-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: March Lift-Off Odds Over 80% On Dec FOMC Minutes

EXECUTIVE SUMMARY

- Chances of rate hike in March rise to 80% in reaction to more hawkish than expected Dec FOMC Minutes

- MNI BRIEF: Dec Minutes, Fed Discussed Faster Rate Liftoff on Inflation Risk

- MNI INTERVIEW: Fed Inflation View Still Too Benign- Blanchard

US

FED: Federal Reserve officials agreed to speed up their taper of QE last month because policymakers would like to be ready to raise interest rates three times over the course of 2022, according to minutes from their December meeting.

- "Participants remarked that inflation readings had been higher and were more persistent and widespread than previously anticipated," the FOMC's report: https://www.federalreserve.gov/monetarypolicy/fomc... said. "Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated."

- Most Fed officials saw inflation risks as tilted to the upside, the minutes said. The Fed revised up its inflation forecast for year-end 2022 to 2.6% from 2.2% at its December meeting, though one prominent economist tells MNI that is still too optimistic.

- Fed officials were also optimistic on jobs. "Participants pointed to a number of signs that the U.S. labor market was very tight, including near-record rates of quits and job vacancies, as well as a notable pickup in wage growth," the minutes said.

- Officials debated how to deal with the central bank's balance sheet, with many arguing that run-off could be undertaken more quickly than the last time the Fed tried to reduce its bond holdings.

- "Almost all" thought it appropriate to initiate b/s runoff at some point after the first hike. Appropriate for timing of b/s runoff to be closer to rate liftoff than in the past (stronger economic outlook, higher inflation and larger balance sheet). They emphasized that the decision to initiate runoff would be data dependent.

- "Some" participants noted that it could be appropriate to begin to reduce the balance sheet relatively soon after beginning to raise the federal funds rate.

- "Many" participants thought the appropriate runoff pace would be faster than it was during the previous normalization episode. Many participants also judged that monthly caps on the runoff of securities could help ensure that the pace would be measured and predictable, particularly given the shorter weighted average maturity of the Federal Reserve's Treasury security holdings.

- "Some participants commented that removing policy accommodation by relying more on balance sheet reduction and less on increases in the policy rate could help limit yield curve flattening during policy normalization".

- "A few of these participants" raised concerns that a relatively flat yield curve could adversely affect interest margins for some financial intermediaries, which may raise financial stability risks. However, a couple of other participants referenced staff analysis and previous experience in noting that many factors can affect longer-dated yields, making it difficult to judge how a different policy mix would affect the shape of the yield curve."

FED: The Federal Reserve remains overly optimistic that price measures will return toward target over 2022, though a temporary dip in inflation in coming months may tempt some observers to declare a premature victory, former International Monetary Fund chief economist Olivier Blanchard told MNI.

- “When you have momentum in inflation it may be hard to stop and they may be forced to do much more than they currently expect,” said Blanchard, now a senior fellow at the Peterson Institute for International Economics, in an interview.

- Robust savings and a hot job market are likely to keep overall inflation above levels Fed officials foresee, Blanchard said. The Fed’s year-end forecast for the personal consumption expenditures index was 2.6% at the December meeting, up from 2.2% in September. For more see MNI Policy main wire at 1043ET.

US TSYS: Treasuries See Large Bear Flattening On FOMC Minutes

- Cash Tsy yields are up 7+bps across the short-end and belly following the FOMC minutes flagging a chance of earlier and faster rate hikes, with runoff starting soon after deemed possible by some participants.

- 2Y yields are +7.0bps at 0.830%, 5Y +7.5bps at 1.433%, 10Y +5.6bps at 1.704% and 30Y -+2.0bps at 2.085%.

- TYH2 is down 0-14+ at 128-17 having reached a low of 128-25+. It has cleared 128-30+ (Nov 26 low) and opened the key support of 128-22+ (Nov 22 low).

- Tomorrow: Weekly jobless claims (overshadowed by large ADP beat today and with payrolls on Fri) and then ISM services for Dec and durable goods for Nov at 1000ET. Price pressures are of particular interest for ISM after costs in today’s PMI reached a new series high.

