-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Safe Havens Surge, Tsy 30Y TIPS Tails

EXECUTIVE SUMMARY

- MNI BRIEF: Bullard Wants Fed Asset Sales If Inflation Too High

- MNI INTERVIEW: BOC Has Historical Bias Toward Easy Policy

- BULLARD: MAY HAVE TO GO BEYOND NEUTRAL RATE TO CONTROL PRICES

- BULLARD: REPEATS HE FAVORS 100BPS OF RATE INCREASES BY JULY 1

- U.S.'S AUSTIN: SEE RUSSIA ADDING MORE TROOPS, EVEN IN LAST DAYS

- RUSSIA SAYS THERE IS NO UKRAINE INVASION, NONE PLANNED: IFX

- RUSSIA INSISTS ON U.S. PULLING BACK TROOPS FROM E.EUROPE: IFX

- RUSSIA SAYS DE-ESCALATION REQUIRES THAT UKRAINE COMPLY WITH MINSK AGREEMENTS AND NO MORE WEAPONS SHOULD BE DELIVERED TO UKRAINE - RIA. RUSSIA EXPECTS SPECIFIC PROPOSALS FROM U.S. AND NATO REGARDING NO FURTHER EASTWARD ENLARGEMENT - RIA.

US

FED: St. Louis Fed President James Bullard on Thursday said the Federal Reserve should consider selling longer term assets as a "Plan B" if inflation remains high after the initial phase of rate hikes and QT.

- "I'd put that out as a Plan B that we'd pull out later if inflation doesn't dissipate as much as expected," he told a Columbia University and SGH Macro Advisors webcast.

- "If we get further along and inflation remains high and does not look to be returning to target at the appropriate speed, then I think we should have a plan for asset sales. And those asset sales could be concentrated more at longer term securities that would presumably put upward pressure on longer term yields in tandem with the upward pressure that increases in the policy rate would put, so you'd maintain a yield curve that's relatively stable, same kind of spreads you'd have today."

- He also reiterated his view that the fed funds rate should rise by 100 bps by July with natural runoff of Fed assets starting in the second quarter.

CANADA

BOC: The Bank of Canada has tended to react more forcefully when inflation falls below target than when it overshoots, authors of an academic paper digging into central bank staff forecasts told MNI, with one adding that their results would be consistent with relatively modest tightening in response to the current surge in prices.

- Once inflation becomes low and stable, the BOC shifts its emphasis from inflation to the state of the economy, according to the paper examining policymaker actions from 1991, when Canada adopted inflation targeting, until the oil slump of 2015. Since 1995, when targeting was well established, the "BoC responds to the output gap and real interest rate, and also exhibits substantial inertia in the policy-making process," the research by Christos Shiamptanis and Ke Pang of Wilfrid Laurier University showed.

- “The empirical evidence is telling us that they seem to be responding mainly on inflation undershooting, so inflation being below the target, and we don't find evidence for them to be responding on inflation above the target, especially in the period towards the end of our sample,” Shiamptanis said in a joint interview with his co-author. For more see MNI Policy main wire at 1039ET

US TSYS: Russia/Ukraine Tension Heavy on Stocks, SPX Falls Over 2% Late

Ongoing Russia/Ukraine tension the main narrative driving risk-off tone Thursday (unconfirmed reports of renewed artillery firing in Eastern Ukraine making the rounds -- but note: Russia/Belarus were scheduled to perform live fire exercises today and Saturday).- Flood of headlines on day, gist: US/Allies disagree with reports of Russia troop withdrawals, wary of "false flag" operations.

- Gold surged +29.25 on safe haven buying, WTI crude weaker -1.87 at 91.79 on Iran nuclear deal hopes. US$ index DXY firmer +.122 to 95.823.

- For more prosaic reasons: Tsys extended early NY session highs after higher than forecasted weekly claims (+23k to 248k vs. 218k est).

- Long end Tsy futures pared gains briefly after poorly received $9B 30Y TIPS auction, tailing appr 6.5bp w/ 0.195% high-yield (-0.292% prior auction in Aug '21) vs. 0.130% WI; 2.17x bid-to-cover vs. last month's 2.34x.

- Indirect take-up receded to 69.9% vs. 74.9% last August; direct bidder take-up fell to 9.9% vs. 12.4%, primary dealer take-up climbed to 20.2% vs.12.7%.

- Implied vol held firm, sellers wary of taking on additional risk on headline prone markets. Steady drip of upside call and call spd trade, long put positions holding stead. Call volume climbing: over 400k calls traded between Mar-Jun expiries Wednesday, OI +149k.

