-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - Brexit Legislation Sparks Potential Legal Action

EXECUTIVE SUMMARY:

- BOND ROUT EXTENDS, US YIELDS RALLY SHARPLY

- S&P500 CEMENTS BEAR MARKET STATUS

- EU TO CONSIDER NEW LEGAL ACTIONS AGAINST UK OVER NI PROTOCOL

- NY FED SURVEY: US NEAR-TERM PRICE EXPECTATIONS AT RECORD HIGH

NEWS

EU-UK (MNI): RTE: EU Could Launch Legal Action After UK Presents NI Protocol Bill

Tony Connelly at RTE tweets on potential EU legal action against the UK following the presentation of the Northern Ireland Protocol bill later today.- Much more aggressive rhetoric than has previously been utilised, with expectations that the EU would not launch any action until the NI Protocol bill was on the statute books, or at least more progressed through Parliament. https://marketnews.com/rte-eu-could-launch-legal-a...

EU-UK (MNI): The EU will consider reviving its infringement procedure against the UK, after the Westminster government launched legislation ending the UK's participation in the Northern Ireland Protocol, Commission Vice President Maros Sefcovic said Monday. He added that the legislation was of "significant concern" and that the UK's unilateral actions were damaging to mutual trust, but he added that any EU reaction would be aimed at securing the implementation of the Protocol and would be proportionate. Full statement here: https://ec.europa.eu/commission/presscorner/detail...

MNI: ECB Will Likely Keep Quiet On Any Anti-Fragmentation Tool Until Needed

According to a Bloomberg article just published, ECB officials are 'determined' not to detail plans for fighting bond market stress. As recently suggested in our review of the June meeting, the ECB will likely want to keep any such tool in reserve until the point at which it will actually be deployed. Since a significant part of the compression in spreads is likely to come from the 'announcement effect', as has been seen with various QE rounds across developed markets, announcing a new instrument now without actually deploying it could blunt the instrument in future periods of sovereign bond stress.

US-CANADA (MNI): Canadian Prime Minister Justin Trudeau has announced on Twitter that he has tested positive for COVID-19. Trudeau: "I've tested positive for COVID-19. I'll be following public health guidelines and isolating. I feel okay, but that's because I got my shots. So, if you haven't, get vaccinated - and if you can, get boosted. Let's protect our healthcare system, each other, and ourselves." Trudeau had a bilateral meeting with US President Joe Biden on the sidelines of the Summit of the Americas in Los Angeles on Thursday.

ITALY (MNI): Strong Right-Wing Performance In Local Elections But Lega Referenda Fail. Exit polls from the 12 June local elections in 26 cities across Italy show strong performances from right-wing parties in what is the final major set of elections before the next legislative elections are due in June 2023.

The official vote count got underway at 1400CET today, but exit polls show that in cities where the right-wing parties (Matteo Salvini's Lega, the Brothers of Italy, and Silvio Berlusconi's Forza Italia) could agree on a joint candidate they are in position to win in the first round.

Eurozone (MNI): Euro Debt Crisis Fears Exaggerated- ESM's Regling

Fears of a euro zone debt crisis have been "completely exaggerated" by the media, ESM Managing Director Klaus Regling said Monday. Speaking at a Capital Markets Seminar, Regling said that all EZ states had the lowest interest rate burden on their public debt since World War II, around a third of the levels a decade ago.

Eurozone (MNI): Dutch Inflation Close To 11% In Worst Case Scenario

A long war in Ukraine could see headline inflation in the Netherlands hit 10.8% this year and 5.1% in 2023 according to a "severe' scenario outlined by the Dutch central bank Monday, while the country could slip into recession if Russia cuts off energy supplies to Europe. HICP inflation is projected to average 8.7% this year, before falling to 3.9% in 2023 and 2.4% in 2024 under the DNB's baseline scenario. Core inflation is projected at 3.9% in 2022, falling to 2.6% in both 2023 and 2024.

Eurozone (MNI): NGEU Issuance Seen At €50bn In H1, Similar H2 - Hahn

EU Commissioner Johannes Hahn said today that the Commission remained on track to issue 50bn in NGEU bonds in the first six months of this year and a "similar magnitude" in the second half of the year. Speaking at a Capital Markets Seminar, Hahn also said that the Ukraine had not dented market confidence in the EU and NGEU bond issuances continued to be "still very much oversubscribed".

DATA

MNI BRIEF: US Near-Term Price Expectations Hit Record - NY Fed

U.S. households' expectations for the near-term future path of inflation surged back to record levels in May to 6.6% from 6.3% in April, according to the latest New York Fed survey, while expectations at the three-year horizon were unchanged at 3.9%.

The survey also shows household spending expectations over the next year rose to a new series high 9.0% from 8.0% in April, the fifth straight gain. Median expected growth in household income decreased 0.1ppt to 3.0% and the average perceived probability of missing a minimum debt payment over the next three months increased 0.4ppts to 11.1%.

