-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Focus on October Employment

EXECUTIVE SUMMARY

- MNI STATE OF PLAY: BOE MPC Holds Fire, Flags Hike Coming Soon

- TSY SEC YELLEN: BIDEN AGENDA BILL IS FISCALLY RESPONSIBLE, Bbg

US TSYS: Steady BoE Early Tailwind For Tsys, Focus Now On Oct NFP

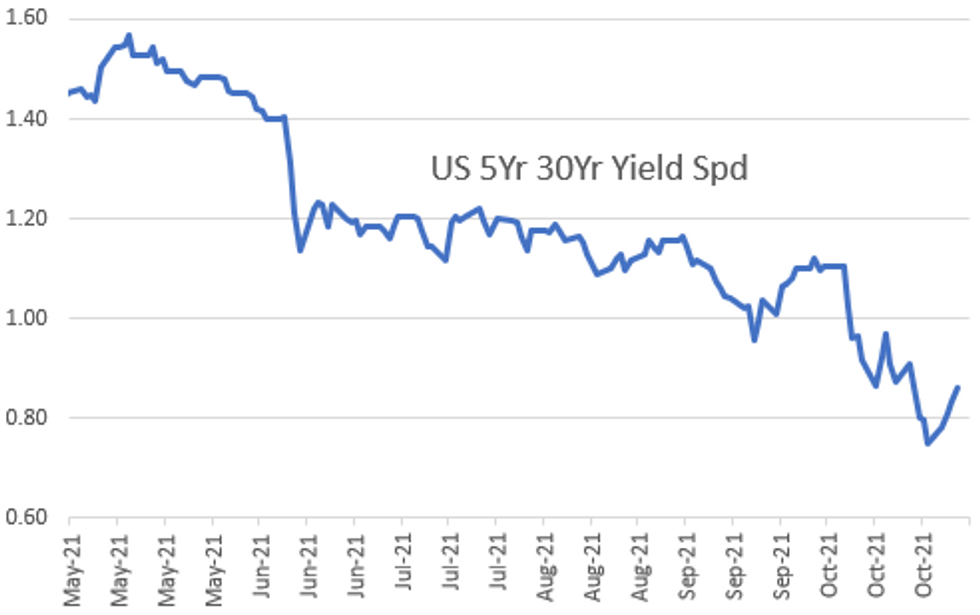

Tsy futures extended session highs late -- USZ1 back to Sep 24 levels, while FVZ and TYZ tapped mid-October lvls before scaling back by the close. In turn, yield curves mixed: flatter in the short end while 5s and 10s vs. 30s holding steeper.

Rates had opened mixed but charged higher after the Bank of England BoE unexpectedly held rates steady.

- First half: Tsy futures drifting back toward mid-morning highs, while sources report better selling from central banks in 5s and real$ in 10s and 30s. Yield curves mixed with steepeners in 5s vs. 10s and 30s noted earlier.

- After midday, sources report two-way in the short end w/ leveraged acct selling 2s-3s vs. fast$ and prop acct buying in 2s-5s, continued real-$ selling in 10s-30s. Modest deal-tied rate locks earlier and swap-tied paying in 5s.

