-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Ylds Recede, Nothing Off the Table for Powell

EXECUTIVE SUMMARY

- MNI: Fed Rate Decisions To Be Made Meeting By Meeting - Powell

- MNI BRIEF: Powell Says Market Appropriately Pricing Tighter Fed

- MNI BRIEF: Powell Keeps 100bp Move As Fed Option If Needed

- MNI: Evans Backs Fed Hiking A Good Deal More, Staying Flexible

- MNI BRIEF: Fed’s Harker- Markets Need Time To Respond To Hikes

US

FED: Federal Reserve Chairman Jerome Powell Wednesday told Congress the U.S. central bank plans to continue to raise interest rates with sizes decided on a meeting by meeting basis.

- "We will make our decisions meeting by meeting, and we will continue to communicate our thinking as clearly as possible," he said in written testimony to Congress. "We anticipate that ongoing rate increases will be appropriate; the pace of those changes will continue to depend on the incoming data and the evolving outlook for the economy."

- "Our overarching focus is using our tools to bring inflation back down to our 2% goal and to keep longer-term inflation expectations well anchored," Powell added. For more see MNI Policy main wire at 0930ET.

- "I think I would never take something off the table for any and all purposes. The committee that I chair will make whatever moves that it believes are appropriate to restore price stability," Powell said, when asked why he appeared to remove the percentage point option at the June FOMC post-meeting press conference if needed later on.

- “Financial conditions have tightened and have priced in a string of additional rate increases, and that’s appropriate. The market has been reading our reaction function reasonably well,” he told U.S. senators. “What you’ll see is continued expeditious progress toward higher rates. The center of the committee wrote down that rates would be between 3% and 3.5% by the end of this year.”

- "It will be necessary to bring rates up a good deal more over the coming months in order to return inflation to the Committee’s 2% average inflation target," Evans said in the text of a speech titled "A Stronger Policy Response to Restrain Inflation."

- "I want to get to neutral ... as expeditiously as possible but not so quickly that we distort markets and we can't let the markets respond appropriately," he said.

US TSYS: Fed "Vigorously" Using it's Tools

Rates trading near late session highs after the bell, decent volumes (TYU2>1.5M), 30YY -.0974 at 3.2398, yield curves managing to hold steeper profile: 2s10s +2.391a t 9.619, 5s10s +1.621 at -7.397.

- Debatable drivers for the rally in rates that kicked off overnight deemed risk-off as stocks traded weaker/paring Tue's gains on the back of sharply lower crude oil prices (WTI fell to 101.67 low vs. 109.71 high as demand eased and markets anticipated a 3M gas-tax proposal from Pres Biden).

- Rates held near highs in second half after Fed Chair Powell's Senate testimony initially deemed less hawkish for rates with the goal to bring inflation back down to our 2%. "We will make our decisions meeting by meeting, and we will continue to communicate our thinking as clearly as possible," he said in written testimony to Congress. "We anticipate that ongoing rate increases will be appropriate; the pace of those changes will continue to depend on the incoming data and the evolving outlook for the economy."

- Unwilling to take chance of 100bp hike off the table, followed by Chicago Fed Evans calling 75bp hike in July "very reasonable", helped keep futures in check as buy interest moderated.

- Tsy futures holding near session highs (USU2 +2-21 at 136-01; 30YY 3.2346% at the moment) after $14B 20Y bond auction (912810TH1) re-open : 3.488% high yield vs. 3.488% WI; 2.60x bid-to-cover vs. last month's 2.50x.

OVERNIGHT DATA

US REDBOOK: JUN STORE SALES +12.2% V YR AGO MO

US REDBOOK: STORE SALES +12.8% WK ENDED JUN 18 V YR AGO WK

CANADA MAY CPI 7.7% YOY VS APR 6.8%, FORECAST 7.4%; CPI IS FASTEST SINCE 1983

CANADA MAY CPI 1.4% MOM VS APR 0.6%, FORECAST 1.1%

CANADA MAY CPI EX FOOD & ENERGY 0.9% MOM; 5.2% YOY

BANK OF CANADA AVG 3 CORE CPI RATES 4.7% MAY VS APR 4.43%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 128.62 points (0.42%) at 30658.61

