-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: More Bear Flattening; TYH Through Key Support

EXECUTIVE SUMMARY

- MNI: Fed's Bullard Wants March Hike, Warns of More Tightening

- MNI: St. Louis Fed Model Sees 1M+ Jobs Added in December

- MNI BRIEF: Daly Says Fed Is Close To Reaching Mandate Goals

- MNI: DALY SUPPORTS FED'S CURRENT PACE OF QE TAPERING

- IRAN: WE'RE HEARING GOOD THINGS FROM U.S. OVER NUCLEAR DEAL, Bbg

US

FED: The Federal Reserve could start raising interest rates rates in March and potentially allow for some balance sheet runoff later in response to an inflation surge late last year, St. Louis Fed President James Bullard said Thursday.

- “The FOMC could begin increasing the policy rate as early as the March meeting in order to be in a better position to control inflation,” Bullard said in prepared remarks.

- The Fed sped up its taper of QE in December and penciled in as many as three interest rate hikes for 2022.

- “Subsequent rate increases during 2022 could be pulled forward or pushed back depending on inflation developments.” Fore more see MNI Policy main wire at 1315ET.

FED: U.S. hiring in December likely picked up strongly from a month earlier, according to the St. Louis Fed's analysis of real-time employment data from scheduling software company Homebase, showing a seasonally-adjusted rise of over 1 million jobs, economist Max Dvorkin told MNI on Thursday.

- Since the survey was conducted mid-December, "it is likely that the effects of the new wave of Covid cases won't be reflected in the December jobs report," Dvorkin said.

- In November, the model forecast a seasonally-adjusted gain of 537,000 jobs as measured by the BLS's household survey. The official payrolls figure based on the "establishment" survey of businesses came in at 210,000, though the household survey found employment surged by 1.1 million during the month.

- The two surveys usually track closely but use different definitions of employment and technical factors.

- In non-seasonally-adjusted terms, the Homebase model predicts an increase of 408,000 jobs in December, Dvorkin said.

- The pace of QE tapering announced in December "feels very appropriate" she said during an online talk, adding that the idea of further runoff may need to be considered. The job market "looks like it's very strong" but labor supply is constrained by women with children staying out of the market and more people moving into retirement, she said.

US TSYS: Yields Inch Higher Ahead Key Employment Data Friday

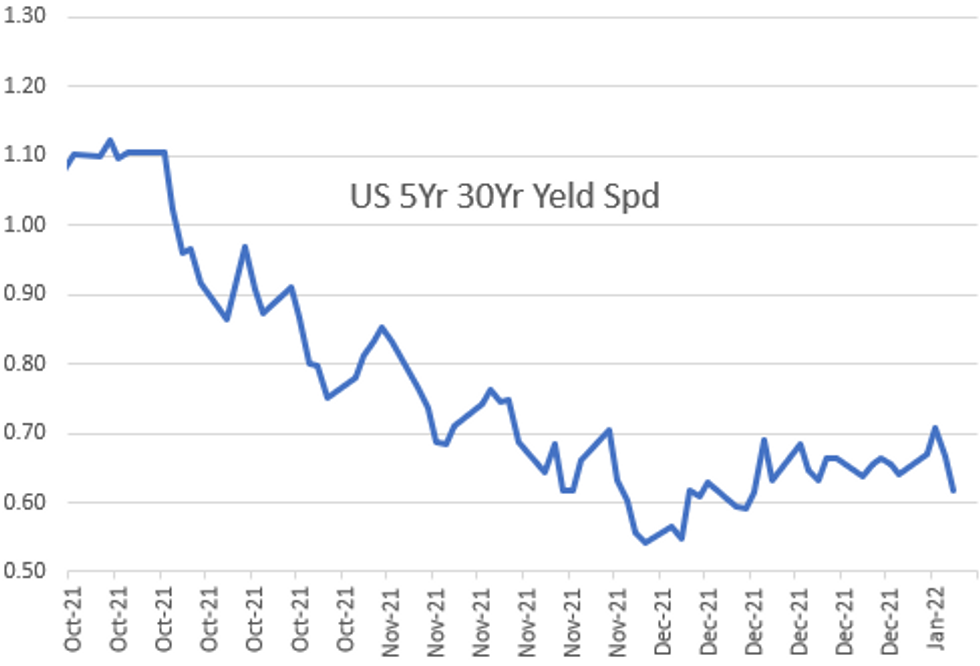

Yields inched higher, curves bear flattening (5s30s -5.00 at 61.21) for second consecutive session in the lead-up to headline December employment data Friday.- Median estimate for December job gains climbed +42k to +442k after the release of more hawkish than anticipated minutes from Dec FOMC yesterday; not to mention Wed's ADP private jobs overshoot of +807k vs. +410k est).

