-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY177.8 Bln via OMO Wednesday

MNI ASIA OPEN: SPX Back Over 200 DMA

EXECUTIVE SUMMARY

- MNI INTERVIEW: Jan Payrolls Likely Fell-St Louis Fed Economist

- MNI: Working With Congress On Sanctions, SCOTUS Consultation Beginning

- MNI Atlanta Fed Bostic Boomerangs, Tempers Weekend Statement

- KC Fed George: STRONGER BAL-SHEET MOVE MAY ALLOW SHALLOWER RATE PATH, Bbg

- GEORGE:STEEP RATE PATH, MODEST BAL-SHEET MOVE MAY FLATTEN CURVE, Bbg

US

FED: A record surge in Covid-19 infections likely caused U.S. hiring to contract in January for the first time in over a year, according to the St. Louis Fed's employment model, economist Max Dvorkin told MNI, adding that he expects payrolls to make a strong recovery in February.

- The Fed bank's coincident employment index using high-frequency data from scheduling software company Homebase predicts a seasonally-adjusted decline of 260,000 jobs for January as measured by the BLS's household survey. But that likely overestimates the drop in hiring because Homebase doesn't count workers who are absent due to illness whereas the BLS survey does, Dvorkin said.

- "The employment loss is likely magnified, the reason being clocking in and out didn’t happen for a lot of people. But other pieces of evidence still suggest employment probably had a negative evolution last month," Dvorkin said.

- *BOSTIC: 50-BP HIKE IS NOT MY PREFERRED POLICY ACTION FOR MARCH, Bbg

- Saturday FT interview Bostic said 50Bp hike in March possible. “Every option is on the table for every meeting. If the data say that things have evolved in a way that a 50-basis-point move is required or be appropriate, then I’m going to lean into that . . . If moving in successive meetings makes sense, I’ll be comfortable with that,” he told the newspaper." Financial Times.

- Additional Bostic headlines:

- PENCILED IN 3% INFLATION FOR FULL YEAR 2022,

- ANTICIPATE LABOR, SUPPLY DISRUPTIONS WILL EASE

- NOT SET ON ANY PARTICULAR PROGRESSION FOR POLICY

- The White House working closely with Congress on the bipartisan Russian sanctions bill. 'Sanctions can be an effective tool of deterrent.'

- No direct response to the question of whether Biden will be willing to sign the bill into law. Last year President Biden vetoed a Nordstream 2 sanctions bill. A move praised by the Kremlin for supporting stability in Europe.

- Supreme Court: Biden will select a SCOTUS nomination with the Senate’s guidance. Consultations to start this week. The President will choose a black woman with 'impeccable credentials' and hope for bipartisan support for his nomination.

- Psaki stressed that the nomination will be qualified for the role. This is in reference to a poll that has circulated today saying that most Americans don’t support the President’s ambition to restrict the nomination to a black woman. This could become a bitter debate in the coming weeks.

- No official news on Build Back Better but there is a lot of 'discussion on the Hill' about how to move forward.

US TSYS: Eurodollar/Treasury Roundup, Bumpy Ride

Rates had a bumpy ride Monday, rallying off early lows into the NY close, support evaporating late.- Tsy yield curves rebounding from year+ lows (2s10s taps 61.463 recently vs. 57.076 low) around midday with better fast and real$ buying in 2s-5s after domestic real$ selling 2s and separately buying 5s around late morning.

- Short end lead rebound early in second half, 30Y Bonds back to steady after Atlanta Fed Bostic headlines from Yahoo Finance interview: BOSTIC: 50-BP HIKE IS NOT MY PREFERRED POLICY ACTION FOR MARCH, Bbg

- Saturday FT interview Bostic said 50Bp hike in March possible. “Every option is on the table for every meeting. If the data say that things have evolved in a way that a 50-basis-point move is required or be appropriate, then I’m going to lean into that," Financial Times.