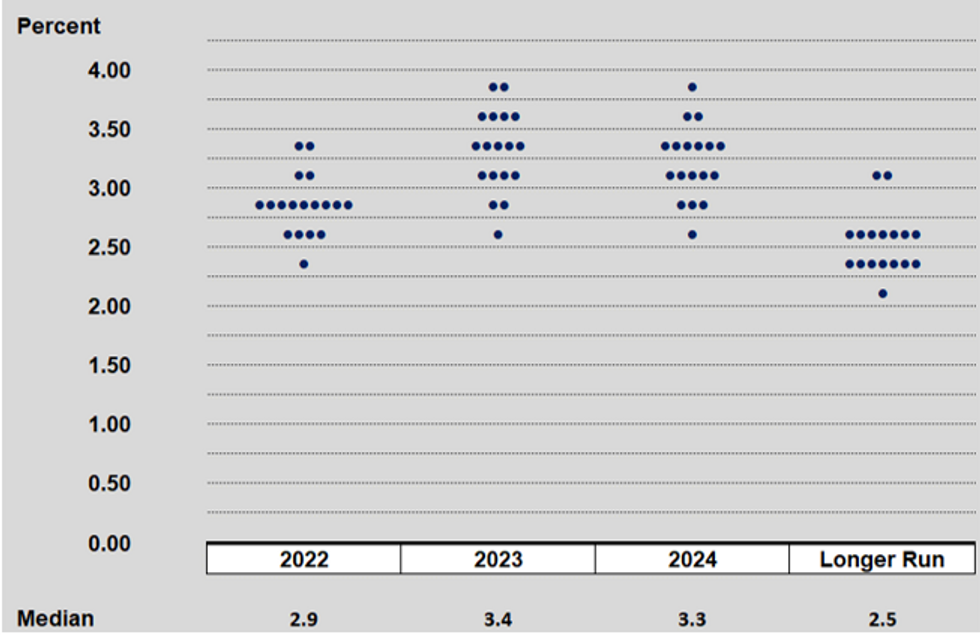

MNI Fed Preview - June 2022: Higher Pressure, Higher Dots

We've just published our June 2022 Fed preview, emailed to subscribers (and available on our website):

- June’s FOMC meeting is likely to deliver the previously-promised 50bp hike, but the market reaction to May’s inflation report significantly raised the bar to a hawkish meeting outcome.

- The Dot Plot will signal a more hawkish rate path than had been expected a few weeks ago, but it would be surprising if it came close to confirming market rate hike pricing.

- Backed by the Dot Plot, Chair Powell is likely to signal that 50bp hikes are the base case in July and September, but is unlikely to pre-commit beyond that.

MNI Expectations For June 2022 Dot PlotSource: MNI

MNI Expectations For June 2022 Dot PlotSource: MNI

FOREX: USD Index Reaches Highest Level Since 2002 Amid Yield Surge

- The greenback maintained its upward trajectory on Monday, briefly breaching the May highs above the 1.0500 mark and in doing so, registered the highest print for the index since 2002.

- The upward trajectory for global yields continues to underpin the supportive price action for the USD, weighing on most other G10 currencies.

- The significant weakness in global equity benchmarks weighed heavily on the likes of AUD, NZD and GBP. AUDUSD is the poorest performer, having retreated 1.60% from last Friday’s close. The extension lower has prompted a breach of support at 0.6950, May 18 low. The focus now turns to the technical bear trigger at 0.6829, May 12 low, where a breach of this level would resume the broader downtrend.

- The outlier during the US session on Monday was a strong reversal in the Japanese Yen. Early greenback strength had resulted in USDJPY testing above 135.00 during the APAC session, the highest level since 1998. However, waning risk sentiment eventually boosted the Japanese Yen, which recovered around 1% from its worst levels. Despite the move lower, USDJPY conditions remain bullish and initial firm support is not seen until 130.60, the 20-day EMA.

- GBPUSD (-1.27%) extends recent weakness on the back of a poorer-than-expected monthly GDP release, with April GDP contracting by 0.3% in what's expected to be a rocky few quarters for the economy. Furthermore, negative headlines resurfacing between the UK and the EU regarding the Northern Ireland protocol bill add a layer of political significance behind the GBP weakness.

- The bear trigger at 1.2156, the May 13 low, has been breached and a sustained break of this level would confirm a resumption of the broader downtrend.

- Tuesday’s data calendar includes UK unemployment and German ZEW sentiment readings. US PPI provides the last look at inflation before Wednesday’s FOMC decision/projections.

US TSYS Summary: Hawkish Rate Expectations Intensify Ahead of FOMC This Week

Mirroring the sell-off in EGBs seen earlier in the session, USTs have traded sharply weaker today on the back of intensifying hawkish rate expectations.

- Cash yields are now 17-22bp higher with the curve bear flattening. TYU2 is holding near the lows of the day.

- The 10-year benchmark yield has firmly surpassed the 2018 highs and returned to levels not seen since 2011, while the 2-year yield is back to 2007 levels.

- With the ECB making an uncharacteristically hawkish pivot at last week's GC meeting when President Lagarde indicated that a 50bp hike in September is on the cards provided there is not a marked improvement in the inflation outlook, a small number of analysts are speculating on the possibility of a 75bp Fed hike this week.

- The next round of primary elections will take place tomorrow in Maine, Nevada, North Dakota and South Carolina. This will mark a test of former president Donald Trump's endorsees against more moderate GOP candidates.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/06/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 14/06/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 14/06/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 14/06/2022 | 0600/0800 | * |  | DE | Wholesale Prices |

| 14/06/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 14/06/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 14/06/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/06/2022 | 1230/0830 | *** |  | US | PPI |

| 14/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/06/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 14/06/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 14/06/2022 | 1700/1900 |  | EU | ECB Schnabel on Euro Bond Market Fragmentation |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.