-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Hitting Ground Running in 2022

US OUTLOOK/OPINION: December Employment Estimates

Change in Nonfarm Payrolls for Dec next wk Friday, range of opinions from 33 economists polled by Bbg from +150k to +720k, median est +400k vs +210k in Nov.- Deutsche Bank: "With the four week moving average of initial jobless claims down about 70k from the survey week in November, " DB expects a jobs to climb by +375k (+300k private).

- "The Fed will want to see the unemployment rate (4.2% vs. 4.2%) continuing to fall, or at minimum remaining stable amidst a rising labor force participation rate. The rise of the omicron variant could put a damper on that though, given that covid is the major factor weighing on participation, particularly for prime age workers."

- JP Morgan: Expects jobs gain off +450k for December and slightly lower unemployment rate of 4.1%.

- "While establishment survey job growth disappointed in November and there are signs that consumer spending was weak during the holiday season, there are several reasons we expect firming in job growth in December relative to November" citing "a boomy November increase in household survey employment and continued strength in our employment nowcasters."

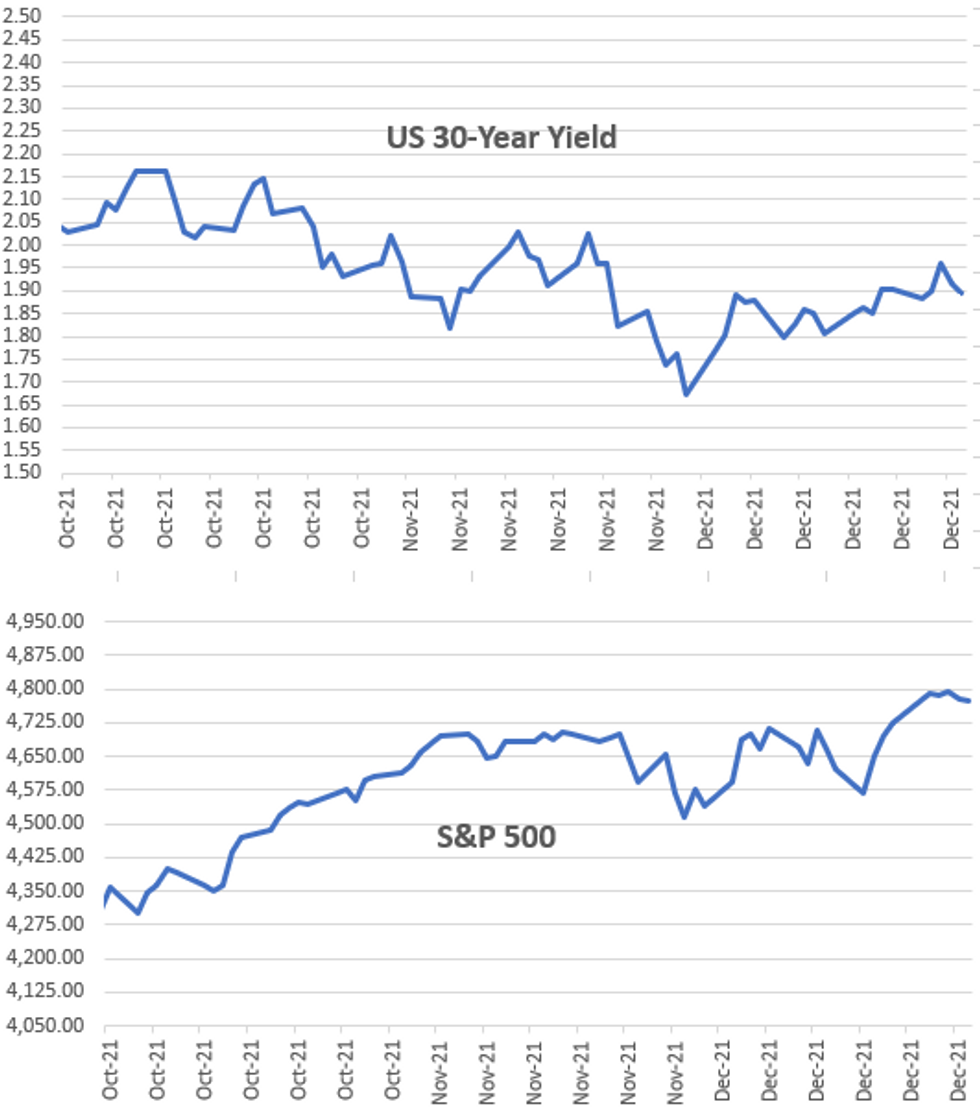

US TSYS: Putting 2021 Behind Us

Tsys finished out the shortened year-end holiday session higher -- paring Wed losses to near middle of range for the week; 30YY at 1.9018% after the bell, yield curves flatter, 5s30s -1.15 at 63.93.- Equities little weaker (ESH2 -3.25 at 4769.0( not far off Thu's all time high of 4799.5.; Gold +13.25 at 1827.92; West Texas Crude -1.69 at 75.30.

- Very light volumes on net did see spike in volume in last few minutes of pit trade, appr 175k TYH2 helped push total volume over 600k by the bell.

- No economic data on day, sites on next week:

- Jan-04 ISM Mfg (60.3)

- Jan-05 Services PMI (57.5) , ADP Private employment, Dec FOMC minutes

- Jan-06 Weekly claims (206k), int'l trade (-$72B), ISM Services (67.0)

- Jan-07 Employment data for December (+400k)

- NY Fed buy operations resume Monday

- The 2-Yr yield is down 0.2bps at 0.7223%, 5-Yr is down 1bps at 1.2532%, 10-Yr is down 1bps at 1.498%, and 30-Yr is down 2.3bps at 1.8942%.

MARKETS SNAPSHOT

Key late session market levels

- DJIA down 36.8 points (-0.1%) at 36361.09

- S&P E-Mini Future down 7.25 points (-0.15%) at 4765

- Nasdaq down 48.4 points (-0.3%) at 15693.25

- US 10-Yr yield is down 1.2 bps at 1.4963%

- US Jun 10Y are up 0.5/32 at 130-10

- EURUSD up 0.0058 (0.51%) at 1.1382

- USDJPY down 0.02 (-0.02%) at 115.06

- WTI Crude Oil (front-month) down $1.41 (-1.83%) at $75.56

- Gold is up $12.29 (0.68%) at $1826.90

- EuroStoxx 50 down 7.66 points (-0.18%) at 4298.41

- FTSE 100 down 18.47 points (-0.25%) at 7384.54

- French CAC 40 down 20.2 points (-0.28%) at 7153.03

US TSY FUTURES CLOSE

- 3M10Y -0.233, 145.524 (L: 142.943 / H: 147.055)

- 2Y10Y -0.428, 77.37 (L: 76.045 / H: 79.419)

- 2Y30Y -2.236, 116.437 (L: 115.033 / H: 120.607)

- 5Y30Y -1.455, 63.63 (L: 62.211 / H: 66.681)

- Current futures levels:

- Mar 2Y up 0.5/32 at 109-2.5 (L: 109-02 / H: 109-03.5)

- Mar 5Y up 1/32 at 120-30 (L: 120-29 / H: 121-01)

- Jun 10Y up 2/32 at 130-11.5 (L: 130-10 / H: 130-13)

- Jun 30Y up 19/32 at 162-14 (L: 161-20 / H: 162-13)

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.005 at 99.655

- Jun 22 +0.005 at 99.405

- Sep 22 steady at 99.190

- Dec 22 -0.005 at 98.950

- Red Pack (Mar 23-Dec 23) steady to +0.010

- Green Pack (Mar 24-Dec 24) +0.010 to +0.015

- Blue Pack (Mar 25-Dec 25) +0.015 to +0.020

- Gold Pack (Mar 26-Dec 26) +0.010 to +0.020

SHORT TERM RATES

US DOLLAR LIBOR: Settlements resume

- O/N -0.00825 at 0.06438% (-0.00537/wk)

