-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Supply-Demand Imbalances Easing?

EXECUTIVE SUMMARY

- MNI: Fed Emphasizes Data Dependency In Push To Restrictive

- MNI: Fed Says Likely Appropriate To Slow Hikes 'At Some Point'

- MNI FED: Staff Lowers Inflation Forecasts As "Supply-Demand Imbalances" Seen Easing

- MNI INTERVIEW: US Labor Force 'Missing' 2.5M Workers - KC Fed

- MNI INTERVIEW: Russia Gas Flow Key To EZ Recession Fear

- EUROPEAN BANKS RESTART RUSSIAN BOND TRADING AS U.S. CLIENTS WIND DOWN - FT

- UBS, BARCLAYS AND DEUTSCHE BANK HAVE ALL RESUMED ALLOWING CLIENTS TO SELL THEIR RUSSIAN DEBT HOLDINGS – FT

US

FED/FOMC: Federal Reserve officials emphasized data dependency when it comes to future rate rises but made clear the FOMC intends to move policy to a restrictive setting while potentially moving in smaller steps going forward, the minutes from the July FOMC meeting showed."In light of elevated inflation and the upside risks to the outlook for inflation, participants remarked that moving to a restrictive stance of the policy rate in the near term would also be appropriate from a risk-management perspective because it would better position the Committee to raise the policy rate further, to appropriately restrictive levels, if inflation were to run higher than expected," the minutes said.

"Participants judged that, as the stance of monetary policy tightened further, it likely would become appropriate at some point to slow the pace of policy rate increases while assessing the effects of cumulative policy adjustments on economic activity and inflation."

FED: The July FOMC minutes show staff projections for core PCE were lowered vs June's minutes.

- The core projections per July's minutes: 4.0% 2022; 2.6% in 2023 / 2.0% in 2024. June's minutes: 4.1% 2022 / 2.6% in 2023 / 2.2% 2024.

- Headline PCE is seen dropping to 1.9% in 2024 (below June's 2.0% expectation), both on core inflation falling, and "a projected rapid deceleration in consumer food and energy prices in coming quarters".

US: Around 2.5 million workers are "missing" from the U.S. labor force, a figure that's increased half a million since May, Federal Reserve Bank of Kansas City senior economist Didem Tuzemen told MNI.

- "We have lost people from the labor force since March," she said. The decline in the size of the labor force has been driven by "missing" workers, who may yet return, rather than demographic factors such as slower population growth and an aging population, she said in an interview.

- Using data from the U.S. Census Bureau’s Current Population Survey, Tuzemen estimates the size of the U.S. labor force if it had continued to grow at its 2015–19 trend during the pandemic then discounts both slower population growth and the aging of the population. She estimates that as of July the missing labor force is now around 2.5 million. For more see MNI Policy main wire at 1134ET.

EUROPE

EU/RUSSIA: The euro zone will avoid a full-on recession so long as Russia maintains even a reduced rate of gas supply to EU countries, according to Gerhard Huemer, Economic Policy Director at EU small business organization SMEunited.

- “If there is a total shutdown of Russian gas, we will see a recession from the fourth quarter of this year,” Huemer told MNI.

- So far, small and medium enterprises (SMEs) across the euro zone seem hopeful that the worst scenarios can be avoided this winter. The group will publish its new EU SME Barometer survey in October, but so far feedback from small businesses is that things may indeed be getting worse - but not dramatically so.

- “With part of the Russian gas supply coming in, there is no need to ration gas and we will not see a recession. But if there is no gas coming in and there is rationing, there will be a recession is for sure,” Huemer said, accepting there was still a great deal of uncertainty.

