-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Early Geopol Risk Roils, Focus Turns To Fed

MNI ASIA MARKETS ANALYSIS: South Korea Rescinds Martial Law

MNI ASIA OPEN: Broad Strokes From Fed, Balance Sheet Drawdown

EXECUTIVE SUMMARY

- MNI: Fed To Aim For USD95B Cap To Shrink Balance Sheet

- MNI: Harker Sees Series of Deliberate Fed Rate Hikes This Year

- MNI BRIEF: Fed's Barkin Supports Gradual Rate Hike Path

- BARKIN: FOMC COULD CERTAINLY MOVE IN 50BPS INCREMENT IF NEEDED, Bbg

US

FED: The Federal Reserve will begin rapidly shrinking its USD8.9 trillion balance sheet starting as early as May as part of a broader tightening campaign that has officials considering one or more 50BP rate hikes this year, minutes from the central bank's March meeting showed.

- "Participants generally agreed that monthly caps of about $60 billion for Treasury securities and about $35 billion for agency MBS would likely be appropriate. Participants also generally agreed that the caps could be phased in over a period of three months or modestly longer if market conditions warrant," the March FOMC minutes said.

FED: Inflation that is running far too hot for the Federal Reserve will force policymakers to tighten this year in a “deliberate, methodical” manner, Philadelphia Fed President Patrick Harker said Wednesday.

- Along with rate hikes “we will begin to reduce our holdings of Treasury securities, agency debt, and mortgage-backed securities soon,” Harker said in prepared remarks to the Delaware State Chamber of Commerce. “Inflation is running far too high, and I am acutely concerned about this.”

- Harker described inflation pressures as broad based and troublesome, ascribing its surge to a variety of factors. “Generous fiscal policies, supply chain disruptions, and accommodative monetary policy have pushed inflation far higher than I — and my colleagues on the FOMC — are comfortable with,” Harker said. “I’m also worried that inflation expectations could become unmoored.” For more see MNI Policy main wire at 0930ET.

- "The rate path we forecasted in March shouldn't drive economic decline. We're still far from the level of rates that constrain the economy," said Barkin, a 2024 FOMC voter, downplaying recessionary fears and commenting that the Fed's moves have less impact on inflation in the near-term. The Richmond Fed chief said "our balance sheet moves can work in the background to reinforce this rate path." For more see MNI Policy main wire at 1031ET.

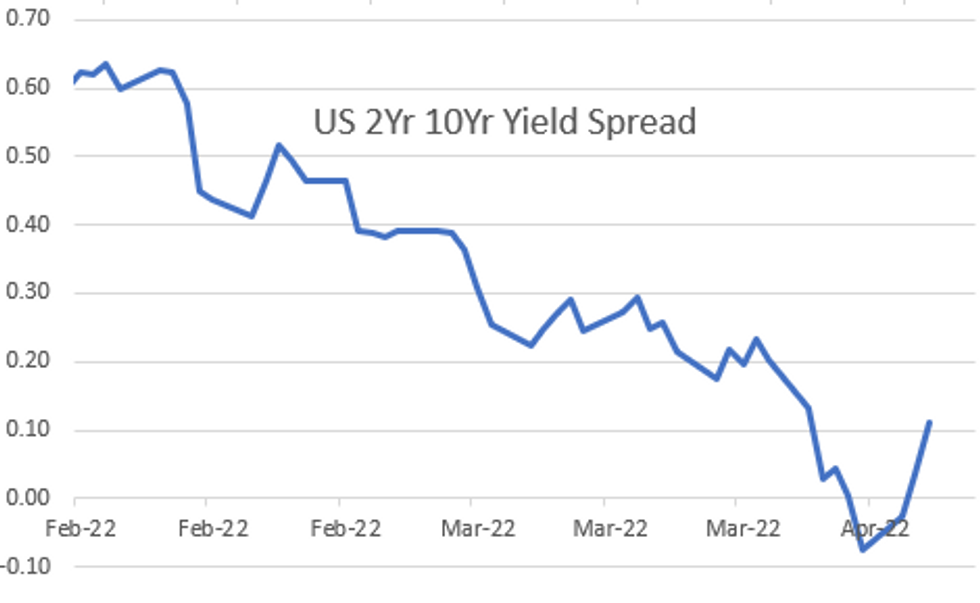

US TSYS: Rapid QT Ahead

Heavy whipsaw action following March FOMC minutes, curves holding steeper even as bonds climbing off lows again well after the closing bell.- The Federal Reserve will begin rapidly shrinking its USD8.9T balance sheet starting as early as May as part of a broader tightening campaign that has officials considering one or more 50BP rate hikes this year, minutes from the central bank's March meeting showed.

- Very short end grappling with pricing in prospect of more aggressive policy if inflation persists (CPI +7.9% March YoY while the Fed's preferred PCE measure +6.4% in Feb YoY). "Many participants noted that one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified."

