-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: 30YY Tops 2.75%

EXECUTIVE SUMMARY

- MNI EU Commission Pres Von Der Leyen: Ukraine EU Membership Fast-Tracked

- MNI INTERVIEW: Canada Budget Clashes With BOC Tightening-Beatty

- PM Johnson Says Scholz Agrees On 'Importance Of Weaning Off Russian O&G'

- JOHNSON: ALLIES MUST GO FURTHER IN SUPPORTING UKRAINE, Bbg

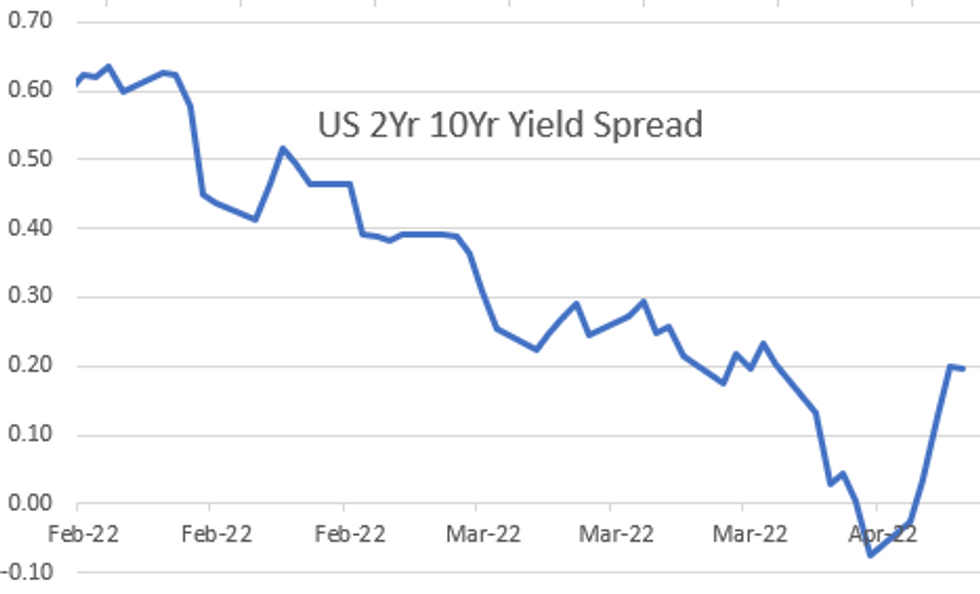

US TSYS: Tsy Yield Curves Reverse Early Flattening

Tsys see-sawed in weaker range all session, near lows after the bell. Generally quiet end to the week: no react to Wholesale inventories (2.5%)/trade sales (1.7%) earlier. Two-way positioning/squaring up ahead the weekend, markets keeping wary eye on geopol headline risk re: Russia war in Ukraine, continued global sanctions.- Yield curves inched steeper, however, after trading flatter in early trade. Currently, 2s10s nearly 30bp off Sunday evening inverted low of -9.531 at +19.542 (+.320) while 3s, 5s and 7s remain inverted vs. 10s (-1.872, -4.547, -8.477 respectively).

- Limited data (NY Fed survey of consumer expectations at 1100ET) kicks off next week's shortened* pre-Easter holiday trade though several Fed speakers scheduled on Monday:

- Atl Fed Bostic open remarks: Fed Listens event in Nashville; Fed Govs' Bowman and Waller closing remarks at same event at 0930ET

- NY Fed John Williams CME/Economic Club of New York event

- Chicago Fed Evans economic outlook at 1240ET

- Treasury supply:

- US Tsy $57B 13W, $48B 26W bill auctions at 1130ET

- US Tsy $46B 3Y Note auction (91282CEH0) at 1300ET

- * Note: CME floor closes early Thursday, April 14 at 1300ET, markets closed next Friday for Easter holiday.

EUROPE

EU Commission President Ursula Von Der Leyen today met with Ukrainian President Volodymyr Zelensky in Kyiv today and visited Bucha, the site of reported Russian war crimes.

