-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: 10YY Back Below 3%

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed Could Revise Down Rate Peak-S&P's Gruenwald

- US DATA: MNI Chicago Business Barometer Falls to 56.0 in June

- MNI BRIEF: Dallas Fed Trimmed Mean Inflation Surges Higher

- OPEC+ RATIFIES PLANNED AUGUST OIL-SUPPLY HIKE: DELEGATES, Bbg

US

FED: Aggressive Federal Reserve policy spurred by ongoing price spikes will usher in low economic growth this year and perhaps a recession next year, which could push the central bank to reconsider guidance suggesting it will push rates further toward 4% in 2023, Global Chief Economist at S&P Global Ratings Paul Gruenwald told MNI.

- In the Fed's projections released in June, the median central bank official penciled in a 3.4% fed funds rate by year-end and a terminal rate of 3.8% in 2023. Yet 2023 is when many economists, including Gruenwald, believe the economy might slip into recession as unemployment ticks up and consumer spending ebbs.

- "The Fed is strongly focusing on the inflation numbers, and inflation expectations moving higher supports the Fed's overshoot argument, but maybe they'll need to slow down if there is a turn later on in consumption," he said. For more see MNI Policy main wire at 1140ET.

- The 12-month inflation rate also moved higher to 3.96% over the 12 months to May from 3.76% in April, the fastest annual gain since 1990. Officials have cited the Dallas Fed's measure as one of the best indicators of underlying inflation.

- The Cleveland Fed's median PCE inflation rate released earlier Thursday also showed a step up in the month-over-month figures, jumping 0.58% in May, up from 0.44% in April and 0.24% in March. The Cleveland Fed's year-over-year figure increased to 4.75% from 4.40% the prior month, the highest since 1983. Official Bureau of Economic Analysis data from the Commerce Department earlier Thursday showed headline PCE inflation rising 6.3% over the year, while core PCE was 4.7%.

US TSYS: 10YY Well Below 3.0%

Month-end risk-off tone held in late trade, Tsys near late session highs after the bell, 30YY slips to 3.1163% low, 10YY well below 3.0% to 2.9685% - lowest since June 10. Meanwhile, stocks trade weaker - but trading off midmorning lows after the rate close, SPX ESU2 futures around 3797.0 at the moment.

- Tsys loosely tracked higher EGBs coming into the session, extended gains post-data: PCE deflator and May spending on the soft side (0.2% vs. 0.4% est), on top of prior personal spending revised lower. Not much of a reaction as Chicago PMI tumbled to 56.0 in June, giving back last month's recovery.

- Month/half-yr end as trading desks continue to mull hard landing after Wed's central bank policy meeting in Sintra. Tsy extension est +.07yr.

- Technicals for TYU2: Treasuries have recovered from Tuesday’s low of 116-11. Key short-term resistance is unchanged at 118-09+, the Jun 30 high where a break would signal a resumption of recent gains. This would open the 50-day EMA, at 118-16 - an important short-term pivot resistance.

- Note that the primary trend is down. Initial firm support to watch is 115-20, the Jun 17 low. A breach would expose 114-07+, the bear trigger.

- Reminder, slightly early close Fri (1300ET) going into extended 4th of July holiday.

OVERNIGHT DATA

- US JOBLESS CLAIMS -2K TO 231K IN JUN 25 WK

- US PREV JOBLESS CLAIMS REVISED TO 233K IN JUN 18 WK

- US CONTINUING CLAIMS -0.003M to 1.328M IN JUN 18 WK

- US MAY PERSONAL INCOME +0.5%; NOM PCE +0.2%

- US MAY PCE PRICE INDEX +0.6%; +6.3% Y/Y

- US MAY CORE PCE PRICE INDEX +0.3%; +4.7% Y/Y

- US MAY UNROUNDED PCE PRICE INDEX +0.588%; CORE +0.348%

- Production slowed 5.7 points in June, 4.7 points below the 12-month average. Firms cited waning demand and slowing production.

- New Orders saw the largest decrease this month, dropping 9.8 points to 49.9, the lowest in two years. A quarter of firms saw fewer new orders received in June.

- Order Backlogs saw the second-largest decline, falling 9.4 points to a 19-month low of 55.2. As new orders fell, backlogs saw a substantial decrease. For more see MNI Main Wire at 0945ET.

US DATA: ADP Reports Postponed, Will New Methodology Be Better NFP Predictor? ADP have announced they are pausing their monthly Employment Reports in order to implement a new methodology, and will not issue a new one until Aug 31 (the Jul 7 and Aug 3 releases are cancelled). Market-wise, the ADP Employment Report has been seen as a somewhat useful indicator of the general direction of monthly nonfarm private payrolls which typically comes out a day or two later.

