-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Short End Unwinds 100Bp Hike Pricing

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed To Hike Into Weaker Growth If Inflation High

- MNI: Fed's Waller Backs At Least 75BP After ‘Major League’ CPI

- MNI: Fed Fears Financial Tightening May Speed Up -Ex-Officials

- WALLER: JUNE CPI ANCHORED MY VIEW ON NEED FOR 75 BP JULY HIKE, Bbg

US

FED: The Federal Reserve will likely keep raising interest rates even if the economy slows considerably as long as headline inflation remains elevated because the risk of unanchored expectations means it can no longer look through energy price shocks, ex-Fed governor Jeremy Stein told MNI.

- Fed officials have made clear that fighting 40-year high inflation is their top priority regardless of a possible slowing in the economy, which policymakers still hope can avoid a recession. .

- “It sounds like they’re not really giving themselves that out the way they talk. They’re just saying we want to see headline inflation come down,” Stein said in an interview. For more see MNI Policy main wire at 1249ET.

FED: The Federal Reserve probably needs to raise interest rates another 75 basis points at this month's meeting, Governor Christopher Waller said Thursday, but he could support a larger hike if demand doesn't show signs of slowing.

- "We have important data releases on retail sales and housing coming in before the July meeting. If that data come in materially stronger than expected it would make me lean towards a larger hike at the July meeting to the extent it shows demand is not slowing down fast enough to get inflation down," he said in prepared remarks.

- Calling the June CPI report showing inflation surged to 9.1% over the year a "major league disappointment," Waller said he supports another 75-basis point increase at the July 26-27 FOMC meeting, bringing the fed funds rate to 2.25% - 2.5%. For more see MNI Policy main wire at 1100ET.

FED: Federal Reserve officials are worried U.S. financial conditions could tighten more quickly than expected in response to aggressive rate increases and balance sheet runoffs, potentially compromising economic expansion, former central bank officials and researchers told MNI.

- Policymakers are paying close attention to various measures of financial conditions including the stock market, whose sharp recent decline could drag on investment and household wealth, and to an incipient widening of credit spreads, as they seek to gauge how close rates are getting to neutral levels that neither boost nor slow growth and avoid any overshoot in monetary tightening, ex-policymakers said.

- “How much tightening you’re getting depends on financial markets -- what does the stock market do, what does credit do? I find it hard to think about (neutral) in terms of a stopping point defined in units of Treasury rates,” said Jeremy Stein, a former Fed governor now at Harvard University, in an interview. For more see MNI Policy main wire at 1116ET.

US TSYS: Fed's Waller, Bullard Tamp Down 100Bp Hike Pricing

Rates trading weaker after the bell -- are well off first half lows after Fed Gov Waller tamped down on mkt pricing in chance of 100bps hike at the end of the month following Wed's "major league" CPI.

- Short end Fed Funds and Eurodollar futures gapped higher on Fed Gov Waller comments that he supports another 75-basis point increase at the July 26-27 FOMC meeting, bringing the fed funds rate to 2.25% - 2.5%.

- Sidebar: StL Fed Bullard also said he favored a 75bp hike at the end of the month. On Wednesday, Sep'22 Eurodollar futures settled -0.300 to 96.385 as markets reacted to hot Jun CPI inflation data, extending the move late after Fed's Bostic said "everything In play for future policy decisions".

- Waller judges that level is close to neutral," he said. "I think that estimates of the real federal funds rate should be based on the expected policy rate one to one and a half years in the future."

- Though June CPI may have "anchored" Waller's 75bp hike expectation in a couple weeks, He would "lean toward larger, full-point" hike if "retail sales, housing data are 'materially stronger than expected' Rtrs reported.

- Heavy data focus Friday includes Retail Sales MoM (-0.3%, 0.9%); ex-Auto (0.5%, 0.7%), Import/Export Prices, Cap-U/IP, UofMich Sentiment. Expect more Fed speak with policy blackout starting Fri at midnight. Sock earnings continue: Bank of NY Mellon, Wells Fargo, Citi Group, Blackrock, State Stree and US Bancorp on Friday.

