-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - USD/JPY Retraces Off Seven-Year High

Highlights:

- USD/JPY posts a three big figure range in whipsaw session

- Equities surge, e-mini S&P tops key resistance

- Oil sheds over 8% as market issues caution over Shanghai lockdown plans

US TSYS SUMMARY: Treasuries Maintain Flattening On Lockdown Fears, Aggressive Hiking

- Cash Tsys are hanging on for a large twist flattening after an even larger outright bear flattening this morning, kick-started by further supply-side disruption fears following the two-stage lockdown in Shanghai.

- This has been compounded by a tale of two auctions, with the 2Y seeing a modest tail and weak internals, before the 5Y subsequently stopped through and with further signs of healthier demand.

- 2YY +5.8bps at 2.328%, 5YY +0.7bps 2.553%, 10YY -0.9bps at 2.464% and 30YY -2.4bps at 2.560%.

- Fed Funds pricing has generally been wound back through the day but there remains a substantial 210bps of hikes priced over the six remaining meetings this year, weighing on the growth outlook further ahead.

- Various curve metrics are off earlier lows but remain historically flat: 5s30s at just 1bp (having earlier been inverted for the first time since 2006 with a low of -7bps ), whilst 2s10s are 14bps, within 20bps of the 2019 low and having last seen sustained inversion in early 2007 at the end of a hiking cycle rather than the start.

- Continued sizeable supply tomorrow with the $47B 7Y auction at 1300ET, along with a return to Fedspeak with Harker (2023 voter) due to give his first post-FOMC thoughts.

Market Inflation Expectations Firm

- 10Y Tsy yields are down only 1.5bps on the day after sizeable swings, driven by lower real yields (-0.53%) rather than trimmed inflation breakevens.

- Instead, the 10Y breakeven has firmed 1bp to 2.99% and remains close to Thursday’s high of 3.03% despite another ~20bps of hikes being priced in for 2022 since then.

- Whilst there has been a similar increase in the 5Y5Y forward breakeven to 2.39% and a larger pop higher in the 5Y5Y inflation swap to 2.67%, both remain broadly at levels that FOMC members have described recently as being anchored, but will likely have particular sensitivity to if this latest increase continues.

US 10Y breakeven (white), 5Y5Y breakeven (yellow), 5Y5Y inflation swap (green) and Fed Funds Dec'22 FOMC implied rateSource: Bloomberg

US 10Y breakeven (white), 5Y5Y breakeven (yellow), 5Y5Y inflation swap (green) and Fed Funds Dec'22 FOMC implied rateSource: Bloomberg

US ISSUANCE UPDATE: 2y, 5y Note Auctions

Review 5Y Note Auction: Better Demand Relative to 2y Sale

- 5y sale stops through by 1bps (2.543% vs. WI of 2.553%) for a healthier auction result relative to the 2y. High yield at 2.543% marks the highest at auction since mid-2019

- Bid/cover at 2.53 is ahead of the 5 auction average (2.46) - last b/c of that size back in October last year. Appears that concession built in since last sale (yield up around 67bps) has proved attractive, a decent test for demand in the belly of the curve.

Review 2Y Note Auction: Modest Tail, Weak Overall Stats

- The $50B 2Y Note auction tails by 1bp, with high yield of 2.365% vs when-issued yield of 2.355%. That's the biggest tail for a 2Y sale since November 2021, with the peripheral stats corroborating a fairly weak story for this auction.

- Bid-to-cover ratio (2.46x) was the lowest since November 2021, while dealers took up 19.4% of the offering (up from 15.7% prior but down from the 24.3% 5-auction average coming into today).

- Yields ticked higher in line with the tail, with attention moving swiftly tothe 5Y sale in just over an hour (1300ET).

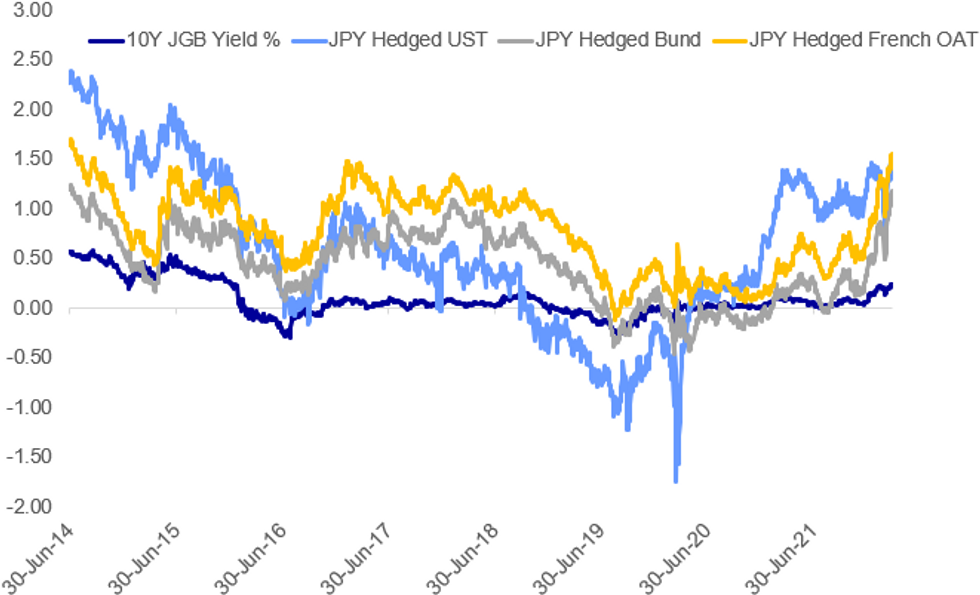

German And French JPY-Hedged Yields Increasingly Attractive

A quick look at 3-month JPY-hedged 10Y yields (ie from the perspective of Japanese investors) vs the 0.25% on offer for JGBs.

