-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: No Recession Through 2023?

EXECUTIVE SUMMARY

- MNI BRIEF: Freeland Confident In BOC Amid Global Inflation

- St. Louis Fed’s Bullard Doesn’t See Recession This Year or Next, Bbg

US

US-JAPAN: Pres Biden Continues ROK Tour Before Japanese Defense Announcement

- President Biden will conclude his tour of South Korea tomorrow before travelling to Japan for a meeting with Japanese Prime Minister Fumio Kishida after which Kishida is expected to announce a significant increase in Japanese defense spending.

- Western newswires have picked up a story from Japanese broadcaster Asahi reporting that Kishida will consider doubling defense spending to the 2% of GDP baseline of NATO members.

- Nikkei Asia: 'With war raging in Ukraine and tensions rising in East Asia, former Prime Minister Shinzo Abe warned that Japan will become a "laughing stock" if it doesn't lift its defense budget in line with NATO countries.'

- In Tokyo, Biden will also officially unveil the Indo-Pacific Economic Framework. The new scheme to boost US economic presence in the region and counter China's influence has received a lukewarm reception in Asia.

- Andrew Haffner of Al Jazeera writes: 'While many of China's regional neighbours share Washington's concerns about the burgeoning superpower's ambitions, the IPEF's lack of clear trade provisions could make it an uninspiring prospect for potential members, especially in Southeast Asia.'

CANADA

Canadian Finance Minister Chrystia Freeland said Friday she's confident in the independent work of the national central bank. Freedland spoke after a leading opposition lawmaker said Governor Tiff Macklem should be fired.

- Speaking on a call with reporters from a G7 meeting in Germany, Freeland referenced a global jump in prices linked to things such as the Ukraine war and said the independence of the central bank has served Canada well for decades.

US TSYS: Risk Off or Forced Unwinds Run Course? Stock Rebound Late

No data Friday -- But StL Fed President did appear on Fox Business interview in the afternoon. Nothing particularly new from Bullard though he did add he does not see a recession occurring this or next year.

- Bullard said he would leave the "timing" of when to hike rates up to Powell, but sees 50bp hike as a "good plan for now" while "the more we can frontload" hikes, the "better off we'll be." Bullard said he sees economic growth accelerating in the second half of the year to appr 2.5-3.0%, while unemployment will continue to recede.

- Early focus on headline risk with buying/short cover support possibly tied to China/covid headlines (CHINA PORT CITY TIANJIN STARTS MASS TEST IN FIVE DISTRICTS, Bbg).

- Decent overall volumes tied to accelerating Jun/Sep Tsy futures rolling, 5s and 10s lead again w/ over 240k and 175k recorded after the bell.

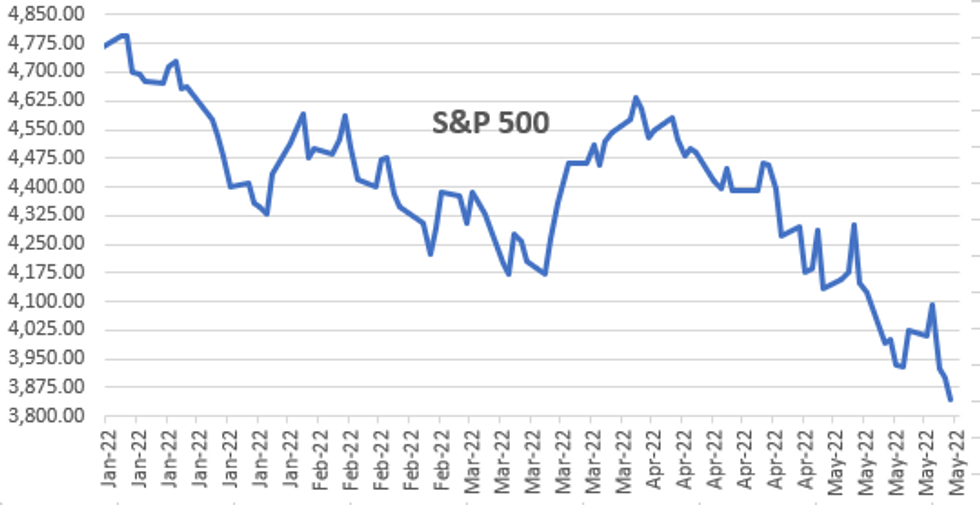

- Investment-grade corporate credit risk had climbed to new 2Y highs after midday as equity indexes sell-off. Back to March 2021 levels SPX eminis now appr 20% off early Jan high (4778.0) at 3829.00 (-68.75) after breaching key support / bear trigger levels of 3855.00, May 12 low AND 3843.25, the Mar 25 2021 low (cont).

