-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Aggressive Hikes Cautioned

EXECUTIVE SUMMARY

- MNI INTERVIEW: Aggressive Fed Risks Liquidity Squeeze-Hoenig

- MNI INTERVIEW: Fed Says Market Strains Could Ramp Up QT Effect

- MNI: Lawmakers To Back Draghi If He Stays As PM-Party Sources

- US: Biden To Deliver Remarks On Climate Crisis Tomorrow

- IRAN'S KHAMENEI SAYS BOTH TEHRAN AND MOSCOW WILL BENEFIT FROM LONG TERM COOPERATION - TV, Rtrs

US

FED: The Federal Reserve risks triggering a sharp and sudden tightening of credit conditions in coming months as it tightens aggressively to make up for lost time, former Kansas City Fed President Thomas Hoenig told MNI.

- The Fed has upped its pace of rate hikes at every meeting so far this year, increasing by 25 bps in March after standing pat in January, then by 50 bps in May and 75 bps in June. It is widely expected to deliver another 75 bps at next week’s meeting.

- “I don’t think people appreciate just how far behind the curve they were and remain. And I don’t think people appreciate that the so-called tightening phase didn’t really start until May or June, because the first move was so insignificant,” said Hoenig, who expects the Fed to tighten into a likely recession. “You will see a liquidity squeeze of some significance and that will further assure us of a significant financial constraint here in the next few months.”

FED: Strains in the U.S. Treasury market and risk averse traders could complicate the central bank's plans to reduce its balance sheet by amplifying the effect of those reductions on financial markets and raising interest rates more than anticipated, the author of a new Atlanta Fed paper told MNI.

- Bin Wei of the Atlanta Fed said in an interview Friday risk aversion amongst traders as the central bank pulls back from the Treasury market and adds additional supply to the market could mean this round of "quantitative tightening" could have a larger impact.

- A passive roll off of USD2.2 trillion of the Fed's holdings of U.S. Treasury bonds over the next three years would have the equivalent impact of immediately increasing the short-term federal funds policy rate by about 0.29 percentage points but 74 basis points during turbulent periods, said Wei. "This estimate is based on the assumption of normal market conditions and the 29 basis points is not that big." For more see MNI Policy main wire at 0912ET.

- This week has seen speculation that Biden will use executive powers to pursue climate goals following the collapse of the reconciliation talks with Senator Joe Manchin (D-WV) last week.

- A White House official told WaPo: "The president made clear that if the Senate doesn't act to tackle the climate crisis and strengthen our domestic clean energy industry, he will. We are considering all options and no decision has been made."

EUROPE

ITALY: Parliamentarians from across Italy’s political divide are likely to provide broad backing for Mario Draghi if he offers to stay in government and continue economic reforms in an address to parliament on Wednesday as pressure mounts on the prime minister to reverse last week’s moves towards resigning, senior officials from parties backing his government told MNI.

- Sources from the centre-left Democratic Party and the centrist Italia Viva said they are convinced Draghi will remain as prime minister, while the right-wing League and Forza Italia, which had been tempted by the prospect of early elections, said they now see a 50% chance he will drop any idea of quitting. For more see MNI Policy main wire at 1020ET.

US TSYS: Short End Weaker on Potential 50Bp ECB Hike Thu; Stocks Well Bid

Rates weaker after the bell, inside range w/ Bonds back near middle of range -- curves flatter w/ the short end near lows, pressured after Reuters, then Bloomberg cited ECB sources pointing to potential 50bp hike at Thu's meeting vs the long-expected 25bp.- Yield curves flatter, 2s10s -2.041 at -21.556 vs. -15.344 high. Overall volumes remain light by the close, TYU2 915k after the bell. Pick-up in swappable debt issuance from domestic/foreign banks generated decent two-way hedging in short end to intermediates w/ surprise $10B BoA jumbo 3pt issuance leading total $18.55B issuance on the day, $39.3B/wk.

- Earlier risk-on tone coincided with headlines Russia's Nord Stream 1 pipeline to restart flow at reduced levels sometime Thu. Closed due to maintenance - the reopening underscored the morning risk-on tone, Tsys and EGBs lower.