- In a statement released a short time ago Von der Leyen outlined a new EU strategy for Ukraine. Most notably an apparent fast-tracking of EU membership.

- 'Ukraine belongs in the European family. We have heard your request, loud and clear. And today, we are here to give you a first, positive answer. In this envelope, dear Volodymyr, there is an important step towards EU membership...This is where your path towards the European Union begins. We will be at your disposal 24 hours a day, 7 days a week to work on this common basis... And due to our association agreement, Ukraine is already closely aligned with our Union. So we will accelerate this process as much as we can, while ensuring that all conditions are respected.'

- The statement also congratulates Slovakia on delivery of an S-300 missile defense system today, opening the door for more overt offensive.

- The friendship between our two countries has become even more vital since Putin launched his barbaric onslaught into Ukraine'.

- On Kramatorsk: 'It is a war crime, indiscriminately to attack civilians. And Russia's crimes in Ukraine will not go unnoticed or unpunished.'

- 'We also agree on the importance of weaning ourselves off dependence of Russian oil and gas. This is not easy for any of us and I applaud the seismic decisions taken by Olaf's government...We cannot transform our respective energy systems overnight...'

CANADA

CANADA: Canada's continued budget deficits clash with a central bank moving to raise interest rates and businesses will suffer as borrowing costs rise and inflation persists, former revenue minister and national chamber of commerce head Perrin Beatty told MNI.

- The spending plan announced late Thursday was a "mixed bag" of various supports for business that provide some help bringing in skilled immigrants and growing small firms, while prioritizing increased spending at the wrong time, he said.

- "There's a mixed message being sent out here, the government spending on the one hand, continuing to pump money into the economy, and then the central bank raising interest rates to prevent an overheating," Beatty said. "We really need both sides of the administration to function in concert with one another."

OVERNIGHT DATA

- MNI: US FEB WHOLESALE INV 2.5%; SALES 1.7%

- CANADA MARCH EMPLOYMENT +72.5K; JOBLESS RATE 5.3%

- CANADA MARCH FULL-TIME JOBS +92.7K; PART-TIME -20.3K

- CANADA MARCH JOBLESS RATE FALLS TO 5.3% FROM 5.5% IN FEB

- JOBLESS RATE IS LOWEST IN STATSCAN RECORDS BACK TO 1976

- CANADIAN MARCH EMPLOYMENT +72.5K VS FORECAST +38K, FEB +336.6K

- CANADA HOURLY WAGES +3.4% YOY; PERMANENT WORKERS +3.7%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 211.86 points (0.61%) at 34800.26

- S&P E-Mini Future down 0.5 points (-0.01%) at 4495.75

- Nasdaq down 129.5 points (-0.9%) at 13768.92

- US 10-Yr yield is up 5.2 bps at 2.7095%

- US Jun 10Y are down 13/32 at 120-4.5

- EURUSD up 0.0005 (0.05%) at 1.0884

- USDJPY up 0.41 (0.33%) at 124.35

- WTI Crude Oil (front-month) up $2.08 (2.17%) at $98.10

- Gold is up $12.28 (0.64%) at $1944.14

- EuroStoxx 50 up 56.36 points (1.48%) at 3858.37

- FTSE 100 up 117.75 points (1.56%) at 7669.56

- German DAX up 205.52 points (1.46%) at 14283.67

- French CAC 40 up 86.54 points (1.34%) at 6548.22

US TSY FUTURES CLOSE

- 3M10Y +2.561, 199.535 (L: 192.449 / H: 203.342)

- 2Y10Y -0.059, 19.163 (L: 13.913 / H: 21.942)

- 2Y30Y +1.123, 22.468 (L: 14.502 / H: 24.933)

- 5Y30Y +1.909, -1.281 (L: -7.722 / H: -0.27)

- Current futures levels:

- Jun 2Y down 3.875/32 at 105-16.625 (L: 105-15.25 / H: 105-21.5)

- Jun 5Y down 9.75/32 at 113-6.5 (L: 113-01.25 / H: 113-18.75)

