-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Reverse Course, Curves Bull Flatten

EXECUTIVE SUMMARY

- MNI: Fed June Dots To Show Further Hawkish Shift -Ex-Officials

- MNI: World Bank Slices Global Growth Call, Warns of Stagflation

- MNI INTERVIEW: BOC Challenged By Prices Yet To Peak-Researcher

US

FED: Federal Reserve officials are likely to pencil in more aggressive rate hikes in their June forecasts because high inflation is proving even more persistent and widespread than policymakers believed, former Fed policymakers and staff economists told MNI.

- Those shifts since the last official set of economic projections in March will likely be accompanied by a mix of higher inflation and lower growth estimates to balance out the policy message.

- “You’ve got a number of people who are definitely arguing we should be at least at 3% by the end of the year, so I think you’re going to see a significant jump up,” from a median of 1.9% by year-end 2022 in the March dot plot, said Randall Kroszner, former Fed governor, in an interview. For more see MNI Policy main wire at 1113ET.

GLOBAL: The World Bank slashed its global growth forecast by nearly a third and warned of 1970s-style stagflation and recession as central banks raise interest rates.

- “The war in Ukraine, lockdowns in China, supply-chain disruptions, and the risk of stagflation are hammering growth. For many countries, recession will be hard to avoid,” said World Bank Group President David Malpass. “Changes in fiscal, monetary, climate and debt policy are needed to counter capital misallocation and inequality.”

- Global growth this year was reduced 1.2pp to 2.9% this year, by 0.2pp next year to 3.0%, and there could be “a protracted period of feeble growth,” the World Bank said. For more see MNI Policy main wire at 0930ET.

CANADA

BOC: Canadian inflation will likely quicken further in the near term, complicating the central bank's message about hiking interest rates to a public that hasn’t faced such big price gains in decades, a top monetary policy researcher told MNI.

- Governor Tiff Macklem must balance a resolve to restore 2% inflation against the dangers of spooking consumer confidence or fostering a recession according to Michelle Alexopoulos. The University of Toronto professor and BOC Fellowship Award winner is working with staff economists on using facial and voice recognition to track market reactions to Fed speeches.

- Unexpected, unpredictable and global shocks are Canada's major problem today including China’s Covid lockdowns, choked supply chains and especially the Ukraine war. “That’s why I think we’re going to see a bit of a ramp-up before things subside,” on inflation, she said. For more see MNI Policy main wire at 1358ET.

US TSYS: Turnaround Tuesday, 10YY Sub 3%, Stocks Extend Late Highs

Turnaround Tuesday lives up to it's name. Except for yield curves that finished near lows, rates stronger after the bell, near late session highs on strong volumes (TYU2>1.2M) w/bonds unwinding Mon's weakness. Current 30YY 3.1319% after nearly tapping Mon's 3.2044% high overnight; 10YY back below 3.0% at 2.9828% vs. 3.0621% overnight high.

- No specific driver for the reversal, trading desks say, though there are "big short positions per JPM survey .. while we usually rally through supply," on added, citing Tsy coupon auctions that start w/ $44B 3Y notes today.

- "Today is a buy everything day," another quipped as stocks extended session highs late (ESM2 +34.5 at 4154.5; Gold +13.00 at 1854.43; WTI crude +1.60 at 120.10.

- Treasury futures held gains after $44B 3Y note auction (91282CEU1) tailed: 2.927% high yield vs. 2.915% WI; 2.45x bid-to-cover vs. 2.59x last month.

- No react to limited data: US APR TRADE GAP -$87.1B VS MAR -$107.7B, nor Consumer credit ($38.1B).

- No react to Tsy Sec Yellen testimony to Committee on Finance, U.S. Senate, nothing really new as the former Fed chair touches upon supply constraints, chip shortages underpinning inflation. That said -- starting to see pick-up in stories suggesting global inflation may be topping out, Bbg citing semiconductor prices, spot rate for shipping containers and fertilizer prices plateauing.