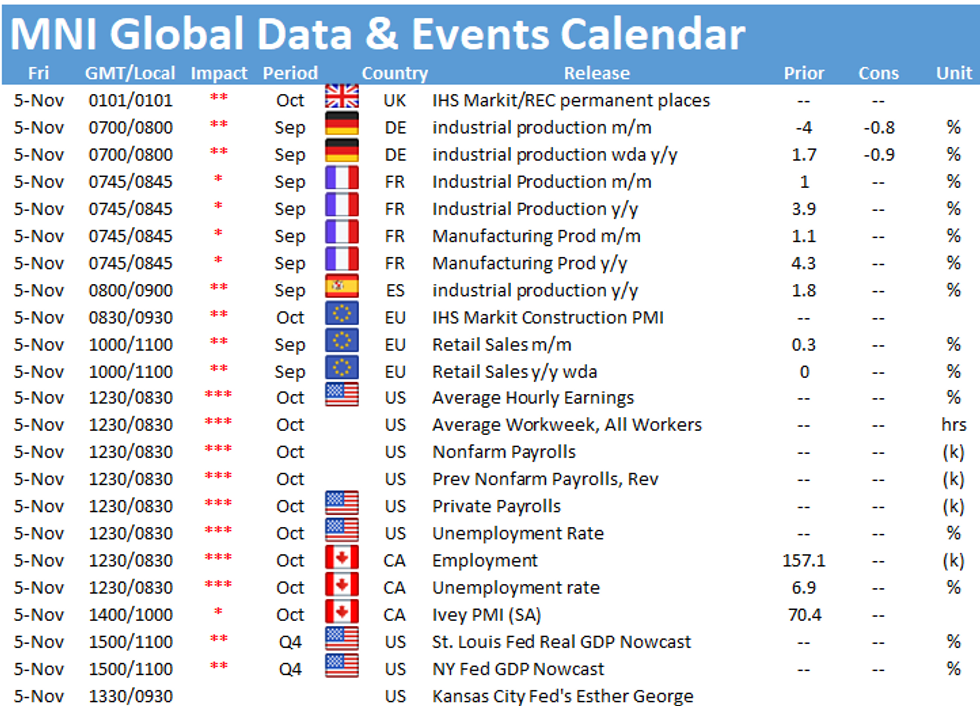

- Focus turns to Fri's October employment report: +450k median est (+194k in Sep) on range of +50k/L to +750k/H from 71 economists polled by Bbg, late whisper number +495k.

- The 2-Yr yield is down 5.1bps at 0.4145%, 5-Yr is down 8.6bps at 1.1024%, 10-Yr is down 7.9bps at 1.5244%, and 30-Yr is down 5.9bps at 1.9617%.

EUROPE

BOE: The Bank of England Monetary Policy Committee voted to seven-to-two to leave its policy rate on hold at 0.1% and firmed up its messaging to make clear that tightening was on the way, with the first hike most likely "in coming months", although policymakers pushed back against market expectations of aggressive tightening to come.

- The MPC's forecasts, based on Bank Rate rising to 1%, showed inflation above target at the two-year horizon but just below it three years ahead, suggesting that the latest pre-policy announcement market rate path, for Bank Rate rising to 1.3%, was clearly overblown.

- The two members who voted for a hike, Deputy Governor Dave Ramsden and Michael Saunders, opted for only a 15 basis point increase. They both voted again for an early end to the current asset purchase round, and were joined by Catherine Mann in this, but with that round set to end in December it will now inevitably be completed.

OUTLOOK/OPINION: Goldman: Payrolls To Step Up In October

Goldman Sachs looks for a +525k nonfarm payrolls reading in October, above +450k survey median, with a 4.7% unemp rate (in line). They point to "the first full month of hiring following the expiration of federal enhanced unemployment benefits, and coupled with improving public health and strong labor demand, we expect this report to mark a step-up in trend."

- Some of the recovery will be Delta related (dining activity seen picking up), while education payrolls should reverse the 180k decline in September.

- Though seasonal factors may weigh on the outturn (to fit the strong Oct 2020 data).

- The unemp rate drop reflects strong household employment gains and a rebound in the participation rate (benefits ending, childcare constraints abating, etc), while they see an AHE increase of 0.5% (vs 0.4% consensus), in part due to higher wages at Wal-Mart.