- S&P E-Mini Future up 21.5 points (0.57%) at 3789

- Nasdaq up 73.7 points (0.7%) at 11143.01

- US 10-Yr yield is down 11.7 bps at 3.158%

- US Sep 10Y are up 36/32 at 116-29.5

- EURUSD up 0.0033 (0.31%) at 1.0566

- USDJPY down 0.29 (-0.21%) at 136.28

- WTI Crude Oil (front-month) down $3.73 (-3.41%) at $105.82

- Gold is up $4.73 (0.26%) at $1837.70

- EuroStoxx 50 down 29.36 points (-0.84%) at 3464.64

- FTSE 100 down 62.83 points (-0.88%) at 7089.22

- German DAX down 148.12 points (-1.11%) at 13144.28

- French CAC 40 down 48.03 points (-0.81%) at 5916.63

US TSY FUTURES CLOSE

- 3M10Y -15.055, 155.73 (L: 146.292 / H: 168.035)

- 2Y10Y +2.345, 9.573 (L: 5.246 / H: 10.439)

- 2Y30Y +4.553, 18.008 (L: 12.083 / H: 19.338)

- 5Y30Y +3.84, 1.05 (L: -2.967 / H: 4.196)

- Current futures levels:

- Sep 2Y up 10.125/32 at 104-20.375 (L: 104-09.625 / H: 104-21.375)

- Sep 5Y up 23.25/32 at 111-2.75 (L: 110-11.25 / H: 111-07.25)

- Sep 10Y up 1-06/32 at 116-31.5 (L: 115-28.5 / H: 117-06)

- Sep 30Y up 2-23/32 at 136-03 (L: 133-22 / H: 136-10)

- Sep Ultra 30Y up 4-05/32 at 151-05 (L: 147-27 / H: 151-14)

US 10Y FUTURES TECH: (U2) Corrective Cycle Still In Play

- RES 4: 118-28 50-day EMA

- RES 3: 118-06 High Jun 10

- RES 2: 117-07+ 20-day EMA

- RES 1: 116-21+ 38.2% of the May 26 - Jun 14 range

- PRICE: 116-13+ @ 11:15 BST Jun 22

- SUP 1: 115-20/114-07+ Low Jun 17 / Low Jun 14 and bear trigger

- SUP 2: 114-00 Round number support

- SUP 3: 113-19 Low Jun 19, 2009 (cont)

- SUP 4: 112-27+ 1.236 proj of the Mar 31 - May 9 - 26 price swing

Treasuries are trading closer to recent highs and the current corrective cycle remains in play. The primary trend direction remains down and a resumption of weakness would refocus attention on 114-07+, the Jun 14 low and the bear trigger. A breach would confirm a resumption of the downtrend and open 114-00. Firm resistance is seen at 117-07+, the 20-day EMA. A stronger bounce would be considered corrective.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.055 at 96.680

- Dec 22 +0.145 at 96.180

- Mar 23 +0.185 at 96.180

- Jun 23 +0.180 at 96.270

- Red Pack (Sep 23-Jun 24) +0.180 to +0.210

- Green Pack (Sep 24-Jun 25) +0.165 to +0.205

- Blue Pack (Sep 25-Jun 26) +0.120 to +0.150

- Gold Pack (Sep 26-Jun 27) +0.115 to +0.125

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00371 to 1.57129% (+0.00386/wk)

- 1M -0.00886 to 1.63271% (+0.02042/wk)

- 3M +0.03014 to 2.18457% (+0.08871/wk) * / **

- 6M -0.01529 to 2.82657% (+0.04714/wk)

- 12M -0.04557 to 3.57986% (-0.00600/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2+Y high: 2.15443% on 6/22/22

- Daily Effective Fed Funds Rate: 1.58% volume: $67B

- Daily Overnight Bank Funding Rate: 1.57% volume: $242B

- Secured Overnight Financing Rate (SOFR): 1.45%, $957B

- Broad General Collateral Rate (BGCR): 1.46%, $372B

- Tri-Party General Collateral Rate (TGCR): 1.46%, $362B

- (rate, volume levels reflect prior session)

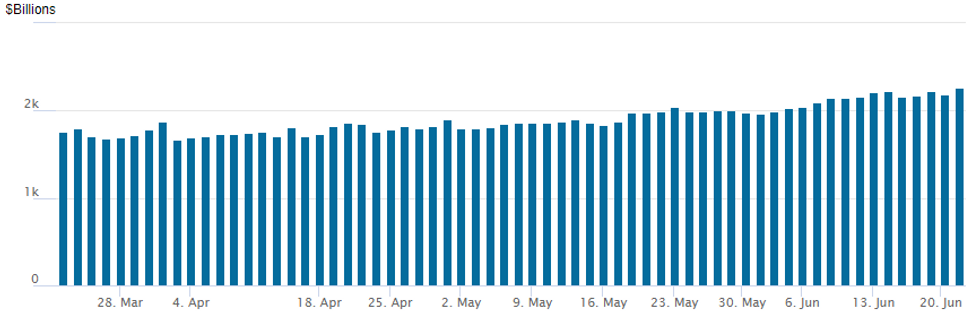

FED Reverse Repo Operation: New Record High

NY Federal reserve/MNI

NY Fed reverse repo usage climbs to new record high of $2,259.458B w/ 95 counterparties vs. $2,188.627 prior session. Compares to last Friday's record high of $2,229.279B.

