-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

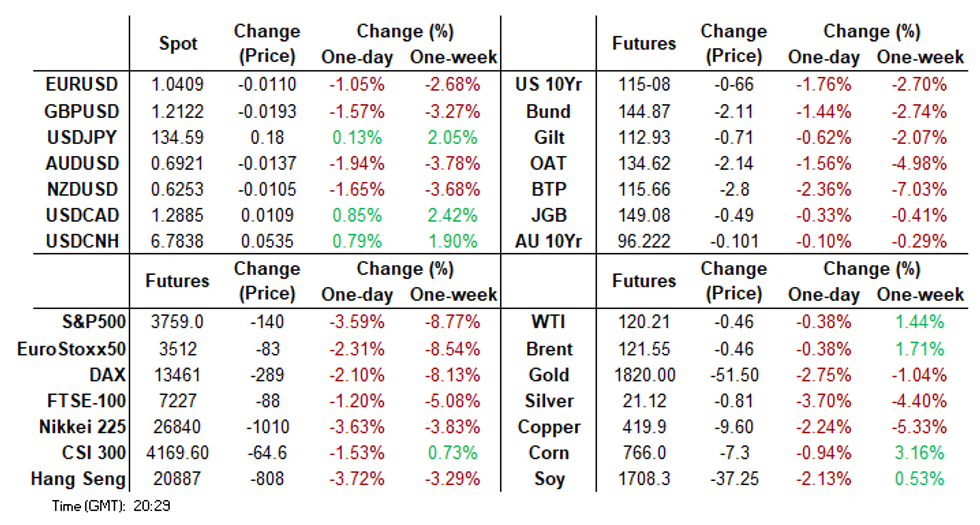

Free AccessMNI ASIA MARKETS ANALYSIS - Global Yields Maintain Upward Trajectory

Highlights:

- Greenback follows rates higher, USD Index at highest since 2002

- US equities cement bear market status

- US PPI provides last look at inflation pre-FOMC

US TSYS Summary: Hawkish Rate Expectations Intensify Ahead of FOMC This Week

Mirroring the sell-off in EGBs seen earlier in the session, USTs have traded sharply weaker today on the back of intensifying hawkish rate expectations.

- Cash yields are now 17-22bp higher with the curve bear flattening. TYU2 is holding near the lows of the day.

- The 10-year benchmark yield has firmly surpassed the 2018 highs and returned to levels not seen since 2011, while the 2-year yield is back to 2007 levels.

- With the ECB making an uncharacteristically hawkish pivot at last week's GC meeting when President Lagarde indicated that a 50bp hike in September is on the cards provided there is not a marked improvement in the inflation outlook, a small number of analysts are speculating on the possibility of a 75bp Fed hike this week.

- The next round of primary elections will take place tomorrow in Maine, Nevada, North Dakota and South Carolina. This will mark a test of former president Donald Trump's endorsees against more moderate GOP candidates.

