-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Atl Fed Bostic Comfortable w/ 50Bp Hikes

EXECUTIVE SUMMARY

- MNI: US Inflation Has Become More Persistent -SF Fed Paper

- MNI: US/ASIA Quad Summit Provides Opportunity For Informal Bilateral Talks

- Atlanta Fed Bostic: COMFORTABLE WITH 50 BPS HIKES NEXT COUPLE OF MEETINGS .. OPEN TO MOVING MORE AGGRESSIVELY IF INFLATION HIGHER, Bbg

US

FED: Persistent factors have become more important drivers of U.S. inflation in recent months, which could call for a "stronger and longer-lasting policy response," a Federal Reserve Bank of San Francisco paper said Monday.

- Using a 10-year rolling average measure, the paper found a rise in the persistence of inflation levels and inflation changes starting in mid-2019, nearly a year before the Covid-19 pandemic. By March 2022, "persistent shocks to inflation are about twice as volatile as transitory shocks," Fed economists Kevin Lansing wrote. "This result implies that persistent shocks are the more important driver of recent inflation movements."

- It's also increasingly likely that longer-run inflation has drifted up, he added.

- "The prospect that recent elevated inflation is being driven by persistent shocks raises the risk that inflation will remain above 2% for a longer period. In such an environment, a strong and long-lasting policy response may be needed to achieve the Federal Reserve’s goal of 2% average inflation over time," Lansing said.

- 09:20 ET 02:20 BST: Quad Leaders 'family photo'

- 09:30 ET 02:30 BST: Quad Leaders' Summit with President Biden of the United

- States, Prime Minister Kishida Fumio of Japan, Prime Minister Narendra Modi of India, and Prime Minister Anthony Albanese of Australia begins

- 11:30 ET 04:30 BST: Quad Leaders launch the 'Quad Fellowship'

- 11:45 ET 04:45 BST: Quad Leaders working lunch

- US National Security Advisor Jake Sullivan has confirmed that US President Joe Biden will engage in informal bilateral talks with the other leaders on the sidelines of the summit.

- The Quad summit will be the first diplomatic engagement of incoming Australian Prime Minister Anthony Albanese.

- Japanese Prime Minister Fumio Kishida is expected to use the summit to announce a significant increase in the country's defence budget.

- Indian Prime Minister Narendra Modi will likely resist calls from President Biden to increase cooperation with the G7 in anti-Russia measures.

- China has called the Quad the 'pacific NATO' and much of the Quad agenda will be concerned with countering Chinese influence in the region.

US TSYS: 30YY Comfortably Over 3% Again

Rates finished broadly weaker Monday, near session lows on deceptively robust volumes (TYM2> 1.5M, FVM2>1.4M) for an otherwise quiet session. Yield curves bear steepened with bonds leading the sell-off, 30YY comfortably above 3% at 3.0696% (+.0837) after the close. Robust futures volumes tied to increase in Jun/Sep rolls ahead May 31 First Notice w/ FVM/FVU near 600k by the close.- Rates extended lows prior to positive but not market moving April Chicago Fed National Activity Index 0.47 vs. 0.50 est (March down-revision to 0.36 from 0.44).

- Otherwise, no obvious headline driver or block print to explain the initial move save carry-over risk-on tone with banks leading the rally in stock indexes: (JPM and Citi +7.12%, Bank of America +6.38%).

- Nothing new from Atlanta Fed Bostic as he commented on economic outlook: COMFORTABLE WITH 50 BPS HIKES NEXT COUPLE OF MEETINGS .. OPEN TO MOVING MORE AGGRESSIVELY IF INFLATION HIGHER, Bbg

- Tuesday focus:

- S&P Global US Mfg PMI (59.2, 57.7), Services PMI (55.6, 55.2) and Composite PMI (56.0, 55.7) at 0945ET; May-24 1000 Richmond Fed Mfg Index (14, 10) and New Home Sales (763k, 750k); MoM (-8.6%, -1.7%) at 1000ET.

- Fed Chair Powell recorded open remarks eco-summit, text, no Q&A at 1220ET

- US Tsy $47B 2Y note auction (91282CER8) at 1300ET

OVERNIGHT DATA

The April Chicago Fed National Activity Index came in at a below-expected 0.47 (0.50 survey) vs 0.36 prior (revised down from 0.44).

- Since a zero value is associated with growth at its historical trend, the April report suggests that US growth was above-trend in April (as has been the case since October 2021).

- The report notes that "Sixty-two of the 85 individual indicators made positive contributions to the CFNAI in April, while 23 made negative contributions. Forty-seven indicators improved from March to April, while 37 indicators deteriorated and one was unchanged."

