-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Risk-On, Strong 20Y Re-Open Sale

EXECUTIVE SUMMARY

- MNI INSIGHT: BOE On Tightening Path Without Forward Guidance

- WHO: "Omicron is gaining ground: PROTECT, PREVENT, PREPARE"

- FDA EXPECTED TO AUTHORIZE PFIZER, MERCK COVID PILLS THIS WEEK, Bbg

- European Gas Jumps to Record as Russian Flows Reverse Direction, Bbg

US: President Biden New Covid Steps

President Biden New steps/action plan

- 1) Increased booster efforts, with +10,000 new vaccine sites to 90k, more pop-up sites coming in January 2022.

- 2) Importance of vaccinating children, but still waiting for under five years of age.

- 3) New free Federal testing sites coming next week. Delivering 500M free at-home testing kits starting next week.

- 4) adding 1,000 medical military personnel to support hospital staffing. FEMA looking to expand hospital beds if needed.

- 5) Companies with over 500 employees require vaccination or sent home.

UK

BOE: The next hike in UK interest rates looks set to be delivered without any official steer as to timing or to the precise conditions to be met to justify tightening, following the Bank of England’s decision to move away from explicit forward guidance.

- The Monetary Policy Committee’s prior conditional guidance that it did not intend to tighten without “clear evidence that significant progress is being made in eliminating spare capacity” was ditched in September. Then in December, when the MPC delivered a 15-basis point hike, it also dropped November’s guidance, which had stated that if incoming data, particularly on the labour market, were broadly as expected it would be necessary to boost rates over coming months.

- The Bank’s experience with guidance has often been an unhappy one, earning it the moniker “unreliable boyfriend”. New BOE Chief Economist Huw Pill has now expressed his unease over even conditional forward guidance, saying that such policy forays tend to end in confusion. For more see MNI Policy main wire at 0752ET.

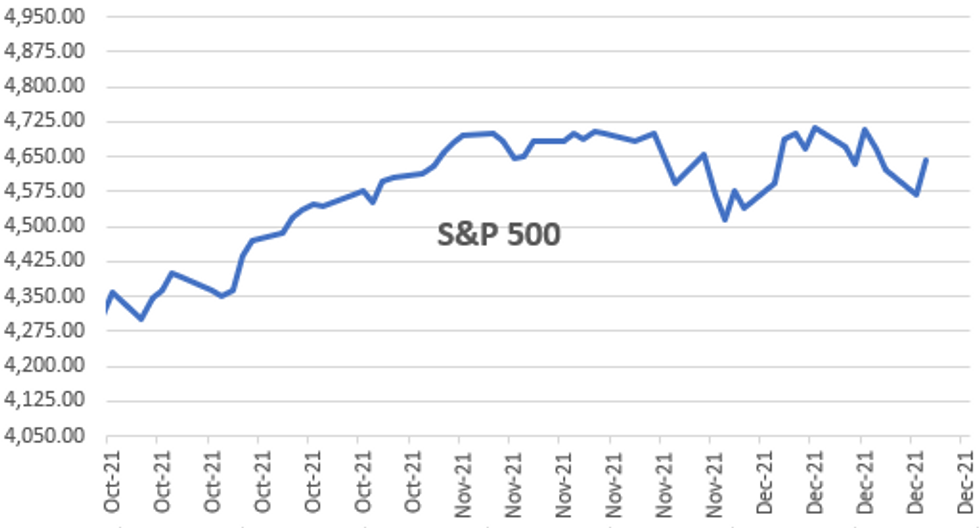

US TSYS: Risk Appetite Improves Ahead Holidays

Risk appetite improved early Tuesday amid cooling concerns over Covid curbs in London: UK PM Johnson stating no new restrictions before Christmas. Meanwhile, World Health Organization message a little darker: Meanwhile WHO message: "Omicron is gaining ground: PROTECT, PREVENT, PREPARE".- Risk-on tone carried over to US markets with Tsys yields climbing (30YY tapped 1.9246% high) and stocks climbing: ESH2 climbed to 4638.75 high in late trade, DJIA up over 500.0, and West Texas Crude held near 71.50 high (+2.89).

- US Pres Biden address re: Covid response not market moving as he reiterated importance of being vaccinated and receiving booster; +10,000 new vaccine sites to 90k, more pop-up sites coming in January 2022.

- Rates bounced off lows (yield curves reversed steeper levels) amid moderate hedge unwind volumes after the 20Y Bond performed better than expected (1.942% high yield vs. 1.964% WI). Indirect take-up climbed to yr high of 64.83% (matching October's) vs. Nov's 60.18%; direct bidder take-up also yr high of 20.83% while primary dealer take-up receded to yr low of 14.34% vs. 19.36% 5-month avg.