- But it hasn't historically been seen as a particularly reliable signal, not least because prior months are often revised significantly due to their methodology - it's a model-based indicator that takes into account their own proprietary payrolls data and previous months' nonfarm payrolls readings, among other inputs.

- The new methodology is being designed with the Stanford Digital Economy Lab in order to emerge with "a more robust, high-frequency view of the labor market and trajectory of economic growth".

- ADP often gets market attention but is largely shrugged off quickly, so it will be interesting to see over time if the new data and methodology makes it a better predictor of NFPs going forward (and therefore more market-moving).

- Link: ADP Postponed

- CANADA APR GROSS DOMESTIC PRODUCT +0.3% MOM

- CANADA APR GOODS INDUSTRY GDP +0.9%, SERVICES +0.1%

- CANADA REVISED MAR GROSS DOMESTIC PRODUCT +0.7% MOM

- CANADA APR GDP +0.3% VS MAR +0.7%, FORECAST +0.3%

- CANADA APR GOODS GDP +0.9%, SERVICES +0.1%

- CANADIAN YOY GDP WAS +5.0% IN APRIL

- CANADA REAL ESTATE SECTOR -0.8% IN APRIL, AIRLINES +20%

- CANADA FLASH MAY GDP -0.2% ON MINES, ENERGY, FACTORIES

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 405.72 points (-1.31%) at 30624.46

- S&P E-Mini Future down 52.5 points (-1.37%) at 3769.5

- Nasdaq down 206.3 points (-1.8%) at 10971.89

- US 10-Yr yield is down 11.1 bps at 2.9777%

- US Sep 10Y are up 31.5/32 at 118-16

- EURUSD up 0.0026 (0.25%) at 1.0469

- USDJPY down 0.96 (-0.7%) at 135.62

- WTI Crude Oil (front-month) down $4.03 (-3.67%) at $105.73

- Gold is down $11.97 (-0.66%) at $1805.77

- EuroStoxx 50 down 59.46 points (-1.69%) at 3454.86

- FTSE 100 down 143.04 points (-1.96%) at 7169.28

- German DAX down 219.58 points (-1.69%) at 12783.77

- French CAC 40 down 108.62 points (-1.8%) at 5922.86

US TSY FUTURES CLOSE

- 3M10Y -2.881, 130.113 (L: 125.441 / H: 133.659)

- 2Y10Y +0.439, 5.092 (L: 2.482 / H: 7.187)

- 2Y30Y +2.805, 20.392 (L: 15.742 / H: 21.087)

- 5Y30Y +4.574, 11.965 (L: 6.203 / H: 12.384)

- Current futures levels:

- Sep 2Y up 9/32 at 105-0.25 (L: 104-23.25 / H: 105-00.625)

- Sep 5Y up 22/32 at 112-7.5 (L: 111-16.5 / H: 112-08.75)

- Sep 10Y up 32/32 at 118-16.5 (L: 117-14 / H: 118-18)

- Sep 30Y up 51/32 at 138-17 (L: 136-18 / H: 138-22)

- Sep Ultra 30Y up 67/32 at 154-3 (L: 151-15 / H: 154-14)

US 10YR FUTURES TECHS: (U2) Extends Bounce From Tuesday’s Low

- RES 4: 120-00 Round number resistance

- RES 3: 119-16+ High Jun 1

- RES 2: 119-03+ 76.4% retracement of the May 26 - Jun 14 bear leg

- RES 1: 118-09+/16 High Jun 30 / 50-day EMA

- PRICE: 118-06+ @ 1125ET Jun 30

- SUP 1: 116-11/115-20 Low Jun 17

- SUP 2: 114-07+ Low Jun 28 / 14 and bear trigger

- SUP 3: 114-00 Round number support

- SUP 4: 113-19 Low Jun 19, 2009 (cont)

Treasuries have recovered from Tuesday’s low of 116-11. Key short-term resistance is unchanged at 118-09+, the Jun 30 high where a break would signal a resumption of recent gains. This would open the 50-day EMA, at 118-16 - an important short-term pivot resistance. Note that the primary trend is down. Initial firm support to watch is 115-20, the Jun 17 low. A breach would expose 114-07+, the bear trigger.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.060 at 96.790

- Dec 22 +0.140 at 96.310

- Mar 23 +0.195 at 96.385

- Jun 23 +0.220 at 96.570

- Red Pack (Sep 23-Jun 24) +0.20 to +0.210

- Green Pack (Sep 24-Jun 25) +0.170 to +0.195

- Blue Pack (Sep 25-Jun 26) +0.140 to +0.160

- Gold Pack (Sep 26-Jun 27) +0.125 to +0.135

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00871 to 1.57900% (+0.00286/wk)

- 1M +0.07357 to 1.78671% (+0.15400/wk)

- 3M +0.00800 to 2.28514% (+0.05071/wk) * / **

- 6M -0.01157 to 2.93514% (+.06857/wk)