- NY Fed buy-op: TIPS 7.5Y-30Y, appr $925M (1120ET).

- Issuance: $50B 4W, $40B 8W bill auctions.

- The 2-Yr yield is up 6.2bps at 0.8216%, 5-Yr is up 6.4bps at 1.4211%, 10-Yr is up 5.3bps at 1.6999%, and 30-Yr is up 2.2bps at 2.0867%.

OVERNIGHT DATA

- ADP RESEARCH INSTITUTE SAYS U.S. ADDED 807,000 JOBS IN DEC (+410k est)

- US Markit Services PMI (Dec F) M/M 57.6 vs. Exp. 57.5 (Prev. 57.5)

- Composite PMI (Dec F) M/M 57.0 (Prev. 56.9)

- US MBA: REFIS -2% SA; PURCH INDEX -4% SA THRU DEC 31 WK

- US MBA: UNADJ PURCHASE INDEX -12% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.31% VS 3.35% PREV

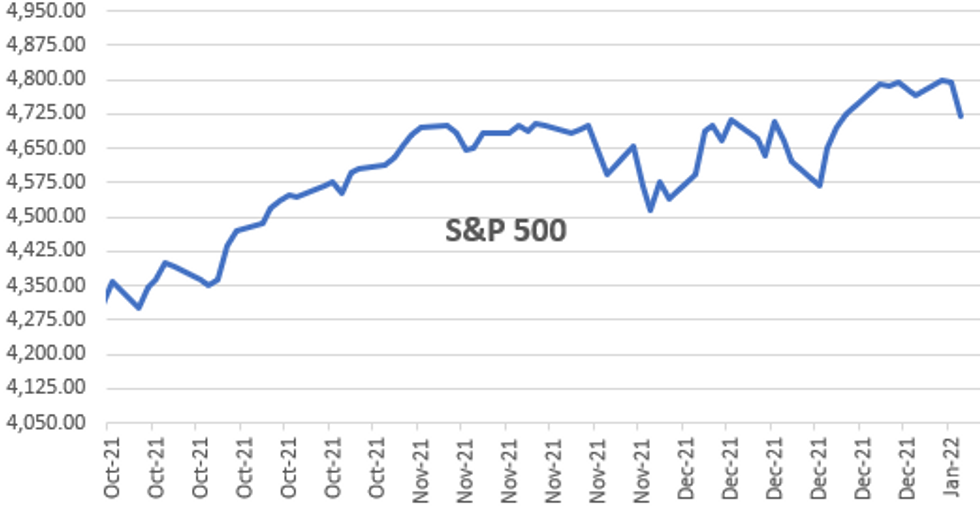

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 266.8 points (-0.73%) at 36538.57

- S&P E-Mini Future down 72.75 points (-1.52%) at 4711.75

- Nasdaq down 453.4 points (-2.9%) at 15171.54

- US 10-Yr yield is up 5.3 bps at 1.6999%

- US Mar 10Y are down 11.5/32 at 128-29.5

- EURUSD up 0.0021 (0.19%) at 1.1308

- USDJPY down 0.05 (-0.04%) at 116.11

- WTI Crude Oil (front-month) up $0.39 (0.51%) at $77.37

- Gold is down $3.51 (-0.19%) at $1811.12

- EuroStoxx 50 up 24.53 points (0.56%) at 4392.15

- FTSE 100 up 11.72 points (0.16%) at 7516.87

- German DAX up 119.14 points (0.74%) at 16271.75

- French CAC 40 up 58.96 points (0.81%) at 7376.37

US TSY FUTURES CLOSE

- 3M10Y +4.758, 161.038 (L: 153.971 / H: 161.565)

- 2Y10Y -1.105, 87.605 (L: 85.955 / H: 89.24)

- 2Y30Y -3.758, 126.547 (L: 125.041 / H: 130.45)