- Equities extended gains following positive earnings annc's from: Signature Bank NY (SBNY) $5.26 vs. $5.057, Truist (TFC) $1.20 vs. $1.146, JNJ $2.59 vs. $2.553, Hasbro (HAS) $1.15 vs. $0.935, Halliburton (HAL) $0.49 vs. $0.449. Huge beat for Lockheed Martin (LMT) $6.32 vs. $3.974 est.

- Cross-asset, crude firmer (WTI +1.37 at 103.97 (vs. 99.97 low), Gold firmer but off highs +2.53 at 1711.75.

- In focus Wednesday: Existing Home Sales (5.41M prior, 5.40M est); MoM (-3.45%, -0.2%) at 0830ET. US Tsy $14B 20Y Bond auction re-open (912810TH1) at 1300ET.

OVERNIGHT DATA

- US JUN HOUSING STARTS 1.559M; PERMITS 1.685M

- US MAY STARTS REVISED TO 1.591M; PERMITS 1.695M

- US JUN HOUSING COMPLETIONS 1.365M; MAY 1.431M (REV)

- US REDBOOK: JUL STORE SALES +13.8% V YR AGO MO

- US REDBOOK: STORE SALES +14.6% WK ENDED JUL 16 V YR AGO WK

MARKETS SNAPSHOT

Key late session market levels:

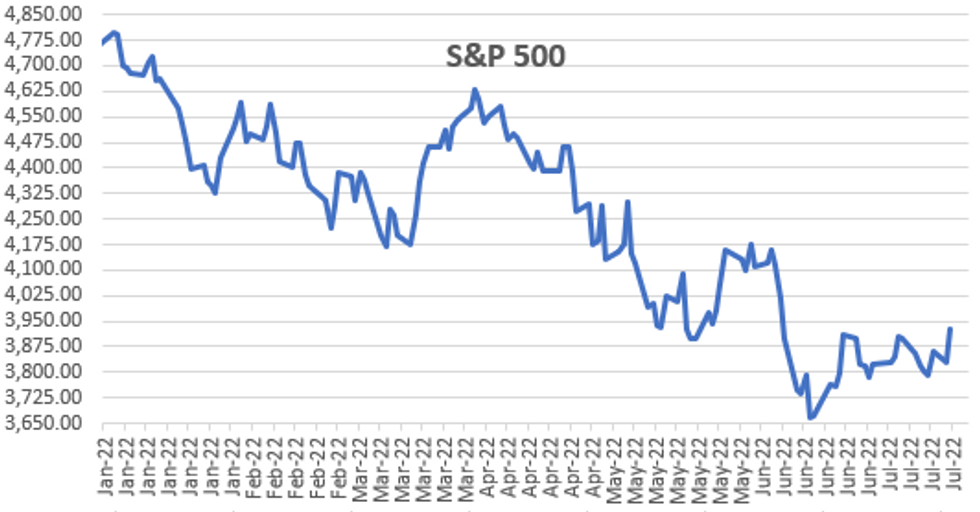

- DJIA up 661.6 points (2.13%) at 31733.43

- S&P E-Mini Future up 96 points (2.5%) at 3929.5

- Nasdaq up 320.6 points (2.8%) at 11681.09

- US 10-Yr yield is up 3 bps at 3.0153%

- US Sep 10Y are down 17/32 at 117-30

- EURUSD up 0.0084 (0.83%) at 1.0227

- USDJPY up 0.07 (0.05%) at 138.21

- WTI Crude Oil (front-month) up $1.4 (1.36%) at $104.00

- Gold is up $0.86 (0.05%) at $1710.13

- EuroStoxx 50 up 75.58 points (2.15%) at 3587.44

- FTSE 100 up 73.04 points (1.01%) at 7296.28

- German DAX up 348.6 points (2.69%) at 13308.41

- French CAC 40 up 109.31 points (1.79%) at 6201.22

US TSY FUTURES CLOSE

- 3M10Y -10.712, 51.564 (L: 45.906 / H: 58.829)

- 2Y10Y -2.273, -21.788 (L: -22.347 / H: -15.344)

- 2Y30Y -3.392, -5.948 (L: -6.327 / H: 1.744)