- Jun 10Y down 14/32 at 120-3.5 (L: 119-29 / H: 120-23)

- Jun 30Y down 1-04/32 at 143-4 (L: 142-26 / H: 144-27)

- Jun Ultra 30Y down 2-04/32 at 166-31 (L: 166-18 / H: 170-11)

US 10Y FUTURES TECH: (M2) Fresh Cycle Low And Probes 120.00

- RES 4: 124–27+50-day EMA

- RES 3: 124-18 High Mar 21

- RES 2: 123-04 High Mar 31 and a key resistance

- RES 1: 121-06+/22-27+ High Apr 7 / 20-day EMA

- PRICE: 120-03+ @ 18:59 BST Apr 8

- SUP 1: 119-29 Low Apr 8

- SUP 2: 119-22 Low Dec 12 2018 (cont)

- SUP 3: 119-04+ Low Dec 3 2018 (cont)

- SUP 4: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

Treasuries traded lower today and registered a fresh cycle low of 119-29. The break lower confirms a resumption of the primary downtrend and maintains the bearish price sequence of lower lows and lower highs. Moving average studies are also pointing south and scope is seen for a clear break of the 120-00 handle. Key short-term trend resistance has been defined at 123-04, the Mar 31 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.025 at 98.330

- Sep 22 -0.025 at 97.640

- Dec 22 -0.055 at 97.10

- Mar 23 -0.085 at 96.765

- Red Pack (Jun 23-Mar 24) -0.12 to -0.105

- Green Pack (Jun 24-Mar 25) -0.105 to -0.09

- Blue Pack (Jun 25-Mar 26) -0.09 to -0.075

- Gold Pack (Jun 26-Mar 27) -0.09 to -0.08

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00643 at 0.32757% (+0.00028/wk)

- 1 Month +0.02586 to 0.51400% (+0.07643/wk)

- 3 Month +0.02185 to 1.01071% (+0.04871/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.03786 to 1.54043% (+0.05129/wk)

- 1 Year +0.05671 to 2.27157% (+0.10000/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $78B

- Daily Overnight Bank Funding Rate: 0.32% volume: $257B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $906B

- Broad General Collateral Rate (BGCR): 0.30%, $335B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $327B

- (rate, volume levels reflect prior session)

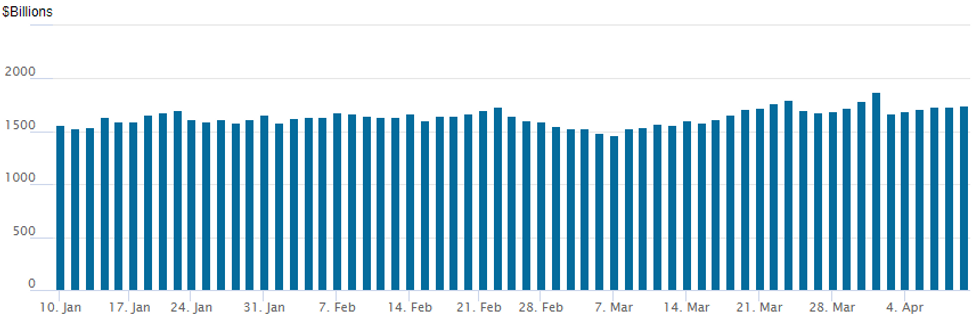

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches higher: 1,750.498B w/ 84 counterparties from prior session 1,734.424B. Compares to all-time high of $1,904.582B on Friday, December 31.