- 1 Month -0.00063 to 0.10125% (+0.00000/wk)

- 3 Month -0.00525 to 0.20913% (-0.00875/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00638 to 0.33875% (-0.00450/wk)

- 1 Year -0.00562 to 0.58313% (+0.01600/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $77B

- Daily Overnight Bank Funding Rate: 0.07% volume: $239B

- Secured Overnight Financing Rate (SOFR): 0.04%, $836B

- Broad General Collateral Rate (BGCR): 0.05%, $322B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $307B

- (rate, volume levels reflect prior session)

- NY Fed buy-operations pause for holidays, resume Jan 3:

- Mon 01/03 1010-1030ET: Tsy 2.25Y-4.5Y, appr $6.325B vs. $7.375B prior

- Tue 01/04 1100-1120ET: TIPS 1Y-7.5Y, appr $1.525B

- Wed 01/05 1010-1030ET: Tsy 7Y-10Y, appr $2.425B vs. $2.825B prior

- Wed 01/05 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/06 1100-1120ET: TIPS 7.5Y-30Y, appr $0.925B

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

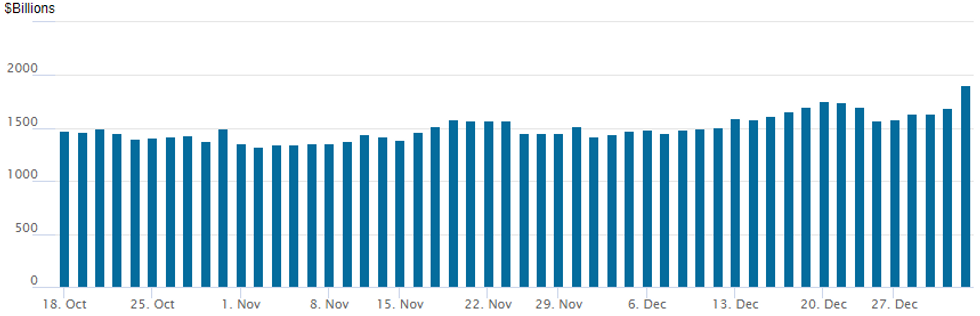

FED Reverse Repo Operation: New Record High

NY Federal Reserve/MNI

NY Fed reverse repo usage surged to new record high of $1,904.582B from 103 counterparties vs. $1,696.496B Thursday. Compares to prior record high of $1,758.041B posted Monday, December 20.

FOREX: Greenback Loses Ground, EURUSD To Best levels In A Month

- Broad dollar weakness in the final session of 2021 with the USD index retreating roughly 0.35% to 95.60.

- With possible month/year-end dynamics in play, EURUSD rose half a percent on the day - from 1.1303 session lows to 1.1380, representing the highest levels seen for the pair since late November. The pair hovers just below this key resistance at 1.1383, Nov 30 high. A break of this hurdle is required to signal potential for a stronger recovery towards 1.1404 the 50-day EMA.

- CNH one of the early standouts in European morning trade, with USD/CNH lurching lower and through the 6.3660 support. Pair traded down to its lowest levels since Dec9, and focus is on major support at the 2021 low at 6.3305.

- CAD was the strongest performer in G10, rising 0.75%. USDCAD trades around 1.2650 and is homing in on the December lows just above the 1.26 handle after a string of positive sessions for the Canadian dollar.

- In emerging markets, USDTRY slowly climbed above 13.60, however the pair pulled back ahead of the close to remain just 1% higher on the session around 13.25.

- Some final manufacturing PMI figures to be published on Monday, however, with multiple holidays to start the week, markets may wait for Tuesday to kick-off the new year.

OUTLOOK

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/01/2022 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/01/2022 | 0730/0830 | ** |  | SE | Manufacturing PMI |

| 03/01/2022 | 0730/0830 | ** |  | SE | Services PMI |

| 03/01/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 03/01/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 03/01/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 03/01/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 03/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/01/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/01/2022 | 1500/1000 | * |  | US | construction spending |

| 03/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.