- Best volumes in weeks (TYH2 >1.6M) amid two-way positioning ahead Fri's jobs data, curves flatter/short end weighed with StL Fed Bullard saying liftoff could occur as early as March and potentially allow for some balance sheet runoff later in response to an inflation surge late last year.

- Incidentally, little react to modest gain in weekly claims (207k vs. 195k est).

- Decent option hedging rate hikes via put structures in March, June and Sep reported. Flipside: longer expirys looking for policy overshoot/potential rate cut in 2023) +25,000 Red Mar'23 99.75 calls, 2.5 (open interest over 313k).

- No coupon sales Friday, but NY Fed buy-op scheduled: Tsy 0Y-2.25Y, appr $9.325B.

- The 2-Yr yield is up 5.4bps at 0.8796%, 5-Yr is up 4.6bps at 1.4753%, 10-Yr is up 2.3bps at 1.7281%, and 30-Yr is down 0.7bps at 2.0874%.

US 10Y FUTURES Tech (H2) Through Key Support

- RES 4: 131-19 High Dec 20 and key resistance

- RES 3: 130-18+/28+ High Dec 31 / High Dec 22

- RES 2: 129-31 Low Dec 8 and a recent breakout level

- RES 1: 129-19 High Jan 4

- PRICE: 128-19 @ 16:29 GMT Jan 6

- SUP 1: 128-05 1.618 proj of the Dec 20 - 29 - 31 price swing

- SUP 2: 128-00 Psychological round number

- SUP 3: 127-30 1.764 proj of the Dec 20 - 29 - 31 price swing

- SUP 4: 127-18+ 2.00 proj of the Dec 20 - 29 - 31 price swing

Treasuries remain soft and the contract has today cleared key support at 128-22+, Nov 22 low. The break strengthens the current bearish cycle that started Dec 20 and the focus is on the 128-00 psychological handle next. Moving average conditions remain bearish and this reinforces the current broader downtrend. Initial resistance is seen at 129-19, the Jan 4 high. Short-term gains are likely to be corrective in nature.

OVERNIGHT DATA

- US JOBLESS CLAIMS +7K TO 207K IN JAN 01 WK

- US PREV JOBLESS CLAIMS REVISED TO 200K IN DEC 25 WK

- US CONTINUING CLAIMS +0.036M to 1.754M IN DEC 25 WK

- US NOV TRADE GAP -$80.2B VS OCT -$67.2B

- US NOV FACTORY ORDERS +1.6%; EX-TRANSPORT NEW ORDERS +0.8%

- US NOV DURABLE ORDERS +2.6%

- US NOV NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.0%

- US DEC ISM SERVICES PMI 62.0 VS 69.1 NOV

- US ISM SERVICES PRICES 82.5 DEC VS 82.3 NOV

- US ISM SERVICES BUSINESS INDEX 67.6 DEC VS 74.6 NOV

- US ISM SERVICES EMPLOYMENT INDEX 54.9 DEC VS 56.5 NOV

- US ISM SERVICES NEW ORDERS 61.5 DEC VS 69.7 NOV

- US ISM SERVICES SUPPLIER DELIVERIES 63.9 DEC VS 75.7 NOV (NSA)

- US ISM SERVICES ORDER BACKLOG 62.3 DEC VS 65.9 NOV (NSA)

- US ISM SERVICES EXPORT ORDERS 61.5 DEC VS 57.9 NOV (NSA)

- US ISM SERVICES IMPORTS INDEX 55.5 DEC VS 50.5 DEC (NSA)

- US ISM SERVICES INVENTORIES 46.7 DEC VS 48.2 DEC (NSA)

- US ISM SERVICES INVENT SENTIMENT 38.3 DEC VS 36.4 NOV (NSA)

- CANADIAN NOV TRADE BALANCE +3.1 BILLION CAD

- CANADA NOV EXPORTS 58.6 BLN CAD, IMPORTS 55.4 BLN CAD

- CANADA REVISED OCT MERCHANDISE TRADE BALANCE +2.3 BLN CAD

- CANADA TRADE SURPLUS IS WIDEST SINCE SEPT 2008

US OUTLOOK/OPINION: Updated Sell-Side Analyst Ests' for Dec Employ Figures

Median estimate for December job gains climbed +42k to +442k after the release of more hawkish than anticipated minutes from the Dec FOMC yesterday; not to mention Wed's ADP private jobs overshoot of +807k vs. +410k est). Sell-side analysts have in turn adjusted their estimates higher:- RBS/NatWest: Anticipate the "report as a whole to be healthy" as the drag from Omicron occurred after the latest data set. NatWest estimates Dec jobs gain of 500k noting "softer-than-expected November increase in nonfarm payrolls and the fact that other employment-related indicators continued to show strength."