- After the bell, 2-Yr yield is down 4.4bps at 1.4765%, 5-Yr is down 7.2bps at 1.8466%, 10-Yr is down 6.8bps at 1.9702%, and 30-Yr is down 3.5bps at 2.3109%.

OVERNIGHT DATA

- US JOBLESS CLAIMS +23K TO 248K IN FEB 12 WK

- US PREV JOBLESS CLAIMS REVISED TO 225K IN FEB 05 WK

- US CONTINUING CLAIMS -0.026M to 1.593M IN FEB 05 WK

- US FEB PHILADELPHIA FED MFG INDEX 16

- U.S. JAN. HOUSING STARTS FALL 4.1% TO 1.64 MLN RATE (-0.4% had been expected; +1.4% prior)

- U.S. JAN. BUILDING PERMITS AT 1.899 MLN RATE

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 549.65 points (-1.57%) at 34384.41

- S&P E-Mini Future down 83.25 points (-1.86%) at 4386.75

- Nasdaq down 345.6 points (-2.4%) at 13778.56

- US 10-Yr yield is down 6.8 bps at 1.9702%

- US Mar 10Y are up 19/32 at 126-13

- EURUSD down 0.001 (-0.09%) at 1.1364

- USDJPY down 0.64 (-0.55%) at 114.89

- WTI Crude Oil (front-month) down $2.03 (-2.17%) at $91.66

- Gold is up $30.35 (1.62%) at $1900.33

- EuroStoxx 50 down 24.03 points (-0.58%) at 4113.19

- FTSE 100 down 66.41 points (-0.87%) at 7537.37

- German DAX down 102.67 points (-0.67%) at 15267.63

- French CAC 40 down 18.16 points (-0.26%) at 6946.82

US TSY FUTURES CLOSE

- 3M10Y -2.816, 160.15 (L: 153.263 / H: 162.587)

- 2Y10Y -2.401, 48.923 (L: 46.473 / H: 53.527)

- 2Y30Y +0.774, 82.823 (L: 77.976 / H: 85.491)

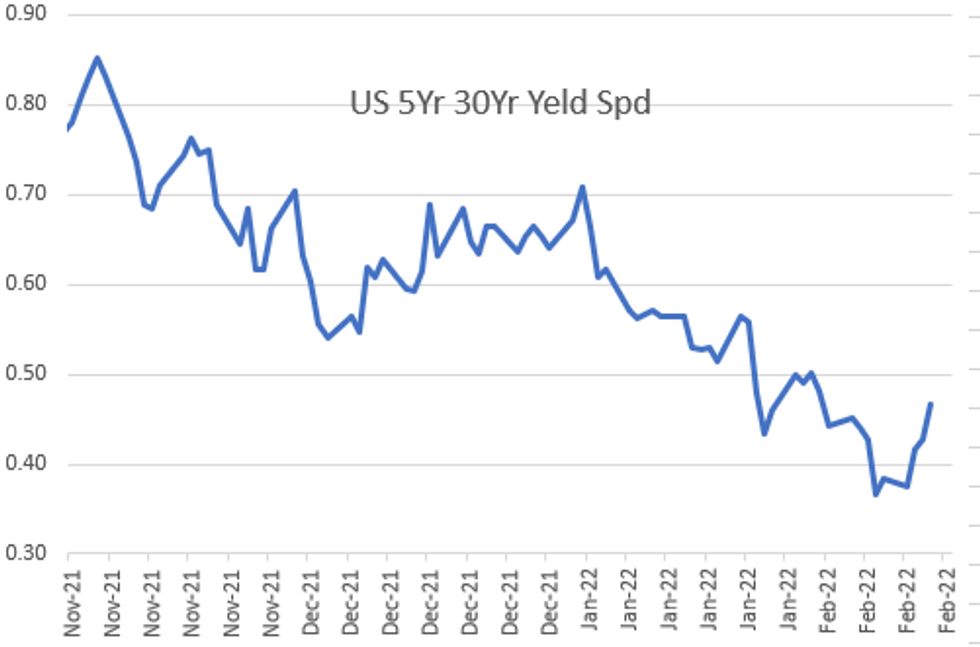

- 5Y30Y +3.572, 46.095 (L: 41.544 / H: 46.419)

- Current futures levels:

- Mar 2Y up 2.5/32 at 107-23.5 (L: 107-20.75 / H: 107-25)

- Mar 5Y up 10.75/32 at 117-30.25 (L: 117-18.5 / H: 118-00)

- Mar 10Y up 19/32 at 126-13 (L: 125-25 / H: 126-15.5)

