-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy 2s10s Curve Dis-Inverts

EXECUTIVE SUMMARY

- MNI: Fed's Brainard Sees Series Of Hikes, Faster QT Phase-In

- MNI: Fed Must Cool Job Market - Ex-Officials

- MNI INTERVIEW:US Services Expect Growth Amid Darker Clouds-ISM

- NATO: Stoltenberg: Russia Shifting Focus To East To Seek To Take Donbas

- TWITTER TO APPOINT ELON MUSK TO BOARD OF DIRECTORS, Bbg

- GERMANY IS SAID TO CONSIDER STOPPING RUSSIAN COAL IMPORTS, Bbg

US

FED: Federal Reserve Governor Lael Brainard Tuesday said she expects a series of interest-rate increases and balance sheet reduction as soon as the May FOMC meeting, with significantly larger caps and a much shorter period to phase in the maximum caps compared with after the financial crisis.

- "It is of paramount importance to get inflation down," she said, noting inflationary pressures have been broadening out. "Accordingly, the Committee will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting."

- While the March Statement of Economic Projections implies monetary tightening will cool the labor market simply via a lower rate of job openings than the 400,000 per month average seen over the past 11 months, a jobless rate at March’s post-pandemic low of 3.6% and wages growth at 5.6% are too hot for the Fed’s comfort, the former officials and staff said.

- The Fed needs to get rates up closer to neutral to stop the labor market from tightening further, former Fed vice chair Donald Kohn said in a recent interview. The current rate of gains in wages in particular is leaving the central bank in an awkward position, said Jonathan Wright, a former member of the Fed Board's division of monetary affairs. For more see MNI Policy main wire at 1239ET.

- "We're still in good shape and we'll still see continued growth going forward. It won't be the big spikes that we saw last year, but we're not going to look at contraction anytime soon. If we do see some fall off, it'll probably be toward the latter part of the year if that even happens," he said.

- "When we look at the components of what would contribute to us getting into a recessionary period, the only one we're combating right now is the inflation side effects," he said. "We're still on the right path. All indications are that we're not going to get into that negative territory." For more see MNI Policy main wire at 1404ET.

US TSYS: The Power of Fed Speak

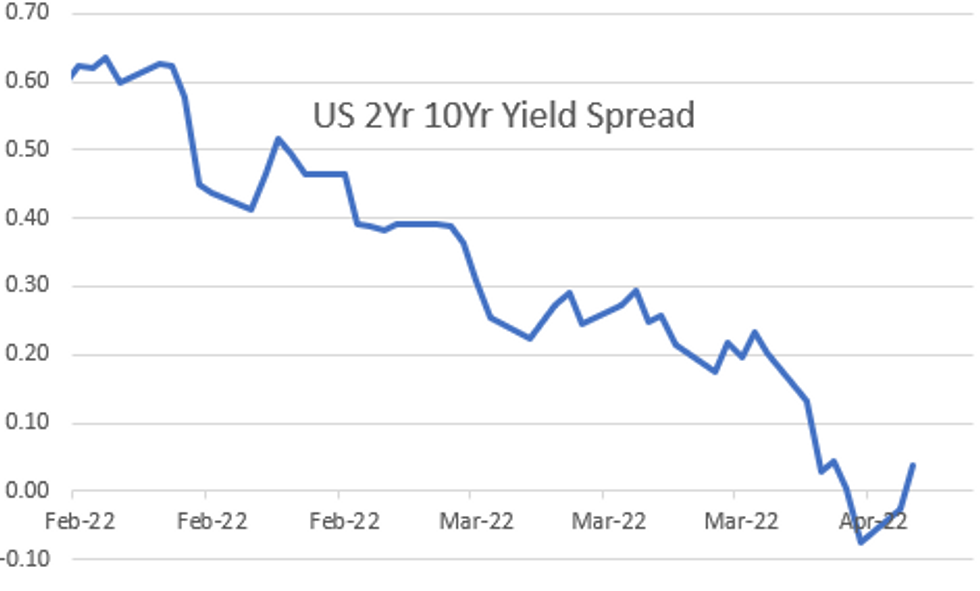

Rates finished broadly lower Tuesday, near second half lows after hawkish Fed rhetoric initially weighed heavily on the long end, yield curves steepening on net, 2s10s dis-inverting to +4.042 from -3.125 low. 30YY climbed from around 2.50% prior to Fed Gov Brainard to 2.596% session high.- In short, Fed Gov Brainard and KC Fed George delivered one-two punch to markets midmorning on the importance of keeping inflation contained by raising rates methodically and starting draw balance sheet draw down as soon as May.

