-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Bounce, Recession Flags Overblown?

EXECUTIVE SUMMARY

- MNI: Fed's Daly Watching For Impact From Global Tightening

- MNI: Daly Sees Neutral Fed Rate By Yearend, Smooth Rise Best

- MNI BRIEF: Fed's Evans Can See 50BP Hikes At Next Two Meetings

- RUSSIA IS IN POTENTIAL DEFAULT, SWAPS PANEL RULES, Bbg

US

FED: San Francisco Federal Reserve President Mary Daly sees interest rates reaching a neutral level of 2.5% by yearend before policymakers reassess what to do next, and said a smooth tightening path is the best way to avoid the risk of a recession while heading off entrenched inflation.

- "I see an expeditious march to neutral by the end of the year as a prudent path," she said Wednesday in the text of a speech. "Once accommodation is removed, we need to evaluate the effects-observe how financial conditions adjust, how much inflation recedes, and what more remains to be done to ensure a sustained expansion."

- "If we slam the brakes on the economy by adjusting rates too quickly or too much, we risk forcing unnecessary adjustments by businesses and households, potentially tipping the economy into recession," Daly said. "A smooth and methodical approach to policy will alert us to hazards along the way, prepare us for unexpected bumps in the road, and ultimately keep us moving forward-not just to our immediate destination, but to all of the destinations that follow."

- “You see central banks across the globe, many of them, not all of them, moving their policy adjustments so that they are no longer as accommodative as they were,” to get policy “more in line” with inflation targets, she said after a speech.

- “The global economy is struggling really with the same thing the U.S. economy is struggling with—high inflation,” she said on a call with reporters when asked about links between Fed tightening and the global economy. The lingering Covid pandemic and the war in Ukraine are also global issues putting “further pressure on supply chains,” she said.

FED: Chicago Federal Reserve President Charles Evans said Wednesday he could see 50bp interest-rate hikes at the next two meetings followed by quarter-point moves at the remaining decisions this year.

- "I'm open to doing 50-basis-point increases," Evans said. The equivalent of nine quarter-point hikes this year would bring borrowing costs to around a neutral level of 2.25%-2.5%, he said during a webinar.

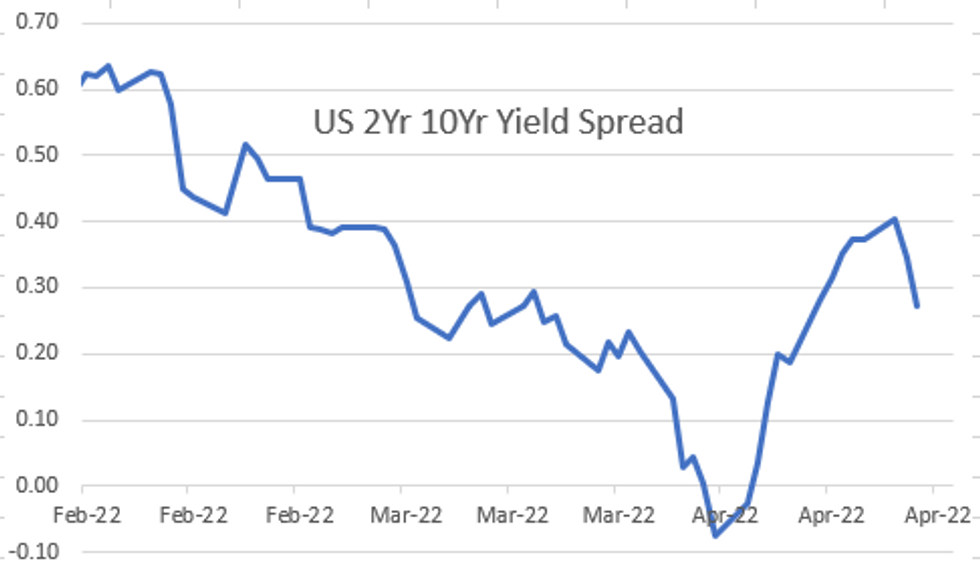

US TSYS: 2s10s Yield Curves 16Bp Off Early Tuesday Highs

Tsy futures trading mostly mostly higher through the day, curves flatter with long end outperforming, 30Y bonds bouncing back near second half highs, 30YY currently 2.8788% vs. 2.8635% low.- Curves bull flattened Wednesday (2s10s off early Tue's high of 42.897, currently -7.606 at 26.219) as short end remained under pressure -- pricing in two to three 50bp hikes over the next three FOMC meetings.

