-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI ASIA OPEN: Strong Data Green Lights Second 75Pb Hike

EXECUTIVE SUMMARY

- MNI: Fed's Williams Expects US Growth To Slow Considerably

- MNI INTERVIEW: No Sign of Slowing in Inflation - Fed's Dolmas

- MNI BRIEF: US June Jobs Stronger-Than-Expected 372k; AHE 0.3%

US

FED: U.S. inflation data show little sign of slowing from a torrid pace in May, with no immediate relief from Fed tightening for key core services components like shelter and dining out costs, Federal Reserve Bank of Dallas economist Jim Dolmas told MNI.

- The Dallas Fed Trimmed Mean PCE inflation rate, a less volatile gauge of price pressures and a better predictor of future price changes, points to an underlying inflation rate of between 4% and 5%, said Dolmas, who developed and maintains the measure.

- Fed officials are likely to support repeating June's aggressive 75 basis point rate hike later this month to tackle soaring inflation. Headline PCE inflation rose 6.3% in May, unchanged from April, while core PCE inflation slowed to 4.7% from 4.9% a month earlier. (See: MNI INTERVIEW: US Inflation Has Likely Peaked-Fed's Andolfatto). For more see MNI Policy main wire at 0938ET.

- Average hourly earnings rose by 0.3% over the month, a tenth slower from May's figure. Labor force participation and the employment-to-population ratio ticked down by 0.1pp and 0.2pp, respectively.

- Job growth was led by professional and business services (+74,000), leisure and hospitality (+67,000) and health care (+57,000). Total nonfarm employment is down by 524,000, or 0.3%, from its pre-pandemic level in February 2020, all due to lower government employment.

- "I currently expect real GDP growth in the United States to be below one percent this year, and then to rebound slightly to around 1-1/2% next year," he said, a downward revision from comments just last week when he told CNBC that he saw growth in the range of 1-1.5% this year. "With overall growth slowing to below its trend level, I expect the unemployment rate to move up from its very low current level, reaching somewhat above 4% next year."

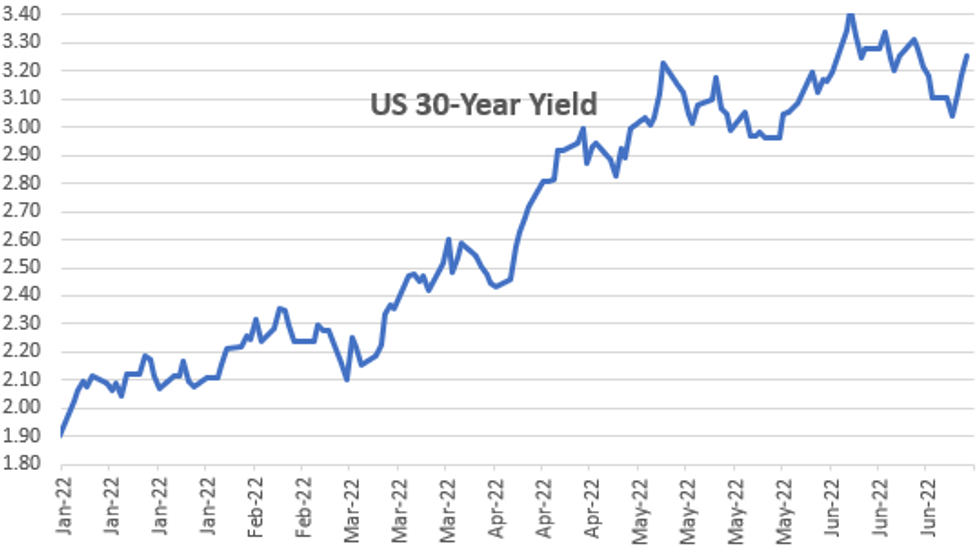

US TSYS: Strong Data Underscores Need For Second 75Bp Hike

Tsy futures broadly weaker after the bell, yld curves marginally steeper w/ long end underperforming after stronger than estimated June employ report +372k vs. +268k est, net revisions for April/May decline 74k.

- Strong data underscored a 75bp hike at end of month while markets got a little carried away pricing in small chance of 100bp hike (<5%) before moderating the move in the first half (balance of White pack (EDZ2-EDH3 currently -0.085-0.100 vs. -0.100-0.170 lows).

