B from 74 counterparties vs. $1,329.913B on Tuesday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: Issuers Sidelined Ahead FOMC Annc

- Date $MM Issuer (Priced *, Launch #)

- 11/03 $Benchmark -- no new issuance Wednesday

- $4.7B to Price Tuesday; $16.15B/wk

- 11/02 $2.5B *Deutsche Bank $1.75B 2Y +52, $750M 2Y FRN/SOFR+50

- 11/02 $850M *Walgreens Boots 2NC.5 +50

- 11/02 $750M *Arthur J Gallagher $400M 10Y +90, $350N +30Y +115

- 11/02 $600M *BOCGI (Bank of China Green) 5Y +75

- Reverse Yankees priced:

- 11/02 E1B *Goldman Sachs 7.5Y +80

- 11/02 E400M *General Mills 4Y +30

EGBs-GILTS CASH CLOSE: ECB Rate Pushback; BoE Eyed

Periphery yields tightened while the Gilt curve underperformed again with notable weakness at the short-end ahead of the US Fed decision after hours and of course the BoE Thursday.

- Some pushback against ECB rate hike pricing by Lagarde and Villeroy helped boost the EGB space, with Italy and Greece outperforming on the periphery. A strong US ISM Services reading in the afternoon pulled Global FI weaker though.

- Overall, fairly subdued session volume-wise by recent standards, with many on the sidelines pre-Fed / BoE.

- A very mixed outlook for Thursday's BoE, with a majority of analysts seeing a 15bp hike tomorrow, but a large plurality seeing December or later (see the MNI Preview).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.2bps at -0.654%, 5-Yr is unchanged at -0.475%, 10-Yr is down 0.3bps at -0.168%, and 30-Yr is down 2.8bps at 0.148%.

- UK: The 2-Yr yield is up 3.7bps at 0.707%, 5-Yr is up 2.4bps at 0.845%, 10-Yr is up 3.6bps at 1.075%, and 30-Yr is up 3bps at 1.203%.

- Italian BTP spread down 2.3bps at 121.5bps / Greek down 2.6bps at 136.9bps

FOREX: Dollar Whipsaws But Ends Lower Following Fed Press Conference

- Immediate price action saw the greenback kneejerk lower following the release of the November FOMC statement. The USD retreated roughly 30 pips before immediately finding support.

- Heading into the press conference the dollar fully retraced and made new highs post the release, however, the rejuvenation was short-lived and the dollar once again traded with an offered tone, eventually making fresh session lows.

- With the continued buoyancy in equity markets, risk-tied currencies are back on the front foot, with NZDUSD leading the charge, up 0.77%. In emerging markets there was a considerable near 2% turnaround after rejecting the late march highs above 20.97.

- EURUSD reacted in tandem with the magnitude of moves seen in broad dollar indices, to trade back above 1.16, up a quarter point on Wednesday. USDJPY particularly lacked direction, spending the majority of the day trading either side of unchanged around the 1.1400 mark.

- Elsewhere cable remained well bid throughout the majority of the day, with multiple lows beneath 1.3610 potentially signalling a short-term inflection point. On the upside, key short-term resistance has been defined at 1.3835, Oct 20 high where a break would instead confirm a resumption of the recent upleg and open 1.3913 once again, Sep 14 high.

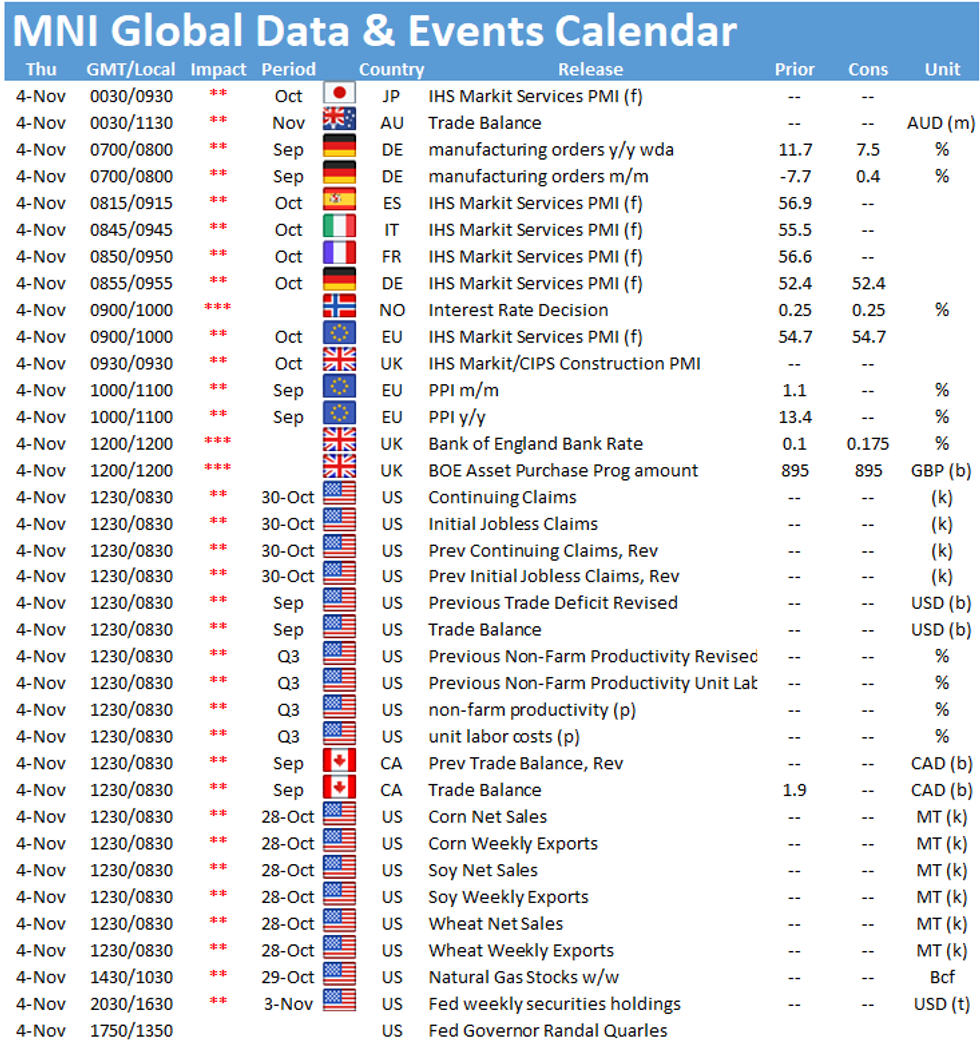

- Aussie retail sales data overnight along with a rate decision from the Norges Bank kicks off the European morning. The focus then turns to the Bank of England Decision, headlining the event risk on Thursday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.