-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Late Month-End Volatility

EXECUTIVE SUMMARY

- MNI: Oil Embargo To Lower EU Growth Outlook - Officials

- MNI ENERGY SECURITY: Dutch PM Rutte Says Hungary Won't Be Backdoor For Russian Oil

- MNI OPEC+: WSJ Reports OPEC Weighs Suspending Russia from Oil-Production Deal

- MNI ECB: Kazimir Keeps 50bps on Table for September

EUROPE

ECB: Reuters runs headlines from ECB's Kazimir:

- EXPECTS 25 BPS RATE HIKE IN JULY BUT OPEN TO DISCUSSING 50 BPS MOVE, POSSIBLY IN SEPT, GIVEN RECORD INFLATION

- NEUTRAL RATE IS CLOSER TO 2% THAN 1%, IT WILL TAKE AROUND 200 BPS OF RATE HIKES TO GET TO NEUTRAL

- INFLATION WILL STAY OVER TARGET IN 2024, POSSIBLY RETURN TO TARGET IN 2025. Comments from Kazimir infitting with his moderately hawkish stance - he votes at the upcoming June, July and September meetings. Had previously argued in favour of exiting negative interest rate policy "within a year at the latest"

EU: The European Union’s planned embargo on Russian oil will push up energy prices and send the bloc’s economy closer to the adverse scenario included in the European Commission’s Spring forecasts, which foresee growth this year of around 1.5%, EU sources told MNI.

- In the adverse scenario, annual GDP growth rates for 2022 and 2023 are estimated to be 1¼ and ½ percentage points below the baseline forecasts for 2.7% and 2.3% growth in 2022 and 2023 respectively. Inflation is estimated to stand ¾ and ½ pps above the forecast baseline of 6.1% in 2022 and 2.7% in 2023. For more see MNI Policy main wire at 1014ET.

ENERGY SECURITY: Dutch PM Rutte Says Hungary Won't Be Backdoor For Russian Oil. Dutch Prime Minister Mark Rutte has told journalists in Brussels that he's satisfied by guarantees put in place in the EU oil embargo that Russian pipeline oil entering Hungary won't flood the single market.

- Rutte: 'The countries making use of the exemptions for pipeline oil aren't allowed to export it to other countries.'

- A short time ago at the EU Council, French President Emmanuel Macron said he hasn't ruled out pursuing a Russia gas ban.

- Macron: 'We have to keep credibility and this strategic ambiguity is also useful.'

- Dave Keating of France 24 says: '...privately energy industry insiders & EU sources tell me at this time there is almost no chance of an EU embargo on Russian gas.'

- Exempting Russia from its oil-production targets could potentially pave the way for Saudi Arabia, the United Arab Emirates and other producers in the Organization of the Petroleum Exporting Countries to pump significantly more crude, something that the U.S. and European nations have pressed them to do as the invasion of Ukraine sent oil prices soaring above $100 a barrel.