- Up-revision for Nov wouldn't be a surprise NatWest added as "payroll revisions in general tend to be positively correlated with the underlying trend in payroll growth, which is exceptionally strong.

- TD Securities: Also estimate +500k jobs survey period missed the rise in Omicron, while the Nov read "appeared to be held down by an overly aggressive seasonal adjustment factor."

- TD added "rates market is arguably priced for a good report but the market is skittish given the hawkish message from the December FOMC minutes" remaining "long 2y Treasuries and short 10y real rates."

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 72.36 points (-0.2%) at 36333.08

- S&P E-Mini Future up 12 points (0.26%) at 4704

- Nasdaq up 62.7 points (0.4%) at 15162.61

- US 10-Yr yield is up 2.3 bps at 1.7281%

- US Mar 10Y are down 8.5/32 at 128-18.5

- EURUSD down 0.0026 (-0.23%) at 1.1288

- USDJPY down 0.2 (-0.17%) at 115.92

- WTI Crude Oil (front-month) up $1.88 (2.41%) at $79.73

- Gold is down $21.37 (-1.18%) at $1789.01

- EuroStoxx 50 down 67.34 points (-1.53%) at 4324.81

- FTSE 100 down 66.5 points (-0.88%) at 7450.37

- German DAX down 219.72 points (-1.35%) at 16052.03

- French CAC 40 down 126.71 points (-1.72%) at 7249.66

US TSY FUTURES CLOSE

- 3M10Y +1.184, 162.32 (L: 158.268 / H: 165.804)

- 2Y10Y -2.456, 84.903 (L: 84.104 / H: 88.969)

- 2Y30Y -5.781, 120.532 (L: 120.06 / H: 127.443)

- 5Y30Y -5.327, 60.89 (L: 60.581 / H: 66.768)

- Current futures levels:

- Mar 2Y down 3.25/32 at 108-25.125 (L: 108-24.625 / H: 108-29)

- Mar 5Y down 7.5/32 at 119-28.25 (L: 119-27 / H: 120-07.25)

- Mar 10Y down 8/32 at 128-19 (L: 128-14 / H: 129-00)

- Mar 30Y down 9/32 at 156-3 (L: 155-15 / H: 156-20)

- Mar Ultra 30Y up 12/32 at 190-2 (L: 187-31 / H: 190-05)

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.010 at 99.60

- Jun 22 -0.035 at 99.310

- Sep 22 -0.035 at 99.080

- Dec 22 -0.030 at 98.830

- Red Pack (Mar 23-Dec 23) -0.045 to -0.035

- Green Pack (Mar 24-Dec 24) -0.05 to -0.035

- Blue Pack (Mar 25-Dec 25) -0.04 to -0.035

- Gold Pack (Mar 26-Dec 26) -0.035 to -0.025

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N +0.00400 at 0.07414% (+0.00976/wk)

- 1 Month +0.00214 to 0.10414% (+0.00075/wk)

- 3 Month +0.00572 to 0.23129% (+0.02216/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.02657 to 0.36657% (+0.02782/wk)

- 1 Year +0.05142 to 0.64771% (+0.06458/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $263B

- Secured Overnight Financing Rate (SOFR): 0.05%, $946B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $325B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $901M accepted vs. $1.721B submission

- Next scheduled purchases:

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

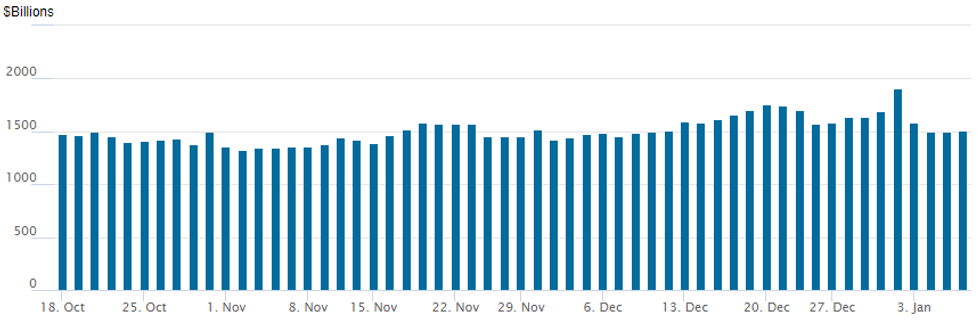

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $1,510.553B (74 counterparties) vs. $1,492.787B on Wednesday.

All-time high of $1,904.582B on Friday, December 31.

