-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI BRIEF: China Passenger Car Sales Up In November Y/Y

MNI ASIA OPEN: Hike in May and Go Away?

EXECUTIVE SUMMARY

- NY Fed Williams: 50bp hike in May as a "very reasonable option"

- MNI: Inflation Is Clear & Present Danger For Central Banks-IMF

- MNI BRIEF: No Doubt ECB Will Find New Tools If Needed: Lagarde

- ECB POLICYMAKERS SEE JULY HIKE AS STILL POSSIBLE AFTER THURSDAY'S MEETING, Rtrs

- ECB POLICYMAKERS BACKED THURSDAY'S DECISION UNANIMOUSLY, DIFFERED ON RISKS, RtrsNY FED'S WILLIAMS: ON BALANCE SHEET, I DO EXPECT WE WILL GET THAT UNDERWAY IN JUNE IF WE TAKE DECISION IN MAY, Rtrs

EUROPE

IMF: Central banks must take decisive action against the most dangerous inflation in many years to make sure price expectations remain under control, even with global growth taking another hit from the Ukraine invasion, IMF chief Kristalina Georgieva said Thursday.

- "Inflation has become a clear and present danger for many countries around the world," she said in a curtain-raiser speech for the fund's spring meetings and revised global outlook . "This is a massive setback for the global recovery."

- Global growth estimates will be reduced for this year and next following the January cut in the 2022 forecast to 4.4%, Georgieva said in prepared remarks, which also cited drags from Chinese supply bottlenecks and the ongoing pandemic. Russia's invasion means forecast downgrades for 143 economies this year, or 86% percent of global GDP.

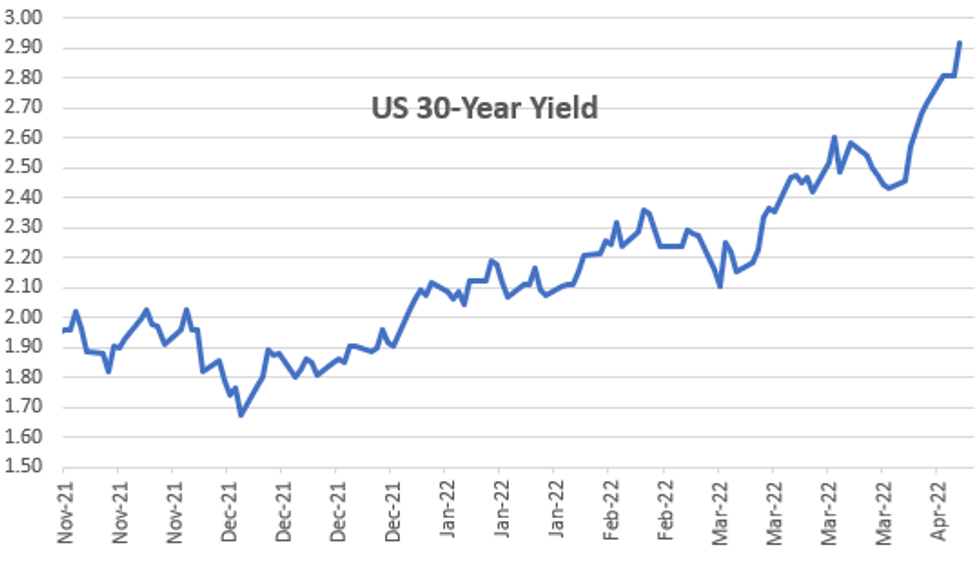

US TSYS: 30YY Taps 2.9268, May 2019 Level

FI markets trading broadly weaker after the early closing bell (Globex closes normal time at 1700ET), near late lows as 30YY hits 2.9268 high -- last seen May 2019.

- Little delay in post-US data selling into bid that developed after steady ECB policy annc. Retail Sales in-line w/ estimates (+0.5%), weekly claims slightly higher (+185k) continuing claims lower (1.475M) while Import/Export prices stronger than expected in all areas.

- Eurodollar futures under heavy pressure as 50bp rate hike chance on the rise again after NY Fed Williams sees 50bp hike in May as a "very reasonable option" in the Fed's effort to "get inflation back to 2%." while they can debate MBS sales further down the road."