OVERNIGHT DATA

- US JOBLESS CLAIMS +9K TO 244K IN JUL 09 WK

- US PREV JOBLESS CLAIMS REVISED TO 235K IN JUL 02 WK

- US CONTINUING CLAIMS -0.041M to 1.331M IN JUL 02 WK

- US JUN FINAL DEMAND PPI +1.1%, EX FOOD, ENERGY +0.4%

- US JUN FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.3%

- US JUN FINAL DEMAND PPI Y/Y +11.3%, EX FOOD, ENERGY Y/Y +8.2%

- US JUN PPI: FOOD +0.1%; ENERGY +10.0%

- CANADIAN MAY MANUFACTURING SALES -2.0% MOM

- CANADA MAY FACTORY INVENTORIES +1.6%; INVENTORY-SALES RATIO 1.59

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 184.87 points (-0.6%) at 30602.16

- S&P E-Mini Future down 17.5 points (-0.46%) at 3789.5

- Nasdaq down 12.8 points (-0.1%) at 11240.04

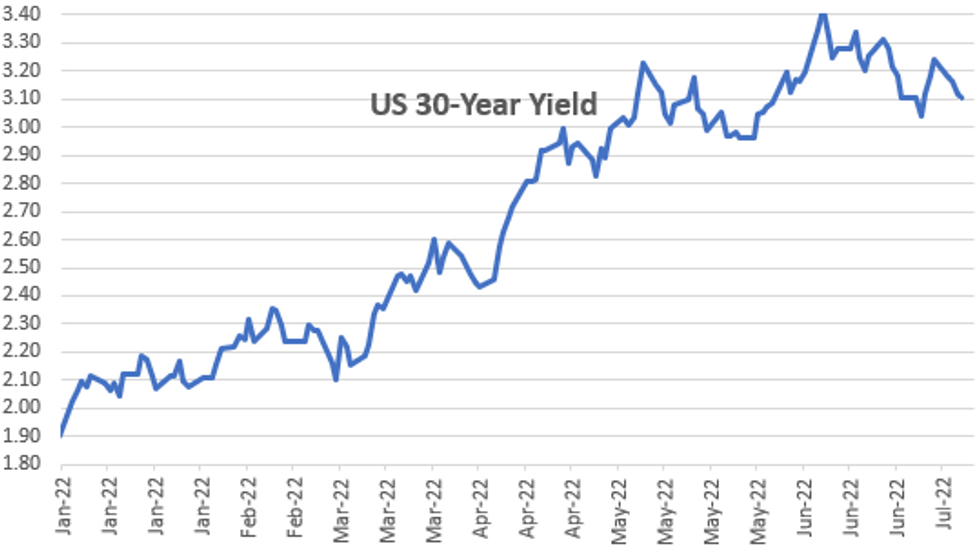

- US 10-Yr yield is up 3.1 bps at 2.965%

- US Sep 10Y are down 16.5/32 at 118-13

- EURUSD down 0.004 (-0.4%) at 1.002

- USDJPY up 1.54 (1.12%) at 138.92

- WTI Crude Oil (front-month) up $0.07 (0.07%) at $96.40

- Gold is down $25.66 (-1.48%) at $1709.93

- EuroStoxx 50 down 57.36 points (-1.66%) at 3396.61

- FTSE 100 down 116.56 points (-1.63%) at 7039.81

- German DAX down 236.66 points (-1.86%) at 12519.66

- French CAC 40 down 84.83 points (-1.41%) at 5915.41

US TSY FUTURES CLOSE

- 3M10Y +6.237, 58.885 (L: 45.131 / H: 59.87)

- 2Y10Y +3.54, -19.194 (L: -27.574 / H: -15.023)

- 2Y30Y -0.645, -5.129 (L: -13.313 / H: 1.435)

