-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Yld Curves Steeper Post-Jan FOMC Minutes

EXECUTIVE SUMMARY

- MNI: Fed And BOE To Lead Tightening, ECB Has More Time- IMF

- MNI: US Labor Market To Tighten Despite Fed Rate Hikes

- MNI BRIEF: Fed's Harker Supports 25BP Hike in March

- MNI FED: Kashkari Says Fed Shouldn't "Overdo It" On Tightening

- MNI US-RUSSIA: Menendez: Biden Does Not Need Congressional Approval For Sanctions

- BLINKEN: NO EVIDENCE OF RUSSIA PULLBACK

- ZELENSKIY: UKRAINE DOESN'T SEE RUSSIAN TROOPS PULLBACK

US

FED: Philadelphia Federal Reserve President Patrick Harker said Wednesday he would support a quarter point rate hike at the March meeting.

- "I am very supportive of starting the process of raising the fed funds rate which is our primary tool of monetary policy, start to raise that, and I would be supportive of as early as March a 25 basis point in that rate," he said. "We need to walk a fine line at the Fed," Harker said in an interview with WHYY, a Philadelphia public radio station.

- Harker added that he sees 3.5% inflation this year, adding that it will take time for price increases to come down.

- "There is significant differentiation across economies," she wrote. "It means withdrawal of monetary accommodation in countries such as the U.S. and the United Kingdom, where labor markets are tight and inflation expectations are rising." For more see MNI Policy main wire at 1019ET.

US: The U.S. unemployment rate will likely fall toward 3.5% this year and wage pressures remain high despite the Federal Reserve's plan to lift interest rates, as officials seek to preserve labor market gains even as they move to contain inflation expectations, former Fed and Labor Department officials told MNI.

- After 40 to 50 years of decline in labor’s share of national income, the Fed welcomes growth at the bottom of the wage distribution, the former officials said, particularly as higher pay would mitigate the effect of inflation on those most exposed.

- “I do think it means that the Fed has to carefully manage inflation expectations. That's part of what they're trying to do by moving more quickly to raise rates," said Stephanie Aaronson, former assistant director of the research division at the Fed Board of Governors, now at the Brookings Institution. "It certainly is possible for the FOMC to raise rates to a more neutral level that would slow the recovery in employment but would not put a stop to it.” (See MNI: Fed To Frontload Hikes But Keep Eye On Jobs--Ex-Officials). For more see MNI Policy main wire at 0947ET.

- 'I think that if Congress acted in a bipartisan way, and augmented the President's hand and sent a global message that not only the executive branch, but the legislative branch is in concurrence, it would be a good thing.'

- Menendez and his Republican counterpart on the committee James Risch (R-ID) have come under criticism for failing to reach an agreement on a sanctions package despite weeks of negotiating.

- Both Biden and Sec of State Blinken have made it clear that Nordstream 2 will be blocked if Russian invades Ukraine.

US TSYS: FOMC Minutes: Little Insight On Balance Sheet Drawdown

Tsy futures making modest gains after the bell, back near top end of the range again after making appr 2-3 round trips on the session. Couple bouts of real vol on the day, first in the minutes after the morning's retail sales release, then again late in the session around the Jan FOMC minutes release.- FI markets reverse gains post-data, knee-jerk reaction to initial headline Retail Sales gain of +3.8% vs. +2.0% est, control group +4.8% vs. +1.3% est.

- Strong data tempered by down revisions and mixed performance on the internals, with a few categories contracting M/M (incl health, personal care, gasoline, sporting goods, misc stores, food services).

- Tsy futures held modest gains following brief two-way after $19B 20Y note auction (912810TF5) came in on target: 2.396% high yield vs. 2.396% WI; 2.44x bid-to-cover vs. last month's 2.48x.

- Long end Tsys futures had already sold off in the minutes lead-up to the Jan minutes release, are off early session lows -- stocks gapped higher, SPX emini near highs late: +12.5 at 4477.0.

- Fed minutes: “Most participants suggested that a faster pace of increases in the target range for the federal-funds rate than in the post-2015 period would likely be warranted.”

- On-tap Thursday: weekly claims, housing data, 30Y TIPS auction while StL Fed Bullard makes another appearance at 1100ET.

- Currently, the 2-Yr yield is down 5bps at 1.527%, 5-Yr is down 2bps at 1.9202%, 10-Yr is up 0.4bps at 2.0469%, and 30-Yr is up 0.6bps at 2.3632%.

