-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Yld Curve Inversion Unwinds

EXECUTIVE SUMMARY

- MNI INTERVIEW:US Can Handle 4% Wage Gains-Minneapolis Fed Econ

- MNI INTERVIEW: Room For More Labor Market Gains– Fed's Rodgers

- FRANCE EXPELS RUSSIAN DIPLOMATS, Bbg

US

FED: U.S. workers could ring up wage gains of 4% or more without rattling price stability while inflation may moderate as recent surges in oil and goods prices fade, the Minneapolis Fed's assistant director of the research division and adviser to President Neel Kashkari told MNI.

- That 4% pace would be consistent with inflation at the Fed’s 2% target and productivity growing at the same pace according to Terry Fitzgerald, who leads the economic analysis branch and coordinates briefings ahead of FOMC meetings. The share of national income going to workers has slipped over time and if that picked up sustainable wage gains could reach around 4.5%, he said.

- Recent big gains aren't leading to a wage-price spiral and it's helpful that some of the largest raises in the pandemic recovery are going to the lowest-earning workers, Fitzgerald said. Wage bargaining has been tamer than say the 1970s with a decline in unionization and few recent major contracts containing special cost of living adjustments, he said. For more see MNI Policy main wire at 1325ET.

FED: A jump in U.S. inflation over the past year coupled with a rockier stock market may be curbing Americans’ appetite for early retirement, suggesting further room for gains in the labor force, St. Louis Fed economist William Rodgers III told MNI.

- “The big factor that we’re beginning to think about is the role that inflation could be playing,” said Rodgers, who is vice president and director of the St. Louis Fed’s Institute for Economic Equity.

- “When inflation started to tick up at the end of the year, that’s when we also started to see a little bit of a downward trend in the retiree population. These people are on fixed incomes. Their income is not going to go as long or as far as it could have.” For more see MNI Policy main wire at 1148ET.

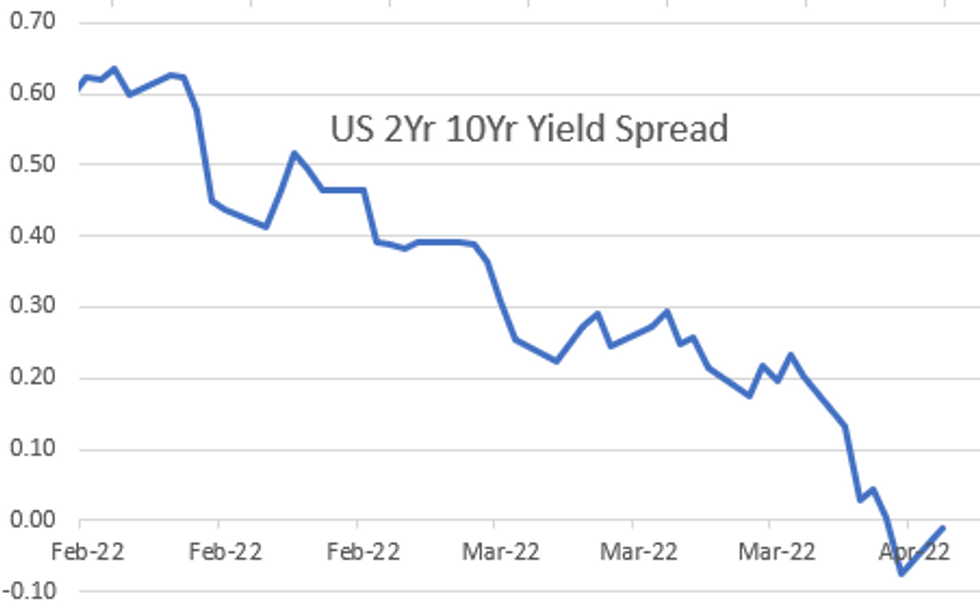

US TSYS: Week Opener: Risk-On

Rates trading weaker after the bell, near session lows -- long end underperforming after ECB Vasle headline that "negative rates may end by year end." Tsy 30YY hit 2.4882 high. Yield curves steeper but still inverted: 2s10s climbing +7.314 to -.717 while 5s30s climbed 3.499 to -14.188.

- Contributing Blocks: sales in 2s and 5s prior to ECB Vasle headline. Large 2s/ultra-Bond steepener late: +19,730 TUM2 105-22.62 vs. -2,484 WNM2 176-19.

- Stocks continued to extend session highs in late FI trade, SPX eminis back to late Thursday range amid ongoing focus on tech shares and micro bloggers.

- No react to data: Rates holding near lows after Feb factory orders -0.5, ex-trans +0.4, while equities holding decent gains (ESM2 +16.75 4556.0).