- The 2-Yr yield is up 3.7bps at 0.6685%, 5-Yr is up 5.7bps at 1.2238%, 10-Yr is up 5.1bps at 1.4737%, and 30-Yr is up 2.9bps at 1.8805%.

OVERNIGHT DATA

- PHILADELPHIA FED NON-MANUFACTURING REGIONAL BUSINESS ACTIVITY INDEX 28.3 IN DEC VS 46.1 IN NOV

- NON-MANUFACTURING FIRM-LEVEL BUSINESS ACTIVITY INDEX 30.6 IN DEC VS 47.0 IN NOV

- NEW ORDERS INDEX 21.0 IN DEC VS 19.2 IN NOV

- FULL-TIME EMPLOYMENT INDEX 14.4 IN DEC VS 15.2 IN NOV

- WAGE AND BENEFIT COST INDEX 59.5 IN DEC VS 60.0 IN NOV

- U.S. 3Q CURRENT ACCOUNT DEFICIT AT $214.8B; EST. -205.0B

- US REDBOOK: DEC STORE SALES +15.9% V YR AGO MO

- US REDBOOK: STORE SALES +16.4% WK ENDED DEC 18 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

- CANADA OCT RETAIL SALES EX-AUTOS/PARTS-GASOLINE +1.5%

- CANADIAN OCT RETAIL SALES +1.6%; SALES EX-AUTOS/PARTS +1.3% - MNI

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 533.75 points (1.53%) at 35468.9

- S&P E-Mini Future up 75.75 points (1.66%) at 4634.75

- Nasdaq up 343.6 points (2.3%) at 15324.88

- US 10-Yr yield is up 5.5 bps at 1.4771%

- US Mar 10Y are down 17/32 at 130-20

- EURUSD up 0.0004 (0.04%) at 1.128

- USDJPY up 0.48 (0.42%) at 114.09

- Gold is down $1.82 (-0.1%) at $1789.19

- EuroStoxx 50 up 67.86 points (1.65%) at 4174.99

- FTSE 100 up 99.38 points (1.38%) at 7297.41

- German DAX up 207.77 points (1.36%) at 15447.44

- French CAC 40 up 94.89 points (1.38%) at 6964.99

US TSY FUTURES CLOSE

- 3M10Y +4.195, 141.12 (L: 133.457 / H: 143.004)

- 2Y10Y +1.782, 80.454 (L: 78.044 / H: 81.964)

- 2Y30Y -0.189, 121.544 (L: 120.154 / H: 125.447)

- 5Y30Y -2.337, 65.931 (L: 65.492 / H: 70.656)

- Current futures levels:

- Mar 2Y down 2.75/32 at 109-3.5 (L: 109-03.125 / H: 109-06.875)

- Mar 5Y down 10.25/32 at 121-0.5 (L: 120-30.75 / H: 121-12.25)

- Mar 10Y down 17/32 at 130-20 (L: 130-17 / H: 131-08)

- Mar 30Y down 1-2/32 at 160-29 (L: 160-14 / H: 162-03)

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.010 at 99.635

- Jun 22 -0.025 at 99.390

- Sep 22 -0.035 at 99.190

- Dec 22 -0.050 at 98.955

- Red Pack (Mar 23-Dec 23) -0.075 to -0.06

- Green Pack (Mar 24-Dec 24) -0.07 to -0.06

- Blue Pack (Mar 25-Dec 25) -0.085 to -0.07

- Gold Pack (Mar 26-Dec 26) -0.095 to -0.085

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00038 at 0.07288% (-0.00138/wk)

- 1 Month +0.00075 to 0.10425% (+0.00175/wk)

- 3 Month +0.00175 to 0.21600% (+0.00338/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00887 to 0.32550% (+0.01275/wk)

- 1 Year +0.01012 to 0.54200% (+0.01238/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.04%, $905B

- Broad General Collateral Rate (BGCR): 0.05%, $337B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $324B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, appr $899M accepted vs. $979M submission

- Next scheduled purchases

- Wed 12/22 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B

- NY Fed buy-operations pause for holidays, resume Jan 3

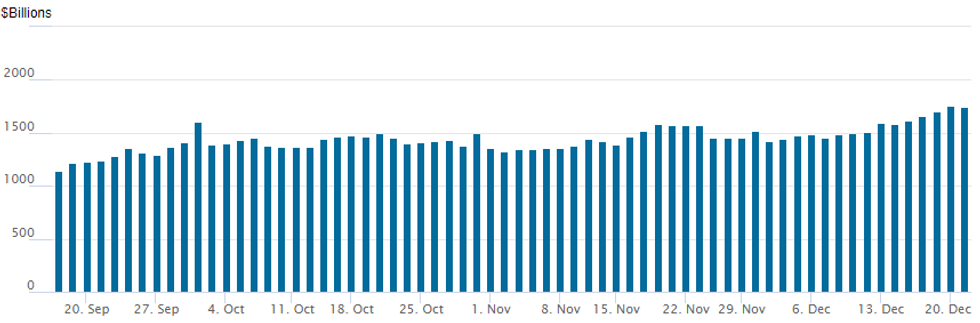

FED Reverse Repo Operation

NY Federal Reserve/MNI

After climbing to four consecutive new highs, NY Fed reverse repo usage recedes to $1,748.285B from 77 counterparties vs. Monday's record high of $1,758.041B.

