-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak Tsy 7Y Note Sale

EXECUTIVE SUMMARY

- US Pres Biden, Russia Pres Putin to hold telephone talks Thursday over Ukraine tensions

- U.K. REPORTS NEW DAILY RECORD 183,037 COVID-19 CASES ON DEC. 29, Bbg

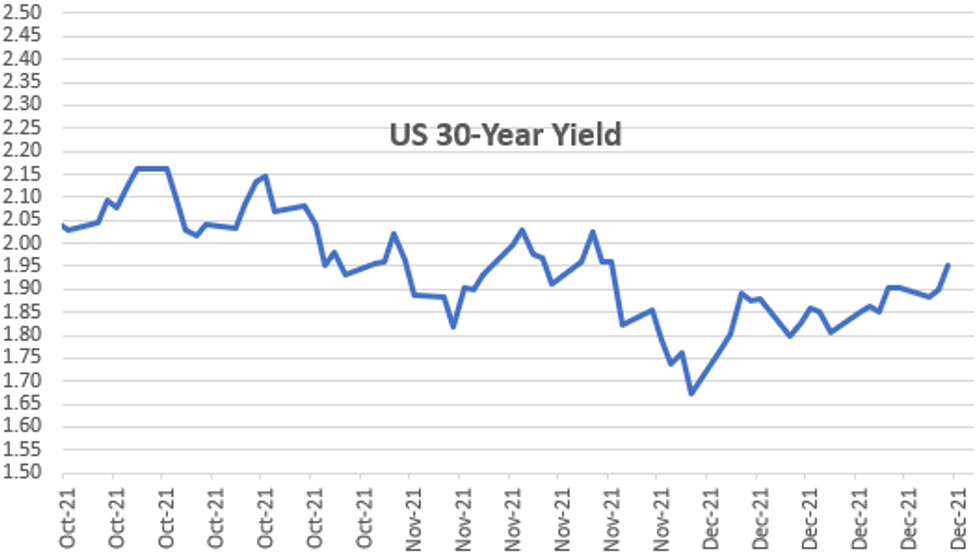

US TSYS: Bond Yields Back to Late Nov Levels

Better Tsy volumes with London back on line, and session still went out with a whimper. Thin year-end participation as Bond yds climbed back to late Nov levels.- Tsys gapped lower on the open, rebounded on air ahead the Nov adv goods trade deficit ($97.8B), wholesale inv +1.2 %, retail +2.0%.

- Modest bounce off session lows on Block buy of 2,000 WNH2 194-26, well through the 194-21 post time offer at 0947:31ET. Renewed selling in TYH2 after 130-07.5 first support breached, 130-03 low. Sell-off coincided with round of selling in equities after ESH2 made new ATH Tue: 4797.0.

- Tsy futures extend session lows after final coupon sale of 2021 trades weak: $56B 7Y note auction (91282CDP3): 1.480% high yield vs. 1.457% WI; 2.21x bid-to-cover lowest since Feb (five auction avg: 2.30x). Indirect take-up 59.25% vs. Nov's 59.29%

- Thursday last full session of 2021, data on tap:

- 0830 Jobless Claims (205k, 207k)

- 0830 Continuing Claims (1.859M, 1.875M)

- 0945 MNI Chicago PMI (61.8, 62.0)

- US Pres Biden, Russia Pres Putin to hold telephone talks Thursday over Ukraine tensions, no set time.

- The 2-Yr yield is down 0.2bps at 0.748%, 5-Yr is up 4.6bps at 1.2905%, 10-Yr is up 5.7bps at 1.5375%, and 30-Yr is up 4.9bps at 1.9491%.

US OUTLOOK/OPINION

Deutsche Bank Quicktake on Chicago PMI: Due out Thursday, 0945ET: MNI Chicago PMI: 62.0 median est 62.0 vs. 61.8 last month. Deutsche economists in line with 62.0 est, adding the data point "should remain firmly in expansion territory given continued strong underlying demand for goods."

- That said, we will pay equally as close attention to order backlogs, supplier deliveries and buying policy metrics that will shed light on the state of supply chain bottlenecks.

- Though some of these series appear to have peaked over the past few months, omicron could potentially throw another temporary wrench into supply chains.

OVERNIGHT DATA

U.S. ADVANCE NOV. GOODS TRADE DEFICIT AT $97.8B

U.S. ADVANCE WHOLESALE INVENTORIES ROSE 1.2 % IN NOV.

U.S. ADVANCE RETAIL INVENTORIES ROSE 2.0 % IN NOV.

