-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Claw Back From Fri's Post Jobs Rout

EXECUTIVE SUMMARY

- MNI INTERVIEW: Build Up To Beat Canada Housing Squeeze-CMHC

- BIDEN: IF RUSSIA INVADES, THERE WILL NO LONGER BE NORD STREAM2, Bbg

- SCHOLZ: CLEAR THAT WEST WELL PREPARED WITH RUSSIA SANCTIONS, Bbg

- U.S., JAPAN SET TO ANNOUNCE PACT TO END TRUMP-ERA STEEL TARIFFS, Bbg

- ECB LAGARDE: ECB WON'T HIKE RATES BEFORE NET BOND-BUYING ENDS, Bbg

US: Tsy/Eurodlr Derivatives Roundup, Focus On Thu's CPI Inflation Data

US FI markets clawed back some ground Monday after perhaps leaning a bit too far over it's skis after Fri's strong Jan jobs gain of +467k vs. +125k est (total up-revisions of +709k for Nov-Dec) as 30YY gained 8bp to 2.2312%; 10YY +10bp to 1.9302%. Markets overestimated Covid's drag on Jan employ gains and overreacted to the data by selling off too far as more aggressive rate hikes priced in.

- Generally subdued start to next week, dearth of scheduled Fed speakers until Fed Gov Bowman and Cleveland Fed Pres Mester at separate events Wed, main focus on Jan CPI on Thursday (0.4% median est vs. 0.5% prior; 7.2% YoY est).

- BLS will release seasonal adjustment factors are recalculated to reflect price movements from the just-completed calendar year late morning.

- Eurodollar/Treasury option trade included a steady drip of repositioning and/or outright unwinds of March and June expirys as option accts look to longer dates for more relative value.

- Other salient flow: Unlikely a hedge for hawkish Fed -- possibly a tactical play in event of a weak Tsy 3Y note auction (91282CDZ1), $50B sale Tues: +25,000 short Feb 98.00/98.12 put spds, 2.75 ref: 98.185.

- Early Blocks: Conditional bear curve steepeners: with paper buying March, April and June 1Y midcurve put spds vs. Golds expiry put spds.

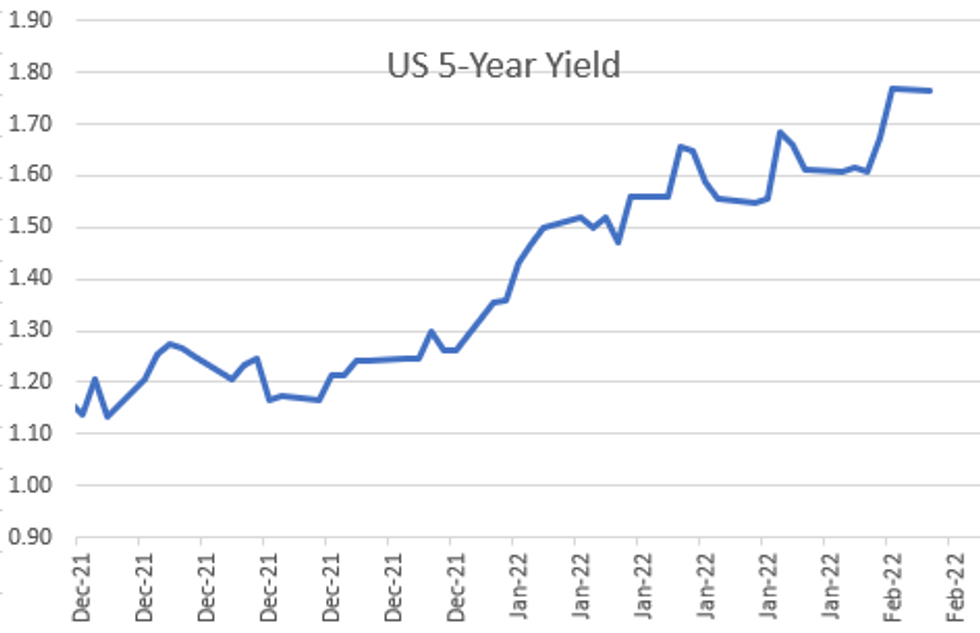

- After the close, 2-Yr yield is down 1.4bps at 1.2964%, 5-Yr is down 0.3bps at 1.765%, 10-Yr is up 0.9bps at 1.9177%, and 30-Yr is up 1.1bps at 2.2214%.

CANADA

CANADA: Canada's housing squeeze that has sent prices soaring may persist unless the supply shortage is addressed by shifting away from traditional single-family suburban housing in big cities that are increasingly squeezed for space, the federal housing agency's chief economist told MNI.

