-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASI OPEN: Fed Bostic Still Confident of Waning Inflation

MNI ASIA MARKETS ANALYSIS: Tsy Curves Twist Flatter

PIPELINE: $2.2B Nigeria 2Pt Kicks Off December Issuance

MNI ASIA OPEN: Taking Geopol Tension Seriously

EXECUTIVE SUMMARY

- MNI: Fed Turns To QT As Active Tightening Tool - Ex Officials

- MNI INTERVIEW: Bank Of Canada Should Hike Next Week-Ex Adviser

- US-CHINA: China Accuses US Warship Of Illegal Incursion

- US-RUSSIA: Blinken-Lavrov Talks Unlikely To Resolve Tensions

- SOS BLINKEN: U.S. AIMS TO DETER FURTHER INCURSION OF RUSSIA INTO UKRAINE, Bbg

- BLINKEN SAYS U.S. AND EUROPEAN PARTNERS WILL ACT WITH ONE VOICE ON RUSSIA, UKRAINE, Bbg

US

FED: The Federal Reserve is keen to reduce its balance sheet more aggressively in the face of soaring inflation, despite seeing quantitative tightening as an uncertain tool with likely only a small impact on price pressures compared to raising interest rates, former Fed officials told MNI.

- "A faster move on portfolio policy takes pressure off having to raise rates more quickly," said former Fed Board of Governors research director David Wilcox, now an economist with the Peterson Institute for International Economics and Bloomberg Economics.

- "The theory is QE causes longer-term interest rates to be lower than they otherwise would be, so the simplest and most reasonable hypothesis is, roughly speaking, the reverse also holds" for QT, he said. But, “nobody really knows, because we’ve only run this experiment once in modern economic history." For more, see MNI Policy main wire at 1339ET.

- The most likely outcome of the meeting is a reassertion of incompatible positions on European security. Beyond that it is likely we will see proposals from Russia for more strategic talks on security planned for the future. The Putin administration has a history of engaging in drawn-out diplomatic talks.

- The current level of tension on the Ukrainian border is very high and the extent of troop mobilisations in recent days is unprecedented. The threat of a Russian invasion remains strong and comments by US President Joe Biden yesterday may have damaged Blinken's negotiating position.

- The European bloc, however, is now more aligned after a so called 'Transatlantic Quad' meeting today. Hawkish comments from German Foreign Minister Annalena Baerbock suggest that Germany will be willing to support highly punitive US sanctions.

US/CHINA: Chinese military spokesperson Colonel Tian Junli has said that China has issued an 'eviction warning' to US warship USS Benfold operating in disputed waters around the Xisha island chain in the South China Sea.

- The official statement from the Chinese military read: 'We solemnly demand that the US side immediately stop such provocative actions, otherwise it will bear the serious consequences of unforeseen events'.

- Whilst this event isn't in itself a dramatic escalation of tensions in the region it highlights the increasing assertiveness of Chinese militarisation of the South China Sea.

- The Xisha Islands are claimed by China, Vietnam, and Taiwan but China holds de facto control through military infrastructure on the island chain.

- The US military has a stated foreign policy objective of maintaining freedom of navigation in the South China Sea but the Biden administration has been criticised for its lack of military presence in the region.

- Increased Chinese assertiveness could be another headache for US foreign policy makers as the so called 'pivot to the East' is being challenged by Russian aggression in Ukraine focusing US military and diplomatic attention on NATO's European defence framework.

CANADA

BOC: The Bank of Canada has enough evidence in hand on inflation and a tight job market to lift interest rates next week, Stephen Williamson, who has been a visiting scholar at the Bank of Canada and the Federal Reserve, told MNI.

- “The Bank of Canada really needs to get going here” and should hike at the Jan. 26 meeting, said Williamson, a Western University professor in London, Ontario. “You can be fairly gradual about it” and avoid worries about “driving the economy off a cliff” he said, saying a hike every other meeting could work.

- Bets on Governor Tiff Macklem waiting until at least April to lift the record low 0.25% rate -- guidance he gave just last month -- are being torn up this week. Reports have shown two-thirds of executives see inflation topping 3% over the next two years and CPI at the highest since 1991 when the BOC adopted inflation targets. While some economists maintain the BOC will wait until March to ensure the economy returns to full potential through the most infectious wave of Covid yet, Williamson said evidence from the UK and elsewhere suggests Omicron will cause less of a hit. For more see MNI Policy main wire at 1127ET.

