-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Bond Yields Drop Ahead Next Wk's Dec NFP

US OUTLOOK/OPINION: Varied Opinions For Dec Jobs Gains Next Week

Data picks up as 2022 gets underway next week, Change in Nonfarm Payrolls for December next week Friday, wide range of sell-side opinions, mean est +400k so far vs. +210k in Nov.- TD Securities expects a gain of +500k, positing the "late-December COVID surge likely came too late to prevent a pickup in US payrolls after the gain in November (210k) appeared to be held down by an overly aggressive seasonal factor."

- On the flipside:

- Morgan Stanley estimates Dec jobs to gain 260k with "little change in public employment, so that private payrolls increased 265k. This, in combination with a slight uptick in labor force participation from 61.8% to 61.9%, is expected to leave the unemployment rate unchanged at 4.2%."

- MS also "expect average hourly earnings growth was also unchanged at 0.3%M in December, lowering the year-over-year rate from 4.8% to 4.1%. We expect the average workweek will remain unchanged at 34.8."

US TSYS: Bond Near Late Session Highs

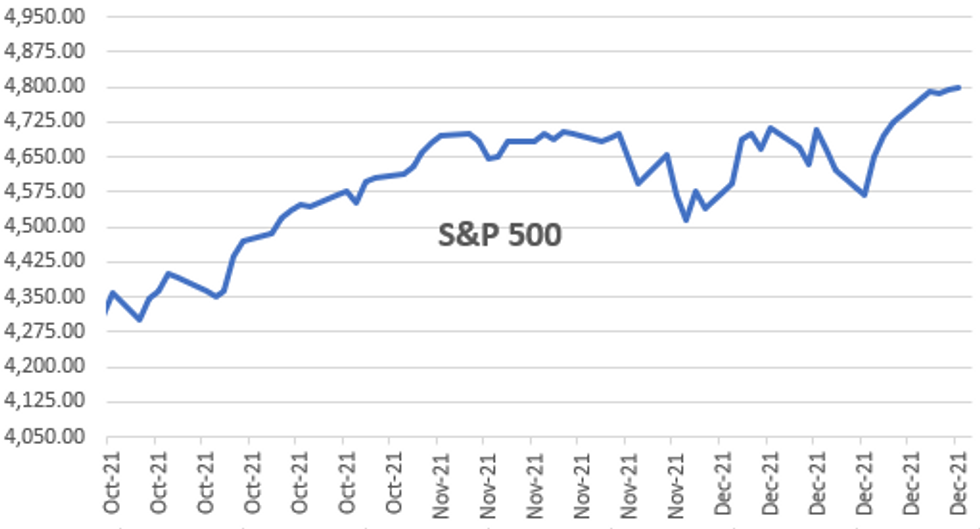

Tsys near late session highs after the close, yield curves flatter; equities higher after making new all-time highs around midday (ESH2 4799.75), Gold well bid +11.60 at 1816.31, West Texas crude +.10 at 76.67.- Despite the best volumes of the week (TYH2>675k, thin year-end participation made for whippy trade in the first half -- last full session of 2021 w/early close New Years eve (1300ET).

- Rates traded steady to mixed after weekly claims came out lower than est (-8k to 198k vs. 206k est). Pre-open bid in long end evaporated after the bell/well ahead data release, are holding near lows/early evening range.

- Trimmed Gains Post-Chicago PMI: Tsy futures receded to steady/marginally mixed levels after slightly better than expected Chicago PMI: 63.1 vs. 62.0 est. USH2 weaker now, but just as quickly regained footing.

- Data picks up as 2022 gets underway next week, Change in Nonfarm Payrolls for December next week Friday, wide range of sell-side opinions, mean est +400k so far vs. +210k in Nov.

- The 2-Yr yield is down 0.8bps at 0.7382%, 5-Yr is down 2.4bps at 1.2726%, 10-Yr is down 3.6bps at 1.5134%, and 30-Yr is down 3.8bps at 1.9226%.

OVERNIGHT DATA

- US JOBLESS CLAIMS -8K TO 198K IN DEC 25 WK

- US PREV JOBLESS CLAIMS REVISED TO 206K IN DEC 18 WK

- US CONTINUING CLAIMS -0.140M to 1.716M IN DEC 18 WK

US DATA: Chicago Business Barometer sees modest pre-Christmas recovery. The Chicago Business Barometer produced with MNI, rose to 63.1 in December, picking up again after last month's decline. Inventories hit a four-year high as firms created buffers for longer lead times.

- Among the main five indicators, Production and New Orders and were higher. Order Backlogs, Employment and Supplier Deliveries fell across the month.

- Prices Paid dropped 4.2 points to a seven-month low of 89.6 in December. This is still above the 12-month average of 88.0, as shortages of certain materials led to inflated costs.

- In December, Production continued to increase, rising modestly by 0.4 points to 61.9, the highest reading since July 2021

- Employment dipped again for the second month in a row, dropping 7.0 points to 44.6, the lowest since June 2021. Firms stated that finding new hires to fill empty positions is challenging.

- After the sharp November fall, New Orders recovered almost to October's level, picking up 8.2 points to stand at 66.5.