- Remains to be seen whether he can say anything new to make markets react but StL Fed Bullard will talk about US economy/mon-pol at U of Missouri event tomorrow at 0900ET, text and Q&A.

- Economic data on tap for Thursday at 0830ET:

- Initial Jobless Claims (202k, 200k), Continuing Claims (1.307M, 1.302M)

- Apr-7 1500 Consumer Credit ($6.838B, $18.100B) late in session at 1500ET

- The 2-Yr yield is down 2bps at 2.4939%, 5-Yr is up 0bps at 2.6956%, 10-Yr is up 5.3bps at 2.5994%, and 30-Yr is up 4.8bps at 2.6212%.

OVERNIGHT DATA

- US MBA: MARKET COMPOSITE -6.3% SA THRU APR 01 WK

- US MBA: REFIS -10% SA; PURCH INDEX -3% SA THRU APRIL 1 WK

- US MBA: UNADJ PURCHASE INDEX -9% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 4.90% VS 4.80% PR

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 170.62 points (-0.49%) at 34483.72

- S&P E-Mini Future down 46.75 points (-1.03%) at 4476.25

- Nasdaq down 304.1 points (-2.1%) at 13908.15

- US 10-Yr yield is up 5.3 bps at 2.5994%

- US Jun 10Y are down 6.5/32 at 120-23

- EURUSD down 0.001 (-0.09%) at 1.0896

- USDJPY up 0.19 (0.15%) at 123.79

- WTI Crude Oil (front-month) down $4.84 (-4.75%) at $97.06

- Gold is up $0.89 (0.05%) at $1924.58

- EuroStoxx 50 down 93.16 points (-2.38%) at 3824.69

- FTSE 100 down 26.02 points (-0.34%) at 7587.7

- German DAX down 272.67 points (-1.89%) at 14151.69

- French CAC 40 down 146.68 points (-2.21%) at 6498.83

US TSY FUTURES CLOSE

- 3M10Y +5.879, 192.013 (L: 186.421 / H: 196.256)

- 2Y10Y +8.223, 10.722 (L: 0.81 / H: 12.179)

- 2Y30Y +7.88, 13.17 (L: 2.273 / H: 15.518)

- 5Y30Y +5.627, -6.967 (L: -15.606 / H: -5.446)

- Current futures levels:

- Jun 2Y up 1.125/32 at 105-18.125 (L: 105-11 / H: 105-21.375)

- Jun 5Y up 0.75/32 at 113-12.75 (L: 112-28.75 / H: 113-20.25)

- Jun 10Y down 7/32 at 120-22.5 (L: 120-05.5 / H: 121-01.5)

- Jun 30Y down 31/32 at 145-14 (L: 144-24 / H: 146-22)

- Jun Ultra 30Y down 1-21/32 at 170-29 (L: 169-11 / H: 172-26)

US 10Y FUTURES TECH: (M2) Resumes Its Downtrend

- RES 4: 125-07 50-day EMA

- RES 3: 124-18 High Mar 21

- RES 2: 123-04 High Mar 31 and a key resistance

- RES 1: 122-10 High Apr 5

- PRICE: 120-09+ @ 11:26 BST Apr 6

- SUP 1: 120-04+ Low Dec 12/13 2018 (cont)

- SUP 2: 120.00 Low Dec 6 2018 (cont) and psychological support

- SUP 3: 119-22 Low Dec 12 2018 (cont)

- SUP 4: 119-04+ Low Dec 3 2018 (cont)

Treasuries traded to a fresh contract low Tuesday and are weaker again today. Yesterday’s move lower confirmed a resumption of the primary downtrend and marks an extension of the bearish price sequence of lower lows and lower highs. Moving average studies are also pointing south. Attention is on the 120.00 handle next. Key short-term trend resistance has been defined at 123-0, the Mar 31 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.040 at 98.350

- Sep 22 steady at 97.650

- Dec 22 +0.010 at 97.130

- Mar 23 +0.015 at 96.805

- Red Pack (Jun 23-Mar 24) +0.010 to +0.010

- Green Pack (Jun 24-Mar 25) -0.005 to +0.010

- Blue Pack (Jun 25-Mar 26) -0.05 to -0.01

- Gold Pack (Jun 26-Mar 27) -0.085 to -0.055

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00186 at 0.32800% (+0.00071/wk)

- 1 Month +0.00543 to 0.45143% (+0.01386/wk)

- 3 Month +0.01986 to 0.98643% (+0.02443/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.02685 to 1.50171% (+0.01257/wk)

- 1 Year +0.01557 to 2.24343% (+0.07186/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $79B

- Daily Overnight Bank Funding Rate: 0.32% volume: $263B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $929B

- Broad General Collateral Rate (BGCR): 0.30%, $336B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $323B

- (rate, volume levels reflect prior session)