- “I absolutely agree with that statement” Bob Dugan of Canada Mortgage and Housing Corp.'s Bob Dugan said when asked about a shift away from major urban suburbs in favor of condos and apartments. “Especially the large cities where land costs are so high, we have to think very seriously about higher density and within that higher density, building the units that are suitable for families. Otherwise, it's very hard to tackle affordability.”

- This summer CMHC expects to publish a new study showing the extent of the supply shortfall and a detailed look on how deep the needs are in specific cities, Dugan said. Since a 2018 paper found supply growth was tightest in Vancouver and Toronto even with massive price gains, unpublished CMHC data shows the pandemic has is also creating pressure in smaller cities, Dugan said.

OVERNIGHT DATA

- US DEC CONSUMER CREDIT +$18.9B

- US DEC REVOLVING CREDIT +$2.1B

- US DEC NONREVOLVING CREDIT +$16.8BB

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 185.87 points (0.53%) at 35298.45

- S&P E-Mini Future up 12.5 points (0.28%) at 4508.25

- Nasdaq up 34.3 points (0.2%) at 14142.66

- US 10-Yr yield is up 0.9 bps at 1.9177%

- US Mar 10Y are up 4/32 at 126-28.5

- EURUSD down 0.001 (-0.09%) at 1.1441

- USDJPY down 0.19 (-0.16%) at 115.07

- WTI Crude Oil (front-month) down $0.93 (-1.01%) at $91.39

- Gold is up $13.71 (0.76%) at $1822.35

- EuroStoxx 50 up 33.98 points (0.83%) at 4120.56

- FTSE 100 up 57.07 points (0.76%) at 7573.47

- German DAX up 107.08 points (0.71%) at 15206.64

- French CAC 40 up 57.87 points (0.83%) at 7009.25

US TSYS FUTURES CLOSE

- 3M10Y +0.304, 167.565 (L: 164.56 / H: 170.682)

- 2Y10Y +2.918, 62.169 (L: 57.521 / H: 63.054)

- 2Y30Y +2.99, 92.4 (L: 86.876 / H: 93.938)

- 5Y30Y +1.646, 45.501 (L: 41.614 / H: 46.772)

- Current futures levels:

- Mar 2Y up 1.875/32 at 108-3 (L: 108-00.125 / H: 108-03.5)

- Mar 5Y up 4/32 at 118-15 (L: 118-08.75 / H: 118-16.25)

- Mar 10Y up 4/32 at 126-28.5 (L: 126-22.5 / H: 127-01)

- Mar 30Y up 7/32 at 153-15 (L: 153-02 / H: 153-30)

- Mar Ultra 30Y up 11/32 at 184-20 (L: 183-24 / H: 185-21)

US 10Y FUTURES TECHS: (H2) Resumes Downtrend

- RES 4: 129.14 High Jan 5

- RES 3: 129-00 50-day EMA

- RES 2: 128-04/22+ 20-day EMA / High Jan 24

- RES 1: 127-24 High Feb 4

- PRICE: 126-26+ @ 16:42 GMT Feb 7

- SUP 1: 126-22+ Intraday low

- SUP 2: 126-17/16 1.0% 10-dma Env / 1.236 of Jan 13-19-24 swing

- SUP 3: 126-10+ 61.8% retracement of the 2018 - 2020 bull cycle

- SUP 4: 126-01 1.50 proj of the Jan 13 - 19 - 24 price swing

Treasuries extended lower Friday. The sell-off resulted in a break of support at 127-02, the Jan 19 low and bear trigger. Furthermore, the move lower has confirmed a resumption of the downtrend and cleared the base of a recent triangle or pennant formation. With moving average studies also pointing south, attention is on weakness towards 126-16 next, a Fibonacci projection and 126-10+, a retracement level. Initial resistance is at 127-24.

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.025 at 99.420

- Jun 22 +0.020 at 98.975

- Sep 22 +0.030 at 98.675

- Dec 22 +0.030 at 98.385

- Red Pack (Mar 23-Dec 23) +0.010 to +0.025

- Green Pack (Mar 24-Dec 24) +0.020 to +0.025

- Blue Pack (Mar 25-Dec 25) +0.020 to +0.025

- Gold Pack (Mar 26-Dec 26) +0.015 to +0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00014 at 0.07714% (-0.00400 total last wk)

- 1 Month +0.00942 to 0.12471% (+0.00900 total last wk)

- 3 Month +0.02343 to 0.36243% (+0.02243 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.06714 to 0.62257% (+0.02100 total last wk)

- 1 Year +0.09271 to 1.09171% (+0.05114 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $277B

- Secured Overnight Financing Rate (SOFR): 0.05%, $891B

- Broad General Collateral Rate (BGCR): 0.05%, $344B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $334B

- (rate, volume levels reflect prior session)

- Buy-operations resume Tuesday:

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

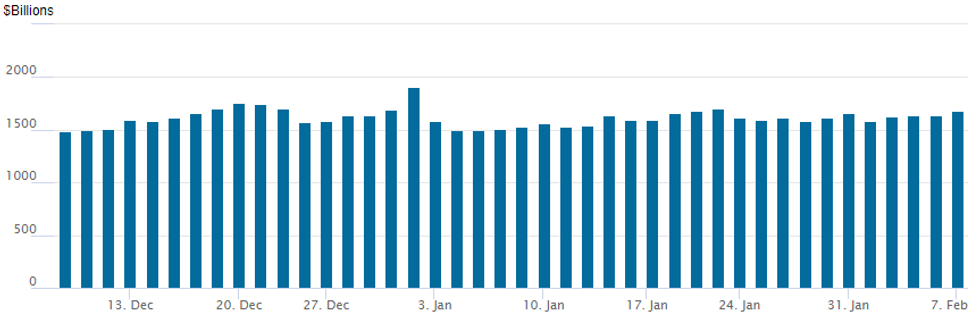

FED Reverse Repo Operation: Second Highest for 2022

NY Federal Reserve/MNI

NY Fed reverse repo climbs to second highest usage of $1,679.932B w/ 81 counterparties vs. $1,642.892B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: Domestic Issuers Still Sidelined

Still no high-grade issuance on tap for Monday, slow to migrate off sidelines after Fri's unexpected jobs gain (+467k, Nov-Dec up-rev'ns). Latest earnings cycle ongoing but winding down this week, Thu CPI likely keeping domestic names from issuing until they have better picture of inflation metric. On tap for Tuesday:

- Date $MM Issuer (Priced *, Launch #)

- 02/08 $Benchmark Inter-American Development Bank (IADB) 7Y SOFR+30a

- 02/08 $500M Development Bank of Japan 3Y +30a

EGBs-GILTS CASH CLOSE: Lagarde Pulls Yields Back

ECB President Lagarde's appearance before the European Parliament ECON committee took centre stage Monday, with little data/speaker flow of interest otherwise.

- She didn't say much new ("no need to rush to premature conclusions"), but lack of hawkish surprises helped short-end German yields ease in particular.

- Short-end and periphery EGBs (especially Greece, +20bp vs Bunds on the day) sold off on the open after weekend comments from ECB's Knot over the weekend that we could see 25bp rate hikes in Q4-22 and Q1-23.

- Of note, MNI's interview w Kazaks out this afternoon included discussion on ending ECB's "triple-lock" forward guidance.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.9bps at -0.287%, 5-Yr is up 0.5bps at 0.053%, 10-Yr is up 2.2bps at 0.227%, and 30-Yr is up 3.8bps at 0.393%.

- UK: The 2-Yr yield is up 1.3bps at 1.275%, 5-Yr is unchanged at 1.31%, 10-Yr is down 0.3bps at 1.408%, and 30-Yr is up 2.2bps at 1.503%.

- Italian BTP spread up 1.9bps at 156bps / Greek up 22bps at 228.6bps

FOREX: EUR Crosses Erode Recent Gains As ECB Temper Expectations

- The Euro underperformed on Monday and in particular EURAUD (-0.93%) and EURCAD (-0.88%) unwound recent strength as the ECB tempered expectations of premature tightening.

- President Lagarde used her platform at the European Parliament Economic and Monetary Affairs Committee to emphasize the safeguards in place “against a premature increase in interest rates”. Furthermore, she reiterated that any adjustments would be gradual, weighing on Euro-area front-end bond yields.

- The comments bolstered the downward trajectory for euro crosses, that had been in play throughout much of Monday, eating into the majority of Friday’s advance.

- EURUSD a touch softer on the day, however, the pair maintains a bullish theme following last week’s gains that resulted in the break of a number of key short-term resistance points. Initial support is seen at 1.1346.

- Overall subdued price action for currencies, evident by a close to unchanged US dollar index to start the week. A quiet data calendar is highlighted by US inflation data on Thursday that will likely be the driving force behind short-term greenback sentiment.

- Overnight, potential comments from RBNZ Governor Orr who is due to speak about the future of money at the Annual New Zealand Angel Summit, in Wellington.

Data Calendar for Tuesday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/02/2022 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 08/02/2022 | 0700/0800 | ** |  | SE | Private Sector Production |

| 08/02/2022 | 0745/0845 | * |  | FR | current account |

| 08/02/2022 | 0745/0845 | * |  | FR | foreign trade |

| 08/02/2022 | 0800/0900 | ** |  | ES | industrial production |

| 08/02/2022 | 0900/1000 | * |  | IT | retail sales |

| 08/02/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/02/2022 | 1330/0830 | ** |  | US | trade balance |

| 08/02/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 08/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/02/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 08/02/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.