Tsy/Eurodollar Roundup: Taking Geopol Tension Seriously

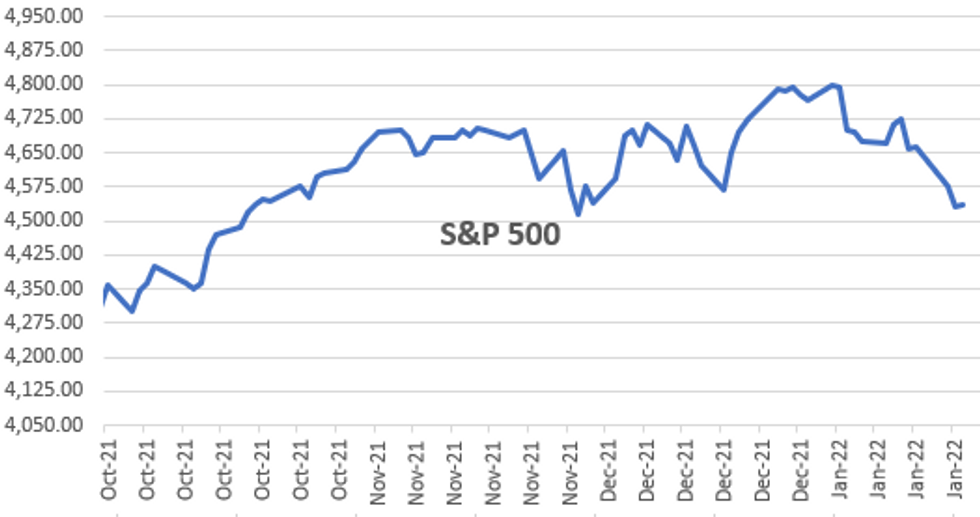

Rates held stubbornly to a narrow range Thursday as rising geopolitical tensions between the US and China as well as Russia helped reverse decent first half gains in equities: ESH2 4594.0 late morning highs vs. 4499.0 after the FI close.

- Equities started to trim gains following headlines that the US Senate panel approved an "anti-trust bill restricting big-tech platforms" WSJ.

- Sell-off accelerated after WSJ headlines on US/Russia tensions over Ukraine providing arms definitely turning up the heat: "U.S. Gives Baltic States Approval to Send U.S.-Made Weapons to Ukraine, Sources Say; Decision Will Enable Estonia, Lithuania, Latvia to Send Anti-Tank Weapons, Air Defense Systems to Ukraine", WSJ.

- Additional tension remains with China: Chinese military spokesperson Colonel Tian Junli has said that China has issued an 'eviction warning' to US warship USS Benfold operating in disputed waters around the Xisha island chain in the South China Sea

- Markets largely shrugged off early data: weekly claims gained 55k to 286k, higher than est 225k, continuing claims 1.635M vs. 1.563M est. Trade desks noted better buying from fast$, prop and option trading accts, carry-over real$ selling 10s and 30s.

- Selling Into Session Highs: Intermediates still outperforming short/long-end rates while trading desks reporting pick-up in sell interest: along with deal-tied rate-lock selling in 3s-10s, real$ and leveraged acct selling 5s, real$ selling 20s and 30s while central bank buying noted in 10s. Two-way option-related flow noted ahead Fri's Feb option expiration.

- The 2-Yr yield is down 0.8bps at 1.0494%, 5-Yr is down 3.2bps at 1.6165%, 10-Yr is down 3.2bps at 1.8326%, and 30-Yr is down 3.7bps at 2.1389%.

OVERNIGHT DATA

- US JOBLESS CLAIMS +55K TO 286K IN JAN 15 WK

- US PREV JOBLESS CLAIMS REVISED TO 231K IN JAN 08 WK

- US CONTINUING CLAIMS +0.084M to 1.635M IN JAN 08 WK

- US JAN PHILADELPHIA FED MFG INDEX 23.2

- US DEC EXISTING HOME SALES -4.6% TO 6.18M SAAR

- US DEC MEDIAN EXISTING HOME PRICE $358,000, +15.8% YOY

- NAR: TOTAL HOUSING INVENTORY -18% TO 910,000 UNITS, 1.8-MONTH SUPPLY

- NAR'S YUN: SALES DECLINE DUE TO RISING MORTGAGE RATES, LOW INVENTORY

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 24.91 points (0.07%) at 35058.57