- 12M +0.00543 to 3.61900% (+0.07429/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.28514% on 6/30/22

- Daily Effective Fed Funds Rate: 1.58% volume: $85B

- Daily Overnight Bank Funding Rate: 1.57% volume: $238B

- Secured Overnight Financing Rate (SOFR): 1.51%, $940B

- Broad General Collateral Rate (BGCR): 1.51%, $352B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $332B

- (rate, volume levels reflect prior session)

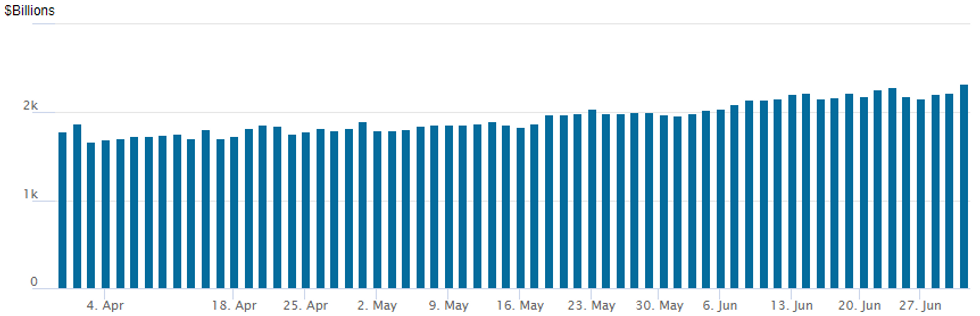

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new record high of $2,329.743B w/ 108 counterparties vs. $2,226.976B prior session. Compares to prior record high of $2,285.428B from Thursday June 23.

PIPELINE

No new issuance since Wednesday, total $7.75B priced on week, $79.25B total for June compares to $136.35B for June 2021.

EGBs-GILTS CASH CLOSE: Risk-Off Rally Continues

Bund yields continued to plummet Thursday, continuing the price action following a below-expected German inflation print Wednesday.

- Schatz and Bobl yields erased the last three weeks' rise, with the German curve outperforming its UK counterpart.

- Bull steepening was the common theme as rate hikes were priced out (ECB end-2022 implied rates fell 14bp, BoE -8bp), with growth fears resurfacing (commodity prices dropped sharply, European equities down 1.5-2% to end a miserable half-year).

- BTP spreads fell to session lows on a Reuters sources report saying the ECB will buy periphery EGB bonds with proceeds from maturing core/semi-core instruments bought under PEPP. But the move eventually faded, due in part to the risk-off move overall, but also perhaps lingering doubts over whether this is a "done deal".

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 18.9bps at 0.649%, 5-Yr is down 21.6bps at 1.067%, 10-Yr is down 18.3bps at 1.336%, and 30-Yr is down 12.3bps at 1.615%.

- UK: The 2-Yr yield is down 19.9bps at 1.842%, 5-Yr is down 18.2bps at 1.893%, 10-Yr is down 15.6bps at 2.229%, and 30-Yr is down 10.5bps at 2.564%.

- Italian BTP spread up 4.6bps at 192.8bps / Greek up 12.8bps at 228bps

FOREX: US Dollar Reverses Lower As US Yields Plunge

- US 10-year note yields dropped back below 3% for the first time in 3 weeks, weighing heavily on the greenback as currency markets dealt with additional month-end dynamics.

- The greenback had extended gains initially on Thursday, sitting in firm positive territory approaching the NY crossover. Potential profit-taking ahead of month-end rebalancing may have been a factor for a swift reversal in sentiment and a consistent grind lower through the US trading session.

- Furthermore, the dollar weakness was exacerbated after data on US consumer spending and the key PCE deflator gauge advanced less than expected, signaling US inflation may have peaked.

- Still, the dollar is still headed for its best quarter since 2016, helped by higher rates and haven flows amid downbeat expectations for economic growth and the DXY remains up just shy of a half percent this week.

- EURUSD had significantly narrowed the gap with 1.0350, May 13 low and the technical bear trigger. Troughing at 1.0383, the pair was a key beneficiary to the reversal in greenback sentiment, rising over 100 pips to print fresh highs at 1.0488.

- Strength in the Japanese Yen was a notable standout today as the interest rate differential between 10-year U.S. notes and Japanese notes narrowed by roughly 10 basis points. The pair has firmly faded off the cycle peak posted yesterday at 137.00, the highest print since 1998. JPY is the strongest currency across G10, up 0.75% against the US dollar.

- Eurozone June CPI Flash Estimate y/y headlines the data docket tomorrow before the US ISM Manufacturing PMI marks the final major data point of the week.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/07/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/07/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/07/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 01/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 01/07/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/07/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/07/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/07/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 01/07/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/07/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/07/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/07/2022 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.