OVERNIGHT DATA

- US JOBLESS CLAIMS -14K TO 269K IN OCT 30 WK

- US PREV JOBLESS CLAIMS REVISED TO 283K IN OCT 23 WK

- US CONTINUING CLAIMS -0.134M to 2.105M IN OCT 23 WK

- US Q3 PREL UNIT LABOR COSTS +8.3% VS Q2 +1.1%; Y/Y +4.8%

- US Q3 PREL NONFARM PRODUCTIVITY -5.0% VS Q2 +2.4%; Y/Y -0.5%

- US SEP TRADE GAP -$80.9B VS AUG -$72.8B

- CANADA SEPT TRADE BALANCE +CAD1.86 BLN

MARKET SNAPSHOT

Key late session market levels:

- DJIA down 150.86 points (-0.42%) at 36007.25

- S&P E-Mini Future up 10 points (0.21%) at 4663

- Nasdaq up 119.3 points (0.8%) at 15932.57

- US 10-Yr yield is down 7.9 bps at 1.5244%

- US Dec 10Y are up 17/32 at 131-9.5

- EURUSD down 0.0059 (-0.51%) at 1.1553

- USDJPY down 0.27 (-0.24%) at 113.75

- WTI Crude Oil (front-month) down $1.91 (-2.36%) at $78.95

- Gold is up $22.73 (1.28%) at $1792.54

- EuroStoxx 50 up 23.73 points (0.55%) at 4333.34

- FTSE 100 up 31.02 points (0.43%) at 7279.91

- German DAX up 69.67 points (0.44%) at 16029.65

- French CAC 40 up 37.14 points (0.53%) at 6987.79

US TSY FUTURES CLOSE

- 3M10Y -8.011, 147.257 (L: 146.129 / H: 155.376)

- 2Y10Y -2.848, 110.31 (L: 109.634 / H: 114.009)

- 2Y30Y -0.485, 154.362 (L: 152.209 / H: 158.244)

- 5Y30Y +2.968, 85.863 (L: 81.909 / H: 88.261)

- Current futures levels:

- Dec 2Y up 4.5/32 at 109-26 (L: 109-21.375 / H: 109-27.25)

- Dec 5Y up 15.25/32 at 122-8.25 (L: 121-23.75 / H: 122-09.5)

- Dec 10Y up 19.5/32 at 131-12 (L: 130-18 / H: 131-14)

- Dec 30Y up 27/32 at 161-10 (L: 159-18 / H: 161-16)

- Dec Ultra 30Y up 1-3/32 at 195-20 (L: 192-19 / H: 195-29)

US EURODOLLAR FUTURES CLOSE

- Dec 21 +0.020 at 99.810

- Mar 22 +0.020 at 99.775

- Jun 22 +0.045 at 99.625

- Sep 22 +0.065 at 99.445

- Red Pack (Dec 22-Sep 23) +0.080 to +0.125

- Green Pack (Dec 23-Sep 24) +0.085 to +0.115

- Blue Pack (Dec 24-Sep 25) +0.060 to +0.075

- Gold Pack (Dec 25-Sep 26) +0.040 to +0.050

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00475 at 0.07300% (-0.00313/wk)

- 1 Month +0.00413 to 0.08963% (+0.00213/wk)

- 3 Month +0.00463 to 0.14438% (+0.01213/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00525 to 0.21325% (+0.01225/wk)

- 1 Year +0.00488 to 0.36250% (+0.00138/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $75B

- Daily Overnight Bank Funding Rate: 0.07% volume: $276B

- Secured Overnight Financing Rate (SOFR): 0.05%, $877B

- Broad General Collateral Rate (BGCR): 0.05%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $329B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $5.999B accepted vs. $12.901B submission