- S&P E-Mini Future down 3 points (-0.07%) at 4522

- Nasdaq down 19.4 points (-0.1%) at 14324.92

- US 10-Yr yield is down 3.4 bps at 1.8308%

- US Mar 10Y are up 1/32 at 127-22.5

- EURUSD down 0.0025 (-0.22%) at 1.1318

- USDJPY down 0.2 (-0.17%) at 114.13

- WTI Crude Oil (front-month) down $0.06 (-0.07%) at $86.90

- Gold is down $0.83 (-0.05%) at $1839.69

- EuroStoxx 50 up 31.33 points (0.73%) at 4299.61

- FTSE 100 down 4.65 points (-0.06%) at 7585.01

- German DAX up 102.61 points (0.65%) at 15912.33

- French CAC 40 up 21.18 points (0.3%) at 7194.16

US TSY FUTURES CLOSE

- 3M10Y -3.566, 165.147 (L: 164.224 / H: 168.818)

- 2Y10Y -2.793, 77.545 (L: 77.545 / H: 80.36)

- 2Y30Y -3.226, 108.245 (L: 108.245 / H: 112.214)

- 5Y30Y -0.517, 52.112 (L: 51.383 / H: 54.886)

- Current futures levels:

- Mar 2Y down 1.625/32 at 108-15.25 (L: 108-14 / H: 108-17.25)

- Mar 5Y down 0.75/32 at 119-5.75 (L: 118-29.25 / H: 119-09.25)

- Mar 10Y up 1.5/32 at 127-23 (L: 127-08 / H: 127-26.5)

- Mar 30Y down 1/32 at 154-17 (L: 153-18 / H: 154-18)

- Mar Ultra 30Y steady at 187-23 (L: 185-31 / H: 187-23)

US 10YR FUTURE TECHS: (H2) Downtrend Intact

- RES 4: 129-23+ 50-day EMA

- RES 3: 128.31 20-day EMA

- RES 2: 128-27 High Jan 13 and key short-term resistance

- RES 1: 128-01+ High Jan 18

- PRICE: 127-22+ @ 19:53 GMT Jan 20

- SUP 1: 127-02 Low Jan 19

- SUP 2: 127-00+ Low Jul 31, 2019 (cont)

- SUP 3: 126-23 Low Jul 17, 2019 (cont)

- SUP 4: 126-10+ 61.8% retracement of the 2018 - 2020 bull cycle

The downtrend in Treasuries remains intact and further weakness is seen likely near-term. The contract has cleared support at 127-30, Jan 10 low. This has confirmed a resumption of the underlying downtrend and an extension of the bearish price sequence of lower lows and lower highs. Moving average studies are in a bear mode too. The focus is on 127-00. Firm short-term resistance has been defined at 128-27, Jan 13 high.

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.010 at 99.550

- Jun 22 -0.010 at 99.205

- Sep 22 -0.030 at 98.925

- Dec 22 -0.035 at 98.650

- Red Pack (Mar 23-Dec 23) -0.035 to -0.02

- Green Pack (Mar 24-Dec 24) -0.01 to steady

- Blue Pack (Mar 25-Dec 25) +0.010 to +0.020

- Gold Pack (Mar 26-Dec 26) +0.015 to +0.020

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N +0.00029 at 0.07843% (+0.00443/wk)

- 1 Month +0.00015 to 0.10929% (+0.00600/wk)

- 3 Month +0.00372 to 0.25886% (+0.01757/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00085 to 0.44629% (+0.05129/wk)

- 1 Year -0.00514 to 0.79843% (+0.07272/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07% volume: $262B

- Secured Overnight Financing Rate (SOFR): 0.05%, $917B

- Broad General Collateral Rate (BGCR): 0.05%, $351B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $339B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.601B accepted vs. $4.062B submission

- Next scheduled purchases:

- Fri 01/21 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B vs. $9.325B prior

- Tue 01/25 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B vs. $1.525B prior

- Pause for FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

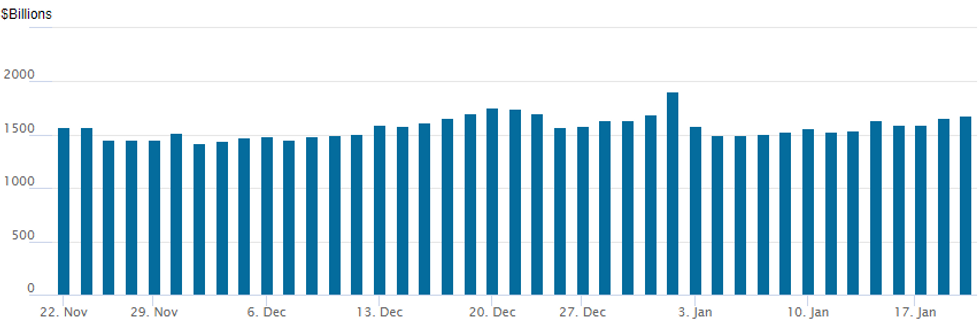

FED Reverse Repo Operation

NY Federal Reserve/MNI

Second consecutive new high: NY Fed reverse repo usage climbs to $1,678.931B w/82 counterparties today vs. $1,656.576B prior session -- still well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $1.5B Bank of New Zealand, $2.1B US Bancorp Launched; Updated Guidance BoA