- Given Brainard's dovish credentials, she makes a notable mention of legendary hawk Fed Chair Paul Volcker in the first paragraph...then again, she also mentions Arthur Burns under whose leadership inflation soared.

- On tightening: "It is of paramount importance to get inflation down... accordingly, the Committee will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting."

- Lacking on the data front, Wednesday focus on afternoon release of March FOMC minutes:

- US Data/Speaker Calendar (prior, estimate)

- Apr-6 0700 MBA Mortgage Applications (-6.8%, --)

- Apr-6 0930 Philly Fed Harker on economic outlook

- Apr-6 1400 March FOMC minutes

- The 2-Yr yield is up 8bps at 2.5017%, 5-Yr is up 13.8bps at 2.6887%, 10-Yr is up 14.6bps at 2.5413%, and 30-Yr is up 11.1bps at 2.5674%.

OVERNIGHT DATA

- US FEB TRADE GAP -$89.2B VS JAN -$89.2B

- US FINAL S&P SERVICES PMI 58.0 (FLASH 58.9, FEB 56.5)

- US ISM MAR SERVICES PRICES 83.8

- US ISM MAR SERVICES EMPLOYMENT INDEX 54

- US ISM MAR SERVICES BUSINESS INDEX 55.5

- US ISM MAR SERVICES COMPOSITE INDEX 58.3

- US ISM MAR SERVICES NEW ORDERS 60.1

- CANADIAN FEB TRADE BALANCE +2.7 BILLION CAD

- CANADA FEB EXPORTS 58.7 BLN CAD, IMPORTS 56.1 BLN CAD

- CANADA REVISED JAN MERCHANDISE TRADE BALANCE +3.1 BLN CAD

- CANADA FEB EXPORTS +2.8% TO RECORD, IMPORTS +3.9%

- CANADA FEB TRADE BALANCE +CAD2.7 BLN VS FORECAST +CAD$2.8 BLN

- CANADA REVISES JAN TRADE BALANCE TO +CAD3.1B FROM +CAD2.6 BLN

- CANADA'S JAN MERCHANDISE TRADE SURPLUS WAS WIDEST SINCE 2008

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 251.25 points (-0.72%) at 34664.5

- S&P E-Mini Future down 53.25 points (-1.16%) at 4523.75

- Nasdaq down 324.1 points (-2.2%) at 14206.24

- US 10-Yr yield is up 14.6 bps at 2.5413%

- US Jun 10Y are down 35.5/32 at 120-31.5

- EURUSD down 0.0071 (-0.65%) at 1.0901

- USDJPY up 0.84 (0.68%) at 123.63

- WTI Crude Oil (front-month) down $1.69 (-1.64%) at $101.60

- Gold is down $9.88 (-0.51%) at $1922.88

- EuroStoxx 50 down 33.27 points (-0.84%) at 3917.85

- FTSE 100 up 54.8 points (0.73%) at 7613.72

- German DAX down 93.8 points (-0.65%) at 14424.36

- French CAC 40 down 85.86 points (-1.28%) at 6645.51

US TSY FUTURES CLOSE

- 3M10Y +1.017, 183.931 (L: 171.028 / H: 188.321)

- 2Y10Y +6.285, 3.18 (L: -3.125 / H: 5.62)

- 2Y30Y +3.493, 6.402 (L: 2.898 / H: 8.766)

- 5Y30Y -1.884, -11.723 (L: -13.417 / H: -6.938)

- Current futures levels:

- Jun 2Y down 5.125/32 at 105-17 (L: 105-15.375 / H: 105-24)

- Jun 5Y down 19.5/32 at 113-13 (L: 113-08.75 / H: 114-05.5)

- Jun 10Y down 1-2.5/32 at 121-0.5 (L: 120-25.5 / H: 122-10)

- Jun 30Y down 2-6/32 at 146-23 (L: 146-07 / H: 149-11)

- Jun Ultra 30Y down 3-13/32 at 172-27 (L: 172-00 / H: 176-27)

US 10Y FUTURES TECH: (M2) Contract Lows

- RES 4: 125-17 50-day EMA

- RES 3: 124-28+ High Mar 17

- RES 2: 123-19+ 20-day EMA

- RES 1: 123-04/12 High Mar 31 / High Mar 23

- PRICE: 120-27.5 @ 1900ET Apr 5

- SUP 1: 120-26+ Low Mar 28 and the bear trigger

- SUP 2: 120-12 2.0% Lower Bollinger Band

- SUP 3: 120-04+ Low Dec 12/13 2018 (cont)

- SUP 4: 120.00 Low Dec 6 2018 (cont) and psychological support

Treasuries traded to a fresh contract low Tuesday, extending the pullback off last week’s high. The bearish theme dominates and recent short-term gains appear to be a correction. Initial resistance at 123-12, Mar 23 high, remains in place and this lies ahead of the 20-day EMA, at 123-19+. Attention is on the 2.0% lower Bollinger Band for support, which undercuts at 120-12. A break would confirm a continuation of the downtrend and open the 120-00 handle.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.025 at 98.390

- Sep 22 -0.055 at 97.655

- Dec 22 -0.070 at 97.130

- Mar 23 -0.090 at 96.795

- Red Pack (Jun 23-Mar 24) -0.10 to -0.095

- Green Pack (Jun 24-Mar 25) -0.135 to -0.095

- Blue Pack (Jun 25-Mar 26) -0.20 to -0.16

- Gold Pack (Jun 26-Mar 27) -0.205 to -0.19

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00143 at 0.32614% (-0.00115/wk)

- 1 Month +0.01743 to 0.44600% (+0.00843/wk)

- 3 Month -0.00243 to 0.96657% (+0.00457/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.01785 to 1.47486% (-0.01428/wk)

- 1 Year +0.02643 to 2.22786% (+0.05629/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $78B

- Daily Overnight Bank Funding Rate: 0.32% volume: $254B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $940B

- Broad General Collateral Rate (BGCR): 0.30%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $319B

- (rate, volume levels reflect prior session)

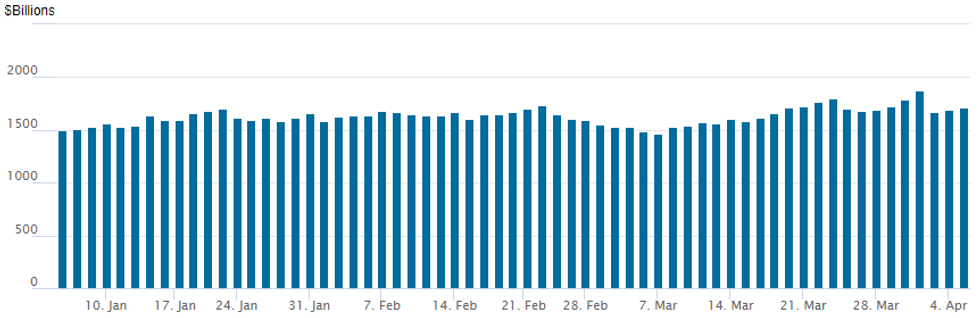

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,710.834B w/ 86 counterparties from prior session 1,692.936B. Compares to all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $3.35B Bank of Nova Scotia 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 04/05 $3.35B #Bank of Nova Scotia $1.75B 3Y +80, $350M sY SOFR+90, +1.25B 15NC10 +205

- 04/05 $1B *IADB 5Y SOFR+28

- 04/05 $1.6B #Entergis Escrow Corp 7NC +215

- 04/05 $600M #Sun Communities 10Y +172

- 04/05 $500M #JAB Holdings 30Y +200

- 04/05 $500M #Sammons Fncl 10Y +220

- Expected Wednesday:

- 04/06 $3B EIB +3Y SOFR+24

- 04/06 $Benchmark Ontario Teachers Fnc 5Y +656a

EGBs-GILTS CASH CLOSE: Macron Malaise Sinks BTPs

European bond yields rose sharply Tuesday with periphery EGBs particularly badly hit, with a combination of Fed tightening prospects and political risk contributing to the weakness.