- On tap Tuesday:

- 0830 Trade Balance (-$89.7B, -$88.5B)

- 0945 S&P Global US Services PMI (58.9, 58.9); Comp PMI (58.5, 58.5)

- 1000 ISM Services Index (56.5, 58.5)

- 1005 Fed Gov Brainard virtual forum on inflation, text, Q&A

- 1230 SF Fed Daly on US economy, text, Q&A TBA

- 1400 NY Fed Williams virtual discussion on health & economy

- By the close, the 2-Yr yield is down 3bps at 2.4262%, 5-Yr is unchanged at 2.5587%, 10-Yr is up 3.1bps at 2.4135%, and 30-Yr is up 4.3bps at 2.4751%.

OVERNIGHT DATA

- US FEB FACTORY ORDERS -0.5%; EX-TRANSPORT NEW ORDERS +0.4%

- US FEB DURABLE ORDERS -2.1%

- US FEB NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT -0.2%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 72.46 points (0.21%) at 34889.99

- S&P E-Mini Future up 30.25 points (0.67%) at 4569.5

- Nasdaq up 243.3 points (1.7%) at 14505.92

- US 10-Yr yield is up 3.1 bps at 2.4135%

- US Jun 10Y are down 6/32 at 122-1.5

- EURUSD down 0.0069 (-0.62%) at 1.0974

- USDJPY up 0.24 (0.2%) at 122.76

- WTI Crude Oil (front-month) up $4.21 (4.24%) at $103.47

- Gold is up $6.7 (0.35%) at $1932.42

- EuroStoxx 50 up 32.44 points (0.83%) at 3951.12

- FTSE 100 up 21.02 points (0.28%) at 7558.92

- German DAX up 71.68 points (0.5%) at 14518.16

- French CAC 40 up 47.06 points (0.7%) at 6731.37

US TSY FUTURES CLOSE

- 3M10Y -0.197, 185.486 (L: 182.335 / H: 190.148)

- 2Y10Y +7.498, -0.533 (L: -9.531 / H: -0.368)

- 2Y30Y +8.587, 5.586 (L: -5.34 / H: 5.662)

- 5Y30Y +5.03, -7.835 (L: -15.244 / H: -6.346)

- Current futures levels:

- Jun 2Y up 0.5/32 at 105-22.375 (L: 105-17.5 / H: 105-23.75)

- Jun 5Y down 0.5/32 at 114-0.25 (L: 113-24.25 / H: 114-05.75)

- Jun 10Y down 7/32 at 122-0.5 (L: 121-27 / H: 122-12.5)

- Jun 30Y down 1-5/32 at 148-21 (L: 148-13 / H: 149-21)

- Jun Ultra 30Y down 2-7/32 at 175-28 (L: 175-05 / H: 177-16)

US 10Y FUTURES TECH: (M2) Primary Trend Remains Down

- RES 4: 125-17 50-day EMA

- RES 3: 124-28+ High Mar 17

- RES 2: 123-25 20-day EMA

- RES 1: 123-12 High Mar 23

- PRICE: 122-03+ @ 1235ET Apr 4

- SUP 1: 120-30+ Low Mar 28 and the bear trigger

- SUP 2: 120.28 Low Dec 26 2018 (cont)

- SUP 3: 120-04+ Low Dec 12/13 2018 (cont)

- SUP 4: 120.00 Low Dec 6 2018 (cont) and psychological support

Treasuries remain below last week’s high. A bearish theme continues to dominate and short-term gains are considered corrective. Initial resistance at 123-12, the Mar 23 high, remains in place and this lies ahead of the 20-day EMA, at 123-25. A resumption of weakness would refocus attention on the recent low of 120-30+ (Mar 28), where a break would confirm a continuation of the downtrend and open the 120-00 handle.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.010 at 98.420

- Sep 22 steady at 97.715

- Dec 22 +0.005 at 97.205

- Mar 23 +0.015 at 96.895

- Red Pack (Jun 23-Mar 24) +0.010 to +0.020

- Green Pack (Jun 24-Mar 25) +0.005 to +0.025

- Blue Pack (Jun 25-Mar 26) -0.025 to steady

- Gold Pack (Jun 26-Mar 27) -0.045 to -0.035

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00028 at 0.32757% (+0.00072 total last wk)

- 1 Month -0.00900 to 0.42857% (-0.00757 total last wk)

- 3 Month +0.00700 to 0.96900% (-0.02086 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00357 to 1.49271% (+0.03800 total last wk)

- 1 Year +0.02986 to 2.20143% (+0.08286 total last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $78B

- Daily Overnight Bank Funding Rate: 0.32% volume: $243B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $974B

- Broad General Collateral Rate (BGCR): 0.30%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $321B

- (rate, volume levels reflect prior session)