OVERNIGHT DATA

- US JAN RETAIL SALES +3.8%; EX-MOTOR VEH +3.3%

- US DEC RETAIL SALES REVISED -2.5%; EX-MV -2.8%

- US JAN RET SALES EX GAS & MTR VEH & PARTS DEALERS +3.8% V DEC -3.2%

- US JAN RET SALES EX MTR VEH & PARTS DEALERS +3.3% V US JAN -2.8%

- US JAN RET SALES EX AUTO, BLDG MATL & GAS +3.8% V DEC -3.4%

- US JAN IMPORT PRICES +2.0%

- US JAN EXPORT PRICES +2.9%; NON-AG +2.9%; AGRICULTURE +3.0%

- US JAN INDUSTRIAL PROD +1.4%; CAP UTIL 77.6%

- US DEC IP REV TO -0.1%; CAP UTIL REV 76.6%

- US JAN MFG OUTPUT +0.2%

- CANADA JAN CPI SETS FRESH HIGH VS 1991 RECORD

- CANADA DEC WHOLESALE SALES +0.6%; EX-AUTOS +0.1%

- CANADA DEC WHOLESALE INVENTORIES +2.9%: STATISTICS CANADA

- CANADIAN DEC MANUFACTURING SALES +0.7% MOM

- CANADA DEC FACTORY INVENTORIES +1.7%; INVENTORY-SALES RATIO 1.61

- CANADIAN JAN CONSUMER PRICE INDEX INFLATION +5.1% YOY

- CANADA MOM CPI INFLATION WAS +0.9% IN JAN

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 37.74 points (-0.11%) at 34967.47

- S&P E-Mini Future up 8.25 points (0.18%) at 4474

- Nasdaq up 1 points (0%) at 14146.22

- US 10-Yr yield is up 0.2 bps at 2.0452%

- US Mar 10Y are up 2/32 at 125-25.5

- EURUSD up 0.0032 (0.28%) at 1.139

- USDJPY down 0.15 (-0.13%) at 115.46

- WTI Crude Oil (front-month) up $0.64 (0.7%) at $92.86

- Gold is up $16.74 (0.9%) at $1869.65

- EuroStoxx 50 down 6.49 points (-0.16%) at 4137.22

- FTSE 100 down 5.14 points (-0.07%) at 7603.78

- German DAX down 42.41 points (-0.28%) at 15370.3

- French CAC 40 down 14.99 points (-0.21%) at 6964.98

US TSY FUTURES CLOSE

- 3M10Y +2.974, 164.175 (L: 157.789 / H: 165.245)

- 2Y10Y +5.629, 51.819 (L: 44.83 / H: 52.974)

- 2Y30Y +5.689, 83.264 (L: 75.076 / H: 86.327)

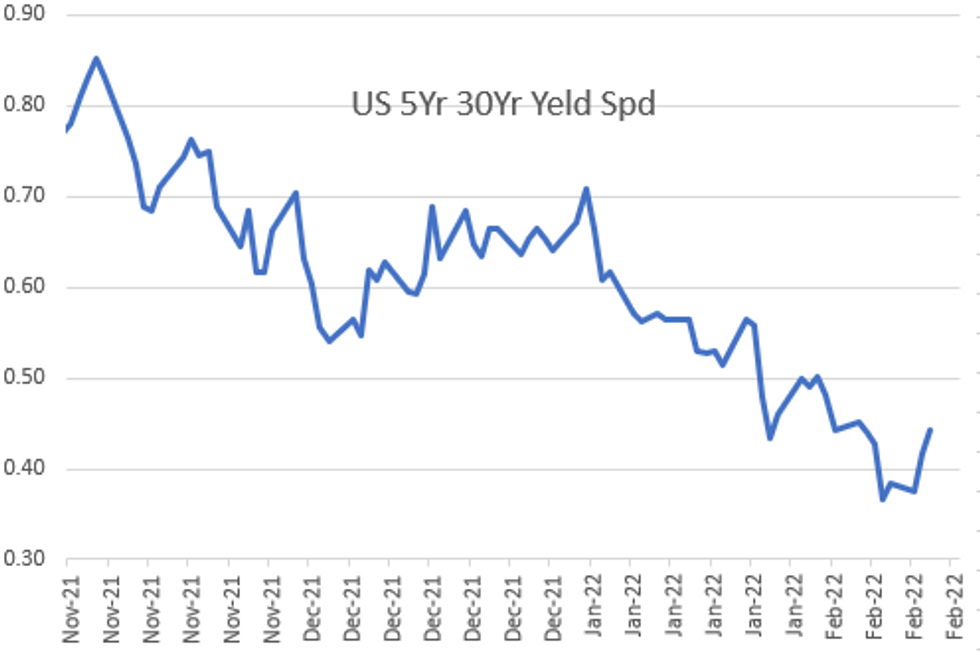

- 5Y30Y +2.869, 44.318 (L: 39.719 / H: 47.191)