U.S. NOV. PENDING HOME SALES RISE 0.2% FROM PREVIOUS YEAR

MARKET SNAPSHOT

Key late session market levels:- DJIA up 103.32 points (0.28%) at 36501.8

- S&P E-Mini Future up 6.25 points (0.13%) at 4785

- Nasdaq down 6.4 points (0%) at 15775.63

- US 10-Yr yield is up 5.7 bps at 1.5375%

- US Jun 10Y are down 9.5/32 at 130-4.5

- EURUSD up 0.0031 (0.27%) at 1.1341

- USDJPY up 0.15 (0.13%) at 114.97

- WTI Crude Oil (front-month) up $0.47 (0.62%) at $76.45

- Gold is down $1.03 (-0.06%) at $1805.15

- EuroStoxx 50 down 27.1 points (-0.63%) at 4284.83

- FTSE 100 up 48.59 points (0.66%) at 7420.69

- German DAX down 111.45 points (-0.7%) at 15852.25

- French CAC 40 down 19.59 points (-0.27%) at 7161.52

US TSY FUTURES CLOSE

- 3M10Y +6.958, 149.2 (L: 138.253 / H: 149.903)

- 2Y10Y +6.79, 79.271 (L: 72.241 / H: 79.715)

- 2Y30Y +5.944, 120.325 (L: 114.136 / H: 121.14)

- 5Y30Y +0.487, 65.793 (L: 63.963 / H: 68.384)

- Current futures levels:

- Mar 2Y down 0.25/32 at 109-1.375 (L: 109-00.75 / H: 109-02.5)

- Mar 5Y down 5/32 at 120-25.25 (L: 120-23 / H: 121-01.25)

- Jun 10Y down 13/32 at 130-1 (L: 130-00 / H: 130-08)

- Jun 30Y down 1-12/32 at 161-12 (L: 160-30 / H: 162-31)

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.005 at 99.630

- Jun 22 steady at 99.375

- Sep 22 -0.010 at 99.160

- Dec 22 -0.015 at 98.925

- Red Pack (Mar 23-Dec 23) -0.02 to -0.015

- Green Pack (Mar 24-Dec 24) -0.045 to -0.025

- Blue Pack (Mar 25-Dec 25) -0.065 to -0.05

- Gold Pack (Mar 26-Dec 26) -0.085 to -0.075

SHORT TERM RATES

US DOLLAR LIBOR: Settlements resume

- O/N +0.00300 at 0.07275% (-0.00450 total last wk)

- 1 Month +0.00300 to 0.10425% (-0.00125 total last wk)

- 3 Month +0.00588 to 0.22375% (+0.00525 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01113 to 0.35438% (+0.03050 total last wk)

- 1 Year +0.01887 to 0.58600% (+0.03750 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $247B

- Secured Overnight Financing Rate (SOFR): 0.04%, $844B

- Broad General Collateral Rate (BGCR): 0.05%, $328B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $315B

- (rate, volume levels reflect prior session)

- NY Fed buy-operations pause for holidays, resume Jan 3:

- Mon 01/03 1010-1030ET: Tsy 2.25Y-4.5Y, appr $6.325B vs. $7.375B prior

- Tue 01/04 1100-1120ET: TIPS 1Y-7.5Y, appr $1.525B

- Wed 01/05 1010-1030ET: Tsy 7Y-10Y, appr $2.425B vs. $2.825B prior

- Wed 01/05 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/06 1100-1120ET: TIPS 7.5Y-30Y, appr $0.925B

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

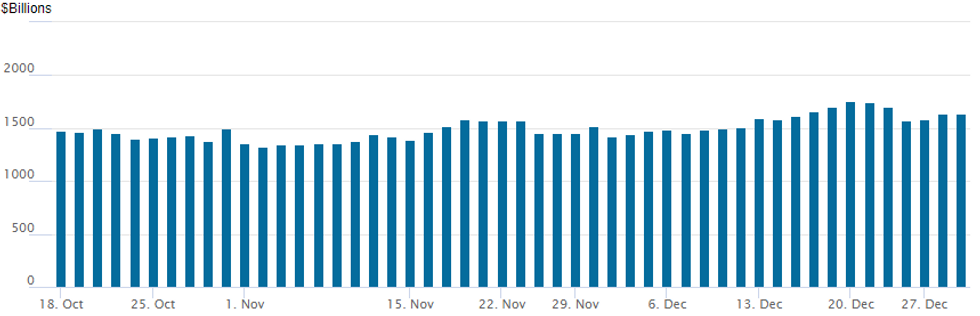

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,642.506B from 84 counterparties vs. $1,637.064B Tuesday. Record high of $1,758.041B posted Monday, December 20.

OUTLOOK: Thu Look Ahead: Weekly Claims, Chicago PMI

- US Data/Speaker Calendar (prior, estimate)

- Dec-30 0830 Initial Jobless Claims (205k, 207k)

- Dec-30 0830 Continuing Claims (1.859M, 1.875M)

- Dec-30 0945 MNI Chicago PMI (61.8, 62.0)

- Dec-30 1130 US Tsy $50B 4W, $40B 8Y bill auctions

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.