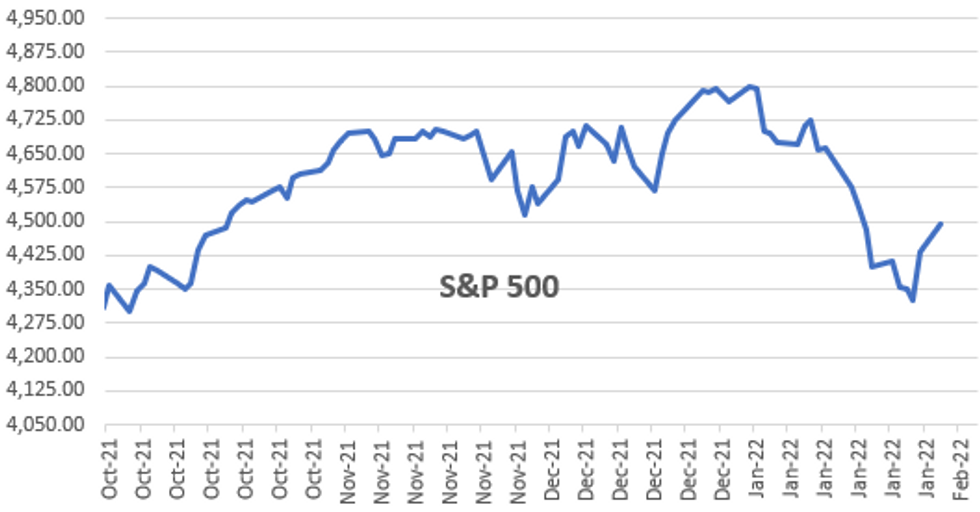

- US equity markets mostly gaining ground, SPX back to Jan 21 levels and north of 200DMA ESH2 topping 4489.0, DOW climbing 285.0 after trading weaker earlier. Contributing to modest risk-appetite, geopol-risk tied to Russia/Ukraine tension little cooler while US officials say diplomatic paths remain.

- Sector performance: Consumer discretionary (+2.05%) sees carry over support from Fri; Information technologies (+1.33%); Communication (+0.75%). flipside: Consumer staples (-0.45%) Financials (-0.40%) lead underperformers.

- Option volumes were fairly muted but continued to favor buying downside put insurance or skew plays: 15,000 short Sep 97.87/98.50 put over risk reversals, 7.5.

- After the bell, 2-Yr yield is up 0bps at 1.1627%, 5-Yr is unchanged at 1.6127%, 10-Yr is up 1.1bps at 1.7802%, and 30-Yr is up 2.7bps at 2.1002%.

OVERNIGHT DATA

- MNI CHICAGO BUSINESS BAROMETER 65.2 JAN V 64.3r DEC

- MNI CHICAGO: JAN PRICES PAID LOWER AT 89.0 VS 90.9r DEC

- MNI CHICAGO: JAN EMPLOYMENT AT 49.1 VERSUS 44.5r DEC

- MNI CHICAGO: PRODUCTION 60.6 JAN VS 62.9r DEC

- U.S. JAN. DALLAS FED MANUFACTURING INDEX AT 2.0

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 255.01 points (0.73%) at 34965.05

- S&P E-Mini Future up 62.75 points (1.42%) at 4484

- Nasdaq up 374.8 points (2.7%) at 14135.13

- US 10-Yr yield is up 0.7 bps at 1.7767%

- US Mar 10Y are up 1.5/32 at 128-0

- EURUSD up 0.0092 (0.83%) at 1.1243

- USDJPY down 0.26 (-0.23%) at 114.97

- WTI Crude Oil (front-month) up $1.21 (1.39%) at $88.11

- Gold is up $7.78 (0.43%) at $1799.56

- EuroStoxx 50 up 37.69 points (0.91%) at 4174.6

- FTSE 100 down 1.7 points (-0.02%) at 7464.37

- German DAX up 152.25 points (0.99%) at 15471.2

- French CAC 40 up 33.32 points (0.48%) at 6999.2

US TSY FUTURES CLOSE

- 3M10Y +2.807, 160.226 (L: 156.744 / H: 162.191)

- 2Y10Y +1.355, 61.669 (L: 57.076 / H: 61.931)

- 2Y30Y +2.695, 93.39 (L: 87.741 / H: 94.479)

- 5Y30Y +2.563, 48.532 (L: 44.509 / H: 49.777)

- Current futures levels:

- Mar 2Y steady at at 108-10.125 (L: 108-07.125 / H: 108-11)

- Mar 5Y up 0.5/32 at 119-5.75 (L: 119-00 / H: 119-08)