- No obvious headline or technical drivers in late morning trade to explain the move, some desks noting carry-over selling in 5s-10s on post-ECB sell positioning.

- After bear flattening in first half, yield curves looking mixed after the bell, off lows: 2s10s at 37.355 (+2.909) vs. 28.308 low; 5s30s at 4.177 (-.0151) vs. 2.136 low.

OVERNIGHT DATA

- US MAR RETAIL SALES +0.5%; EX-MOTOR VEH +1.1%

- US FEB RETAIL SALES REVISED +0.8%; EX-MV +0.6%

- US MAR RET SALES EX GAS & MTR VEH & PARTS DEALERS +0.2% V FEB -0.1%

- US MAR RET SALES EX MTR VEH & PARTS DEALERS +1.1% V US MAR +0.6%

- US MAR RET SALES EX AUTO, BLDG MATL & GAS +0.1% V FEB -0.2%

- US JOBLESS CLAIMS +18K TO 185K IN APR 09 WK

- US PREV JOBLESS CLAIMS REVISED TO 167K IN APR 02 WK

- US CONTINUING CLAIMS -0.048M to 1.475M IN APR 02 WK

- US MAR IMPORT PRICES +2.6%

- US MAR EXPORT PRICES +4.5%; NON-AG +4.5%; AGRICULTURE +4.7%

- MICHIGAN PRELIM. APRIL CONSUMER SENTIMENT AT 65.7; EST. 59

- MICHIGAN 5-YR INFLATION EXPECTATIONS UNCHANGED AT 3%

- MICHIGAN 1-YR INFLATION EXPECTATIONS UNCHANGED AT 5.4%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 5.89 points (-0.02%) at 34556.87

- S&P E-Mini Future down 36.5 points (-0.82%) at 4405.75

- Nasdaq down 228.8 points (-1.7%) at 13414.71

- US 10-Yr yield is up 11.5 bps at 2.814%

- US Jun 10Y are down 30/32 at 119-27.5

- EURUSD down 0.0073 (-0.67%) at 1.0815

- USDJPY up 0.33 (0.26%) at 125.94

- WTI Crude Oil (front-month) up $0.63 (0.6%) at $104.91

- Gold is down $6.47 (-0.33%) at $1971.39

- EuroStoxx 50 up 20.72 points (0.54%) at 3848.68

- FTSE 100 up 35.58 points (0.47%) at 7616.38

- German DAX up 87.41 points (0.62%) at 14163.85

- French CAC 40 up 47.21 points (0.72%) at 6589.35

US TSY FUTURES CLOSE

- 3M10Y +7.716, 201.657 (L: 186.756 / H: 202.807)

- 2Y10Y +1.625, 36.071 (L: 28.308 / H: 37.222)

- 2Y30Y +0.726, 46.393 (L: 37.913 / H: 48.545)

- 5Y30Y -1.258, 14.292 (L: 10.778 / H: 20.155)

- Current futures levels:

- Jun 2Y down 6.5/32 at 105-23.625 (L: 105-21.375 / H: 106-01.25)

- Jun 5Y down 18.25/32 at 113-9.75 (L: 113-06 / H: 114-06.5)

- Jun 10Y down 27.5/32 at 119-30 (L: 119-27 / H: 121-09)

- Jun 30Y down 2-02/32 at 141-04 (L: 140-28 / H: 143-21)

- Jun Ultra 30Y down 3-10/32 at 162-04 (L: 161-22 / H: 166-04)

US 10Y FUTURES TECH: (M2) Returning Lower, Cycle Lows in View

- RES 4: 124–21+ 50-day EMA

- RES 3: 124-18 High Mar 21

- RES 2: 123-04 High Mar 31 and a key resistance

- RES 1: 121-07/22-05 High Apr 13 / 20-day EMA

- PRICE: 120-08+ @ 14:59 BST Apr 14

- SUP 1: 119-10+ Low Apr 12

- SUP 2: 119-04+ Low Dec 3 2018 (cont)

- SUP 3: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 4: 117-22+ Low Nov 8 2018 (cont)

