-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Tone Increasingly Hawkish

EXECUTIVE SUMMARY

- MNI: Fed's Harker Sees March Hike, Warns of More Tightening

- MNI: Survey Hints At Wage-Price Spiral -Atlanta Fed's Meyer

- MNI BRIEF: Brainard Says Fed Moving To Bring Inflation Down

- MNI: Clarida Says Appropriate For Fed To Tighten This Year

- BRAINARD SAYS FED FUNDS RATE IS PRIMARY TOOL FOR INFLATION, Bbg

- FED: Chicago Fed Pres Evans Comments on Inflation -- Chicago Fed Pres Evans (2023 voter) on US economy and monetary policy at event hosted by the Milwaukee Business Journal. Says he is "aligned" with median DOTS of 3 hikes this year while the "FOMC SEES TWO TO FOUR RATE HIKES THIS YEAR" Bbg

US

FED: The Federal Reserve could start raising interest rates rates in March and could well continue to raise rates throughout the year, Philadelphia Fed President Patrick Harker said Thursday.

- "I expect us to complete our taper of asset purchases by March. Then, we can probably expect a rate hike of 25 basis points. We could very well continue to raise rates throughout the year as the data evolve," Harker said according to prepared remarks. "After nearly two years of accommodation, I think we can expect a fair amount of tightening in 2022." For more see MNI Policy main wire at 0800ET.

- "We are taking actions on the monetary policy front that I have confidence will be bringing inflation down while continuing to allow the labor market to return to full strength," Brainard said.

- The Fed has signaled it will likely hike interest rates at least three times this year, and ex-officials tell MNI a nod to a March hike could come as soon as this month's meeting.

- Clarida said there's still some evidence that last year's jump in prices will fade once supply bottlenecks are resolved. "I continue to believe that the underlying rate of inflation in the U.S. economy is hovering close to our 2 percent longer-run objective," he said. The jump in relative prices "will in the end prove to be largely transitory under appropriate monetary policy."

- Earlier this week, Clarida, who led the Fed's framework review, announced his intention to resign on Friday. Writing in a working paper he said "even as the economy we face now looks different than when we set out to do the framework review, we think the new framework is set to serve us well."

US: A lack of available U.S. workers and rising inflation expectations among firms and consumers could perpetuate the current elevated inflation environment well after the pandemic-driven surge in prices has reversed, or even kick off a wage-price spiral, Atlanta Fed economist Brent Meyer said in an interview.

- "October 2021 might have been the high-water mark" for CPI, "but this does not imply that we’ve seen the last of high inflation," Meyer said. "I'm starting to be very concerned about what we're seeing in inflation expectations now."

- Year-ahead business inflation expectations, as measured by the bank's monthly survey of firms in the Fed region, aren't budging from the all-time high of 3.4%, while the survey's measure of longer-run inflation expectations has also picked up, according to data released Wednesday. For more see MNI Policy main wire at 0636ET.

US TSYS: Tsy Futures/Options Round-Up

Bonds leading steady march higher late Thu, highs for the wk outpacing Wed amid combination of short covering and new buying with futures back to early Jan 6 levels.

- Recent 30YY session low at 2.0499% after almost topping 2.10 earlier, 10YY 1.7076% low.

- Are markets fading hawkish Fed-speak? Perhaps that's what's contributing to the steady round of buying as more Fed officials see as many as four 25bp hikes this year.