EGBs-GILTS CASH CLOSE: No Lockdown For Core Yields

European yields rose sharply Tuesday with bear steepening in Gilts and Bunds as equities gained, energy prices soared, and concerns over arduous holiday season lockdowns eased.

- Europe gas and power prices hit fresh all-time highs, weighing particularly on Bunds.

- The Sun reported UK PM Johnson would announce within 48 hours whether the gov't was initiating a "circuit breaker"; on the cash close he confirmed prevailing wisdom that there would be no further restrictions before Christmas. Gilts underperformed Bunds; FTSE futures reached best levels since Dec 13; European stocks 1-2% higher.

- ECB's Kazimir warned of risks of higher inflation in the near term. And the ECB made its final asset purchases of 2021 today.

- Germany: The 2-Yr yield is up 3.4bps at -0.698%, 5-Yr is up 5bps at -0.562%, 10-Yr is up 6.2bps at -0.304%, and 30-Yr is up 7.7bps at 0.068%.

- UK: The 2-Yr yield is up 7.5bps at 0.617%, 5-Yr is up 8.2bps at 0.722%, 10-Yr is up 10.1bps at 0.873%, and 30-Yr is up 10.7bps at 1.059%.

- Italian BTP spread up 1.7bps at 131.3bps / Greek down 1.3bps at 159.2bps

FOREX: Risk-On Bolsters Cross-JPY Recovery

- After treading water for the majority of European trade, USDJPY surged back above 114 as markets welcomed a firmer session for risk sentiment, evident by higher equity and commodity indices.

- The half percent rally fell just short of the December highs. Clearance of 114.26, Dec 15 high is needed to offset any developing bearish technical concerns.

- Stronger gains were seen in cross-yen as the Australian dollar, Kiwi and GBP all benefitted substantially from the renewed optimism in global markets. NZDJPY was the strongest on the board, rising 1.2% with the others following close behind. Firmer crude futures also boosted the Norwegian Krona over 1%.

- For a second consecutive session, the dollar index registered marginal losses, as the greenback lacks momentum in either direction as the holiday approaches.

- In similar fashion, EURUSD obeyed narrow parameters between 1.1260-1.1300 as the bounce in commodity/risk tied FX remained in focus.

- Another wild ride in emerging markets as USDTRY continues to trade in a very volatile manner, following Erdogan’s new plans to halt dollarization. Posting just shy of a 23% intra-day range, the pair looks likely to close the day 3% lower around 12.95.

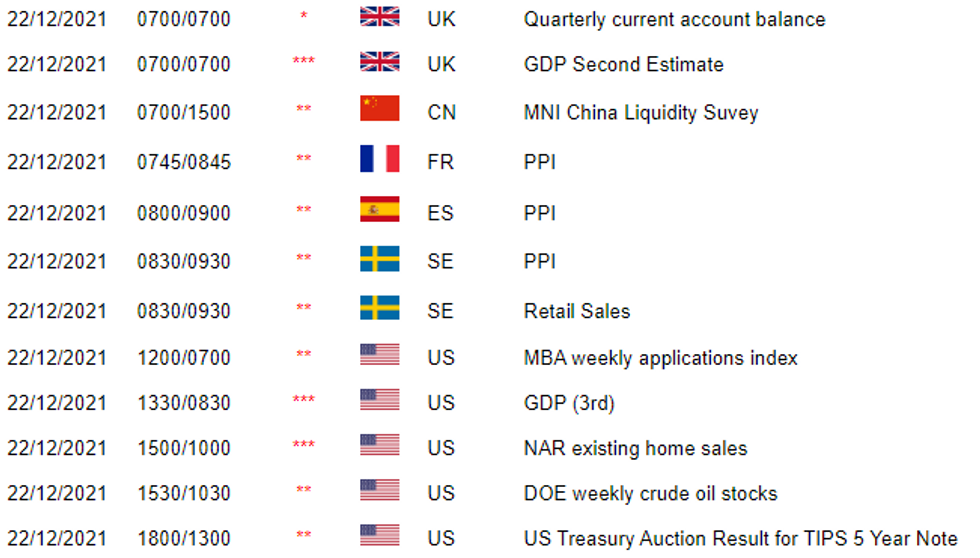

- BoJ minutes overnight before some final GDP readings out of the UK and the US, however, the data docket remains light. Thursday’s US Core PCE Price Index will be the final point of focus before the extended break.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.