- Equities staged a robust rebound off lows in late equity trade, not headline driven, more program/technical while offers fade, SPX eminis nearly back to steady at 3897.75.

OVERNIGHT DATA

No data Friday, resume Monday:- US Data/Speaker Calendar (prior, estimate)

- May-23 0830 Chicago Fed Nat Activity Index (44.0, --)

- May-23 1130 US Tsy $45B 13W, $42B 26W bill auctions

- May-23 1200 Atlanta Fed Bostic economic outlook, no text, moderated Q&A

- May-23 1930 KC Fed George, agricultural symposium, moderated Q&A

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 7.45 points (0.02%) at 31260.58

- S&P E-Mini Future up 6.5 points (0.17%) at 3904.25

- Nasdaq down 33.9 points (-0.3%) at 11354.62

- US 10-Yr yield is down 5.1 bps at 2.7865%

- US Jun 10Y are up 13/32 at 120-3.5

- EURUSD down 0.0033 (-0.31%) at 1.0555

- USDJPY up 0.08 (0.06%) at 127.87

- WTI Crude Oil (front-month) up $1.02 (0.91%) at $113.23

- Gold is up $2.91 (0.16%) at $1844.69

- EuroStoxx 50 up 16.48 points (0.45%) at 3657.03

- FTSE 100 up 87.24 points (1.19%) at 7389.98

- German DAX up 99.61 points (0.72%) at 13981.91

- French CAC 40 up 12.53 points (0.2%) at 6285.24

US TSY FUTURES CLOSE

- 3M10Y -4.228, 175.027 (L: 173.035 / H: 182.476)

- 2Y10Y -2.267, 20.078 (L: 19.539 / H: 23.761)

- 2Y30Y -2.707, 41.057 (L: 40.21 / H: 44.891)

- 5Y30Y -1.737, 19.162 (L: 18.138 / H: 21.638)

- Current futures levels:

- Jun 2Y up 2.375/32 at 105-24.75 (L: 105-20.5 / H: 105-26.25)

- Jun 5Y up 7/32 at 113-11.5 (L: 112-31.75 / H: 113-13.75)

- Jun 10Y up 15.5/32 at 120-6 (L: 119-16 / H: 120-08.5)

- Jun 30Y up 1-08/32 at 141-27 (L: 140-07 / H: 142-01)

- Jun Ultra 30Y up 2-0/32 at 158-14 (L: 155-28 / H: 158-29)

US 10Y FUTURES TECH: (M2) Monitoring Resistance

- RES 4: 122-12+ High Apr 4

- RES 3: 121-09 High Apr 14

- RES 2: 121-00 50-day EMA

- RES 1: 120-010/120-18+ High May 19 / High Apr 27

- PRICE: 119-19+ @ 11:13 BST May 20

- SUP 1: 118-16/117-08+ Low May 18 / Low May 9 and a bear trigger

- SUP 2: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 116-22+ 2.0% 10-dma envelope

- SUP 4: 116.00 Round number support

Treasuries traded higher Thursday and above 120-00+, May 12 high. The contact however failed to hold on to the session high. The trend direction is down and gains are still considered corrective. Any resumption of strength however would open 120-18+, the Apr 27 high. This level represents an important short-term resistance where a break would signal scope for a stronger retracement. Key support and bear trigger is 117-08+, May 9 low.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.008 at 98.193

- Sep 22 +0.025 at 97.390

- Dec 22 +0.020 at 96.880

- Mar 23 +0.030 at 96.730

- Red Pack (Jun 23-Mar 24) +0.065 to +0.10

- Green Pack (Jun 24-Mar 25) +0.080 to +0.095

- Blue Pack (Jun 25-Mar 26) +0.065 to +0.080

- Gold Pack (Jun 26-Mar 27) +0.065 to +0.085

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00471 to 0.82471% (-0.00100/wk)