- 5Y30Y -2.925, 2.193 (L: 1.679 / H: 7.506)

- Current futures levels:

- Sep 2Y down 4.875/32 at 104-17.125 (L: 104-16.625 / H: 104-23.375)

- Sep 5Y down 12.75/32 at 111-18 (L: 111-16.75 / H: 111-31.25)

- Sep 10Y down 17/32 at 117-30 (L: 117-27.5 / H: 118-15.5)

- Sep 30Y down 20/32 at 138-20 (L: 138-01 / H: 139-09)

- Sep Ultra 30Y down 1-01/32 at 152-25 (L: 151-25 / H: 153-27)

US 10YR FUTURES TECHS: (U2) Edging Lower

- RES 4: 121-28+ 1.382 proj of the 14 - 23 - 28 price swing

- RES 3: 121-10 1.236 proj of the 14 - 23 - 28 price swing

- RES 2: 120-19+ High May 26 and a key resistance

- RES 1: 119-06/120-16+ High Jul 13 / High Jul 6 and the bull trigger

- PRICE: 117-29 @ 15:44 BST Jul 19

- SUP 1: 117-18/12 Low Jul 8 / 50.0% of the Jun 14 - Jul 6 rally

- SUP 2: 116-11 Low Jun 28 and a key near-term support

- SUP 3: 115-20 Low Jun 17

- SUP 4: 114-05+ Low Jun 14 and the bear trigger

Treasuries headed into the close lower on the day, but prices remain clear of the first support at 117-18. The short-term trend outlook remains bullish and the recent pullback is considered corrective. Key short-term support is at 116-11, Jun 28 low where a break would strengthen a bearish threat and signal scope for a deeper retracement. On the upside, attention is on the short-term bull trigger at 120-16+, the Jul 6 high. A break resumes the uptrend.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.035 at 96.525

- Dec 22 -0.055 at 96.080

- Mar 23 -0.065 at 96.235

- Jun 23 -0.085 at 96.380

- Red Pack (Sep 23-Jun 24) -0.105 to -0.10

- Green Pack (Sep 24-Jun 25) -0.095 to -0.075

- Blue Pack (Sep 25-Jun 26) -0.07 to -0.055

- Gold Pack (Sep 26-Jun 27) -0.045 to -0.04

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00800 to 1.56214% (-0.00300/wk)

- 1M +0.03514 to 2.16157% (+0.04128/wk)

- 3M +0.02185 to 2.73171% (-0.00586/wk) * / **

- 6M +0.03143 to 3.29886% (-0.01243/wk)

- 12M +0.00657 to 3.86957% (-0.02686/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.74029% on 7/14/22

- Daily Effective Fed Funds Rate: 1.58% volume: $97B

- Daily Overnight Bank Funding Rate: 1.57% volume: $284B

- Secured Overnight Financing Rate (SOFR): 1.54%, $947B

- Broad General Collateral Rate (BGCR): 1.51%, $367B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $358B

- (rate, volume levels reflect prior session)

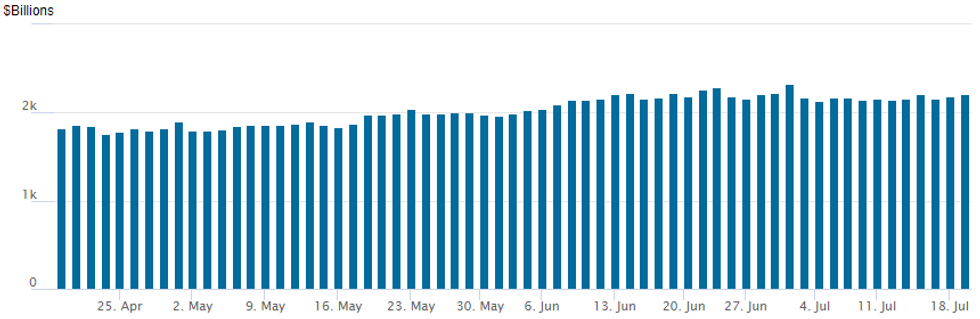

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,211.821B w/ 98 counterparties vs. $2,190.375B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: Surprise $10B Bank of America 3Pt Jumbo Launched