- This isn't a market-moving data point, since it's based on data that has already been released - but its modest uptick in April helps confirm the broader narrative that the US economy was growing at a decent pace to begin Q2, with production-related indicators doing much of the heavy lifting.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 618.74 points (1.98%) at 31880.64

- S&P E-Mini Future up 73.75 points (1.89%) at 3973.25

- Nasdaq up 180.7 points (1.6%) at 11535.27

- US 10-Yr yield is up 8.3 bps at 2.8641%

- US Jun 10Y are down 19/32 at 119-17

- EURUSD up 0.0122 (1.15%) at 1.0686

- USDJPY up 0.04 (0.03%) at 127.91

- WTI Crude Oil (front-month) up $0.07 (0.06%) at $110.36

- Gold is up $6.9 (0.37%) at $1853.38

- EuroStoxx 50 up 51.36 points (1.4%) at 3708.39

- FTSE 100 up 123.46 points (1.67%) at 7513.44

- German DAX up 193.49 points (1.38%) at 14175.4

- French CAC 40 up 73.5 points (1.17%) at 6358.74

US TSY FUTURES CLOSE

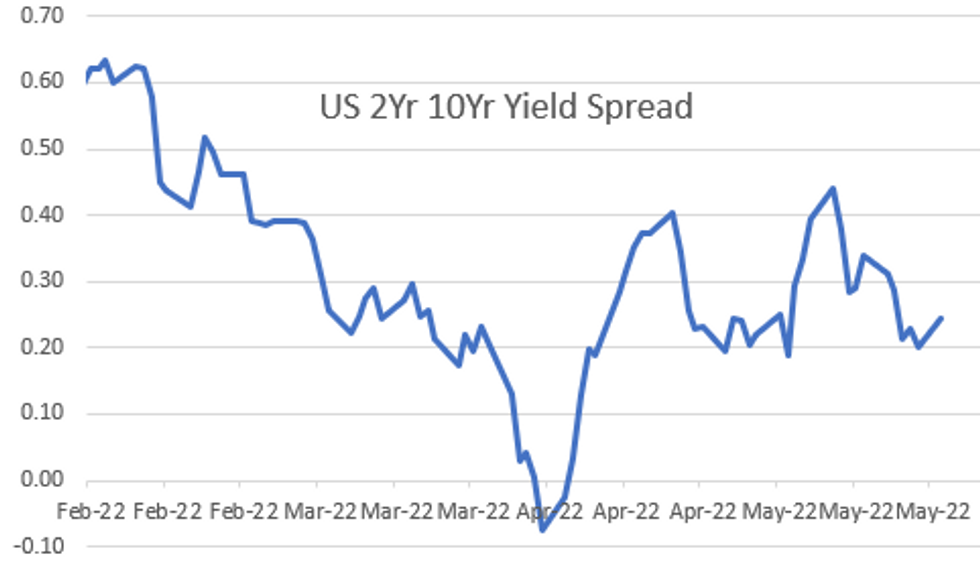

- 3M10Y +8.732, 183.429 (L: 173.737 / H: 183.683)

- 2Y10Y +4.501, 23.926 (L: 18.013 / H: 24.134)

- 2Y30Y +4.811, 44.794 (L: 37.57 / H: 45.293)

- 5Y30Y +0.907, 19.316 (L: 16.559 / H: 20.25)

- Current futures levels:

- Jun 2Y down 2.125/32 at 105-22.375 (L: 105-20.75 / H: 105-24.375)

- Jun 5Y down 11.75/32 at 112-30.75 (L: 112-29.75 / H: 113-10.5)

- Jun 10Y down 19/32 at 119-17 (L: 119-15.5 / H: 120-03.5)

- Jun 30Y down 1-21/32 at 140-4 (L: 140-03 / H: 141-22)

- Jun Ultra 30Y down 2-25/32 at 155-17 (L: 155-13 / H: 158-10)

US 10Y FUTURES TECH: (M2) Holding On To Last Week’s Gains

- RES 4: 122-12+ High Apr 4

- RES 3: 121-09 High Apr 14

- RES 2: 120-31 50-day EMA

- RES 1: 120-10/120-18+ High May 19 / High Apr 27

- PRICE: 119-28 @ 11:18 BST May 21

- SUP 1: 118-16/117-08+ Low May 18 / Low May 9 and a bear trigger

- SUP 2: 116-30 2.0% 10-dma envelope

- SUP 3: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

- SUP 4: 116.00 Round number support

Treasuries last week traded above 120-00+, May 12 high, and the contract is holding on to its recent gains. The primary trend direction is down though and gains are still considered corrective. Any resumption of strength would open 120-18+, the Apr 27 high. This level represents an important short-term resistance where a break would signal scope for a stronger retracement. Key support and the bear trigger is 117-08+, May 9 low.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.008 at 98.188

- Sep 22 -0.025 at 97.365

- Dec 22 -0.035 at 96.840

- Mar 23 -0.040 at 96.685

- Red Pack (Jun 23-Mar 24) -0.08 to -0.045

- Green Pack (Jun 24-Mar 25) -0.09 to -0.085

- Blue Pack (Jun 25-Mar 26) -0.085 to -0.075

- Gold Pack (Jun 26-Mar 27) -0.075 to -0.075

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00157 to 0.82314% (-0.00100 total last wk)

- 1M +0.03214 to 1.00571% (+0.08686 total last wk)