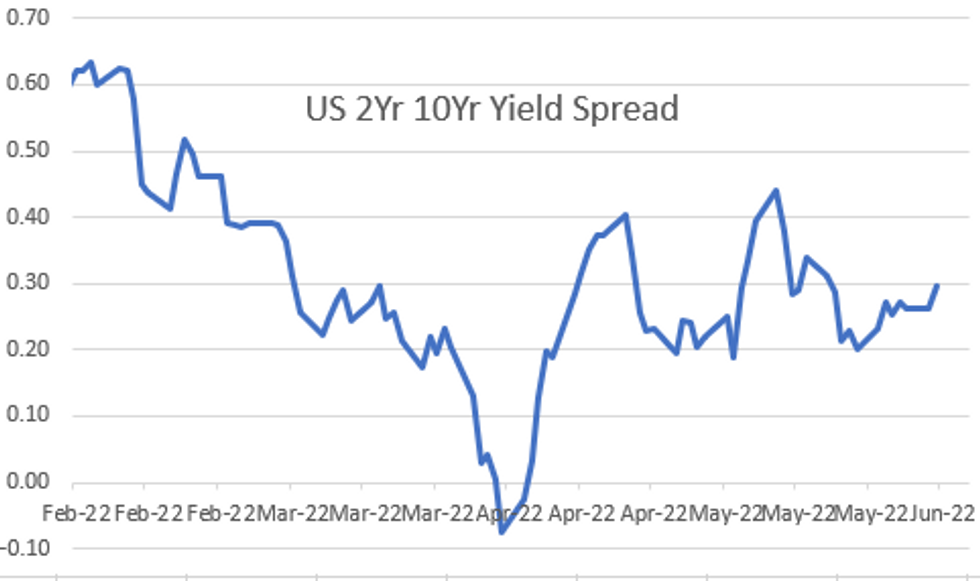

US TSYS: Pricing In Rate Hikes While Yld Curves Bear Steepen

Tsys trading weaker after the bell, near middle of session range, 30YY at 3.0607% (+.0972) after the bell vs. 3.0820H. Yield curves bear steepening (2s10s +5.745 at 31.543; 5s10s +2.190 at 4.056).- Early pressure in FI mkts tied to several factors focused on rate hikes to combat rising inflation: Initial pressure appr two hours after Asia open came from WH statement US Pres Biden will meet with Fed Chair Powell today to discuss economy and inflation. WH spokesman Deese did not reveal anything new at the late session presser, but underscored Pres Biden/Chair Powell's focus in reducing inflation.

- Though oil prices receded late, trading desks also cited higher crude levels (see 1526 and 1442ET bullets) and record Eurozone inflation figures (consumer prices +8.1% vs. +7.8% est).

- Little react to earlier data: FHFA HPI Q/Q SA +4.6% vs. +18.7% Q1 2021, US May Consumer Confidence: 106.4 vs. 103.6 estimate but lower than last month's 107.3.

- Latest Chicago Business BarometerTM found supply chain disruptions to have worsened in May with offshore sourcing the key driver. bi-monthly special question of whether firms were seeing easing up in supply blockages found the majority of respondents were not seeing any easing of supply chain disruptions (61.7%), followed by just under a third experiencing some easing (31.9%).

OVERNIGHT DATA

- US Q1 FHFA HPI Q/Q SA +4.6% V +18.7% Q1 2021

- US MAR FHFA HPI SA +1.5% V +1.9% FEB; +19.0% Y/Y\

- US MAY CONSUMER CONFIDENCE AT 106.4; EST. 103.6

- MNI MAY CHICAGO BUSINESS BAROMETER 60.3 VS 56.4 APR

- MNI CHICAGO: MAY PRICES PAID HIGHER AT 88.6 VS 86.1 APR

- MNI CHICAGO: MAY EMPLOYMENT AT 46.1 VS 45.5 APR

- MNI CHICAGO: MAY PRODUCTION 60.9 VS 50.9 APR

- MNI CHICAGO SURVEY PERIOD MAY 2 TO MAY 17

US DATA: Chicago PMI Sees Supply Chains Worsen in May. This month's Chicago Business BarometerTM found supply chain disruptions to have worsened in May with offshore sourcing the key driver.

- The bi-monthly special question of whether firms were seeing easing up in supply blockages found the majority of respondents were not seeing any easing of supply chain disruptions (61.7%), followed by just under a third experiencing some easing (31.9%). 4.2% continued to be unaffected, whilst only 2.1% of firms confirmed improvements in supply chain blockages.

- The New York Fed's Global Supply Chain Pressure Index (GSCPI) saw renewed strains in April following easing pressures over the previous four months. This was largely due to shortages and delays caused by China's lockdowns.