Treasuries traded to a fresh cycle low of 119-10+ Tuesday before undergoing a corrective bounce. This initial strength faded well into the Thursday close, keeping the outlook bearish for now. This week’s cycle lows have confirmed a resumption of the primary downtrend and an extension of the bearish price sequence of lower lows and lower highs. MA studies also point south and scope is for a move towards 119-04+, Dec 3 2018 low (cont). Key short-term trend resistance is at 123-04, the Mar 31 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.045 at 98.330

- Sep 22 -0.085 at 97.660

- Dec 22 -0.110 at 97.150

- Mar 23 -0.130 at 96.870

- Red Pack (Jun 23-Mar 24) -0.14 to -0.13

- Green Pack (Jun 24-Mar 25) -0.14 to -0.13

- Blue Pack (Jun 25-Mar 26) -0.135

- Gold Pack (Jun 26-Mar 27) -0.14 to -0.135

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00500 at 0.32229% (-0.00529/wk)

- 1 Month +0.04029 to 0.59433% (+0.08043/wk)

- 3 Month +0.01842 to 1.06271% (+0.05200/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00514 to 1.55671% (+0.01628/wk)

- 1 Year -0.02986 to 2.22157% (-0.05000/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $77B

- Daily Overnight Bank Funding Rate: 0.32% volume: $244B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.29%, $874B

- Broad General Collateral Rate (BGCR): 0.30%, $336B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $330B

- (rate, volume levels reflect prior session)

EGBs-GILTS CASH CLOSE: Curves Steepen Post-ECB

Yields finished higher Thursday following the ECB decision, ahead of European markets closure for a long weekend.

- The ECB decision didn't really change the status quo (emphasising a "flexible" approach to removing accommodation), and Bunds initially strengthened as it wasn't as hawkish as some had feared.

- But long-end yields started rising quickly in the closing minutes of Lagarde's press conference, largely tracking USTs. Short-end yields remained subdued.

- A couple of BBG/RTRS sources pieces signalling a Q3/July 25bp rate hike was still possible boosted 2Y Bund yields, but they remained lower on the day.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.7bps at 0.047%, 5-Yr is up 2.5bps at 0.574%, 10-Yr is up 7.6bps at 0.842%, and 30-Yr is up 11.4bps at 1.015%.

- UK: The 2-Yr yield is up 7.1bps at 1.56%, 5-Yr is up 7.5bps at 1.624%, 10-Yr is up 9bps at 1.889%, and 30-Yr is up 10.5bps at 2.051%.

- Italian BTP spread up 3.3bps at 164bps / Spanish up 0.2bps at 93.8bps

FOREX: Euro Plummets As ECB Bides Their Time, DXY Soars

- With no change in ECB policy rates nor the APP purchases schedule, markets were underwhelmed by the governing council’s commitment to optionality, gradualism and flexibility. As such, the Euro came under heavy pressure following both the statement release and price action extended throughout Lagarde’s press conference.

- This translated into EURUSD giving back the entirety of Wednesday’s advance and breaching the key 1.0806/09 support area and bear trigger for the pair. Additional headwinds arising from higher US yields and a firmer dollar index prompted the pair to make fresh 23-month lows at 1.0758.

- After the dust had settled the euro caught a late bid on an ECB sources story suggesting the governing council could still raise its interest rates in July, but policymakers agreed at a meeting on Thursday to keep their options open. EURUSD found relief from around 1.0775 to 1.0815 on the comments and is roughly where we reside approaching the long Easter weekend.

- As mentioned, the greenback performed well on Thursday overall, evident by the DXY (+0.65%) firming to fresh cycle highs at 100.76. This led the majority of the G10 complex lower with AUD, CAD, GBP all falling around half a percent but CHF the notable laggard, retreating 0.8%.

- Similarly, the firmer dollar and higher US yields weighed on the emerging market basket with the JPMorgan EM CCY Index falling 0.5%, led by MXN losses of around 1.00%.

- Despite widespread market closures tomorrow, US Empire State Manufacturing Index data is on the schedule. Focus then turns to Chinese growth data out early on Monday before another set of European holidays may keep impact overall market liquidity.

Friday-Monday Data Calendar

The only data to speak of for Monday is NAHB Housing Market Index at 1000ET

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/04/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/04/2022 | 0800/1000 |  | EU | ECB Professional Forecasters Survey | |

| 15/04/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 15/04/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/04/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 15/04/2022 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.