Credit spds continue to narrow amid robust issuance since beginning of Jan ($186.56B) with more to follow as companies exit latest earnings blackout. Race to secure funding ahead widely expected tighter monetary policy may run out of steam ahead March when the Fed is widely expected to hike rates.

- Date $MM Issuer (Priced *, Launch #)

- 01/20 $1.5B #Bank of New Zealand (BNZ) $750M 5Y +68, $400M 5Y SOFR+81, $350M 10Y +105

- 01/20 $2.1B #US Bancorp $1.25B 6NC5 +60, $850M 11NC10 +85 (dropped 6NC5 SOFR)

- 01/20 $Benchmark Bank of America PerpNC5 4.5%a

EGBs-GILTS CASH CLOSE: Lagarde Keeps Hawks At Bay

Dovish, if not particularly surprising, comments on inflation by ECB President Lagarde early Thursday resulted in a constructive session across the European FI space.

- Periphery yields compressed as well on the ECB pushback on tightening (de Cos also appeared, reiterating no hikes expected in 2022); Italy outperformed.

- Data wasn't much of a market mover (incl weak French confidence data), but record-high German PPI was of some note.

- Last major data point of the week is UK retail sales first thing Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.7bps at -0.577%, 5-Yr is up 4.5bps at -0.296%, 10-Yr is down 1.2bps at -0.024%, and 30-Yr is down 2.1bps at 0.272%.

- UK: The 2-Yr yield is down 0.9bps at 0.899%, 5-Yr is down 1.4bps at 1.043%, 10-Yr is down 3.1bps at 1.225%, and 30-Yr is down 2.5bps at 1.347%.

- Italian BTP spread down 2.5bps at 132.6bps / Greek down 1.2bps at 173.1bps

FOREX: Greenback Regains Poise As Equities Fade From Highs

- The US dollar had initially been trading on the weaker side approaching the London WMR fix, as equities extended gains from their Wednesday trough. However, ongoing tensions surrounding the Russia/Ukraine situation along with firm rhetoric from the US has weighed on equity indices in the latter half of the US session.

- In turn the US dollar has strengthened and the USD Index has risen to fresh session highs, up 0.2% for Thursday, looking set to erode yesterday’s retreat.

- While the likes of AUD and CAD have pared some gains, they still remain the strongest across G10 currencies, rising just shy of 0.5%. USDCAD continues to hover near recent trend lows as we approach a very live BoC meeting next week. A move through 1.2448 support, 76.4% of the Oct - Dec rally, would open 1.2387, the Nov 10 low.

- EURUSD had been consolidating for the majority of the session around 1.1350, however, eventually succumbed to the greenback strength, making new lows for the week as of writing below 1.1315.

- This week’s price action threatens the recent bullish theme and suggests that at this stage, last week’s range and bear channel breakout appears to have been a false one and has failed to deliver a bullish reversal. Next level in focus remains 1.1272, Jan 4 low.

- Worth noting EURGBP made another session low and is eyeing a test of immediate support at 0.8300. Below this level opens up the potential for a test of significant support - 2019/2020 double bottom 0.828222/0.82769. A close below 0.83 would be the lowest daily close since 2016, with many also referencing the significance of a close above 1.20 in GBP/EUR.

- Geopolitical focus undoubtedly on Blinken/Lavrov in Geneva tomorrow with the potential press conference starting around 1300 CET.

- BoJ minutes are scheduled overnight before UK retail sales kick off the European session on Friday. ECB’s LaGarde participating in further panel discussions at the WEF, before Canadian retail sales close out the data for the week.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/01/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/01/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 21/01/2022 | 1230/1330 |  | EU | ECB Lagarde on Global Economic Outlook at WEF | |

| 21/01/2022 | 1300/1300 |  | UK | BOE Mann speaks at OMFIF | |

| 21/01/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/01/2022 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.