- 5Y30Y -4.024, 66.58 (L: 64.873 / H: 70.259)

- Current futures levels:

- Mar 2Y down 4.125/32 at 108-28.5 (L: 108-28 / H: 109-01.5)

- Mar 5Y down 8.75/32 at 120-5 (L: 120-02.75 / H: 120-17.25)

- Mar 10Y down 12/32 at 128-29 (L: 128-25.5 / H: 129-14)

- Mar 30Y down 16/32 at 156-10 (L: 156-05 / H: 157-10)

- Mar Ultra 30Y down 15/32 at 189-18 (L: 189-04 / H: 191-09)

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.025 at 99.615

- Jun 22 -0.050 at 99.355

- Sep 22 -0.070 at 99.125

- Dec 22 -0.075 at 98.870

- Red Pack (Mar 23-Dec 23) -0.085 to -0.07

- Green Pack (Mar 24-Dec 24) -0.065 to -0.04

- Blue Pack (Mar 25-Dec 25) -0.04 to -0.03

- Gold Pack (Mar 26-Dec 26) -0.03 to -0.025

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N -0.00215 at 0.07014% (+0.00576/wk)

- 1 Month -0.00171 to 0.10200% (+0.00075/wk)

- 3 Month +0.00957 to 0.22557% (+0.01644/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00286 to 0.34000% (+0.00125/wk)

- 1 Year +0.00671 to 0.59629% (+0.01316/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $252B

- Secured Overnight Financing Rate (SOFR): 0.04%, $976B

- Broad General Collateral Rate (BGCR): 0.05%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $325B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $2.401B accepted vs. $9.538B submission

- Tsy 22.5Y-30Y, $1.801B accepted vs. $3.469B submission

- Next scheduled purchases:

- Thu 01/06 1100-1120ET: TIPS 7.5Y-30Y, appr $0.925B

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

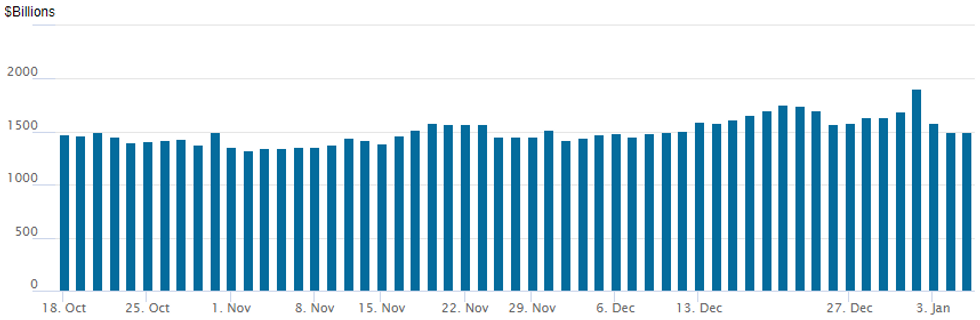

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage continues to recede: $1,492.787B (69 counterparties) vs. $1,495.692B on Tuesday.

All-time high of $1,904.582B on Friday, December 31.

PIPELINE: Over $30B Corporate Issuance Wednesday

$30.45B to price Wednesday- Date $MM Issuer (Priced *, Launch #)

- 01/05 $5B *EIB 5Y SOFR+22

- 01/05 $4B #Reliance Industries $1.5B 10Y +120, $1.75B 30Y +160, $750M 40Y +170

- 01/05 $4B #Airport Authority $1B 5Y +42.5, $1.2B 10Y +80, $1.2B 30Y +120, $600M 40Y +140

- 01/05 $3B #Bank of Montreal (BMO) $1.35 3Y +45, $400M 3Y SOFR+46.5, $1.25B 15NC10 +140

- 01/05 $2B #Sumitomo Mitsui Fncl Grp (SMFG) $500M each: 5Y +75, 5Y SOFR+88, 20Y +85, 7Y +93

- 01/05 $2.5B #Toronto Dominion (TD) $800M 3Y +40, $350M 3Y SOFR+41, $750M 5Y +55, +600M10Y +80