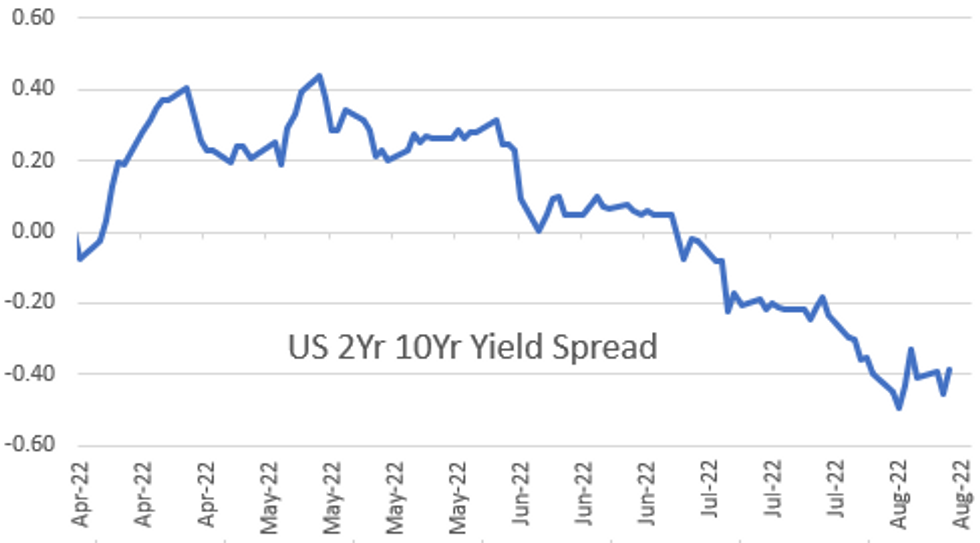

US TSYS: Tsy Yield Curves Bear Steepen Post-FOMC Minutes

Tsys remain weaker after the bell but off session lows, yield curves bear steepening ( 2s10s gapped to session high of -38.963) following July FOMC minutes release, as market digests comments like:

- Officials saw risk the Fed could tighten more than necessary; and as the stance of monetary policy tightened further, it likely would become appropriate at some point to slow the pace of policy rate increases while assessing the effects of cumulative policy adjustments on economic activity and inflation." Link to minutes:

- https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20220727.pdf

- Lead quarterly Eurodollar futures EDU2 climbed to session high of 96.675 (+0.025) after the release as market expectations of more than 50bp hike at Sep 21 cool (despite there being ample time and data between now and then).

- US rates had sold off overnight after higher than expected UK CPI (+0.6% MoM; +10.1 YoY) underscored expectations of further tightening from the BoE.

- Fast two-way trade on decent volumes after steady July Retail sales read vs. +0.1% est (prior 1.0% revised to +0.8%), but higher in Ex-Auto +0.4% MoM vs. -0.1% est (prior 1.0% revised to +0.9%), ex-Auto/Gas +0.7% vs. 0.4% est and Control Group +0.8% (prior 0.8% revised +0.7%) vs. 0.6% est.

- Tsy futures gapped back to session lows briefly following weak $15B 20Y bond auction (912810TK4) tails: 3.380% high yield vs. 3.355% WI; 2.30x bid-to-cover vs. last month's 2.65x.

- The 2-Yr yield is up 2.5bps at 3.2828%, 5-Yr is up 9.5bps at 3.0477%, 10-Yr is up 8.9bps at 2.8931%, and 30-Yr is up 5.8bps at 3.1472%.

OVERNIGHT DATA

US JUL RETAIL SALES +0.0%; EX-MOTOR VEH +0.4%

US JUN RETAIL SALES REVISED +0.8%; EX-MV +0.9%

US JUL RET SALES EX GAS & MTR VEH & PARTS DEALERS +0.7% V JUN +0.7%

US JUL RET SALES EX MTR VEH & PARTS DEALERS +0.4% V US JUL +0.9%

US JUL RET SALES EX AUTO, BLDG MATL & GAS +0.6% V JUN +0.7%

US MBA: MARKET COMPOSITE -2.3% SA THRU AUG 12 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 178.93 points (-0.52%) at 33968.05

- S&P E-Mini Future down 30.75 points (-0.71%) at 4275.5

- Nasdaq down 157.1 points (-1.2%) at 12941.18

- US 10-Yr yield is up 8.9 bps at 2.8931%

- US Sep 10Y are down 20/32 at 118-24.5

- EURUSD up 0.0009 (0.09%) at 1.018

- USDJPY up 0.84 (0.63%) at 135.06

- WTI Crude Oil (front-month) up $1.05 (1.21%) at $87.57

- Gold is down $9.81 (-0.55%) at $1765.88

- EuroStoxx 50 down 49.16 points (-1.29%) at 3756.06

- FTSE 100 down 20.31 points (-0.27%) at 7515.75

- German DAX down 283.41 points (-2.04%) at 13626.71

- French CAC 40 down 64.26 points (-0.97%) at 6528.32

US TSY FUTURES CLOSE

- 3M10Y +11.234, 23.443 (L: 10.925 / H: 23.546)