- Survey ran from Dec 1 through Dec 20.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 30.26 points (0.08%) at 36524.99

- S&P E-Mini Future up 5.25 points (0.11%) at 4790.5

- Nasdaq up 73.2 points (0.5%) at 15841.73

- US 10-Yr yield is down 3.6 bps at 1.5134%

- US Jun 10Y are up 5.5/32 at 130-6.5

- EURUSD down 0.003 (-0.26%) at 1.1319

- USDJPY up 0.15 (0.13%) at 115.1

- WTI Crude Oil (front-month) up $0.16 (0.21%) at $76.72

- Gold is up $10.55 (0.58%) at $1814.96

- EuroStoxx 50 up 21.24 points (0.5%) at 4306.07

- FTSE 100 down 17.68 points (-0.24%) at 7403.01

- German DAX up 32.61 points (0.21%) at 15884.86

- French CAC 40 up 11.71 points (0.16%) at 7173.23

US TSY FUTURES CLOSE

- 3M10Y -3.192, 146.699 (L: 140.924 / H: 150.484)

- 2Y10Y -2.263, 77.501 (L: 77.008 / H: 80.356)

- 2Y30Y -2.378, 118.521 (L: 117.964 / H: 121.745)

- 5Y30Y -1.223, 64.947 (L: 64.601 / H: 67.641)

- Current futures levels:

- Mar 2Y up 0.5/32 at 109-2 (L: 109-01.25 / H: 109-02.875)

- Mar 5Y up 3/32 at 120-28.75 (L: 120-24.75 / H: 120-29.75)

- Jun 10Y up 5.5/32 at 130-6.5 (L: 130-04 / H: 130-08)

- Jun 30Y down 7/32 at 161-5 (L: 161-05 / H: 161-05)

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.020 at 99.645

- Jun 22 +0.030 at 99.40

- Sep 22 +0.030 at 99.190

- Dec 22 +0.025 at 98.950

- Red Pack (Mar 23-Dec 23) +0.020 to +0.025

- Green Pack (Mar 24-Dec 24) +0.010 to +0.020

- Blue Pack (Mar 25-Dec 25) +0.010

- Gold Pack (Mar 26-Dec 26) +0.005 to +0.010

SHORT TERM RATES

US DOLLAR LIBOR: Settlements resume

- O/N -0.00012 at 0.07263% (+0.00288/wk)

- 1 Month -0.00237 to 0.10188% (+0.00063/wk)

- 3 Month -0.00937 to 0.21438% (-0.00350/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00925 to 0.34513% (+0.00188/wk)

- 1 Year +0.00275 to 0.58875% (+0.02162/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $230B

- Secured Overnight Financing Rate (SOFR): 0.04%, $869B

- Broad General Collateral Rate (BGCR): 0.05%, $330B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $308B

- (rate, volume levels reflect prior session)

- NY Fed buy-operations pause for holidays, resume Jan 3:

- Mon 01/03 1010-1030ET: Tsy 2.25Y-4.5Y, appr $6.325B vs. $7.375B prior

- Tue 01/04 1100-1120ET: TIPS 1Y-7.5Y, appr $1.525B

- Wed 01/05 1010-1030ET: Tsy 7Y-10Y, appr $2.425B vs. $2.825B prior

- Wed 01/05 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/06 1100-1120ET: TIPS 7.5Y-30Y, appr $0.925B

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

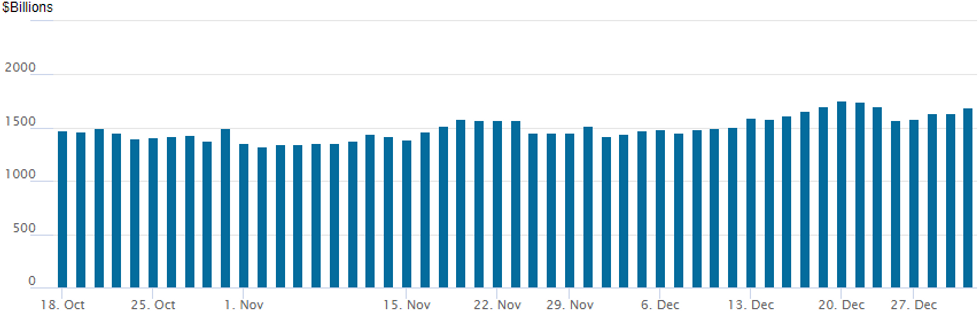

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,696.496B from 90 counterparties vs. $1,642.506B Wednesday. Record high of $1,758.041B posted Monday, December 20.

FOREX: Greenback Regains Poise Amid Two-Way Price Action

- The dollar index is currently up 0.2% on the day and has recovered the majority of yesterday’s selloff. Price action was volatile throughout Thursday’s US trading session with 95.90-96.20 capping the day’s range.

- The euro was the biggest underperformer and trades roughly 65 pips lower than yesterday’s highs at 1.1370. Failure to capitalise on the break of cluster resistance yesterday around 1.1345 prompted the single currency to trade with an offered tone, grinding back towards the 1.1300 mark. Resistance for EUR/USD remains at 1.1388, the 50-day EMA.

- Despite the early close for US markets tomorrow, there is potential for heightened volatility approaching the WMR month/year-end fix amid thin holiday markets.

- In emerging markets, the Turkish Lira underperformed, retreating 4% against the dollar. USDTRY continues to grind further away from the 10.25 lows on Dec 23. The Brazilian Real was the main beneficiary, posting a 2% rally on the final session of the year.

- Chinese manufacturing PMI data overnight before an empty data docket for both he European/US session.

OUTLOOK: New-Year Data: Markit Mfg PMI, Construction Spending, Bill Sales

No new data on tap for Friday's shortened year-end session, resumes Monday full session (London bank holiday, however). NY Fed buy-ops resume.

- US Data/Speaker Calendar (prior, estimate)

- Jan-03 0945 Markit US Manufacturing PMI (57.8, 57.7)

- Jan-03 1000 Construction Spending MoM (0.2%, 0.6%)

- Jan-03 1030 NY Fed buy-op: Tsy 2.25Y-4.5Y, appr $6.325B vs. $7.375B prior

- Jan-03 1130 US Tsy $60B 13W, $51B 26Y bill auctions

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.