- Looking forward, in a government statement on Sunday, easing of Shanghai's lockdown was announced along with measures to reignite growth. Although production is likely to pick up again, container ship backlogs will require longer to ease.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 147.59 points (-0.44%) at 32983.9

- S&P E-Mini Future down 15.25 points (-0.37%) at 4127.75

- Nasdaq down 18.9 points (-0.2%) at 12049.03

- US 10-Yr yield is up 11.2 bps at 2.8495%

- US Sep 10Y are down 24/32 at 119-12.5

- EURUSD down 0.0049 (-0.45%) at 1.0734

- USDJPY up 0.96 (0.75%) at 128.64

- WTI Crude Oil (front-month) up $1.88 (1.63%) at $115.55

- Gold is down $12.63 (-0.68%) at $1840.31

- EuroStoxx 50 down 52.41 points (-1.36%) at 3789.21

- FTSE 100 up 7.6 points (0.1%) at 7607.66

- German DAX down 187.63 points (-1.29%) at 14388.35

- French CAC 40 down 93.59 points (-1.43%) at 6468.8

US TSY FUTURES CLOSE

3M10Y +13.566, 179.605 (L: 171.204 / H: 180.003)

2Y10Y +5.357, 31.155 (L: 23.312 / H: 30.891)

2Y30Y +5.007, 53.371 (L: 43.597 / H: 53.371)

5Y30Y +1.864, 26.296 (L: 18.779 / H: 25.294)

Current futures levels:

Sep 2Y down 3.125/32 at 105-17.125 (L: 105-14.25 / H: 105-21.25)

Sep 5Y down 13/32 at 112-29.25 (L: 112-24.5 / H: 113-13)

Sep 10Y down 1-13/32 at 119-05 (L: 119-03.5 / H: 120-08)

Sep 30Y down 2-0/32 at 138-30 (L: 138-22 / H: 141-03)

Sep Ultra 30Y down 3-14/32 at 154-19 (L: 154-12 / H: 158-15)

US 10Y FUTURES TECH: (U2) Stalls At The 50-Day EMA

- RES 4: 122-00 Round number resistance

- RES 3: 121-27+ High Apr 5

- RES 2: 121-27+ High Apr 7

- RES 1: 120-15/19+ 50-day EMA / High May 26

- PRICE: 119-17 @ 11:31 BST May 31

- SUP 1: 119-03 Low May 23

- SUP 2: 118-01+ Low May 18 and a key short-term support

- SUP 3: 117-18 Low May 11

- SUP 4: 116-21 Low May 9 and a bear trigger

Treasuries have faded off recent highs and are trading lower today. The 50-day EMA, at 120-15, has provided firm resistance. A clear break of this average is required to pave the way for a stronger bull cycle and this would open 122-00 handle. Recent gains are still considered corrective though and the primary trend direction remains down. Key support and the bear trigger is 116-21, May 9 low. Initial firm support to watch is 118-01+, May 18 low.

US EURODOLLAR FUTURES CLOSE

- Jun 22 steady at 98.238

- Sep 22 -0.085 at 97.410

- Dec 22 -0.10 at 96.895

- Mar 23 -0.105 at 96.745

- Red Pack (Jun 23-Mar 24) -0.10 to -0.08

- Green Pack (Jun 24-Mar 25) -0.08 to -0.075

- Blue Pack (Jun 25-Mar 26) -0.085 to -0.08

- Gold Pack (Jun 26-Mar 27) -0.09 to -0.09

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00357 to 0.82200% (-0.00357/wk)

- 1M +0.05829 to 1.11986% (+0.05815/wk)

- 3M +0.03028 to 1.61071% (+0.01285/wk) * / **

- 6M +0.03714 to 2.10600% (+0.01986/wk)

- 12M +0.04243 to 2.74000% (+0.04429/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.61071% on 5/31/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $79B

- Daily Overnight Bank Funding Rate: 0.82% volume: $254B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $963B

- Broad General Collateral Rate (BGCR): 0.79%, $365B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $344B

- (rate, volume levels reflect prior session)

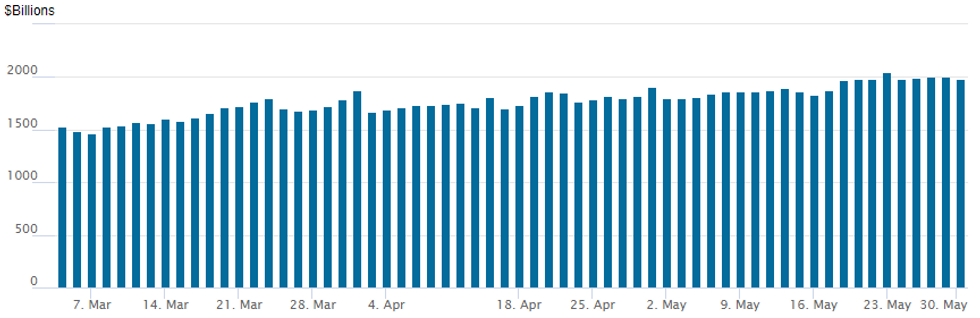

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to 1,978.538B w/ 101 counterparties vs. 2,006.688B prior session, compares to Monday's record high $2,044.658B.