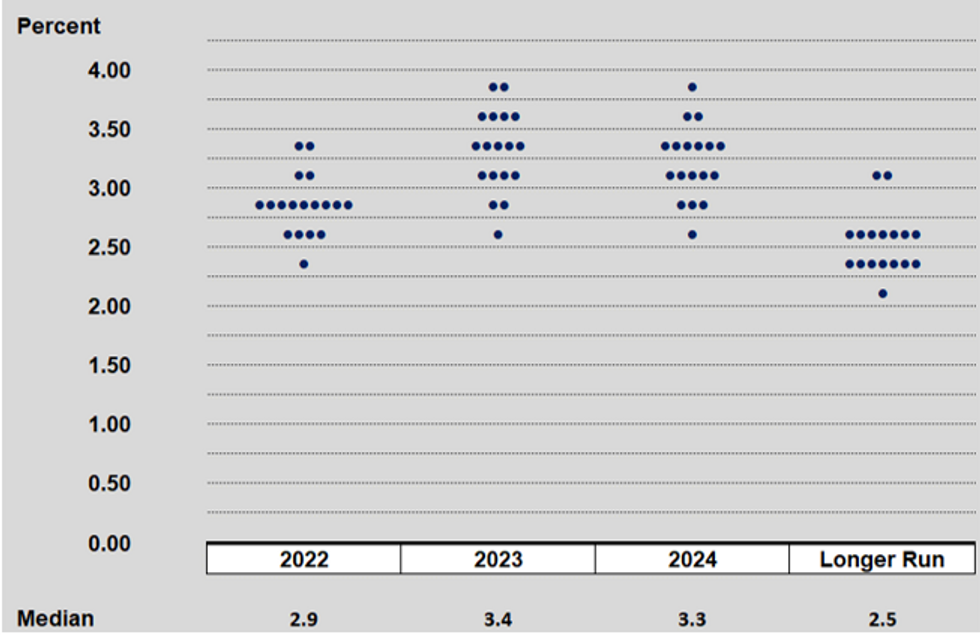

MNI Fed Preview - June 2022: Higher Pressure, Higher Dots

We've just published our June 2022 Fed preview, emailed to subscribers (and available on our website):

- June’s FOMC meeting is likely to deliver the previously-promised 50bp hike, but the market reaction to May’s inflation report significantly raised the bar to a hawkish meeting outcome.

- The Dot Plot will signal a more hawkish rate path than had been expected a few weeks ago, but it would be surprising if it came close to confirming market rate hike pricing.

- Backed by the Dot Plot, Chair Powell is likely to signal that 50bp hikes are the base case in July and September, but is unlikely to pre-commit beyond that.

MNI Expectations For June 2022 Dot PlotSource: MNI

MNI Expectations For June 2022 Dot PlotSource: MNI

EGB/Gilt - A fast market session

- A more range bound affair this afternoon, but this was nonetheless a busy fast market, choppy session, with decent volumes.

- Yields have continued their rallies during the European morning session, but futures are off their lows and in turn Yields off their multi years highs.

- Risk remains under considerable pressure, on the high inflation, slow Growth risk pressures.

- Curves have bear flattened, while peripheral spreads are widened against the German 10yr.

- Italy is in the lead by 10.7bps, closely followed by Spain and Portugal, by 8.4 and 8bps respectively.

- Gilt is down 32 ticks at the time of typing and faring better vs Germany, a continuation from this morning, after UK data missed expectations.

- There's nothing left for the day, but the week is packed with events (CBs) Supply and speakers.

- Sep Bund futures (RX) down 135 ticks at 145.63 (L: 145.27 / H: 147.19)

- Germany: The 2-Yr yield is up 14bps at 1.111%, 5-Yr is up 11bps at 1.439%, 10-Yr is up 7.1bps at 1.587%, and 30-Yr is up 2.9bps at 1.688%.

- Sep Gilt futures (G) down 42 ticks at 112.62 (L: 112.33 / H: 113.01)

- UK: The 2-Yr yield is up 2.8bps at 2.074%, 5-Yr is up 3.3bps at 2.177%, 10-Yr is up 1.8bps at 2.465%, and 30-Yr is up 0.5bps at 2.575%.

- Sep BTP futures (IK) down 205 ticks at 116.41 (L: 116.2 / H: 118.68)

- Sep OAT futures (OA) down 141 ticks at 135.35 (L: 135.03 / H: 136.91)

- Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 14bps at 1.111%, 5-Yr is up 11bps at 1.439%, 10-Yr is up 7.1bps at 1.587%, and 30-Yr is up 2.9bps at 1.688%.UK: The 2-Yr yield is up 2.8bps at 2.074%, 5-Yr is up 3.3bps at 2.177%, 10-Yr is up 1.8bps at 2.465%, and 30-Yr is up 0.5bps at 2.575%

- Italian BTP spread up 10bps at 234.7bps

- Spanish bond spread up 8bps at 134.3bps

- Portuguese PGB spread up 7.8bps at 135.8bps

- Greek bond spread up 3bps at 291.1bps

FOREX: USD Index Reaches Highest Level Since 2002 Amid Yield Surge

- The greenback maintained its upward trajectory on Monday, breaching the May highs above the 1.0500 mark and in doing so, registered the highest print for the index since 2002.