OVERNIGHT DATA

- US APR TRADE GAP -$87.1B VS MAR -$107.7B

- CANADA APR TRADE BALANCE +CAD1.5B VS FORECAST +C$2.5B

- CANADA APR EXPORTS +0.6% VS MAR +7%; VOLUMES -2.1%

- CANADIAN APR IMPORTS +1.9% VS MAR +7.8%; VOLUMES -0.4%

- CANADA REDUCES TRADE SURPLUSES FROM JAN-MAR BY CAD1 BLN

- CANADIAN APR TRADE BALANCE +1.5 BILLION CAD

- CANADA APR EXPORTS 64.3 BLN CAD, IMPORTS 62.8 BLN CAD

- CANADA REVISED MAR MERCHANDISE TRADE BALANCE +2.3 BLN CAD

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 167.85 points (0.51%) at 33103.93

- S&P E-Mini Future up 26 points (0.63%) at 4149.25

- Nasdaq up 81 points (0.7%) at 12151.64

- US 10-Yr yield is down 6.6 bps at 2.9736%

- US Sep 10Y are up 14.5/32 at 118-12

- EURUSD up 0.0011 (0.1%) at 1.0709

- USDJPY up 0.69 (0.52%) at 132.54

- WTI Crude Oil (front-month) up $1.65 (1.39%) at $120.17

- Gold is up $12.9 (0.7%) at $1855.31

- EuroStoxx 50 down 31.68 points (-0.83%) at 3806.74

- FTSE 100 down 9.29 points (-0.12%) at 7598.93

- German DAX down 97.19 points (-0.66%) at 14556.62

- French CAC 40 down 48.43 points (-0.74%) at 6500.35

US TSY FUTURES CLOSE

- 3M10Y -10.481, 171.491 (L: 168.818 / H: 182.617)

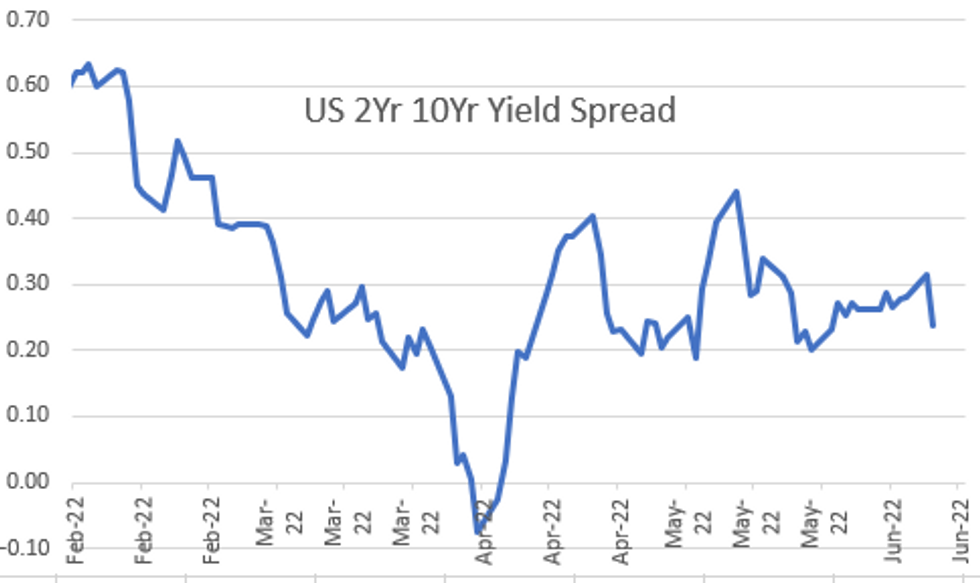

- 2Y10Y -7.274, 23.483 (L: 22.911 / H: 31.076)

- 2Y30Y -7.711, 38.649 (L: 37.861 / H: 45.938)

- 5Y30Y -1.93, 13.982 (L: 12.885 / H: 16.463)

- Current futures levels:

- Sep 2Y down 0.25/32 at 105-5.875 (L: 105-04.375 / H: 105-08.625)