- 1M +0.01286 to 0.97357% (+0.08686/wk)

- 3M +0.00157 to 1.50643% (+0.06272/wk) * / **

- 6M +0.04000 to 2.06557% (+0.07057/wk)

- 12M +0.02400 to 2.73000% (+0.07786wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.50486% on 5/19/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $76B

- Daily Overnight Bank Funding Rate: 0.82% volume: $257B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.79%, $982B

- Broad General Collateral Rate (BGCR): 0.79%, $358B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $344B

- (rate, volume levels reflect prior session)

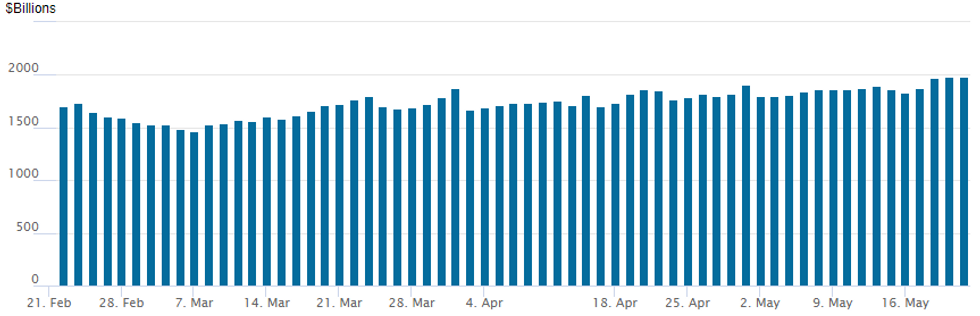

FED Reverse Repo Operation, Third Consecutive New High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new all-time high of 1,987.987B w/ 89 counterparties vs. Thursday's prior record $1,981.005B.

EGBs-GILTS CASH CLOSE: Periphery Spreads Widen Sharply

German bonds outperformed their UK counterparts Friday, with steepening in both curves - though periphery weakness took centre stage.

- With no particular catalyst evident, periphery spreads widened sharply: 10Y BTPs out 10bp to close above 200bp (though just shy of the May high); GGBs underperformed, nearly 18bp wider and starting to threaten the April 2020 wides.

- Gilt and Bund yields faded earlier highs in the afternoon as stocks came off their highs. UK underperformed as BoE hike pricing rose following stronger-than-expected data this week and analyst hike projection upgrades.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 3bps at 0.342%, 5-Yr is down 3.7bps at 0.655%, 10-Yr is down 0.5bps at 0.944%, and 30-Yr is up 4.6bps at 1.116%.

- UK: The 2-Yr yield is up 1.6bps at 1.507%, 5-Yr is up 1.7bps at 1.603%, 10-Yr is up 2.8bps at 1.893%, and 30-Yr is up 3.6bps at 2.13%.

- Italian BTP spread up 10bps at 205.5bps / Greek up 17.8bps at 277.7bps

FOREX: Greenback Trades On Surer Footing As Equities Resume Decline

- The US dollar edged higher throughout the US trading session as risk-off sentiment prevailed across global equity benchmarks approaching the close on Friday.

- G10 currency volatility remained subdued throughout the final trading day of the week as the focus remained on the sharp turnaround in equities as the S&P 500 registered a 20% decline from January’s high, set to enter bear market.

- EURUSD fell just shy of Thursday’s high above 1.0600, with the single currency losing steam and settling back to trade at 1.0550, but retaining ~1.5% gains for the week.

- Equity weakness weighed on the Australian dollar with AUDUSD retreating 0.5%. NOK was the poorest performing G10 ccy, down 0.94% against the greenback, erasing around half of the prior day’s advance.

- German IFO data kicks off Monday’s data calendar with Canada out for a local holiday. Also, potential comments from Bank of England Governor Bailey. He is due to participate in a panel discussion titled "Monetary policy, policy interaction and inflation in a post-pandemic world with severe geopolitical tensions" at the Oesterreichische National Bank Annual Economic Conference, in Vienna.

- European flash PMI’s hit on Tuesday with the RBNZ meeting and FOMC minutes highlights throughout the week.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/05/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 23/05/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 23/05/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 23/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 23/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/05/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/05/2022 | 1615/1715 |  | UK | BOE Governor Bailey Panels Discussion |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.