- The upward trajectory for global yields continues to underpin the supportive price action for the USD, weighing on most other G10 currencies.

- The significant weakness in global equity benchmarks weighed heavily on the likes of AUD, NZD and GBP. AUDUSD is the poorest performer, having retreated 1.60% from last Friday’s close. The extension lower has prompted a breach of support at 0.6950, May 18 low. The focus now turns to the technical bear trigger at 0.6829, May 12 low, where a breach of this level would resume the broader downtrend.

- The outlier during the US session on Monday was a strong reversal in the Japanese Yen. Early greenback strength had resulted in USDJPY testing above 135.00 during the APAC session, the highest level since 1998. However, waning risk sentiment eventually boosted the Japanese Yen, which recovered around 1% from its worst levels. Despite the move lower, USDJPY conditions remain bullish and initial firm support is not seen until 130.60, the 20-day EMA.

- GBPUSD (-1.27%) extends recent weakness on the back of a poorer-than-expected monthly GDP release, with April GDP contracting by 0.3% in what's expected to be a rocky few quarters for the economy. Furthermore, negative headlines resurfacing between the UK and the EU regarding the Northern Ireland protocol bill add a layer of political significance behind the GBP weakness.

- The bear trigger at 1.2156, the May 13 low, has been breached and a sustained break of this level would confirm a resumption of the broader downtrend.

- Tuesday’s data calendar includes UK unemployment and German ZEW sentiment readings. US PPI provides the last look at inflation before Wednesday’s FOMC decision/projections.

Net Long USD Positioning Remains Moderate Despite Risk Off Environment

- Net long specs on the US Dollar decreased in the week ended June 7, down 13.6K to a total of 103.1K contracts.

- Preference for the US Dollar has been surging in recent days amid elevated market and geopolitical uncertainty.

- Investors took the opportunity to buy the dip on the US Dollar following the little consolidation we saw in the second half of May.

- The DXY index broke back above the 104 level this morning and tested its ST resistance at 105 earlier after finding support at its 50DMA in the past two weeks.

- Next key level to watch on the topside stands at 107.31 (June 2002 highs).

- The Fed is meeting this week with the market expecting policymakers to maintain the stance of the tightening by hiking the benchmark rate by 50bps to 1.5%.

- Market uncertainty has also left risky assets vulnerable in the past three days, with the SP500 dropping to 3,900; next key support to watch on the downside stands at 3,800.

Source: Bloomberg/MNI

FX OPTIONS: Expiries for Jun14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0413-25(E3.2bln), $1.0430-40(E930mln), $1.0635-50(E1.0bln)

- USD/JPY: Y131.00($850mln), Y132.30-50($796mln)

- GBP/USD: $1.2200-05(Gbp518mln)

- AUD/USD: $0.7130-40(A$688mln)

- USD/CNY: Cny6.7500($688mln)

EQUITIES: Every Single S&P 500 Stock Sits Lower

- A rare occurrence in markets, with all listed equities in the S&P 500 trading lower so far Monday.

- Across the S&P 500, energy names are leading the weakness, reflecting an unwind of recent strength as well as a step lower in WTI prices (down to ~$118.50/bbl from the ~$123/bbl printed last week) but weakness is seen across all sectors of the index.

- Consumer discretionary and materials names are reflecting the economic uncertainty (higher inflation and rates hurting consumer spending), while the more defensive healthcare and consumer staples sectors are faring better.

- The NYSE's TICK Index showed heavy selling at the open, with programmatic sales of 2,032 names after the bell - the largest sell programme since September last year.

- With futures at session lows of 3770.50 - attention shifts lower to first support at the 0.618 proj of the Mar 29 - May 20 - 31 price swing - this crosses at 3697.99.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/06/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 14/06/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 14/06/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 14/06/2022 | 0600/0800 | * |  | DE | Wholesale Prices |

| 14/06/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 14/06/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 14/06/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/06/2022 | 1230/0830 | *** |  | US | PPI |

| 14/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/06/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 14/06/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 14/06/2022 | 1700/1900 |  | EU | ECB Schnabel on Euro Bond Market Fragmentation |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.