- 01/05 $2B #Standard Chartered $1.25B 6NC5 +118, $750M 11NC10 +190

- 01/05 $2B #Ford Motor Co $1.25B 3Y 2.3%, $750M 7Y 2.9%

- 01/05 $1.5B #Air Lease 5Y +105a, 10Y +145a

- 01/05 $1.45B #Rabobank $1B 3Y +37, $450M 3Y SOFR+38

- 01/05 $1.25B #BNP Paribas perpNC5 4.625%

- 01/05 $1B #Virgina Electric $600M 10Y +70, $400M 2051 Tap +98

- 01/05 $Benchmark Kexim 3Y +50a, 5Y +60a, 10Y +85a

- 01/05 $750M #Jackson National Life 3Y +68

- On tap for Thursday:

- 01/06 $Benchmark IADB 5Y

EGBs-GILTS CASH CLOSE: Supply The Day's Focus

Bunds and Gilts traded largely in ranges Wednesday, perhaps biding time ahead of events out of the US (Fed Minutes after hours and jobs report Friday). Curves traded mixed overall.

- In the meantime, supply was a big theme on the day.

- Plenty of syndication activity: Italy headlined, selling E7bln of 30Y BTP; Slovenia sold E1.75bln of 4 and 40-year bonds. And in auctions, Germany allotted E3.1bln in Bund and Spain E5.7bln in bonds.

- Italy underperformed Spain and Portugal, with more bear steepening in the BTP curve.

- In data, services PMIs were on the soft side; Italy Dec CPI was in line.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.7bps at -0.62%, 5-Yr is down 1.3bps at -0.431%, 10-Yr is up 3.8bps at -0.084%, and 30-Yr is up 0.5bps at 0.262%.

- UK: The 2-Yr yield is down 0.6bps at 0.762%, 5-Yr is up 0.4bps at 0.917%, 10-Yr is up 0.2bps at 1.087%, and 30-Yr is down 1bps at 1.202%.

- Italian BTP spread down 1.8bps at 131.9bps / Spanish down 3bps at 68.2bps

FOREX: Equities Weakness Following Fed Minutes Prompts US Dollar Recovery

- On Wednesday, the dollar was seen broadly weaker as commodities gained and equities held their ground following a large beat in the December US ADP employment change.

- EURUSD had extended gains back above the 1.13 mark, slowing edging to session highs of 1.1346.

- However, with the Fed discussing faster rate liftoff on inflation risk and the minutes of December meeting indicating some discussion of tapering MBS faster than Treasuries, the US dollar reacted positively as US equity indices came under selling pressure.

- EURUSD gave up around 35 pips to trade below 1.1310, with particular weakness seen in risk proxies where the likes of AUD and CAD fell over 0.5% to fresh session lows post the release.

- Overall, the US dollar index remains 0.1% lower on the day but is higher for the week as we approach the December NFP report on Friday.

- Of note, EURGBP is approaching a key support at 0.8333, which when flipped represents 1.2000 in GBP/EUR. While a psychologically significant pivot point, corporate interest ahead of and at this GBP/EUR level bolsters the potential short-term support and medium-term implications of a break below. For reference, there has been just one weekly close below this level since mid-2016 and therefore should be closely monitored in the upcoming trading sessions.

- Tomorrow in Europe, markets will see preliminary German CPI data before Friday’s Eurozone HICP flash estimate. In the US, ISM Services PMI will headline the docket.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/01/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 06/01/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 06/01/2022 | 0700/0800 | ** |  | DE | manufacturing orders |

| 06/01/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/01/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 06/01/2022 | 1000/1100 | ** |  | EU | PPI |

| 06/01/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 06/01/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 06/01/2022 | 1330/0830 | ** |  | US | trade balance |

| 06/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/01/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/01/2022 | 1500/1000 | ** |  | US | factory new orders |

| 06/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 06/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 |  | US | San Francisco Fed's Mary Daly | |

| 06/01/2022 | 1815/1315 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.