- New York Fed President John Williams said Friday he's revised down his expectations for U.S. economic growth and now expects the unemployment rate to rise past 4% next year as the central bank remains resolutely focused on restoring price stability. Williams later went on to say 75-50bps rate hike at the end of this month is the "right positioning" amid "sky high" inflation.

- Atlanta Fed Bostic was "fully supportive" over a second consecutive 75bps hike in July, confident the move would not hurt the economy.

OVERNIGHT DATA

- MNI: US JUN NONFARM PAYROLLS +372K; PRIVATE +381K, GOVT -9K

- US JUN AVERAGE HOURLY EARNINGS +0.3% Vs MAY +0.4%; +5.1% YOY

- US JUN UNEMPLOYMENT RATE 3.6%

- MNI: NET REVISIONS FOR US APRIL, MAY PAYROLLS -74K

- MNI:US MAY WHOLESALE INV 1.8%; SALES 0.5%

- MNI: US MAY CONSUMER CREDIT +$22.3B

- MNI: US MAY REVOLVING CREDIT +$7.4B

- MNI: US MAY NONREVOLVING CREDIT +$14.9B

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 20.31 points (-0.06%) at 31365.53

- S&P E-Mini Future up 0.25 points (0.01%) at 3905.5

- Nasdaq up 19.8 points (0.2%) at 11640.94

- US 10-Yr yield is up 9 bps at 3.084%

- US Sep 10Y are down 17/32 at 117-23.5

- EURUSD up 0.0016 (0.16%) at 1.0177

- USDJPY up 0.07 (0.05%) at 136.08

- WTI Crude Oil (front-month) up $1.88 (1.83%) at $104.60

- Gold is up $1.19 (0.07%) at $1741.30

- EuroStoxx 50 up 18.05 points (0.52%) at 3506.55

- FTSE 100 up 7.16 points (0.1%) at 7196.24

- German DAX up 172.01 points (1.34%) at 13015.23

- French CAC 40 up 26.43 points (0.44%) at 6033.13

US TSY FUTURES CLOSE

- 3M10Y +9.493, 113.341 (L: 101.91 / H: 115.93)

- 2Y10Y +0.506, -2.065 (L: -7.461 / H: -0.755)

- 2Y30Y -1.076, 15.353 (L: 8.284 / H: 18.625)

- 5Y30Y -1.603, 13.316 (L: 8.084 / H: 17.59)

- Current futures levels:

- Sep 2Y down 4.5/32 at 104-22.5 (L: 104-20.375 / H: 104-30.375)

- Sep 5Y down 11/32 at 111-23.5 (L: 111-18.5 / H: 112-10.75)

- Sep 10Y down 17/32 at 117-23.5 (L: 117-18 / H: 118-20)

- Sep 30Y down 1-16/32 at 136-29 (L: 136-25 / H: 138-29)

- Sep Ultra 30Y down 1-21/32 at 150-9 (L: 149-24 / H: 152-29)

US 10YR FUTURES TECHS: (U2) Retracement Extends

- RES 4: 121-28+ 1.382 proj of the 14 - 23 - 28 price swing

- RES 3: 121-10 1.236 proj of the 14 - 23 - 28 price swing

- RES 2: 120-19+ High May 26 and a key resistance

- RES 1: 119-05/120-16+ High Jul 7 / High Jul 6 and the bull trigger

- PRICE: 117-23 @ 13:52 BST Jul 8

- SUP 1: 117-12 50.0% retracement of the Jun 14 - Jul 6 rally

- SUP 2: 116-11 Low Jun 28 and a key near-term support

- SUP 3: 115-20 Low Jun 17

- SUP 4: 114-05+ Low Jun 14 and the bear trigger

Treasuries continue to retreat and the contract is softer following today's NFP data. The current pullback is still considered corrective, as long as price is above to remain above support at 116-11, the Jun 28 low. A break of this support is required to strengthen a bearish threat and would signal scope for a deeper retracement. On the upside, a reversal higher would refocus attention on the short-term bull trigger at 120-16+, Wednesday’s high.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.055 at 96.680

- Dec 22 -0.080 at 96.160

- Mar 23 -0.10 at 96.20

- Jun 23 -0.095 at 96.375

- Red Pack (Sep 23-Jun 24) -0.09 to -0.075

- Green Pack (Sep 24-Jun 25) -0.075 to -0.065

- Blue Pack (Sep 25-Jun 26) -0.065 to -0.06

- Gold Pack (Sep 26-Jun 27) -0.065 to -0.06

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00714 to 1.56057% (-0.00672/wk)