- Little react to in-line March reading of Existing Home Sales of 5.77M units annualized, or -2.7% MoM.

- Bond yield had climbed to new 3-year high of 3.0285% in early Asia hours before the Bank of Japan offered to conduct an unlimited purchase of Japanese Government Bonds (JGBs). That put the brakes on surge in yields as they retreated into the NY open.

- Adding impetus to the bid: Some trading desks citing surge in industrial production and housing starts that recession fears are overblown, and looking for longer futures to continue to rebound.

- Tsy futures gapped higher (30YY falls to 2.8874% low) after strong $16B 20Y note auction reopen (912810TF5) trades through with 3.095% high yield vs. 3.120% WI; 2.80x bid-to-cover vs. last month's 2.72x.

- Fed speak on tap Thu: Fed Chair Powell, ECB Pres Lagarde at IMF/global economy panel event at 1300ET. Fed Blackout midnight Friday.

OVERNIGHT DATA

- US NAR: MARCH EXISTING HOME SALES -2.7% TO 5.77M SAAR; -4.5% YOY

- NAR'S YUN: FED QT CONTRIBUTING TO HIGHER MORTGAGE SPREAD

- NAR'S YUN SEES HOME TRANSACTIONS -10% IN 2022 ON RISING RATES

- NAR'S YUN SEES HOME PRICE APPRECIATION SLOWING TO 5% BY DEC

FED: April Beige Book Summary

- Overall Economic Activity

- Economic activity expanded at a moderate pace since mid-February. Several Districts reported moderate employment gains despite hiring and retention challenges in the labor market. Consumer spending accelerated among retail and non-financial service firms, as COVID-19 cases tapered across the country.

- Manufacturing activity was solid overall across most Districts, but supply chain backlogs, labor market tightness, and elevated input costs continued to pose challenges on firms' abilities to meet demand. Vehicle sales remained largely constrained by low inventories.

- Economic activity expanded at a moderate pace since mid-February. Several Districts reported moderate employment gains despite hiring and retention challenges in the labor market. Consumer spending accelerated among retail and non-financial service firms, as COVID-19 cases tapered across the country.

- Labor Markets

- Employment increased at a moderate pace. Demand for workers continued to be strong across most Districts and industry sectors. But hiring was held back by the overall lack of available workers

- Employment increased at a moderate pace. Demand for workers continued to be strong across most Districts and industry sectors. But hiring was held back by the overall lack of available workers

- Prices

- Inflationary pressures remained strong since the last report, with firms continuing to pass swiftly rising input costs through to customers. Contacts across Districts, particularly those in manufacturing, noted steep increases in raw materials, transportation, and labor costs.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 299.28 points (0.86%) at 35211.42

- S&P E-Mini Future up 0.5 points (0.01%) at 4459.75

- Nasdaq down 147.4 points (-1.1%) at 13472.43

- US 10-Yr yield is down 8.9 bps at 2.8474%

- US Jun 10Y are up 9.5/32 at 119-13

- EURUSD up 0.0058 (0.54%) at 1.0846

- USDJPY down 1.12 (-0.87%) at 127.79

- WTI Crude Oil (front-month) up $0.19 (0.19%) at $102.75

- Gold is up $4.92 (0.25%) at $1955.17

- EuroStoxx 50 up 66.05 points (1.72%) at 3896.81

- FTSE 100 up 27.94 points (0.37%) at 7629.22

- German DAX up 208.57 points (1.47%) at 14362.03

- French CAC 40 up 90.12 points (1.38%) at 6624.91

US TSY FUTURES CLOSE

- 3M10Y -5.691, 201.81 (L: 196.063 / H: 210.57)