- Mar 10Y down 1/32 at 127-29.5 (L: 127-21.5 / H: 128-01)

- Mar 30Y down 9/32 at 155-15 (L: 154-31 / H: 155-30)

- Mar Ultra 30Y down 28/32 at 188-21 (L: 187-30 / H: 189-27)

US 10Y FUTURES TECS: (H2) Trend Direction Remains Down

- RES 4: 129-31 Low Dec 8

- RES 3: 129-09+ 50-day EMA

- RES 2: 129.14 High Jan 5

- RES 1: 128-14+/27 20-day EMA / High Jan 13

- PRICE: 127-29 @ 15:49 GMT Jan 31

- SUP 1: 127-06+/02 Low Jan 26 / Low Jan 19 and the bear trigger

- SUP 2: 127-00+ Low Jul 31, 2019 (cont)

- SUP 3: 126-23 Low Jul 17, 2019 (cont)

- SUP 4: 126-10+ 61.8% retracement of the 2018 - 2020 bull cycle

Treasuries are trading above the 127-02 low from Jan 19. A bearish theme remains intact - this follows the break on Jan 18 of support at 127-30, Jan 10 low. The move lower maintains the price sequence of lower lows and lower highs and note that moving average studies remain in a bear mode. 127-02, Jan 19 low, is the trigger for a resumption of the downtrend. Key short-term resistance is unchanged at 128-27, Jan 13 high.

US EURODOLLAR FUTURES CLOSE

- Mar 22 steady at 99.485

- Jun 22 -0.020 at 99.090

- Sep 22 -0.020 at 98.785

- Dec 22 -0.005 at 98.530

- Red Pack (Mar 23-Dec 23) +0.010 to +0.035

- Green Pack (Mar 24-Dec 24) +0.015 to +0.025

- Blue Pack (Mar 25-Dec 25) -0.005 to +0.010

- Gold Pack (Mar 26-Dec 26) -0.015 to -0.01

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00114 at 0.07700% (+0.00343 total last wk)

- 1 Month +0.00057 to 0.10686% (-0.00142 total last wk)

- 3 Month -0.00771 to 0.30886% (+0.05886 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00957 to 0.54400% (+0.09000 total last wk)

- 1 Year +0.01443 to 0.96229% (+0.14929 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $82B

- Daily Overnight Bank Funding Rate: 0.07% volume: $281B

- Secured Overnight Financing Rate (SOFR): 0.04%, $908B

- Broad General Collateral Rate (BGCR): 0.05%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $332B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.401B accepted vs. $24.870B submitted

- Next scheduled purchases:

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

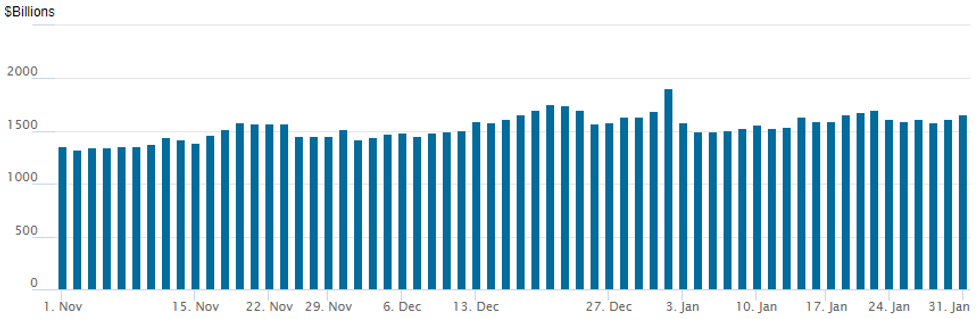

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches higher at $1,654.850B w/88 counterparties vs. $1,615.021B last Friday -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $1.5B National Rural Utilities 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 01/31 $1.5B #National Rural Utilities $400M 1.5YNCL SOFR+40, $600M 3YNCL +50, $500M 10Y +100

- Rolled to Tuesday:

- 01/31 $Benchmark CAF 5Y SOFR+85a

- 02/01 $Benchmark Kommuninvest +2Y SOFR+16a

Off opening high of 63.27, IG corporate credit risk measured by Markit's CDX IG5 index bumping around session lows, currently 60.723 (-.615) in-line with stocks recovering some ground after last week's rout. SPX emini currently +57.0 at 4480.25.