$10B BoA jumbo issuance dropped the 4NC3 SOFR tranche. Total $18.55B to price on the day, $39.3B/wk

- Date $MM Issuer (Priced *, Launch #)

- 07/19 $10B #Bank of America $2B 4NC3 +160, $3B 6NC5 +180, $5B 11NC10 +200

- 07/19 $3.05B #US Bancorp $1.75B 6NC5 +140, $1.3B 11NC10 +195

- 07/19 $2B *TD Bank 3Y SOFR+79

- 07/19 $1.75B #Bank of NY Mellon $1.25B 4NC3 +120, $500M 8NC7 +148

- 07/19 $1B #Taiwan Semiconductor Mfg (TSMC) 5Y +150a, 10Y +200a

- 07/19 $750M #Autozone 10Y +175

EGBs-GILTS CASH CLOSE: Short End Hit On 50bp ECB Hike Talk

Short-end yields rose sharply Tuesday in a bear flattening move as speculation rose over a 50bp ECB July hike.

- Reuters, then Bloomberg, cited ECB sources pointing to potential for a 50bp hike at Thursday's meeting vs the long-expected 25bp. Implied pricing rose accordingly though ended on a knife's edge at 37.5bp (a 50/50 chance of either 25/50bp).

- Afternoon headlines that Russian gas flows would restart sparked a risk-on move, which kept hike pricing elevated and weakened the German short-end.

- BoE's Bailey reiterated the BOE was contemplating a 50bp hike in August.

- MNI's ECB meeting preview went out today - and also of note was our Policy sources piece eyeing potential for broad lawmakers backing for Draghi if he decides to stay ahead of his crunch speech Wednesday (BTP spreads continued to fall Tuesday).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 10.9bps at 0.631%, 5-Yr is up 10.3bps at 1.01%, 10-Yr is up 5.6bps at 1.271%, and 30-Yr is up 2.3bps at 1.463%.

- UK: The 2-Yr yield is up 5.2bps at 2.036%, 5-Yr is up 3.5bps at 1.903%, 10-Yr is up 1.7bps at 2.174%, and 30-Yr is up 4.7bps at 2.681%.

- Italian BTP spread down 1.5bps at 205.4bps / Spanish down 2.2bps at 120.6bps

FOREX: Euro Bounce Extends As ECB Policy Action In Focus, Antipodean FX Surges

- The Euro sits close to the top of the G10 pile Tuesday, with the release of several sources reports to Bloomberg and Reuters making a 50bps rate hike at this Thursday's ECB a certain topic for discussion - although the median consensus still looks for a smaller 25bps rise this week.

- EUR/USD made light work of the Monday highs upon release, and briefly breached resistance through 1.0258, the 20-day EMA, before consolidating just below. A sustained breach of this average would strengthen bullish conditions and signal scope for an extension within the bear channel and would place the focus on the significant breakdown area between 1.0341-59.

- The greenback is the poorest performer on Tuesday, extending the weakness noted on Monday as the USD Index (-0.67%) extends the pullback off last week's cycle high. The USD Index resides around 2.5% off last week’s peak.

- Antipodean currencies clocked +1% gains amid the supportive price action for major equity indices. The Aussie dollar had outperformed during the APAC session as participants parsed the latest round of RBA comments and the pair marched higher throughout Europe. This places the AUD/USD (+1.32%) rate north of $0.69 for the first time since July 1st, briefly reaching touted resistance at 0.6912, the 38.2% retracement of the Jun 3 - Jul 14 downleg.

- Bolstered risk sentiment also propped up Scandinavian FX, with SEK and NOK the main beneficiaries against the USD, rising around 1.8%.

- Overnight, eyes on potential comments from RBA Governor Lowe, due to speak at the Australian Strategic Business Forum, in Melbourne. Inflation data from the UK and Canada headlines the data docket on Wednesday before the key risk events on Thursday – central bank meetings/decisions from the BOJ and ECB.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/07/2022 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 20/07/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 20/07/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 20/07/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/07/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 20/07/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 20/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/07/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 20/07/2022 | 1230/0830 | *** |  | CA | CPI |

| 20/07/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/07/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 20/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.