- Mar 30Y up 1-03/32 at 151-30 (L: 150-29 / H: 152-17)

- Mar Ultra 30Y up 1-20/32 at 181-01 (L: 179-25 / H: 182-17)

US 10Y FUTURES TECH: (H2) Firmer Through London Close

- RES 4: 128-14 50-day EMA

- RES 3: 127-24 High Feb 4

- RES 2: 127-05+ 20-day EMA

- RES 1: 127-01 High Feb 7

- PRICE: 126-14+ @ 16:07 GMT Feb 17

- SUP 1: 125-17+ Low Feb 10 and the bear trigger

- SUP 2: 125-06+ Low May 30 2019 (cont)

- SUP 3: 125-04+ 2.00 proj of the Jan 13 - 19 - 24 price swing

- SUP 4: 124-11 2.0% 10-dma envelope

Treasuries saw early support overnight and through the London close, boosting prices back toward Monday’s highs, which remain the first upside target at 126-25+. Nonetheless, rallies remain shallow, keeping the focus pointed lower for now. Price trades in close proximity to recent lows of 125-17+ where a break would confirm a resumption of the current downtrend. Scope is seen for a move to 125-06+ next, 30 May 2019 low (cont).

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.015 at 99.348

- Jun 22 +0.030 at 98.815

- Sep 22 +0.040 at 98.440

- Dec 22 +0.045 at 98.135

- Red Pack (Mar 23-Dec 23) +0.055 to +0.075

- Green Pack (Mar 24-Dec 24) +0.075

- Blue Pack (Mar 25-Dec 25) +0.080 to +0.090

- Gold Pack (Mar 26-Dec 26) +0.090

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00258 at 0.07629% (-0.00214/wk)

- 1 Month +0.02500 to 0.16171% (-0.02943/wk)

- 3 Month -0.00714 to 0.48100% (-0.02543/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.01357 to 0.77357% (-0.06686/wk)

- 1 Year -0.04100 to 1.28886% (-0.10343/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $241B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $960B

- Broad General Collateral Rate (BGCR): 0.05%, $341B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $335B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Tsy 10Y-22.5Y, appr $1.601B accepted vs. $5.640B submission

- Next scheduled purchases:

- Tue 02/22 1010-1030ET: TIPS 1Y-7.5Y, appr $1.025B vs. $2.025B prior

- Thu 02/24 1010-1030ET: Tsy 0Y-22.5Y, appr $6.225B steady

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

FED Reverse Repo Operation

NY Federal Reserve/MNI

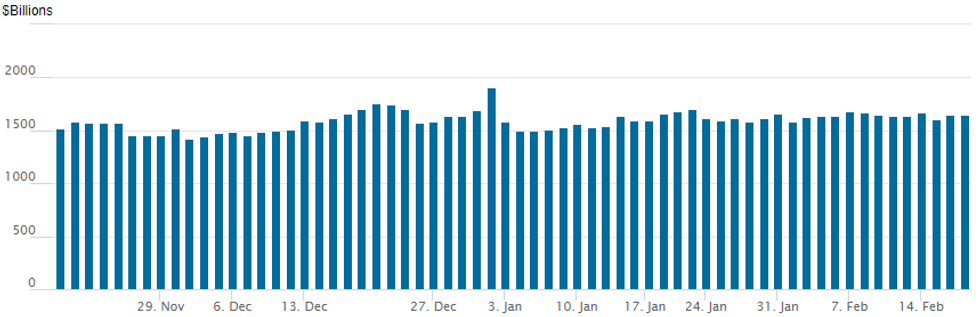

NY Fed reverse repo usage inches to $1,647.202B w/ 79 counterparties vs. $1,644.134B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: Amgen 4Pt Jumbo, Dominican Rep on Tap

Pace slows after dealers crowded market Wednesday, lion's share of $20.75B priced, $31.75B total for week.

- Date $MM Issuer (Priced *, Launch #)

- 02/17 $4B #Amgen $750M 7Y +110, $1B 10Y +140, $1B 30Y +190, $1.25B 40Y +210

- 02/17 $Benchmark Dominican Republic 7Y 5.5%a, 11Y 6%a

- $20.75B Priced Wednesday, $31.75B/wk

- 02/16 $4.6B *JP Morgan $1.45B 4NC3 +85, $750M 4NC3 FRN/SOFR+92, $1.65B 6NC5 +105, $750M 6NC5 SOFR+118

- 02/16 $3B *Rep of Turkey 5Y Sukuk 7.25%

- 02/16 $3B *Citigroup $2.5B 6NC5 +115, $500M 6NC5 FRN/SOFR

- 02/16 $2.5B *Morgan Stanley 4NC3 fix/FRN +100

- 02/16 $2.4B *Pacific Gas & Electric $1B 2NC1 +175, $400M 7Y +220, $450M 10Y +240, $550M 30Y +290