- 2Y10Y +6.78, -39.381 (L: -47.534 / H: -39.146)

- 2Y30Y +3.767, -13.975 (L: -22.471 / H: -13.601)

- 5Y30Y -3.586, 9.778 (L: 6.809 / H: 13.563)

- Current futures levels:

- Sep 2Y down 2.5/32 at 104-17.375 (L: 104-12.375 / H: 104-19.75)

- Sep 5Y down 13.25/32 at 111-29.25 (L: 111-23.25 / H: 112-10.75)

- Sep 10Y down 20/32 at 118-24.5 (L: 118-17.5 / H: 119-14.5)

- Sep 30Y down 31/32 at 140-8 (L: 139-28 / H: 141-15)

- Sep Ultra 30Y down 1-7/32 at 152-26 (L: 152-13 / H: 154-21)

(U2) Outlook Confirmed Bearish

- RES 4: 122-29+ High Mar 31

- RES 3: 122-16 2.0% 10-dma envelope

- RES 2: 120-29/122-02 High Aug 4 / High Aug 02

- RES 1: 120-22 High Aug 10

- PRICE: 118-27 @ 15:34 BST Aug 17

- SUP 1: 118-18 Low Aug 17

- SUP 2: 118-05 50.0% retracement of the Jun 14 - Aug 2 bull cycle

- SUP 3: 117-14+ Low Jul 21 and key near-term support

- SUP 4: 117-07 61.8% retracement of the Jun 14 - Aug 2 bull cycle

Global rates re-pricing saw Treasuries fade fast Wednesday, putting prices through first support at 118-30+ and on track to test the contract 50-dma of 118-16. This sees prices complete the reversal off the 120-00 handle resistance as well as the 120-22 post-CPI high and seals the outlook as bearish. First support crosses at 118-05, the 50.0% retracement of the Jun 14 - Aug 2 bull cycle. Initial resistance remains 120-22, the Aug 10 high.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.015 at 96.665

- Dec 22 -0.010 at 96.085

- Mar 23 -0.045 at 96.050

- Jun 23 -0.070 at 96.125

- Red Pack (Sep 23-Jun 24) -0.13 to -0.085

- Green Pack (Sep 24-Jun 25) -0.14 to -0.125

- Blue Pack (Sep 25-Jun 26) -0.12 to -0.10

- Gold Pack (Sep 26-Jun 27) -0.095 to -0.08

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00872 to 2.31357% (-0.00129/wk)

- 1M -0.01143 to 2.36557% (-0.02129/wk)

- 3M +0.01600 to 2.97657% (+0.05500/wk) * / **

- 6M +0.00171 to 3.50771% (-0.00158/wk)

- 12M +0.04486 to 3.99557% (+0.03657/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.97657% on 8/17/22

- Daily Effective Fed Funds Rate: 2.33% volume: $94B

- Daily Overnight Bank Funding Rate: 2.32% volume: $289B

- Secured Overnight Financing Rate (SOFR): 2.29%, $974B

- Broad General Collateral Rate (BGCR): 2.26%, $393B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $387B

- (rate, volume levels reflect prior session)

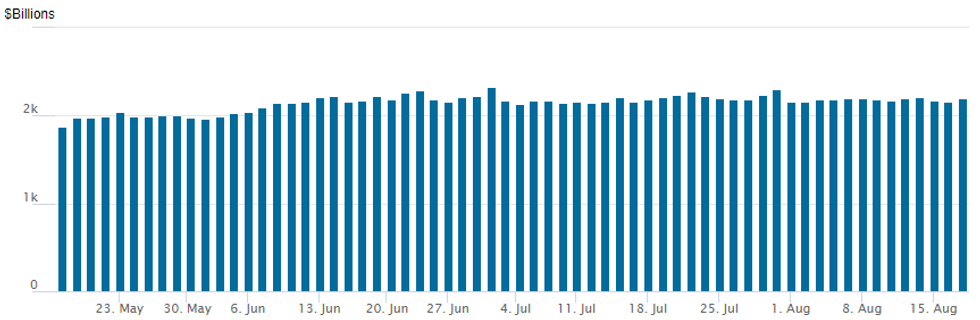

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,199.631B w/ 103 counterparties vs. $2,165.332B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $5.25B Export Development Bank of Canada 3Y SOFR Priced