- 5Y30Y -6.169, 2.527 (L: -1.639 / H: 7.513)

- Current futures levels:

- Sep 2Y down 1.25/32 at 104-21.25 (L: 104-14.625 / H: 104-24)

- Sep 5Y down 8.75/32 at 111-29.25 (L: 111-17.25 / H: 112-07)

- Sep 10Y down 16.5/32 at 118-13 (L: 117-28.5 / H: 118-30)

- Sep 30Y down 27/32 at 139-16 (L: 138-17 / H: 140-07)

- Sep Ultra 30Y down 1-03/32 at 154-23 (L: 153-01 / H: 155-20)

US 10YR FUTURES TECHS: (U2) Trend Needle Still Points North

- RES 4: 121-28+ 1.382 proj of the 14 - 23 - 28 price swing

- RES 3: 121-10 1.236 proj of the 14 - 23 - 28 price swing

- RES 2: 120-19+ High May 26 and a key resistance

- RES 1: 119-06/120-16+ High Jul 13 / High Jul 6 and the bull trigger

- PRICE: 118-12+ @ 1520ET Jul 14

- SUP 1: 117-18/12 Low Jul 8 / 50.0% of the Jun 14 - Jul 6 rally

- SUP 2: 116-11 Low Jun 28 and a key near-term support

- SUP 3: 115-20 Low Jun 17

- SUP 4: 114-05+ Low Jun 14 and the bear trigger

Treasuries are broadly unchanged and remain above 117-18, the Jul 8 low. The short-term trend condition is bullish and recent weakness is considered corrective. Key short-term support is at 116-11, the Jun 28 low where a break is required to strengthen a bearish threat. This would signal scope for a deeper retracement. On the upside, attention is on the short-term bull trigger at 120-16+, the Jul 6 high. A break would resume the uptrend.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.085 at 96.470

- Dec 22 +0.040 at 96.060

- Mar 23 -0.050 at 96.220

- Jun 23 -0.075 at 96.420

- Red Pack (Sep 23-Jun 24) -0.07 to -0.065

- Green Pack (Sep 24-Jun 25) -0.075 to -0.06

- Blue Pack (Sep 25-Jun 26) -0.075 to -0.07

- Gold Pack (Sep 26-Jun 27) -0.075 to -0.065

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00315 to 1.55814% (-0.00243/wk)

- 1M +0.15686 to 2.15600% (+0.25629/wk)

- 3M +0.22829 to 2.74029% (+0.31729/wk) * / **

- 6M +0.32029 to 3.32129% (+.33286/wk)

- 12M +0.24415 to 3.97829% (+0.33343/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.51200% on 7/13/22

- Daily Effective Fed Funds Rate: 1.58% volume: $96B

- Daily Overnight Bank Funding Rate: 1.57% volume: $274B

- Secured Overnight Financing Rate (SOFR): 1.53%, $924B

- Broad General Collateral Rate (BGCR): 1.51%, $367B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $358B

- (rate, volume levels reflect prior session)

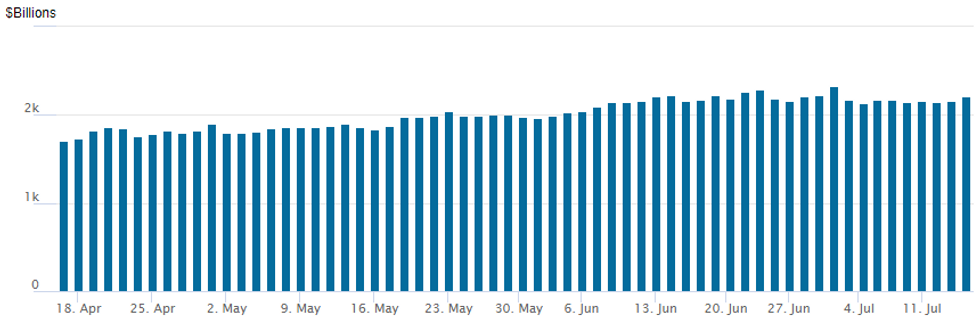

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,207.121B w/ 97 counterparties vs. $2,155.290B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $2.5B PepsiCo 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/14 $2.5B #PepsiCo $750M +5Y +55, $1.25B 10Y Green +95, $500M 30Y +108

EGBs-GILTS CASH CLOSE: BTPs Rally Late As Draghi Seen Staying

The German and UK curves bear flattened Thursday, with Gilts underperforming - though Italian politics stole the show.