- 2Y10Y -7.429, 26.203 (L: 24.119 / H: 35.657)

- 2Y30Y -8.837, 30.67 (L: 28.613 / H: 41.365)

- 5Y30Y -5.682, 1.809 (L: 0.866 / H: 9.207)

- Current futures levels:

- Jun 2Y down 0.25/32 at 105-16.25 (L: 105-13.125 / H: 105-18.75)

- Jun 5Y up 2.75/32 at 112-26 (L: 112-13.25 / H: 112-30)

- Jun 10Y up 10.5/32 at 119-14 (L: 118-19.5 / H: 119-20.5)

- Jun 30Y up 1-14/32 at 140-29 (L: 138-14 / H: 141-11)

- Jun Ultra 30Y up 2-24/32 at 162-22 (L: 158-24 / H: 163-13)

US 10Y FUTURES TECH: (M2) Bearish Trend Structure

- RES 4: 123-04 High Mar 31 and a key resistance

- RES 3: 122-12+ High Apr 4

- RES 2: 121-09/12 High Apr 14 and a key resistance / 20-day EMA

- RES 1: 120-00+ High Apr 18

- PRICE: 119-10+ @ 1120ET Apr 20

- SUP 1: 118-19+ Intraday low

- SUP 2: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 117-22+ Low Nov 8 2018 (cont)

- SUP 4: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

Treasuries remain soft and have once again traded lower today, reaching a fresh cycle low of 118-19+. This confirms a resumption of the primary downtrend and an extension of the bearish price sequence of lower lows and lower highs. MA studies also point south and scope is for a move towards 118-02+ next, a Fibonacci projection. S/T gains are considered corrective. Initial firm resistance has been defined at 121-09, the Apr 14 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.045 at 98.255

- Sep 22 -0.050 at 97.525

- Dec 22 -0.025 at 97.020

- Mar 23 -0.025 at 96.70

- Red Pack (Jun 23-Mar 24) -0.015 to +0.010

- Green Pack (Jun 24-Mar 25) +0.010 to +0.030

- Blue Pack (Jun 25-Mar 26) +0.040 to +0.070

- Gold Pack (Jun 26-Mar 27) +0.080 to +0.090

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00871 at 0.33100% (+0.00114/wk)

- 1 Month +0.00686 to 0.63157% (+0.03714/wk)

- 3 Month +0.03800 to 1.13629% (+0.07358/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.06743 to 1.67457% (+0.11786/wk)

- 1 Year +0.06629 to 2.36886% (+0.14729/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $70B

- Daily Overnight Bank Funding Rate: 0.32% volume: $263B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.28%, $895B

- Broad General Collateral Rate (BGCR): 0.30%, $342B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $327B

- (rate, volume levels reflect prior session)

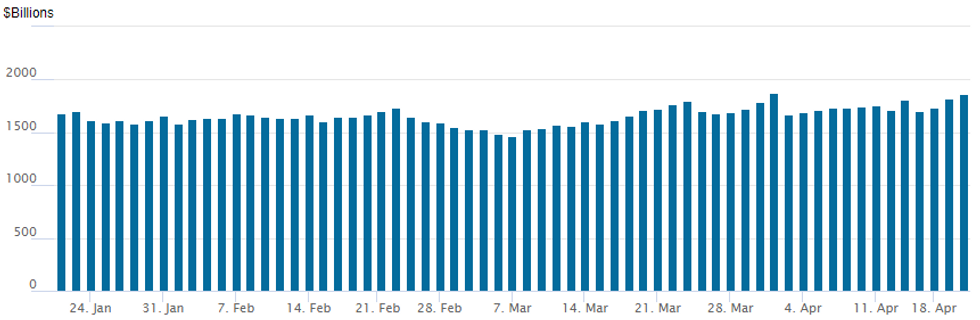

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,866.560B w/ 93 counterparties from prior session 1,817.929B. Compares to all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $5B VICI 5Pt Launched