- Concern that a Macron victory in the French presidential election is no longer clear-cut pushed BTP spreads significantly wider. 10Y Italy/Germany rose 8.4bp, closing on the session high (and widest since March 11).

- Fed Gov Brainard's hawkish-leaning comments in the afternoon spurred a sell-off in Treasuries, with Bunds and Gilts following suit.

- Gilt and Bund yields widened more or less in parallel, with the exception of UK short-end underperformance.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.1bps at -0.022%, 5-Yr is up 9.8bps at 0.443%, 10-Yr is up 10.8bps at 0.614%, and 30-Yr is up 9.4bps at 0.729%.

- UK: The 2-Yr yield is up 9.3bps at 1.459%, 5-Yr is up 9.2bps at 1.479%, 10-Yr is up 10.7bps at 1.654%, and 30-Yr is up 9.7bps at 1.766%.

- Italian BTP spread up 8.4bps at 164.8bps / Spanish up 4bps at 98.6bps

FOREX: Fed Rhetoric Prompts Greenback Spike, AUD Maintains Gains

- The greenback staged a firm turnaround during US hours on Tuesday, largely fuelled by hawkish Fed rhetoric. Lael Brainard’s speech expecting “the balance sheet to shrink considerably more rapidly than in the previous recovery” underpinned a firm USD recovery from the lows of the day.

- Price action immediately weighed on EUR/USD, trading through the overnight lows and extending below touted support at 1.0945, the Mar28 low. The recent failure at 1.1185, Mar 31 high and more importantly, the inability to remain above the 50-day EMA (breached last week), highlights a developing bearish threat, signalling scope for a deeper sell-off and immediate focus is on 1.0898, the Mar 14 low.

- USD/JPY also received a bump higher, putting the rate comfortably back above the Y123.00 handle in a move that gathered momentum throughout the session.

- The risk-off tone filtered through to the EM basket with popular longs such as the Brazilian Real unwinding around 1.5% and USDMXN following suit by narrowing the gap with the 20.00 mark.

- Currencies that may have been expected to feel the pinch a bit more include AUD, NZD and CAD, all residing in positive territory for the session. A lot of this can be explained by the sharp overnight weakness in Euro crosses and the continued pressure on the single currency managing to consolidate said weakness.

- EURAUD especially sits 1.25% lower on the day after breaking horizontal support drawn off the mid-2017 lows at 1.4424, and prices now at the lowest levels since late April 2017 - narrowing the proximity with the 2017 cyclical low of 1.3627.

- Treasury Secretary Yellen is due to testify on the global financial system before the House Financial Services Committee, in Washington DC tomorrow before the release of the March FOMC meeting minutes at 1900BST/1400ET.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/04/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 06/04/2022 | 0600/0800 | ** |  | DE | manufacturing orders |

| 06/04/2022 | 0700/0900 |  | EU | ECB VP de Guindos speaks | |

| 06/04/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/04/2022 | 0900/1100 | ** |  | EU | PPI |

| 06/04/2022 | 0900/1100 |  | EU | ECB Schnabel Panel Moderation at ECB/EC Conference | |

| 06/04/2022 | 0900/1100 |  | EU | ECB Exec Board member Fabio Panetta speech | |

| 06/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/04/2022 | 1145/1345 |  | EU | ECB Philip Lane panel appearance | |

| 06/04/2022 | 1330/0930 |  | US | Philadelphia Fed's Patrick Harker | |

| 06/04/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 06/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 06/04/2022 | 1800/1400 | * |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.