- Italy PM Draghi's government won a closely-watched Senate confidence vote, but his future remains uncertain after 5-Star abstained from supporting (a situation which he had previously said would mean the fall of the government).

- BTP spreads fell sharply from intraday highs (closed 207bp, vs 218bp high) going into the close after reports Draghi hadn't submitted his resignation as had been speculated - he's set to hold a cabinet meeting at 1815CET.

- ECB / BoE hike pricing firmed, following Fed 100bp hike speculation overnight post-US CPI, but faded toward session end on comments by FOMC's Waller that pointed to a 75bp raise.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 6.5bps at 0.523%, 5-Yr is up 3.8bps at 0.874%, 10-Yr is up 3.3bps at 1.178%, and 30-Yr is up 0.3bps at 1.383%.

- UK: The 2-Yr yield is up 16.4bps at 1.962%, 5-Yr is up 7.8bps at 1.833%, 10-Yr is up 4.1bps at 2.101%, and 30-Yr is up 2.9bps at 2.551%.

- Italian BTP spread up 7.1bps at 207.2bps / Spanish up 5bps at 115.8bps

FOREX: USD Paring Gains Amid Bounce In Equities Following Fresh Cycle Highs

- With the focus on a potential acceleration of the Fed’s tightening pace following Wednesday’s inflation data, the greenback has continued to rally, prompting the USD index to print fresh cycle highs. Early weakness across both equity and commodity markets exacerbated the safe haven demand across currency markets, although the greenback rally has been tempered amid the most recent recovery in major equity benchmarks.

- USD/JPY was the early mover, breaking through 138 overnight and indeed accelerating above 139 throughout European trade. The rally narrowed the gap with next resistance at 139.48 (the 1.00 proj of the Jun 16 - 22 - 23) ahead of the psychological 140.00 level.

- Approaching the US cash equity open, EURUSD then finally gave way below parity. After breaching, yesterday’s low of 0.9998, a flurry of activity saw the pair trade as low as 0.9952, in close proximity of 0.9944 support, a Fibonacci projection. Despite the bounce back above parity throughout the US trading session, Trend signals still point south and daily/weekly closes below this psychological level will be significant for further momentum to the downside to gain traction.

- Matching the Japanese Yen, the Canadian dollar equally felt the pinch just a day after the BOC’s aggressive 100bp rate hike. USDCAD strength was exacerbated on a break of yesterday’s high at 1.3060 and the pair surged to 1.3224 highs. Despite the pair reversing 100 pips lower ahead of the APAC crossover, it remains up 1.1% on the day.

- Chinese growth and activity data will be the focus of Friday’s APAC session. US retail sales, empire state manufacturing and university of Michigan sentiment data are all notable releases on the US calendar to finish the week.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/07/2022 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/07/2022 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/07/2022 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/07/2022 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 15/07/2022 | 0200/1000 | *** |  | CN | GDP |

| 15/07/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 15/07/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 15/07/2022 | - |  | EU | ECB Lagarde & Panetta at G20 CB Meeting | |

| 15/07/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 15/07/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/07/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/07/2022 | 1245/0845 |  | US | Atlanta Fed's Raphael Bostic | |

| 15/07/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/07/2022 | 1300/0900 |  | US | St. Louis Fed's James Bullard | |

| 15/07/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 15/07/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 15/07/2022 | 1400/1000 | * |  | US | Business Inventories |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.