$18B To Price Wednesday:- Date $MM Issuer (Priced *, Launch #)

- 04/20 $5B #VICI Properties $500M 3Y +160, $1.25B +5Y +190, $1B +7Y +210, $1.5B 10Y +230, $750M 30Y +275

- 04/20 $4B #CSL Finance $500M 5Y +100, $500M 7Y +120, $1B 10Y +145, $500M 20Y +155, $1B 30Y +185, $500M 40Y +205

- 04/20 $4B *ADB $3B 3Y SOFR+22, $1B 10Y SOFR+47

- 04/20 $3.5B *Canada 3Y +9

- 04/20 $1B #Fifth Third Bancorp $40M 6NC5 +118, $600M 11NC10 +148

- 04/20 $500M #Jabil 5Y +148

- On tap for Thursday:

- 04/21 $Benchmark KFW 5Y SOFR+33a

- 04/21 $Benchmark Development Bank of Japan 5Y SOFR+58a

FOREX: G10 Currencies Supported Amid Greenback Weakness, CNH The Outlier

- As yields in the US reversed the entirety of yesterday’s move higher, the US dollar echoed the price action, trading with an offered tone throughout Wednesday. The USD index is set to snap a four-day winning streak, having retreated 0.62% as we approach the APAC crossover.

- Greenback weakness lent support to the majority of other G10 currencies, with particularly impressive rallies for the likes of AUD, CAD and NZD, all rising over 1% amid another solid day for major equity benchmarks. In particular, the Canadian dollar was provided with an additional tailwind following above expectation CPI figures for March. This prompted various sell-side institutions to adjust their BOC rate calls with a Scotiabank analyst citing there is a solid case for a 75-100bp single hike in June.

- USDCAD’s recent move lower has threatened a bullish theme and highlights the fact that price has so far failed to remain above the 50-day EMA. Note that the Apr 13 session appears to be a bearish engulfing candle, which if correct, highlights a reversal. The breach of both 1.2522, Apr 14 low and 1.2479, Apr 6 low are additional bearish developments.

- USDJPY remains extremely volatile and following another overnight cycle high print of 129.40, the pair has sharply retraced. Worth noting the pair came within four pips of touted Fibonacci projection resistance and aided by the broad dollar weakness, the pair now resides back below the 128 mark.

- The Chinese Yuan was the clear outlier on Wednesday – weaker by almost half a percent. CNH weakness comes as an extension from price action on Tuesday and price action has been exacerbated by technical breaks of both the 200day MA and long-term downward trendline as indicated below.

- New Zealand CPI highlights the overnight data releases before the final reading of Eurozone CPI. Philly Fed Manufacturing Index and Initial Jobless Claims are on the US docket before potential comments from Fed, ECB and BoE Governors as they participate in panel discussions at the Spring meetings of the IMF.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/04/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 21/04/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 21/04/2022 | - |  | EU | ECB Lagarde & Panetta in IMF/World Bank Meetings | |

| 21/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 21/04/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/04/2022 | 1300/1400 |  | UK | BOE Mann Speaks at BOE Webinar | |

| 21/04/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 21/04/2022 | 1500/1100 |  | US | Fed Chair Jerome Powell | |

| 21/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 21/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 21/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 21/04/2022 | 1630/1730 |  | UK | BOE Bailey at Peterson Institute Event | |

| 21/04/2022 | 1630/1230 |  | US | St. Louis Fed's James Bullard | |

| 21/04/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 21/04/2022 | 1700/1300 |  | US | Fed Chair Jerome Powell | |

| 21/04/2022 | 1700/1900 |  | EU | ECB Lagarde at IMF Debate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.