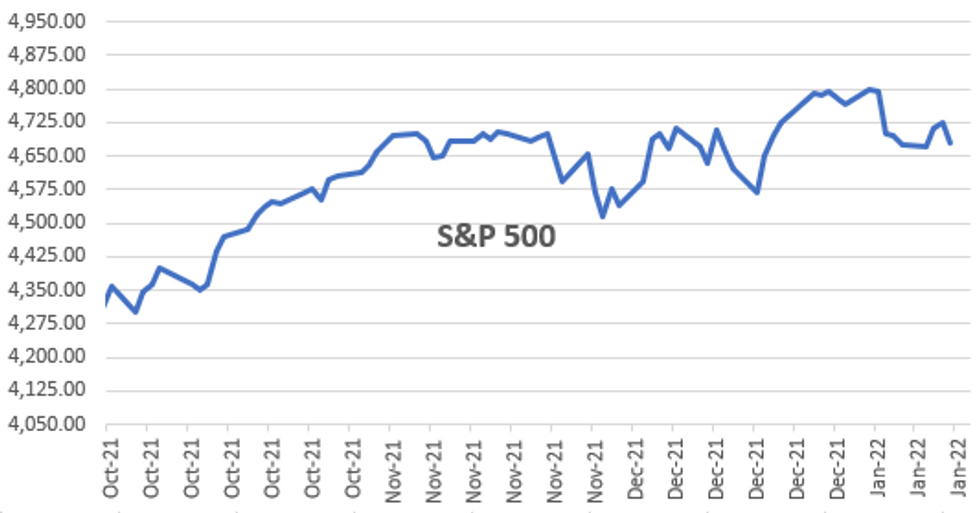

- Then again, it could be straight-up risk-off as equities trade weaker (ESH2 -40.25 at 4676.0; Nasdaq below 100DMA at 14917.0 -271.) with IT (-1.85%), Consumer Discretionary (-1.25%) and Health Care (-1.04%) sectors underperforming.

- Eurodollar/Treasury option trade remains mixed, or less one-way than early week put buying with some accts unwinding downside insurance and buying calls. That said, 1StD put skews outpacing calls, implieds only mildly softer.

- Of note, January Eurodollar options expire Friday, February Treasury options expire next week Friday.

- Tsys gap lower but quickly recover after latest $22B 30Y Bond auction re-open (912810TB4) tailed again: 2.075% high yield vs. 2.072% WI; 2.35x bid-to-cover better than 2.22x last month (2.29x 5-month average)

- Indirect take-up climbs to 64.98% vs. 60.80% in Dec; direct bidder take-up recedes to 17.08% vs. 18.49% prior, while primary dealer take-up slips to 17.95% vs. 20.71%.

OVERNIGHT DATA

- US JOBLESS CLAIMS +23K TO 230K IN JAN 08 WK

- US PREV JOBLESS CLAIMS REVISED TO 207K IN JAN 01 WK

- US CONTINUING CLAIMS -0.194M to 1.559M IN JAN 01 WK

- US DEC PPI FINAL DEMAND +0.2% M/M (+1.0% PRIOR REV, +0.4% SURVEY)

- US DEC PPI FINAL DEMAND EX-FOOD, ENERGY, TRADE +0.4% (+0.8% PRIOR REV, +0.5% SURVEY)

- US DEC PPI EX-FOOD AND ENERGY +0.5% M/M (+0.8% PRIOR REV, +0.5% SURVEY)

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 230.11 points (-0.63%) at 36055.49

- S&P E-Mini Future down 68.5 points (-1.45%) at 4646.75

- Nasdaq down 377.7 points (-2.5%) at 14809.79

- US 10-Yr yield is down 4.4 bps at 1.6988%

- US Mar 10Y are up 7/32 at 128-25.5

- EURUSD up 0.0012 (0.1%) at 1.1454

- USDJPY down 0.55 (-0.48%) at 114.09

- WTI Crude Oil (front-month) down $1.16 (-1.4%) at $81.50

- Gold is down $4.92 (-0.27%) at $1821.27

European bourses closing levels:

- EuroStoxx 50 down 0.49 points (-0.01%) at 4315.9

- FTSE 100 up 12.13 points (0.16%) at 7563.85

- German DAX up 21.27 points (0.13%) at 16031.59

- French CAC 40 down 36.05 points (-0.5%) at 7201.14

US TSY FUTURES CLOSE

- 3M10Y -4.577, 157.281 (L: 156.929 / H: 163.029)

- 2Y10Y -1.171, 80.815 (L: 80.059 / H: 83.815)

- 2Y30Y -1.143, 115.168 (L: 114.263 / H: 118.274)

- 5Y30Y +0.882, 57.434 (L: 55.74 / H: 59.096)

- Current futures levels:

- Mar 2Y up 1.125/32 at 108-24.875 (L: 108-22.125 / H: 108-24.875)

- Mar 5Y up 5/32 at 119-29.75 (L: 119-18 / H: 119-30.25)