- Current futures levels:

- Mar 2Y up 2.75/32 at 107-21 (L: 107-16.5 / H: 107-23)

- Mar 5Y up 3.75/32 at 117-19.5 (L: 117-13.25 / H: 117-24.75)

- Mar 10Y up 2.5/32 at 125-26 (L: 125-20.5 / H: 126-01)

- Mar 30Y steady at 150-24 (L: 150-12 / H: 151-16)

- Mar Ultra 30Y down 1/32 at 179-13 (L: 178-20 / H: 180-26)

US 10Y FUTURES TECH: (H2) Path Of Least Resistance Remains Down

- RES 4: 128-14 50-day EMA

- RES 3: 127-24 High Feb 4

- RES 2: 127-05+ 20-day EMA

- RES 1: 127-01 High Feb 7

- PRICE: 125-25 @ 15:35 GMT Feb 16

- SUP 1: 125-17+ Low Feb 10 and the bear trigger

- SUP 2: 125-06+ Low May 30 2019 (cont)

- SUP 3: 125-04+ 2.00 proj of the Jan 13 - 19 - 24 price swing

- SUP 4: 124-11 2.0% 10-dma envelope

Treasuries stalled at Monday’s high and are trading broadly flat at the Wednesday crossover. Price is approaching its recent low of 125-17+ where a break would confirm a resumption of the current downtrend. A bearish sequence of lower lows and lower highs, together with a bear mode set-up in moving averages suggests the path of least resistance remains down. Scope is seen for a move to 125-06+ next, 30 May 2019 low (cont). Firm resistance is seen at 127-01.

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.028 at 99.335

- Jun 22 +0.040 at 98.790

- Sep 22 +0.050 at 98.40

- Dec 22 +0.045 at 98.090

- Red Pack (Mar 23-Dec 23) +0.035 to +0.050

- Green Pack (Mar 24-Dec 24) steady to +0.025

- Blue Pack (Mar 25-Dec 25) -0.005

- Gold Pack (Mar 26-Dec 26) -0.01 to -0.005

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00043 at 0.07371% (-0.00472/wk)

- 1 Month +0.01700 to 0.13671% (-0.05443/wk)

- 3 Month +0.01943 to 0.48814% (-0.01829/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00557 to 0.78714% (-0.05329/wk)

- 1 Year -0.01285 to 1.32986% (-0.06243/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $65B

- Daily Overnight Bank Funding Rate: 0.07% volume: $249B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $972B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $332B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Next scheduled purchases:

- Thu 02/17 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/22 1010-1030ET: TIPS 1Y-7.5Y, appr $1.025B vs. $2.025B prior

- Thu 02/24 1010-1030ET: Tsy 0Y-22.5Y, appr $6.225B steady

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

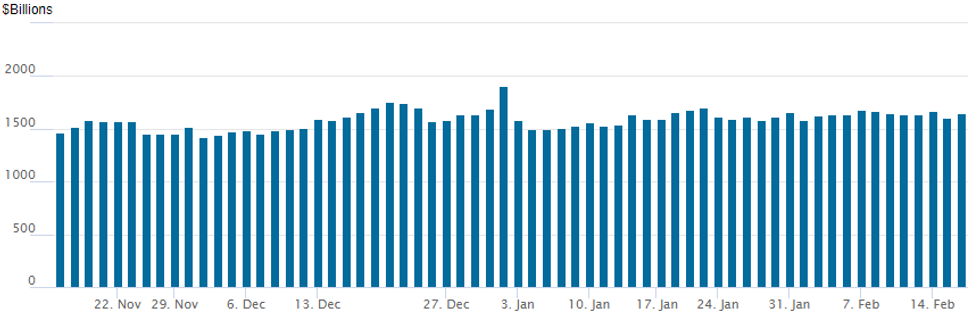

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces to $1,644.134B w/ 87 counterparties vs. $1,608.494B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: High-Grade Debt Issuance Recap, $1.85B Mizuho Launched Late

Still waiting for JP Morgan and Pacific Gas & Electric to launch.