- Tsy 10Y-22.5Y, $1.401B accepted vs. $4.024B submission

- Next scheduled purchase

- Fri 11/05 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

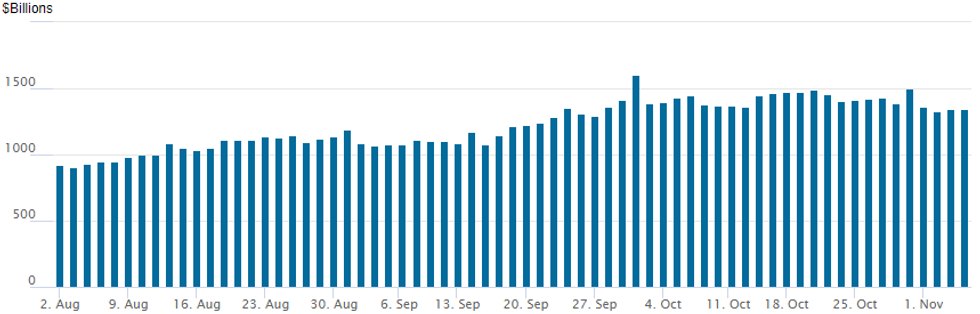

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,348.539B from 73 counterparties vs. $1,343.985B on Wednesday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: $1.5B PSEG 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/04 $1.75B #Public Storage $650M 5Y +43, $550M 7Y +58, %550M 10Y +73

- 11/04 $1.5B #Public Service Enterprise Grp $750M 2NC0.5 +43, $750M 10Y +95

- 11/04 $700M #Lear Corp 10Y $350M +110, $350M 30Y +160

- 11/04 $Benchmark Ford investor calls

EGBs-GILTS CASH CLOSE: Gilts Soar On BoE Stunner

Gilts saw one of the biggest rallies in years after the BoE unexpectedly held rates Thursday, pulling the rest of the global FI space with them.

- 2Yr Gilt yields outperformed, and STIR contracts rallied hard, with the BoE now seen making its next 15bp hike only in February, and ECB liftoff pushed back from 2022 to 2023.

- 5Yr UK yields fell the most since the Brexit referendum.

- Bunds couldn't keep pace but still saw strength across the curve; periphery spreads tightened on reduced likelihood of ECB tightening and a broader risk-on atmosphere.

- BoE commentary including Cunliffe later today, and Ramsden, Pill, Tenreyro, Broadbent, and Bailey Friday will be in focus.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.6bps at -0.71%, 5-Yr is down 8.3bps at -0.559%, 10-Yr is down 5.6bps at -0.224%, and 30-Yr is up 1.2bps at 0.159%.

- UK: The 2-Yr yield is down 20.6bps at 0.498%, 5-Yr is down 19.3bps at 0.66%, 10-Yr is down 13.1bps at 0.944%, and 30-Yr is down 5.6bps at 1.144%.

- Italian BTP spread down 5.9bps at 115.7bps / Greek down 2.9bps at 134bps

FOREX: GBP Sinks As Bank of England Stands Pat

- The BOE disappointed the markets by keeping rates on hold at their November meeting. GBP came under immediate selling pressure, which extended throughout the majority of Thursday's trading session.

- GBPUSD actually spiked around 25 pips to 1.3650 prior to the announcement amid thin liquidity, however, the 7-2 vote in favour of rates on hold sparked a rapid 100 point move lower to 1.3550.

- Consistent selling ensued throughout the press conference and the rest of Thursday as technical conditions deteriorated, both in cable and in the crosses.

- EURGBP (+0.90%) rose above short term resistance, extending the most recent recovery back above 0.8500 to close on a Fibonacci retracement level around 0.8561. A buoyant yen saw GBPJPY plummet 1.65%, encountering the 50-day moving average for the first time since October 7.

- Prior to the BOE, the greenback had a strong recovery post the FOMC weakness late on Wednesday. The dollar index rose to a 3-week high, helped by EURUSD completing a near 100-pip turnaround to trade within a few pips of the 2021 lows residing at 1.1524.

- Dollar gains were broad based but focused against more risky currencies such as AUD (-0.65%), NZD (-0.75%) and CAD (-0.58%) with mixed and more modest performance against both the JPY and CHF.

- The latter half of Thursday saw much more contained ranges as market participants paused for breath between the recent event risk and tomorrow's NFP data. Ahead of the US and Canadian employment reports, the RBA will release their Monetary Policy Statement.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.