- Risk appetite increases on combination of cooling geopolitical tension around Russia/Ukraine, and Atlanta Fed Bostic sounding less hawkish at Yahoo Finance interview than Saturday's Financial Times interview that weighed heavily on short end rates in morning trade (see 1349ET bullet).

- High-yield index, CDXHY5, currently at 106.753 (+.043) vs. 106.35 lows on the open.

EGBs-GILTS CASH CLOSE: Bund Yields Close Above Zero

The week began with sharp rises in UK and German yields, with the short-end and belly bearing most of the brunt as markets eye rising rate hike risks.

- Several factors behind today's rise in yields, including: market-positive political developments in Italy and Portugal, higher than expected inflation readings in Spain / Germany, some continued central bank hike repricing post-Fed, and of course, the looming BoE/ECB meetings this Thursday.

- Multi-year high yields hit across multiple instruments, including Bund (first close above 0% since May 2019), Bobl (Nov 2018)

- Euribor and Short Sterling strips also suffered: 2022 rate hike pricing now roughly totals 25bps for the ECB and 125bps for the BoE.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.9bps at -0.528%, 5-Yr is up 8.5bps at -0.22%, 10-Yr is up 5.6bps at 0.011%, and 30-Yr is up 3.8bps at 0.277%.

- UK: The 2-Yr yield is up 7.7bps at 1.045%, 5-Yr is up 6.3bps at 1.133%, 10-Yr is up 5.8bps at 1.302%, and 30-Yr is up 7.8bps at 1.448%.

- Italian BTP spread down 4.5bps at 128.3bps / Portuguese down 1.1bps at 65.4bps

FOREX: Greenback Continues To Lose Ground As Equities Grind Higher

- The US dollar has been in steady decline throughout the US trading session on Monday, showing a strong inverse relationship to recovering major equity benchmarks.

- Improved risk sentiment lent particular support to the Euro, with EURUSD appreciating around 0.7% to ~1.1230. Today's flash estimates of January inflation in Germany, Spain and Portugal were all substantial upside surprises, causing analysts to pre-empt pressure for Wednesday's Eurozone HICP reading and at the same time stoking some renewed optimism for the single currency. First resistance is at 1.1243 High Jan 27 before the more meaningful level of 1.1299 20-day EMA.

- With the European central bank’s baseline assumption facing increased pressure the ECB could opt to retain some optionality, at Thursday’s meeting, by stressing that inflation forecasts carry a high degree of uncertainty and that there are upside risks to inflation (perhaps citing the risk of persistent energy price pressures).

- Maintaining its position as the best performing G10 currency overnight, AUDUSD remains 1.15% higher to start the week, bolstered by a sharp retracement back above the key technical level at 0.6993/91, the Dec 3 2021 and Nov 2 2020 lows. While remaining technically vulnerable, firm short-term resistance will be in focus at 0.7130, the Jan 7 low ahead of the RBA’s decision overnight.

- Elsewhere the dollar lost ground across the board (DXY -0.66%), with relatively smaller gains (0.25-0.55%) being seen for the likes of JPY, CHF, GBP, NZD and CAD.

- EMFX surged amid the more positive backdrop with emerging market currency indices recording close to 1% gains. Between 1-1.5% advances were seen in MXN, ZAR, BRL and CLP.

- Canadian GDP and US ISM Manufacturing PMI data headline tomorrow’s data calendar.

Data Calendar for Tuesday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 01/02/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 01/02/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/02/2022 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 01/02/2022 | 0700/0700 | * |  | UK | Nationwide House Price Index |

| 01/02/2022 | 0730/0830 | ** |  | SE | Manufacturing PMI |

| 01/02/2022 | 0730/0830 | ** |  | SE | Services PMI |

| 01/02/2022 | 0730/0830 | ** |  | CH | retail sales |

| 01/02/2022 | 0730/0830 | *** |  | FR | HICP (p) |

| 01/02/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0855/0955 | ** |  | DE | unemployment |

| 01/02/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 01/02/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/02/2022 | 1000/1100 | ** |  | EU | unemployment |

| 01/02/2022 | - | *** |  | US | domestic made vehicle sales |

| 01/02/2022 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 01/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/02/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2022 | 1500/1000 | * |  | US | construction spending |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 01/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.