- 02/16 $1.85B *Mizuho $600M 4.25NC3.25 +90, $750M 4.25NC3.25 FRN/SOFR+96, $500M 8.25NC7.25 +125

- 02/16 $1.5B *KDB $1B 3Y +35, $500M 5Y +43 (dropped 10Y)

- 02/16 $1B *Verizon WNG 30Y Green +165a

- 02/16 $900M *DTE Electric $500M 10Y +100, $400M 30Y Green +130

EGBs-GILTS CASH CLOSE: Re-Escalation Drives Yields Lower

European FI rallied strongly Thursday as apparent Ukraine-Russia re-escalation dominated headlines and benefited safe haven assets.

- Bund and Gilt yield drops accelerated in the afternoon after Russia expelled a US diplomat and Pres Biden warned of an imminent Russian invasion of Ukraine.

- Curves bull steepened as near-term central bank hikes were priced out.

- ECB's Lane said in a wide-ranging MNI Webcast that the recent upward shift in inflation expectations will not make a major difference to monetary policy.

- Periphery EGBs managed to keep pace; 10Y BTP spreads fell as much as 5bp.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 6.5bps at -0.429%, 5-Yr is down 6.1bps at -0.019%, 10-Yr is down 4.7bps at 0.229%, and 30-Yr is down 3.3bps at 0.502%.

- UK: The 2-Yr yield is down 7.7bps at 1.33%, 5-Yr is down 6.8bps at 1.35%, 10-Yr is down 6.5bps at 1.459%, and 30-Yr is down 4.7bps at 1.541%.

- Italian BTP spread down 3.4bps at 160bps / Spanish down 1.2bps at 98.4bps

FOREX: Yen, Swiss In Favour On Renewed Equity Weakness

- Currency markets were very much out of the spotlight on Thursday with the majority of the day’s volatility centred around equity and bond markets.

- However, the renewed risk-off sentiment did bolster haven-tied FX with the Japanese Yen and Swiss Franc up 0.45% and 0.3% respectively against the greenback. USDJPY fell to the worst levels in two weeks back below 115.00.

- Overall, the dollar index is likely to snap a two-day losing streak, however, gains for the greenback remain marginal and the index remains around 0.3% softer on the week. Worth noting the dollar continuing its weakening trend against gold, which has risen another 1.6% today, narrowing the gap with the June 2021 highs.

- Despite the lower equity and oil prices, AUD and CAD hold in well, broadly unchanged for the session and perhaps the more notable outperformer is GBP, rising 0.3%.

- EURGBP continues to edge back toward the significant support area around and just below the 0.83 handle, a multi-year range base since 2016 and 0.8282/77, the Feb’20 and Dec’19 lows. The cross is also below both the 20- and 50-day EMAs and resides just above the short-term support at 0.8331, a Fibonacci retracement.

- Naturally in emerging markets, RUB was the worst performer, retreating 1.35%. Despite today’s reversal higher in USDRUB, the pair remains well below the 77.62 highs seen late last week.

- Later today, expect comments from Fed’s Mester - due to speak about the economic and monetary policy outlook at an online event hosted by New York University. Q&A expected.

- Tomorrow’s data calendar will be headlined by retail sales from the UK and Canada before US existing home sales. There are also more scheduled Fed speakers throughout the latter half of Friday’s US session.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/02/2022 | 0700/0800 | *** |  | SE | Inflation report |

| 18/02/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 18/02/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 18/02/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 18/02/2022 | 1000/1100 | ** |  | EU | construction production |

| 18/02/2022 | 1300/1400 |  | EU | ECB Elderson speech on industry climate risks | |

| 18/02/2022 | - |  | EU | ECB Lagarde at G20 CB Governors Meeting | |

| 18/02/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 18/02/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 18/02/2022 | 1500/1000 | * |  | US | Services Revenues |

| 18/02/2022 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

| 18/02/2022 | 1515/1015 |  | US | Chicago Fed's Charles Evans | |

| 18/02/2022 | 1515/1015 |  | US | Fed Governor Christopher Waller | |

| 18/02/2022 | 1600/1100 |  | US | New York Fed's John Williams | |

| 18/02/2022 | 1830/1930 |  | EU | ECB Panetta on CB digital currencies | |

| 18/02/2022 | 1830/1330 |  | US | Fed Governor Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.