- Mar 10Y up 7.5/32 at 128-26 (L: 128-08 / H: 128-27)

- Mar 30Y up 22/32 at 156-23 (L: 155-18 / H: 156-26)

- Mar Ultra 30Y up 33/32 at 191-5 (L: 189-04 / H: 191-11)

US 10Y FUTURE TECHS (H2): Trend Needle Still Points Lower

- RES 4: 131-19 High Dec 20 and key resistance

- RES 3: 130-18+/28+ High Dec 31 / High Dec 22

- RES 2: 129-31 Low Dec 8 and a recent breakout level

- RES 1: 129-00/15 High Jan 6 / 20-day EMA

- PRICE: 128-19 @ 16:33 GMT Jan 13

- SUP 1: 127-30 1.764 proj of the Dec 20 - 29 - 31 price swing

- SUP 2: 127-18+ 2.00 proj of the Dec 20 - 29 - 31 price swing

- SUP 3: 127-07 2.236 proj of the Dec 20 - 29 - 31 price swing

- SUP 4: 127-00 Round number support

Treasuries remain in a downtrend and short-term gains are considered corrective. A clear bearish price sequence of lower lows and lower highs highlights the current trend and signals scope for further weakness. The moving average set-up is also in bear mode, reinforcing current conditions. Initial resistance is seen at 129-00, the Jan 6 high. The focus is on 127-18+ next, a Fibonacci projection.

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.005 at 99.595

- Jun 22 +0.010 at 99.310

- Sep 22 +0.005 at 99.065

- Dec 22 +0.005 at 98.80

- Red Pack (Mar 23-Dec 23) +0.010 to +0.040

- Green Pack (Mar 24-Dec 24) +0.045 to +0.050

- Blue Pack (Mar 25-Dec 25) +0.040 to +0.045

- Gold Pack (Mar 26-Dec 26) +0.040 to +0.045

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N +0.00014 at 0.07743% (+0.00472/wk)

- 1 Month -0.00385 to 0.10629% (+0.00100/wk)

- 3 Month +0.00071 to 0.23914% (+0.00300/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01315 to 0.39686% (+0.02043/wk)

- 1 Year +0.01443 to 0.71357% (+0.05186/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $250B

- Secured Overnight Financing Rate (SOFR): 0.05%, $891B

- Broad General Collateral Rate (BGCR): 0.05%, $351B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $339B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4Y, $6.301B accepted vs. $17.129B submission

NY Fed updated purchase schedule: no new buys Friday through Monday's MLK Jr holiday, resume next week Tuesday, and again around the FOMC policy annc on Jan 26. NY Fed operations desk "plans to purchase approximately $40 billion over the monthly period from 1/14/22 to 2/11/22" vs. $60B prior as QE winds down.

- Tue 01/18 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B vs. $4.525B prior

- Thu 01/20 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Fri 01/21 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B vs. $9.325B prior

- Tue 01/25 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B vs. $1.525B prior

- Pause again around the FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

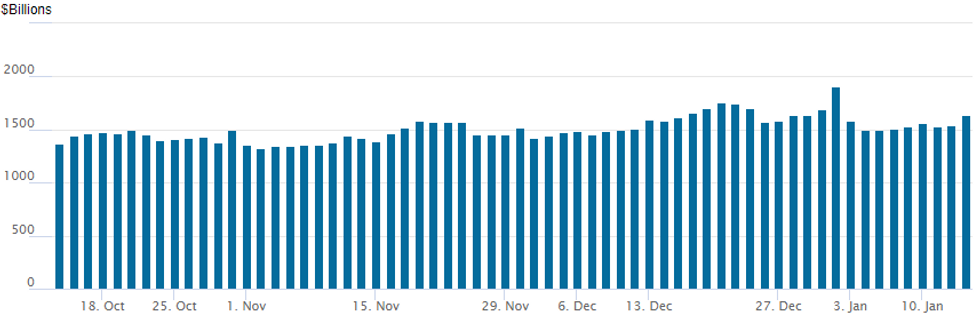

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage surged to $1,636.742B (79 counterparties) vs. $1,536.981B on Wednesday.

Remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $10B to Price Thursday

- $10B to Price Thursday, still waiting on CCO and EIB Pearl

- Date $MM Issuer (Priced *, Launch #)

- 01/13 $2B *China Construction Bank 10NC5 +140

- 01/13 $1.5B *Province of Ontario 10Y +60

- 01/13 $1B CCO Holdings 10NC5

- 01/13 $1B *Kommunekredit 12/2023 SOFR+13

- 01/13 $500M *Mitsui & Co 5Y +68

- 01/13 $500M *CIMB Bank 5.5Y +70

- 01/13 $500M *Ares Finance 30Y +172

- 01/13 $500M *Indian Railway Finance 10Y Green +185

- 01/13 $2.5B EIG Pearl 14.5Y-15Y +185a, 24.5Y-25Y +235a

EGBs-GILTS CASH CLOSE: Rally Continues

A busy supply schedule did little to deter European bond gains Thursday, with Bunds bull flattening and the UK curve bull steepening for the second consecutive session.

- The German long-end once again set the tone for EGBs in general, resuming Wednesday's bullish price action.

- Few European macro drivers today (soft US PPI was marginally positive for core Global FI), but supply was eyed: Italy, Ireland, and Cyprus (the latter two syndications) sold bonds today.

- Periphery EGBs enjoyed a constructive session, with BTPs outperforming.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.2bps at -0.599%, 5-Yr is down 2.2bps at -0.399%, 10-Yr is down 3.1bps at -0.09%, and 30-Yr is down 4.7bps at 0.204%.

- UK: The 2-Yr yield is down 4.6bps at 0.761%, 5-Yr is down 4.2bps at 0.936%, 10-Yr is down 3.5bps at 1.105%, and 30-Yr is down 2.7bps at 1.216%.

- Italian BTP spread down 1.5bps at 130.7bps / Spanish down 0.9bps at 67.7bps

FOREX: US Dollar Consolidates At Two-Month Lows, JPY and CHF Firm

- The greenback is seen one tenth of a percent lower on Thursday, broadly consolidating the sizeable move seen during yesterday’s session. A turn lower in equity indices lent support to the likes of the Japanese Yen and the Swiss Franc.

- USDJPY (-0.47%) completed a full point move to the downside, following Wednesday’s break of 115.00, with the pair trading with a consistently offered tone through the NY session. The pair has now breached both the 20-day EMA and the 50-day EMA - at 114.22. This suggests scope for a deeper sell-off, potentially targeting 113.56, low Dec 21.

- Similarly, USDCHF fell 0.4% and briefly broke below some previous lows through the 0.91 handle.

- Elsewhere, ranges remained tighter compared to yesterday, however, EUR, AUD, GBP, NZD and CAD did all extend on their gains made yesterday.

- In emerging markets, Russia saying Ukraine talks hit a 'dead end' have diminished the chances of diplomatic resolutions and in turn have heavily weighed on the Ruble. USDRUB has risen close to 2% above the 76.00 mark. The break strengthens the bullish case and opens 78.0406, Apr 7 high.

- Chinese trade balance is scheduled overnight before monthly GDP/IP data will be released from the UK. December US retail sales and industrial production data will headline in the final US session of the week.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/01/2022 | 0130/1230 | ** |  | AU | Lending Finance Details |

| 14/01/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 14/01/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 14/01/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 14/01/2022 | 0700/0700 | ** |  | UK | UK monthly GDP |

| 14/01/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 14/01/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 14/01/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/01/2022 | 0830/0930 | *** |  | SE | Inflation report |

| 14/01/2022 | 1000/1100 | * |  | EU | trade balance |

| 14/01/2022 | 1315/1415 |  | EU | ECB Lagarde speech at COSAC | |

| 14/01/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 14/01/2022 | 1330/0830 | ** |  | US | import/export price index |

| 14/01/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 14/01/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/01/2022 | 1500/1000 | * |  | US | business inventories |

| 14/01/2022 | 1500/1000 |  | US | Philadelphia Fed's Patrick Harker | |

| 14/01/2022 | 1600/1100 |  | US | New York Fed's John Williams | |

| 14/01/2022 | 1700/1200 |  | CA | BOC releases climate risk paper |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.