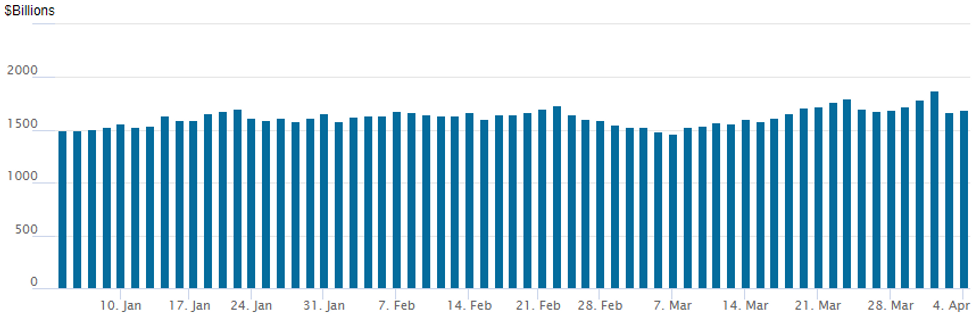

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces to 1,692.936B w/ 81 counterparties from prior session 1,666.063B. Compares to all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $2.5B GM and $2.5B Credit Suisse Launched

- Date $MM Issuer (Priced *, Launch #)

- 04/04 $2.5B #GM Fncl $1.1B 3Y +120, $300M 3Y SOFR+130, $1.1B 7Y +180

- 04/04 $2.5B #Credit Suisse $2.1B 3Y +115, $400M 3Y SOFR+126

- 04/04 $500M #NY Life 5Y +70

- Expected to price Tuesday:

- 04/05 $500M IADB 5Y SOFR+28a

EGBs-GILTS CASH CLOSE: Yields Fall On Modest Geopolitical Risk-Off

Bund and Gilt yields range traded for most of Monday's session, finishing lower, with UK instruments outperforming.

- Core FI strengthened in the morning on headlines that the EU would add further sanctions on Russia "urgently", before drifting for most of the session. Though notably the bond rally lagged an initial drop in equities.

- Yields picked up later in the session, both as equities gained steam, and ECB's Vasle said policy rates could be out of negative territory by end-year.

- Periphery EGB spreads widened by 2-3bp, mostly on the initial safe haven bid.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 1.4bps at -0.082%, 5-Yr is down 3.3bps at 0.345%, 10-Yr is down 4.8bps at 0.507%, and 30-Yr is down 3.6bps at 0.636%.

- UK: The 2-Yr yield is down 0.8bps at 1.366%, 5-Yr is down 3bps at 1.387%, 10-Yr is down 6.1bps at 1.547%, and 30-Yr is down 6.9bps at 1.668%.

- Italian BTP spread up 2bps at 155.8bps / Spanish up 2.6bps at 94.3bps

FOREX: EUR Grinds Lower, AUD To Five-Month High Ahead Of RBA

- The single currency underperformed its G10 counterparts on Monday as markets assess the impact of additional Russian sanctions and the lack of any meaningful breakthrough in diplomatic negotiations surrounding the war.

- EURUSD price action remained slow but directional as the pair extends its pullback from last week’s highs of 1.1185, grinding back through the 1.10 mark to print fresh lows of 1.0966. The pair has narrowed the gap with last week’s low at 1.0945, a key short-term support to watch. The dollar index extends its winning streak to three days, rising another 0.44% on Monday.

- Perhaps more significant are the moves witnessed in Euro crosses with EURAUD (-1.32%) and EURNZD (-1.18%) both resuming the sharp downtrends witnessed across February and March. EURAUD in particular is sitting right on fresh cycle lows around 1.4535 as the Australian dollar receives a boost from the uptick in commodity indices as well as the buoyancy of global equity benchmarks.

- Additionally, AUDUSD saw some interest headed into the WMR fix, which helped the pair clear last week's peak at 0.7540, then briefly matching the 0.7556 key resistance point (late Oct 2021 high).

- The April RBA meeting/decision is the highlight overnight. Despite markets expecting policy to remain unchanged, focus will quickly move to the Bank’s guidance paragraph, with the board likely to reaffirm that it is “prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve”.

- Tomorrow’s US docket will be headlined by ISM Services PMI data ahead of Wednesday’s release of the FOMC minutes.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/04/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/04/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 05/04/2022 | 0630/0830 | ** |  | SE | Services PMI |

| 05/04/2022 | 0645/0845 | * |  | FR | industrial production |

| 05/04/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 05/04/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 05/04/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/04/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/04/2022 | - |  | EU | ECB's de Guindos attends Ecofin | |

| 05/04/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 05/04/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 05/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/04/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/04/2022 | 1400/1000 |  | US | Minneapolis Fed's Neel Kashkari and Fed Governor Lael Brainard | |

| 05/04/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/04/2022 | 1630/1230 |  | US | San Francisco Fed's Mary Daly | |

| 05/04/2022 | 1800/1400 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.