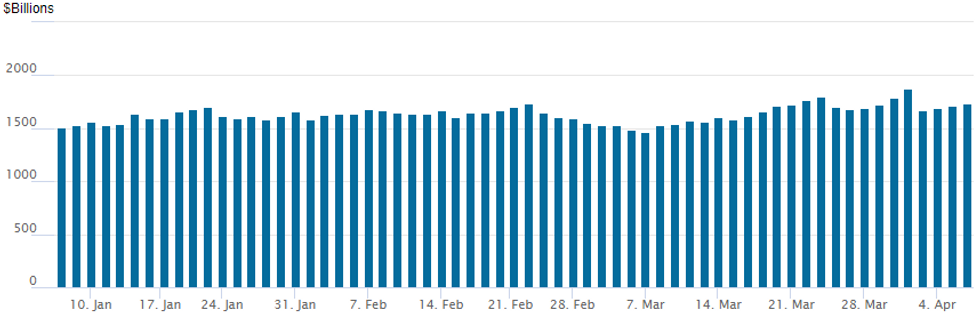

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,731.472B w/ 86 counterparties from prior session 1,710.834B. Compares to all-time high of $1,904.582B on Friday, December 31.

$3B EIB Priced, JBIC Expected Thu

- Date $MM Issuer (Priced *, Launch #)

- 04/06 $3B *EIB +3Y SOFR+22

- 04/06 $1.5B *Ontario Teachers Fnc 5Y SOFR+55

- 04/06 $500M *Shinhan Bank 10Y NC+185

- 04/06 $500M #Orix 10Y +145

- Expected Thursday:

- 04/06 $Benchmark JBIC 3Y SOFR+42a

EGBs-GILTS CASH CLOSE: Late Rally

Bunds and Gilts enjoyed a late rally Wednesday, with yields dropping after an earlier rise. Equities weakened sharply in the afternoon which eventually staunched FI losses.

- Curves closed mixed, though overall, UK and Germany steepened. ECB hike pricing again flirted with a 0.00% end-2022 rate, finishing just negative.

- Periphery yields were wider on the session but well off highs, with BTP spreads narrowing late alongside oil (as EU couldn't agree on Russia sanctions).

- Attention turns to Fed minutes after hours.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.7bps at -0.039%, 5-Yr is down 0.3bps at 0.44%, 10-Yr is up 3.3bps at 0.647%, and 30-Yr is up 6.2bps at 0.791%.

- UK: The 2-Yr yield is up 0.4bps at 1.463%, 5-Yr is up 2.6bps at 1.505%, 10-Yr is up 5bps at 1.704%, and 30-Yr is up 5.4bps at 1.82%.

- Italian BTP spread up 0.6bps at 165.4bps / Greek up 5.3bps at 210.6bps

FOREX: USD Index Set To End Marginally Higher, AUD Reverses Course

- After a very brief blip lower following the release of the latest FOMC minutes, the greenback firmed with the Bloomberg Dollar Index rising to the best levels of the day and equities remaining under pressure.

- For EURUSD, an initial spike to 1.0928 encountered firm offers, prompting a retracement back below the 1.09 handle to trade within close proximity of the early European lows at 1.0875. However, a late bounce in equity indices saw the pair rise back to 1.0900, close to unchanged for Friday.

- As noted, this week’s weakness has reinforced a developing bearish technical threat. The break of 1.0945 signals scope for a deeper sell-off towards 1.0806, the Mar 7 low and a bear trigger.

- In similar vein, USDJPY fell to touch 123.50 before finding good support and now resides just shy of the 124 mark and day’s high at 124.05. Technically, a corrective cycle is still in play despite recent gains, with clearance of 125.09 needed to confirm a resumption of the primary uptrend.

- The overall weakness in equities weighed on Antipodean FX, with AUD the worst performer in G10 and set to snap a three-day winning streak. Additionally, EMFX has come under pressure, evident by the JPMorgan Emerging Market Currency index is seen 0.4% lower amid the dip in risk sentiment with popular longs such as MXN (-0.75%) and BRL (-1.20%) unwinding recent gains.

- AUD trade balance figures overnight before a fairly light data calendar on Thursday highlighted by German IP and Eurozone retail sales. However, the ECB Monetary Policy Meeting Accounts will be published at 1230BST/0730ET.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/04/2022 | 0130/1130 | ** |  | AU | Trade Balance |

| 07/04/2022 | 0545/0745 | ** |  | CH | unemployment |

| 07/04/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/04/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 07/04/2022 | 0900/1100 | ** |  | EU | retail sales |

| 07/04/2022 | 1130/1330 |  | EU | ECB March meet Accts published | |

| 07/04/2022 | 1215/1315 |  | UK | BOE Pill Opening at BOE Sovereign Bond Market Conference | |

| 07/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 07/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 07/04/2022 | 1300/0900 |  | US | St. Louis Fed's James Bullard | |

| 07/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 07/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 07/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 07/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 07/04/2022 | 1800/1400 |  | US | Atlanta Fed's Raphael Bostic, Chicago Fed's Charles Evans | |

| 07/04/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 07/04/2022 | 2005/1605 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.