PIPELINE: Early April Surge: $34.7B Debt Issued, RBC, Indonesia Price Late

No new issuance on tap Friday after $16.65B priced Thursday, pushing total for week to $34.7B.- Date $MM Issuer (Priced *, Launch #)

- 07/07 $4B *Royal Bank of Canada $1.4B 3Y +75, $400M 3Y SOFR+84, $1.2B 5Y +95, $1B 10Y +125

- 04/07 $3B *Freeport Indonesia $750M 5Y +205, $1.5B 10Y +265, $750M 3Y +350

- 04/07 $3B *Keurig Dr Pepper $1B 7Y +125, $850M 10Y +145, $1.15B 30Y +185

- 04/07 $2.7B *Take-Two $1B 2Y +85, $600M 3Y +90, $600M 5Y +100, $500M 10Y +135

- 07/07 $1.75B *Republic of Angola 10Y 8.75%

- 04/07 $1.5B *JBIC 3Y SOFR+39

- 07/07 $700M *South32 10Y +175

EGBs-GILTS CASH CLOSE: Yields Up Again, French Election In Focus

The German curve bear flattened, while the UK's steepened Friday, though yields finished off their peaks.

- Periphery spreads reversed earlier widening on a Bloomberg sources story saying that the ECB "is working on a crisis tool to deploy in the event of a blowout in the bond yields of weaker euro-zone economies"; though later widened again.

- While the ECB decision next week is in view (MNI Sources piece here), the 1st round of the French presidential election takes focus going into the weekend (MNI's Preview), with Macron nursing a slender (and recently shrunken) lead over Le Pen.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.3bps at 0.049%, 5-Yr is up 5bps at 0.527%, 10-Yr is up 2.5bps at 0.706%, and 30-Yr is down 0.3bps at 0.808%.

- UK: The 2-Yr yield is up 0.9bps at 1.479%, 5-Yr is up 1.2bps at 1.529%, 10-Yr is up 1.9bps at 1.749%, and 30-Yr is up 3.4bps at 1.898%.

- Italian BTP spread up 3.4bps at 168.7bps / Spanish up 1.3bps at 99.6bps

FOREX: DXY Set To Extend Winning Streak To Seven Days, Breaches 100

- The greenback has edged slightly higher (DXY +0.12%) on Friday and looks set to extend its winning streak to seven consecutive trading sessions, breaking 100 for the first time since May 2020. Despite this, G10 currency ranges remained narrow and price action once again subdued amid a light data calendar.

- Following on from prior sessions, the likes of AUD, NZD extended their short-term downward bias and are bottom of the G10 pile to finish the week, matched closely by a weaker GBP.

- USDCAD bucked the trend following a solid labour report, which keeps the probability of a 50bp hike high. With employment gains centred on full-time jobs and the unemployment rate fell a tenth more than expected to new lows of 5.3%, the Canadian dollar rose a tenth of a percent in the face of the firmer US dollar.

- 2.5% gains for crude futures also underpinned strength in the Norwegian Krona, rising around 1.25% on Friday.

- EURUSD remains close to unchanged despite printing fresh lows for the week at 1.0837. However, the single currency was well supported off the lows following a Bloomberg sources story saying that the ECB "is working on a crisis tool to deploy in the event of a blowout in the bond yields of weaker euro-zone economies". EURUSD bounced back towards 1.0880 before running out of steam ahead of the weekend close.

- USDJPY also caught a strong bid off the overnight 123.67 lows to trade as high as 124.68 in early NY trade. On the upside, clearance of 125.09, the Mar 28 high and bull trigger, is required to confirm a resumption of the primary uptrend.

- The focus over the weekend will be on the results of the French Presidential Election before Chinese CPI and PPI data kicks off the shortened pre-Easter holiday week.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/04/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 11/04/2022 | 0600/0700 | *** |  | UK | UK Index of Services |

| 11/04/2022 | 0600/0700 | *** |  | UK | UK Industrial Production |

| 11/04/2022 | 0600/0700 | ** |  | UK | UK Trade Balance |

| 11/04/2022 | 0600/0700 | *** |  | UK | UK Monthly GDP |

| 11/04/2022 | 0600/0700 | ** |  | UK | UK Construction Output |

| 11/04/2022 | 1330/0930 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/04/2022 | 1330/0930 |  | US | Fed Governors Michelle Bowman and Christopher Waller | |

| 11/04/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 11/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/04/2022 | 1600/1200 |  | US | New York Fed's John Williams | |

| 11/04/2022 | 1640/1240 |  | US | Chicago Fed's Charles Evans | |

| 11/04/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.