- 1M +0.02757 to 1.89971% (+0.10214/wk)

- 3M -0.00457 to 2.42300% (+0.13014/wk) * / **

- 6M -0.00771 to 3.04843% (+.14914/wk)

- 12M -0.01257 to 3.64486% (+0.08057/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.42757% on 7/7/22

- Daily Effective Fed Funds Rate: 1.58% volume: $92B

- Daily Overnight Bank Funding Rate: 1.57% volume: $271B

- Secured Overnight Financing Rate (SOFR): 1.54%, $966B

- Broad General Collateral Rate (BGCR): 1.51%, $361B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $355B

- (rate, volume levels reflect prior session)

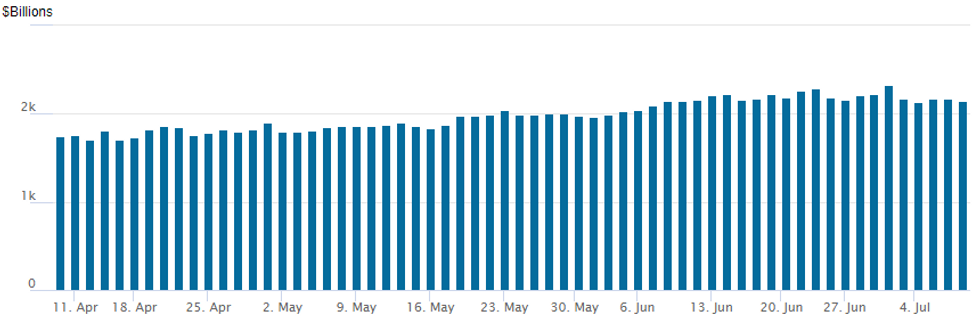

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,144.921B w/ 97 counterparties vs. $2,172.457B prior session. Record high stands at $2,329.743B from Thursday June 30.

EGBs-GILTS CASH CLOSE: Yields Reverse Higher On Strong US Jobs Number

Bund and Gilt yields reversed sharply higher Friday after June's US Employment report was stronger than expected.

- While the initial bearish move faded somewhat by mid-afternoon, yields ended near/at session highs with Gilts underperforming.

- Moves across the curves were mixed: UK yields rose largely in parallel throughout the day; the German curve had earlier bull steepened but ended up twist steepening.

- There was little European data/newsflow driving, and volumes were low - morning trade was very subdued awaiting the US jobs figure.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 3.1bps at 0.527%, 5-Yr is down 1.1bps at 0.966%, 10-Yr is up 2.7bps at 1.345%, and 30-Yr is up 5.7bps at 1.609%.

- UK: The 2-Yr yield is up 10.3bps at 1.93%, 5-Yr is up 10.1bps at 1.912%, 10-Yr is up 10.5bps at 2.233%, and 30-Yr is up 8.7bps at 2.635%.

- Italian BTP spread down 4.7bps at 194.4bps / Spanish down 1.9bps at 107.2bps

FOREX: High Beta FX Rallies on Hopes of Further Gas Flows to Europe

- Confirmation from the Kremlin that repairs on the Nordstream pipeline could prompt increased Russian gas flows into the continent helped soothe sentiment Friday, prompting outperformance of global equity futures as well as commodity-tied currencies. This resulted in AUD and NZD being the two best performers in G10.

- Meanwhile, the June Nonfarm Payrolls report effectively gave the greenlight to further tightening from the Fed, with headline job gains coming in ahead of expectations (+372k vs. Exp. +265k) and Y/Y earnings stronger than forecast - complimented by upward revisions to the prior. The USD benefited from the release, but the strength faded swiftly into the close, putting the USD on track to close lower for the first time in over a week.

- Elsewhere, the CHF slowly but surely slipped lower against all others in G10 having initially dropped alongside the EUR in early Friday trade, before a gradual recovery in equities further dented haven currency appeal. USD/CHF printed the best level since mid-June and the last SNB rate decision, putting the pair north of the 0.9740 50-dma.

- Focus in the coming week turns to the US CPI report for June as well as the prelim University of Michigan survey, Chinese trade balance and the Australian jobs report.

- The quarterly US earnings cycle begins, with early focus on the largest US banks and financial institutions. Among the largest in the coming week are JP Morgan, Citigroup, Morgan Stanley and Wells Fargo.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/07/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 11/07/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 11/07/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 11/07/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 11/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/07/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/07/2022 | 1800/1400 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.