$5.25B high-grade supply priced Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 08/17 $3.25B *Export Development Bank of Canada 3Y SOFR+33

- 08/17 $1B *BNG Bank WNG 2Y SOFR+21

- 08/17 $1B *MuniFin WNG 5Y SOFR+52

- 08/17 $Benchmark Entergy investor calls

EGBs-GILTS CASH CLOSE: Short End Crashes On UK Double-Digit CPI

A higher-than-expected 10.1% UK July CPI reading (a 40-Yr high, vs 9.8% expected) set an extremely bearish tone for Wednesday trade, with short-end instruments badly underperforming as central bank hike expectations ratcheted up.

- European curves bear flattened, with the UK leading the way, as 200+bp of BoE hikes are now priced in this cycle (including a decent chance of 75bp in Sept), vs 170bp yesterday.

- The UK curve inverted further, 2s10s to lowest since 2008, 2s5s since 2007 as 2Y yields hit a post-2008 high.

- The German short end also sold off, with ECB hike pricing higher but not as much as BoE.

- The highest-beta EGB periphery sovereigns - Italy and Greece - underperformed, with 10Y spreads widening around 7bp.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 15.4bps at 0.731%, 5-Yr is up 15.4bps at 0.898%, 10-Yr is up 11.2bps at 1.083%, and 30-Yr is up 6.2bps at 1.292%.

- UK: The 2-Yr yield is up 24.8bps at 2.403%, 5-Yr is up 18.3bps at 2.148%, 10-Yr is up 16.3bps at 2.288%, and 30-Yr is up 10.8bps at 2.623%.

- Italian BTP spread up 7bps at 223.3bps / Greek up 6.7bps at 243.2bps

FOREX: USD Index Pares Gains Following Fed Minutes, Antipodean Weakness Prevails

- Mixed session for currencies across the G10 space on Wednesday with the dollar gaining ground against most other majors, however, notably underperforming against the Euro.

- Prior to the release of the FOMC minutes, AUD and NZD had significantly extended their overnight moves to the downside amid higher US yields and a decent pullback for major equity indices. The higher yields had also worked against the Japanese yen with USDJPY trading above pre-US CPI levels to within close proximity of resistance at 135.58. Overall, this propped up the dollar index, which was trading with 0.3% gains heading into the minutes.

- The minutes came as a dovish cue rather than being massaged in a hawkish direction, led by headlines that whilst some officials still see the Fed Funds rate below neutral, officials saw a slower pace of rate hikes at some point with many officials seeing risk that the Fed could tighten more than necessary. As such, the greenback saw a kneejerk reaction lower, and the USD Index now trades at closed to unchanged levels approaching the APAC crossover.

- An unchanged DXY fails to paint the full picture though as AUD (-1.10%) and NZD (-0.90%) remain notably lower following the earlier RBNZ meeting and Aussie wage price index data. Similarly the Japanese Yen holds onto 0.6% losses for Wednesday.

- While the Euro had been relatively outperforming all day with a notable recovery for the likes of EURAUD, EURNZD and EURJPY, the late USD selloff propelled EURUSD (+0.20%) to briefly trade at fresh highs above the 1.02 mark. Although showing relative strength, the pair still remains comfortably below the week’s opening levels with the ongoing energy crisis capping any bullish momentum up to this point.

- Aussie employment data highlights the docket overnight before the Norges bank decision at 0900BST where the most recent July CPI print tilts the balance of risks to another 50bps rate rise.

- Philly Fed Manufacturing, jobless claims and existing home sales are the US data points of note with potential comments from Fed’s George and Kashkari to watch out for.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/08/2022 | 0130/1130 | *** |  | AU | Labor force survey |

| 18/08/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 18/08/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 18/08/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/08/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 18/08/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 18/08/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 18/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 18/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 18/08/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 18/08/2022 | 1400/1000 | * |  | US | Services Revenues |

| 18/08/2022 | 1400/1000 | ** |  | US | leading indicators |

| 18/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 18/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 18/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 18/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 18/08/2022 | 1715/1915 |  | EU | ECB Schnabel Presentation at IHK Reception | |

| 18/08/2022 | 1720/1320 |  | US | Kansas City Fed's Esther George | |

| 18/08/2022 | 1745/1345 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.