- 3M +0.01743 to 1.52386% (+0.06272 total last wk) * / **

- 6M -0.00371 to 2.06186% (+0.07057 total last wk)

- 12M -0.01200 to 2.71800% (+0.07786 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.52386% on 5/23/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $82B

- Daily Overnight Bank Funding Rate: 0.82% volume: $261B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $943B

- Broad General Collateral Rate (BGCR): 0.79%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $346B

- (rate, volume levels reflect prior session)

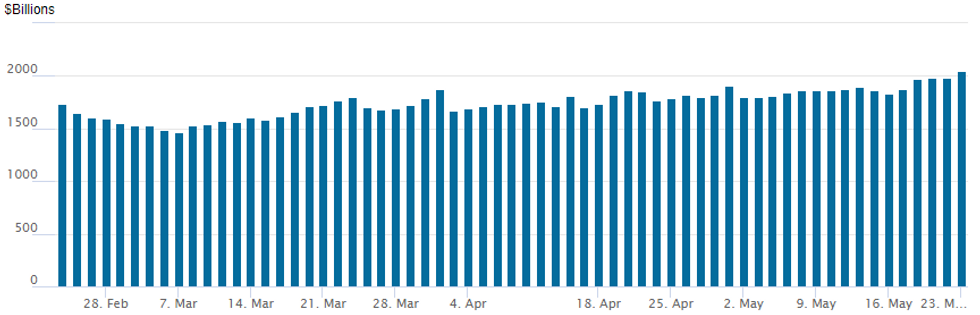

FED Reverse Repo Operation, Fifth Consecutive New High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new all-time high of 2,044.658B w/ 94 counterparties vs. last Friday's record $1,987.987B.

EGBs-GILTS CASH CLOSE: Lagarde Sets The Path To September

European yields rose Monday, with Gilts outperforming Bunds (reversing morning underperformance vs Germany in the afternoon as equity gains accelerated).

- ECB President Lagarde set a hawkish tone for the session with her unusually explicit forward guidance in a morning blog post. She confirmed that a July hike was on the cards, with rates exiting negative territory by end-Q3.

- A BBG sources piece in the afternoon said some officials were dismayed by the effective ruling out of a 50bp hike option for now; little market reaction.

- BTP spreads tightened, having initially reacted negatively to Lagarde's comments.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 7.9bps at 0.421%, 5-Yr is up 8.3bps at 0.738%, 10-Yr is up 7.3bps at 1.017%, and 30-Yr is up 8.2bps at 1.198%.

- UK: The 2-Yr yield is up 6.5bps at 1.572%, 5-Yr is up 6.6bps at 1.669%, 10-Yr is up 7.7bps at 1.97%, and 30-Yr is up 5.5bps at 2.185%.

- Italian BTP spread down 4bps at 201.7bps / Greek down 5.4bps at 272.4bps

FOREX: Greenback Under Pressure As EURUSD Breaks Resistance

- The US Dollar has been on the backfoot from the open and the USD index is around 1% lower on Monday. US yields are higher on the day, however, markets continue to consider the lowering yield differentials last week that has halted the greenback rally for now.

- Adding to the USD pressure, the early mover in FX was in late Asia trade, with USDCNY and USDCNH falling close to 3 big figures, after Biden said that Chinese tariffs imposed by the Trump administration were under consideration.

- Furthermore, comments from ECB President Lagarde via a blog post provoked some very supportive price action for the single currency. Lagarde stated “we are likely to be in a position to exit negative interest rates by the end of the third quarter.” The comments have prompted some sell-side analysts to indicate the next steps for the ECB have been ‘rubber stamped’ with likely 25bp hikes in both July and September.

- Following EURUSD clearing the 20-day EMA at 1.0570 overnight, technical conditions had suggested scope for a stronger short-term recovery which has manifested following a print above key resistance at 1.0642, the May 5 high.

- The current bull cycle started at 1.0350, May 13 low and from the base of a bear channel, drawn from the Feb 10 high. The channel top intersects at 1.0857 and is a potential short-term objective. Initial support is at 1.0533, May 20 low.

- In similar vein, the next upside target for Cable is at 1.2600, followed by 1.2638 High May 4 and a key resistance.

- Focus in the euro area tomorrow remains on economic sentiment surveys with the key preliminary PMIs for May due. Highlights for the week remain Wednesday’s RNBZ meeting/decision as well as the release of the FOMC minutes.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/05/2022 | 2330/1930 |  | US | Kansas City Fed's Esther George | |

| 24/05/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 24/05/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 24/05/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/05/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/05/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/05/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/05/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/05/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/05/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/05/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/05/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 24/05/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 24/05/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 24/05/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/05/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/05/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/05/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 24/05/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 24/05/2022 | 1620/1220 |  | US | Fed Chair Jerome Powell | |

| 24/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/05/2022 | 1715/1815 |  | UK | BOE Tenreyro Panels Discussion | |

| 24/05/2022 | 1800/2000 |  | EU | ECB Lagarde Opens World Economic Forum Dinner |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.