PIPELINE: $3.5B HSBC 2Pt Launch

At least $12.6B to price Tuesday, waiting for Westpac 5Y SOFR to launch

- Date $MM Issuer (Priced *, Launch #)

- 05/31 $3.5B #HSBC +3NC2 +165, 6NC5 +195

- 05/31 $3B #Volkswagen $500M 2Y SOFR+95, $900M 3Y +125, $1.1B 5Y +155, $500M 7Y +175

- 05/31 $2.5B #NAB $750M 3Y +80, $500M 3Y SOFR+96, $1.25B 5Y +110

- 05/31 $1.6B Bank of Montreal $1.3B 3Y +100, $300M 3Y SOFR+106

- 05/31 $1B #Nordea Bank $700M 3Y +90, $300M 3Y SOFR+96

- 05/31 $1B #Burlington Northern 30Y +140

- 05/31 $Benchmark Westpac 5Y SOFR+80a

FOREX: Greenback Pares Gains In Late NY Trade, JPY Weakness Prevails

- The greenback initially traded more positively on Tuesday, recovering the Memorial Day retreat. The USD index rallied just under 1% from Monday’s low of 101.30 to reach an intra-day high print of 102.16 before backing off throughout the latter half of NY trade.

- Initial US dollar strength was due to weakness across global equity benchmarks and higher core yields, however, the late recovery in equities worked against the greenback’s advance with the DXY retreating around 0.5%.

- While most other major currencies weakened against the dollar, the Japanese Yen was under particular pressure with USDJPY rising substantially from the overnight 127.53 lows. USD strength was initially to blame with the late bounce in stocks further supporting the pair. Technical support at the 50-day EMA remains intact with the average intersecting at 126.10, while a further recovery would open 129.78 resistance, May 17 high.

- EURUSD edged off recent highs Tuesday, reversing off a challenge on the top of the bear channel. The channel is drawn from the Feb 10 high and intersects at 1.0804. It marks a key short-term resistance where a break would strengthen bullish conditions and highlight a stronger short-term reversal. The primary trend remains down though and further weakness would reinforce a bearish theme.

- Aussie GDP data is the focus for the Wednesday APAC session before new data for euro area unemployment, German retail sales and final manufacturing PMIs headline the European docket.

- Wednesday’s also marks the Bank of Canada meeting. The BOC is almost unanimously expected to hike its overnight rate by another 50bp to 1.5% on Wednesday, part of its journey to neutral, defined as 2-3%. The statement-only release is likely to maintain its hawkish tone to keep inflation expectations from de-anchoring but offer little in the way of new guidance – i.e. rates need to increase further with timing and pace guided by the inflation target.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/06/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 01/06/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/06/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/06/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/06/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/06/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/06/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/06/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/06/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/06/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 01/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 01/06/2022 | 1100/1300 |  | EU | ECB Lagarde Panelist at Green Swan Conference | |

| 01/06/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/06/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/06/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 01/06/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/06/2022 | 1400/1000 | * |  | US | Construction Spending |

| 01/06/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 01/06/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 01/06/2022 | 1515/1715 |  | EU | ECB Panetta Into at European Parliament | |

| 01/06/2022 | 1530/1130 |  | US | New York Fed's John Williams | |

| 01/06/2022 | 1530/1730 |  | EU | ECB Lane Speaks at CEPR Paris Symposium | |

| 01/06/2022 | 1700/1300 |  | US | St. Louis Fed's James Bullard | |

| 01/06/2022 | 1800/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.