- Foreign instruments are becoming increasingly attractive from this perspective.

- The US nominal move vs JGBs is getting much of the attention but the hedged yield (1.43%) is not much higher than it was a year ago.

- However German (1.18%) and French (1.61%) 10Y hedged yields are the highest since 2014 and up 100+bp since a year ago.

Source: MNI, BBG

Source: MNI, BBG

EGB OPTIONS: Bobl Put Fly And Bor Call Condor Buying In Size

Monday's Europe rates / bond options flow included:

- RXK2 157/156ps, sold at 34 in 3.4k

- RXM2 162/164 call spread bought for 33.5/34 in 5k

- OEM2 128.50/127.50/126.50p fly bought for 14 and 14.5 in 40k

- OEK2 129.50/130.50cs, bought for 22 in 5.2k

- ERU2 99.625/99.875/100.00/100.25 1x1x1x0.5 call condor, bought for 6 in 15k

- ERU2 100.25/100.375/100.50/100.625 call condor bought for 3 in 10k

FOREX: Japanese Yen Extends Decline Despite Intra-Day Recovery

- USDJPY remains 1.25% higher from Friday’s close, continuing the depreciating trend for the Japanese currency that has witnessed a 9% sell-off from peak-to-trough against the dollar throughout March.

- This comes despite a near 200-pip retracement from the intra-day highs above 125.00 before the pair consolidated around 123.60 as of writing.

- From our most recent technical analysis piece: It is fair to say that USDJPY is extremely overbought at current levels with today's impulsive rally touching a high of 125.09. We also highlight that the most recent portion of the uptrend, since Mar 11, is very steep suggesting that a sudden correction would not be a surprise. Indeed, this would be seen as a healthy trend development.

- The June 2015 high of 125.86 is a key resistance and if cleared, would highlight a broader bullish price sequence of higher highs and higher lows on the monthly chart that would reinforce the medium-term bullish argument. Short-term supports are seen at today’s low, 121.97, and then last Thursday’s low of 120.95.

- Elsewhere, higher front-end US TSY yields lent support to the greenback with the dollar index registering a 0.4% advance for Monday.

- USD strength and a 6.5% decline in crude futures weighed on the likes of CAD and NOK, however NZD (-1.05%) sat second from bottom of the G10 leaderboard despite the late bounce in equities.

- Strength in EURJPY kept EURUSD in a relatively narrow range to start the week with 1.10 capping the topside of Monday’s range.

- Minor data points due overnight are Japanese unemployment and Aussie retail sales before a relatively light European and US docket, headlined by JOLTS as we approach US employment figures scheduled for later this week.

FX OPTIONS: Expiries for Mar29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E722mln), $1.0950-60(E1.2bln), $1.0975(E1bln), $1.1000(E2.5bln), $1.1086-00(E1.2bln)

- GBP/USD: $1.3400(Gbp1.3bln)

COMMODITIES: Oil Slides On China Lockdown Demand Fears

- Oil and gold price moves have for once been driven largely by factors other than Russia-Ukraine headlines, where there doesn’t appear to have been much progress in peace talks. Talks have however likely been slowed further by reports of poisoning symptoms for both Abramovich and Ukrainian negotiators.

- The launching of a two-stage lockdown in Shanghai has set the tone for the day with oil prices sliding despite OPEC+ signalling it is likely to stick to plans for only a modest supply increase on Thursday.

- Gold meanwhile suffers as the rising US dollar and yields following the BoJ maintaining extremely accommodative policy took the shine off gold’s safe haven appeal.

- WTI is -7.3% at $105.6 having earlier tested support at the 20-day EMA of $104.7 after which it could open a materially lower $96.05. Resistance remains at $116.64 (Mar 24 high).

- Brent is -7.0% at $112.2 and similarly got close to testing $110.37 (20-day EMA) whilst resistance remains at $123.74 (Mar 24 high).

- Gold is -1.3% at $1932.8 but after a solid run doesn’t trouble initial support at the 50-day EMA of $1901.9. Resistance remains $1966.1, the Mar 24 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/03/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 29/03/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/03/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 29/03/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 29/03/2022 | 0700/0900 |  | ES | Spain Retail Sales | |

| 29/03/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/03/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/03/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 29/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/03/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/03/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 29/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 29/03/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/03/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 29/03/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 29/03/2022 | 1445/1045 |  | US | Philadelphia Fed's Patrick Harker | |

| 29/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.