- Sep 5Y up 7.25/32 at 112-3 (L: 111-23 / H: 112-07)

- Sep 10Y up 14.5/32 at 118-12 (L: 117-22.5 / H: 118-17)

- Sep 30Y up 1-07/32 at 137-28 (L: 136-08 / H: 138-05)

- Sep Ultra 30Y up 1-27/32 at 154-3 (L: 151-25 / H: 154-20)

US !0Y FUTURES TECH: (U2) Retracement Extends

- RES 4: 121-27+ High Apr 5

- RES 3: 120-27+ High Apr 7

- RES 2: 120-04+/19+ 50-day EMA / High May 26 and bull trigger

- RES 1: 119-16+ High Jun 1

- PRICE: 118-07 @ 15:24 BST Jun 6

- SUP 1: 117-22+ Intraday low

- SUP 2: 117-18 Low May 11 07

- SUP 3: 116-21 Low May 9 and a bear trigger

- SUP 4: 116-00 Round number support

Treasuries traded lower Monday extending the pullback from recent highs. This means that futures remain below the 50-day EMA - at 120-04+ today. The EMA represents a key resistance and a clear break would allow for a stronger recovery towards 122-00. The recent move away from the average however, suggests the corrective cycle since May 9 is over. An extension lower would open key support and a bear trigger at 116-21, May 9 low.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.003 at 98.228

- Sep 22 +0.015 at 97.345

- Dec 22 +0.015 at 96.755

- Mar 23 +0.020 at 96.540

- Red Pack (Jun 23-Mar 24) +0.020 to +0.030

- Green Pack (Jun 24-Mar 25) +0.030 to +0.050

- Blue Pack (Jun 25-Mar 26) +0.065 to +0.085

- Gold Pack (Jun 26-Mar 27) +0.090 to +0.095

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00514 to 0.82657% (+0.00743/wk)

- 1M +0.03058 to 1.19029% (+0.07058/wk)

- 3M +0.02543 to 1.69043% (+0.06443/wk) * / **

- 6M +0.05043 to 2.23843% (+0.12914/wk)

- 12M +0.03728 to 2.88957% (+0.11414/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.69043% on 6/7/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $85B

- Daily Overnight Bank Funding Rate: 0.82% volume: $266B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $959B

- Broad General Collateral Rate (BGCR): 0.78%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.78%, $348B

- (rate, volume levels reflect prior session)

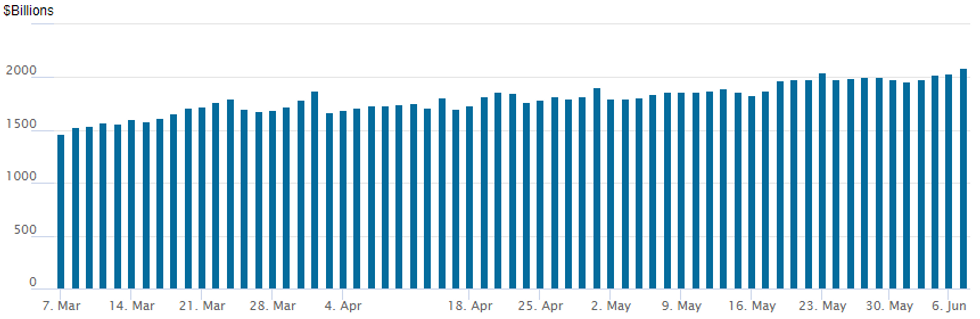

FED Reverse Repo Operation, New Record High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new record high of 2,091.395B w/ 98 counterparties vs. 2,040.093B prior session, compares to prior record of $2,044.658B from Monday, May 23.