- Date $MM Issuer (Priced *, Launch #)

- 02/16 $3B *Rep of Turkey 5Y Sukuk 7.25%

- 02/16 $3B #Citigroup $2.5B 6NC5 +115, $500M 6NC5 FRN/SOFR

- 02/16 $2.5B *Morgan Stanley 4NC3 fix/FRN +100

- 02/16 $1.85B #Mizuho $600M 4.25NC3.25 +90, $750M 4.25NC3.25 FRN/SOFR+96, $500M 8.25NC7.25 +125

- 02/16 $1.5B *KDB $1B 3Y +35, $500M 5Y +43 (dropped 10Y)

- 02/16 $1B *Verizon WNG 30Y Green +165a

- 02/16 $Benchmark JP Morgan 4NC3 +100a, 4NC3 FRN/SOFR, 6NC5 +125a, 6NC5 SOFR

- 02/16 $Benchmark Pacific Gas & Electric 2NC1 +175a, 2NC1 FRN/SOFR, 7Y +220a, 10Y +240a, 30Y +290a

- 02/16 $900M #DTE Electric $500M 10Y +100, $400M 30Y Green +130

EGBs-GILTS CASH CLOSE: UK Short End Yields Fall Hard Despite High CPI

Global FI rallied in the European afternoon Wednesday, despite strong US retail sales and industrial production data.

- There was a little more attention on geopolitics once again (renewed concerns that Russia-Ukraine was not de-escalating) and the sense that plenty of central bank hawkishness is already priced in.

- On that note, UK short end yields collapsed over the session alongside a rate strip rally. This was despite a higher-than-expected UK CPI reading and suggests that BoE hikes were richly priced.

- GGBs didn't move on a BBG story that the ECB was working on a plan to extend their refinancing collateral status through 2024 - appeared priced in already.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.7bps at -0.364%, 5-Yr is down 1.3bps at 0.042%, 10-Yr is down 3.2bps at 0.276%, and 30-Yr is down 1.6bps at 0.535%.

- UK: The 2-Yr yield is down 13bps at 1.407%, 5-Yr is down 10.8bps at 1.418%, 10-Yr is down 5.8bps at 1.524%, and 30-Yr is down 2.1bps at 1.588%.

- Italian BTP spread down 1.5bps at 163.4bps / Spanish down 0.2bps at 99.6bps

FOREX: US Dollar Remains Under Pressure, Extends Tuesday’s Decline

- The US dollar weakened for the second day in a row with the release of the FOMC minutes adding a late headwind for the greenback. While the information remains dated given the most recent US data, markets interpreted the minutes as dovish at the margin.

- With front-end treasury yields shifting lower and stocks recovering off the lows in the aftermath, the US dollar remained under pressure.

- A firmer commodity complex filtered through to AUD and NZD strength, once again the best performers in the G10 space, rising over 0.7%. With that said, greenback weakness was broad based with GBP, CHF, CAD and JPY all firmer on Wednesday.

- EURUSD (+0.30%) gains mirrored the dollar index, narrowing the gap with next resistance at the Feb11 high of 1.1401. However, the pair remains well within the most notable technical range of 1.1280-1.1495.

- The environment continues to be met with supportive price action for EMFX with the JPM Emerging Market Currency index rising 0.35%. Notable strength in ZAR (+0.85%) and MXN (+0.66%) with the latter currently testing the year’s lows/support around 20.25-28.

- Aussie employment data headlines the APAC data calendar for Thursday, before a light European docket. US Philly Fed Manufacturing index and initial jobless claims will be released at 0830 ET. Fed’s Bullard and Mester both due to speak on Thursday.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/02/2022 | 0030/1130 | *** |  | AU | Labor force survey |

| 17/02/2022 | 0700/0800 |  | EU | ECB Schnabel discussion with SPD | |

| 17/02/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 17/02/2022 | - |  | EU | ECB Lagarde at G20 CB Governors Meeting | |

| 17/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 17/02/2022 | 1330/0830 | *** |  | US | housing starts |

| 17/02/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/02/2022 | 1400/1500 |  | EU | ECB Lane on MNI Webcast on ECB Policy | |

| 17/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 17/02/2022 | 1600/1100 |  | US | St. Louis Fed's James Bullard | |

| 17/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 17/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 17/02/2022 | 2200/1700 |  | US | Cleveland Fed's Loretta Mester | |

| 18/02/2022 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.