PIPELINE: $1.5B Eversource 2Y, 5Y Launched

- Date $MM Issuer (Priced *, Launch #)

- 06/22 $2B *IADB 2Y SOFR+5

- 06/22 $1.5B #Eversource 2Y +125a, 5Y +150a

- 06/22 $1.25B Targa Resources $750M 5Y +200, $500M 30Y +300

- 06/22 $1.25B *AIIB 3Y SOFR+38

- 06/22 $1B *PSP Capital 5Y SOFR+58

- 06/22 $1B *Kommuninvest WNG 1.5Y SOFR+11

EGBs-GILTS CASH CLOSE: Yields Move Lower Alongside Oil Prices

EGBs rallied strongly across the board throughout Wednesday's session.

- A sharp drop in oil prices overnight, triggered in part on global growth concerns, helped drag on yields (and equities) early.

- Though stocks rallied in the afternoon, the oil bounce alongside was relatively tame and core FI held gains.

- Gilts outperformed Bunds (despite May UK inflation slightly above expectations); the UK curve bull steepened with Germany bull flattening.

- BTP spreads opened wider but narrowed over the course of the day. GGBs underperformed.

- Attention turns to PMI data Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 9.3bps at 1.062%, 5-Yr is down 13.1bps at 1.421%, 10-Yr is down 13.3bps at 1.638%, and 30-Yr is down 14bps at 1.835%.

- UK: The 2-Yr yield is down 17.2bps at 2.144%, 5-Yr is down 17.4bps at 2.166%, 10-Yr is down 15.5bps at 2.499%, and 30-Yr is down 14bps at 2.731%.

- Italian BTP spread down 4.3bps at 188.4bps / Greek up 9bps at 226.4bps

FOREX: Lower Yields Weigh On Greenback, EUR Crosses Buoyant

- Treasury yields plunged across the curve as fears of an economic recession sent investors into the relative safety of US government debt. G10 currencies were mixed but overall, lower core yields weighed on the USD index, which reversed significantly following initial strength on Wednesday.

- This prompted a steady and substantial bounce in EURUSD (+0.42%) from the 1.0470 early European lows all the way back to the 1.0600 area. Equities aside, growth fears fed into a sense of souring risk sentiment, which also boosted Euro crosses with EURNZD and EURAUD the standout performers, rising around 1% within close proximity of the May highs.

- USD/JPY (-0.25%) retreated off this week's multi-decade cycle high, putting the rate back below the Y136.25 in what's likely to be only a brief respite. USDJPY broke to new cycle highs this week, with price clearing short-term resistance at 135.59, Jun 15 high and this resistance point held as short-term support during today’s session. Overall, the technical break higher confirms a resumption of the primary uptrend and maintains the bullish price sequence of higher highs and higher lows.

- EURNOK had a firm 0.9% rally as a downleg in oil prices undermined sentiment somewhat ahead of tomorrow’s Norges bank meeting. Tighter policy has been well signposted for the June meeting, with the bank signalling a rate hike is “most likely” to be delivered. The size of the hike, however, is less forecastable and may keep NOK volatility elevated over the next 24 hours.

- European flash PMIs for June will headline Thursday’s docket as Fed Chair Powell continues to testify on the Semi-Annual Monetary Policy Report before the House Financial Services Committee.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/06/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/06/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 23/06/2022 | 0600/0800 | ** |  | SE | PPI |

| 23/06/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 23/06/2022 | 0715/0915 |  | FR | Flash Manufacturing, Services PMI | |

| 23/06/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/06/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/06/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/06/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/06/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 23/06/2022 | 0800/1000 |  | EU | ECB Economic Bulletin | |

| 23/06/2022 | 0800/1000 |  | EU | Flash Manufacturing, Services PMI | |

| 23/06/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/06/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/06/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/06/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/06/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/06/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/06/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 23/06/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 23/06/2022 | - |  | EU | ECB Lagarde at European Council Meeting | |

| 23/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 23/06/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 23/06/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/06/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/06/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 23/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/06/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 23/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 23/06/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.