PIPELINE: JPM Updated Guidance; CPPIB, COE Expected Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 06/07 $1.25B *Kommunivest +2Y SOFR+17

- 06/07 $1B #AMD $500M 10Y +95, $500M 30Y +125

- 06/07 $800M *Kepco $500M 3Y +80, $300M 5Y +105

- 06/07 $Benchmark JP Morgan 3NC2 +110, 3NC2 SOFR, 8NC7 +153

- 06/07 $550M #AEP Transmission WNG 30Y +140

- 06/07 $500M #Tokyo Metro Govt WNG 3Y SOFR+57

- 06/07 $500M #Centerpoint Energy WNG 10Y +145

- 06/07 $500M Univision Communications 8NC3

- 06/07 $Benchmark Hungary 7Y, 12Y investor calls

- Expected Wednesday:

- 06/08 $Benchmark CPPIB Capital 5Y SOFR+54a

- 06/08 $Benchmark Council of Europe Development Bank (CoE) 3Y SOFR+23a

EGBs-GILTS CASH CLOSE: Yields Settle Lower Amid Pre-ECB Squaring

Core European bond yields eased from fresh multi-year highs set earlier in the session, settling lower by Tuesday's cash close with modest bull flattening in both the UK and German curves.

- With little data and few headline drivers, the moves were seen as largely squaring/short-covering ahead of Thursday's ECB meeting. Though rate hike pricing didn't change much on the session, there was continued volatility in Periphery EGB spreads amid ongoing speculation over an anti-fragmentation tool.

- Periphery spreads easily outperformed, highlighted by a 9+bp drop in Italian 10Y spreads to the psychologically crucial 200bp mark once again.

- Our ECB preview went out earlier today.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 2.4bps at 0.669%, 5-Yr is down 2.1bps at 1.029%, 10-Yr is down 2.9bps at 1.293%, and 30-Yr is down 4.9bps at 1.526%.

- UK: The 2-Yr yield is down 3.3bps at 1.747%, 5-Yr is down 2.5bps at 1.844%, 10-Yr is down 3.3bps at 2.214%, and 30-Yr is down 5.6bps at 2.425%.

- Italian BTP spread down 9.2bps at 200.2bps / Spanish down 4.5bps at 111.6bps

FOREX: Greenback Reverses Lower Amid Lower US Yields, Higher Equities

- The USD Index made fresh two-week highs in early trade on Tuesday, extending the late recovery seen on Monday from the key support at 101.81, 50-dma. However, a bounce for major equity indices and lower US yields weighed on the greenback throughout the US trading session.

- The softer US Dollar boosted the likes of GBP and CAD which look to post half percent gains on the day. The Euro (+0.10%) was more subdued as markets prepare for Thursday’s ECB meeting.

- The key outperformer was AUD, rising around 0.6% after the RBA surprised markets overnight, raising rates by 50bps against expectations of a 25bps move. The appreciation was by no means in a straight line. After spiking to 0.7246, the pair subsequently faded, printing fresh lows below 0.7160 at the start of NY trade. The currency eventually recovered amid a multitude of sell-side analysts bringing forward forecasts for the next 50bps hike and the renewed bid in global equity benchmarks.

- The Japanese Yen is once again the poorest performer in the G10 currency space. USDJPY has resumed its primary uptrend with the pair clearing resistance at 131.35, May 9 high. The move higher maintains the broader bullish price sequence of higher highs and higher lows and with moving average studies pointing north, indications are that the USD has further to go. The focus is on 134.48, a Fibonacci projection. Initial firm support is seen at 128.94, the 20-day EMA.

- The ECB meeting remains the nearest key risk event for global markets, due Thursday. The ECB is now clear that the APP will end in early July, policy rate lift-off will occur in the same month and policy rates will reach zero by September. A 50bp hike in July is a low, but increasing, risk. However, the probability is rising of a one-off 50bp hike or a series of such hikes from September onward.

- US CPI data and Canadian Employment will be released on Friday.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/06/2022 | 0545/0745 | ** |  | CH | unemployment |

| 08/06/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 08/06/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 08/06/2022 | 0645/0845 | * |  | FR | Current Account |

| 08/06/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 08/06/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 08/06/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/06/2022 | 0900/1100 | *** |  | EU | GDP (2nd est.) |

| 08/06/2022 | 0900/1100 | * |  | EU | Employment |

| 08/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/06/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/06/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 08/06/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.