-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI ASIA MARKETS ANALYSIS - TSY Curve Bull Steepens, USD Snaps Winning Streak

Highlights:

- Fed Raises Rates By 75Bps, George Dissents For Smaller Hike

- Powell Says 75BP Or 50BP Hike Possible For July

- TSY Curve Bull Steepens, USD Index Snaps Five-Day Winning Streak

US TSYS: Bull Steeper As Powell Describes 75bp Hikes As "Unusually Large"

Treasury markets took a dovish interpretation from June's FOMC meeting, with diminished rate hike pricing for the July meeting and a decision (+75bp) and Dot Plot that were in line with expectations.

- The curve flattened sharply a minute or two after the FOMC decision was released, with 2s10s temporarily going negative.

- But ultimately it resolved much steeper as Fed rate hike pricing pared back during Powell's press conference.

- The main trigger to this was Powell's comment early in the presser that the next meeting in July could bring a 50 or 75bp hike - and that a 75bp hike was unusually large and that he didn't expect them to be common.

- 2-Yr yield is down 21.3bps at 3.2138%, 5-Yr is down 20.1bps at 3.3858%, 10-Yr is down 17bps at 3.3029%, and 30-Yr is down 8.9bps at 3.3353%.

BoE, SNB Previews

BOE (MNI): A 25bp hike is fully priced forthis week's MPC meeting, with markets pricing in around a 1/3 probability that the Bank of England vote for a larger 50bp hike. We think that there is likely to be enough support for most (or "the majority") of members to continue with the previous forward guidance for this month at least. Full MNI BOE Preview here: https://marketnews.com/markets/central-bank-reports/central-bank-preview/bank-of-england-preview/mni-boe-preview-june-2022-25bp-but-what-next

SNB (MNI): FX language could be first sign negative rates will be reversed

The SNB are expected to lay the groundwork for the first change to the policy rate in seven years at this week’s meeting. But the bank will likely hold rates for a further three months so as not to add to market uncertainty by prematurely widening the ECB/SNB policy rate differential and inducing FX market volatility. Full MNI SNB Preview here: https://marketnews.com/-2657511324

CHINA: Growth Rate Closer To 2%-2.5%

Executive Summary:

- China alternative measures of GDP growth have been pricing in a significantly lower level of economic activity, therefore confirming that the current official’s growth target rate of 5.5% is ‘unrealistic’.

- According to think tank CASS measure, the current level of GDP growth is closer to 2%-2.5% (rather than the 4.8% reported in Q1).

- CNY remains vulnerable in the medium term as the CH-US bond yield premium keeps falling into deeper negative territory.

Link to full publication:

China Alternative Growth Measures Pricing in (Much) Lower GDP Growth

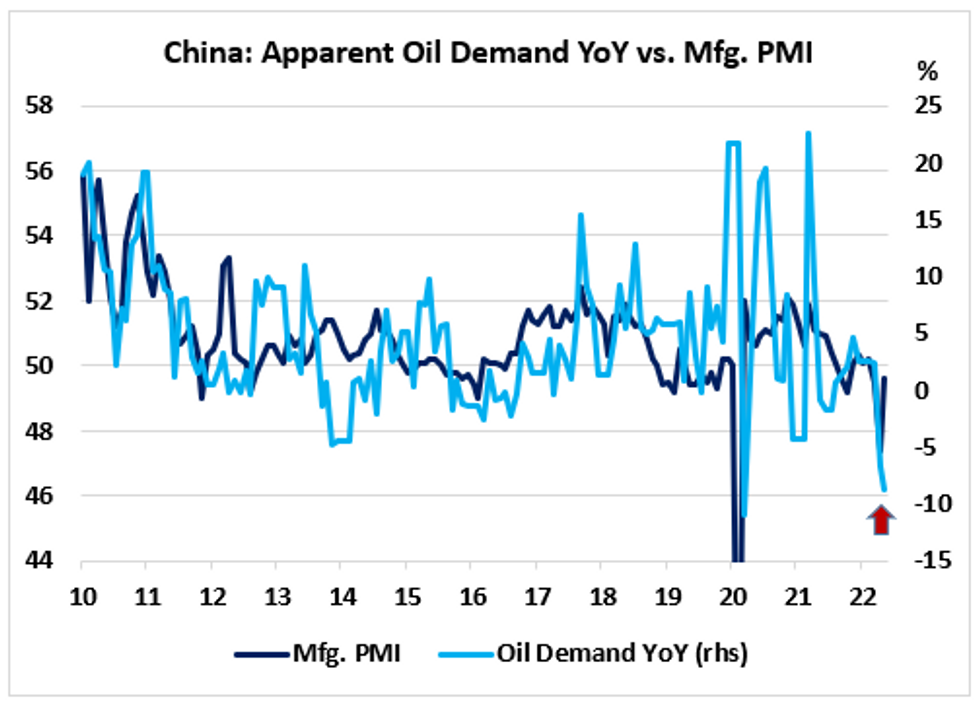

Economic data showed a modest ‘pick up’ in the economic activity in May with PMIs rebounding towards the 50 threshold and industrial production bouncing back into the positive territory overnight (+0.7% YoY, up from -2.9% the previous month). However, China’s apparent oil demand, which some analysts consider as a leading indicator of business activity, continued to drop in May, down 8.7% YoY, therefore pricing in a further slowdown in the near term.

The chart below shows that a plunge in apparent oil demand (YoY) has generally been associated with a sharp contraction in China manufacturing PMI.

Source: Bloomberg/MNI

FOREX: Volatile Session Sees USD Weaken, Powell Hints 75BP Not To Be Common

- The US Dollar traded in a volatile manner following the Fed’s decision to hike rates by 75bp at their June meeting, the largest hike since 1994.

- Initial weakness, potentially on the sole dissent for a smaller hike, was short-lived with the DXY swiftly reversing course and printing a fresh high at 105.79. In turn, EURUSD headed quickly through the overnight lows to print 1.0359, coming within touching distance of the key bear trigger at 1.0350, May 13 low.

- Once again there was a swift reversal in greenback sentiment as Chair Powell began his press conference. Following the comments regarding not to expect 75 basis-point moves to be common, markets favoured USD selling and momentum was encouraged by stronger US equity benchmarks.

- This emboldened the likes of AUD, GBP and NZD which look set to post extremely strong +1.5% recoveries. Additionally, CNH has strengthened 1.25% against the dollar, supported by the better-than-expected activity data overnight.

- Central bank meetings continue on Thursday with the Swiss National bank preceding the Bank of England. The Bank of Japan round off the central bank slate during Friday’s APAC session.

FX OPTIONS: Expiries for Jun15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-11(E817mln)

- USD/JPY: Y131.50($550mln), Y134.00($593mln)

- GBP/USD: $1.2180-90(Gbp827mln)

- EUR/GBP: Gbp0.8515-20(E551mln), Gbp0.8600-20(E523mln)

- AUD/USD: $0.7050(A$651mln)

- USD/CNY: Cny6.6500($1.3bln)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/06/2022 | 0130/1130 | *** |  | AU | Labor force survey |

| 16/06/2022 | 0730/0930 |  | CH | SNB interest rate decision | |

| 16/06/2022 | 0730/0930 | *** |  | CH | SNB policy decision |

| 16/06/2022 | 0750/0950 |  | EU | ECB Panetta Speech & Q&A at European Payments Council | |

| 16/06/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/06/2022 | 0830/1030 |  | EU | ECB de Guindos at Osservatorio Giovani-Editori Conference | |

| 16/06/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 16/06/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 16/06/2022 | - |  | JP | Bank of Japan policy meeting | |

| 16/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 16/06/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/06/2022 | 1400/1000 | *** |  | US | Housing Starts |

| 16/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 16/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 16/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.