PIPELINE: $2.5B GM Fncl 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 01/06 $3.5B *IADB 5Y SOFR+22

- 01/06 $2.5B #GM Fncl $1B 5Y +90, $300M 5Y SOFR+104, $1.2B 10Y +138

- 01/06 $1B #Genuine Parts $500M 3NC1 +70, $500M 10Y +115

- 01/06 $Benchmark Ares Capital +5Y +150a

- 01/06 $450M #Protective Life 3Y +50a

- 01/06 $Benchmark UBS Group perp NC5 5.125%a

- 01/06 $Benchmark Farm Credit System Banks 3Y

- 01/06 $500M #Banco de Brasil 7Y 4.95%

EGBs-GILTS CASH CLOSE: Hawks Take Flight (Then Take Profit)

The UK curve underperformed Germany's Thursday, with bear steepening and multi-year highs set in long-end yields.

- The sell-off came mostly in the early morning/open following the hawkish reaction to Wednesday's Federal Reserve minutes which helped boost global rate hike expectations.

- Indeed, we saw some apparent profit-taking by bond shorts in the afternoon.

- 10Y and 30Y Gilt yields underperformed and hit fresh post-Oct 2021 highs. But short-end /belly UK instruments took centre stage, with 2Y and 5Y yields hitting highest since Mar 2019 (0.827% / 0.981% intraday highs respectively).

- Attention turns to the U.S. again Friday, for the Dec nonfarm payrolls report.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 2.1bps at -0.599%, 5-Yr is up 3.1bps at -0.4%, 10-Yr is up 2.3bps at -0.061%, and 30-Yr is up 0.4bps at 0.266%.

- UK: The 2-Yr yield is up 5.1bps at 0.813%, 5-Yr is up 5.6bps at 0.973%, 10-Yr is up 6.9bps at 1.156%, and 30-Yr is up 7.3bps at 1.275%.

- Italian BTP spread up 1.5bps at 133.4bps / Spanish up 0.2bps at 68.4bps

FOREX: Greenback Treads Water Ahead Of Dec. Non-Farm Payrolls

- The dollar index is marginally in the green having given back some of the early gains on Thursday. However, the index has traded in a fairly narrow range ahead of the December payrolls report, scheduled for tomorrow.

- There were mixed performances in G10 FX against the US dollar as equity indices consolidated yesterday’s retreat following the FOMC minutes.

- Antipodean FX were clear underperformers with both AUD and NZD dropping around 0.75%. AUD/USD's downtick Thursday puts the pair short of a firm break above the 50-dma - and the rejection could mark the beginning of a bearish reversal that initially targets 0.7082 ahead of 0.6993.

- Both the Swiss Franc and the Chinese Yuan also struggled on Thursday, losing 0.5% and 0.32% respectively.

- CAD bucked this trend and rose a quarter point buoyed by rising crude prices and WTI futures briefly testing above $80/bl. The pair remains above last week’s low of 1.2621 on Dec 31 - a key short-term support.

- EURUSD and USDJPY remained in familiar territory around 1.13 and 116 respectively, with markets lacking direction ahead of tomorrow’s jobs data.

- On Friday the Eurozone will publish their HICP flash estimate, before we see employment figures for both the US and Canada to round off the week.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/01/2022 | 0645/0745 | ** |  | CH | unemployment |

| 07/01/2022 | 0700/0800 | ** |  | DE | industrial production |

| 07/01/2022 | 0700/0800 | ** |  | DE | trade balance |

| 07/01/2022 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/01/2022 | 0730/0830 | ** |  | CH | retail sales |

| 07/01/2022 | 0745/0845 | ** |  | FR | Consumer Spending |

| 07/01/2022 | 0745/0845 | * |  | FR | industrial production |

| 07/01/2022 | 0745/0845 | * |  | FR | foreign trade |

| 07/01/2022 | 0745/0845 | * |  | FR | current account |

| 07/01/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 07/01/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 07/01/2022 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 07/01/2022 | 1000/1100 | * |  | EU | Business Climate Indicator |

| 07/01/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 07/01/2022 | 1000/1100 | ** |  | EU | retail sales |

| 07/01/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 07/01/2022 | 1330/0830 | *** |  | US | Employment Report |

| 07/01/2022 | 1500/1000 | * |  | CA | Ivey PMI |

| 07/01/2022 | 1500/1000 |  | US | San Francisco Fed's Mary Daly | |

| 07/01/2022 | 1600/1600 |  | UK | BOE Mann at CFR meeting | |

| 07/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 07/01/2022 | 1715/1715 |  | UK | BOE Mann on panel at AEA | |

| 07/01/2022 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 07/01/2022 | 2000/1500 | * |  | US | Consumer C |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.