-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI US MARKETS ANALYSIS - MoF Knocks USD/JPY Down a Few Pegs

Highlights:

- Initial JPY surge subsides, but USD/JPY still 300 pips off highs

- Central bank mania with Switzerland, Norway, Indonesia, Taiwan, Vietnam and Phillippines all hiking rates

- Bank of England, CBRT and SARB still to come

Key Links: BoE Preview / SARB Preview / BoJ on Hold for Years as MoF Buys Yen

US TSYS: Treasuries Bear Flatten To New 2s10s Cycle Lows

- Cash Tsys bear flatten on the day with the front end continuing a sizeable sell-off since yesterday’s FOMC and hawkish dot plot. 2YY are up 4bps even whilst remaining firmly within overnight ranges having touched a yet new cycle high of 4.1253% before moving off extremes helped in part after JPY intervention and ahead of the BoE decision at 1200BST.

- The flattening sees 2s10s hit cycle lows of -57bps (currently -55bp) with 2YY +4.2bps at 4.090%, 5YY +2.5bps at 3.791%, 10YY -0.2bps at 3.528% and 30YY -2.7bps at 3.475%.

- Data: Initial jobless claims covering a payrolls reference week plus indicators with the leading index for Aug and KC Fed manufacturing for September.

- Bond issuance: US Tsy $15B 10Y TIPS auction re-open (91282CEZ0) – 1300ET

- Bill issuance: US Tsy $50B 4W, $45B 8W bill auctions – 1130ET

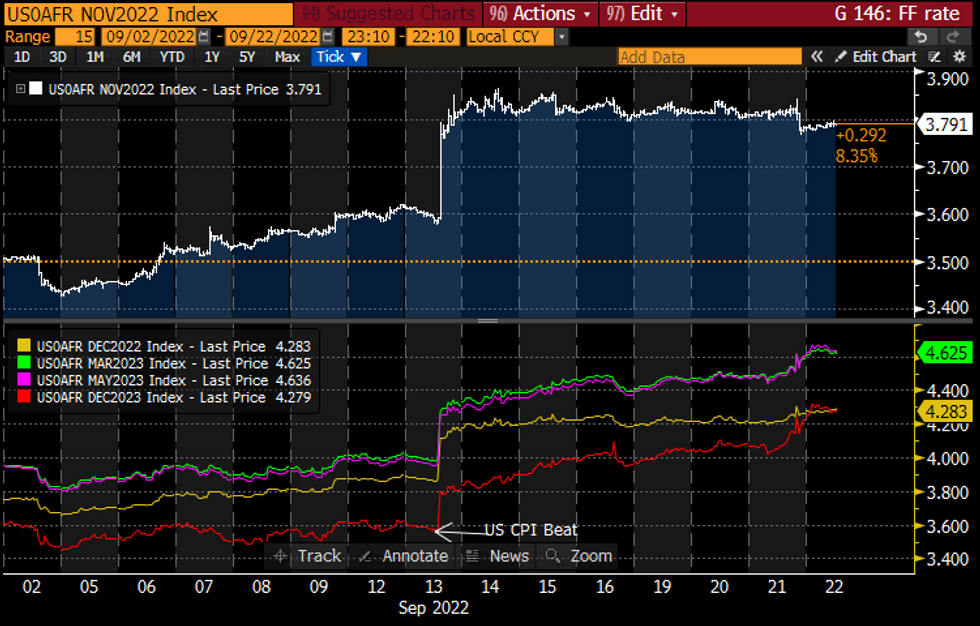

STIR FUTURES: Fed Funds Dec'23 Rate Closes Gap On Dec'22

- Fed Funds implied hikes show 70bp priced for the Nov FOMC (+1bp) - figures all assuming an implied O/N rate of 3.088.

- 120bp of hikes over the two meetings left this year to 4.28% for Dec’22 (+1.5bp on day, +7bp since Tue) before a terminal of 4.63% now seen nudged into May (+2.5bp, +15bp).

- A trimming in cut expectations now sees 4.27% come Dec’23 (+4bp, +18bp since Tue), closing the gap on the Dec'22 rate.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

BoE: What will drive the market reaction?

- The biggest thing in our view that could impact the market reaction today would be the removal of the "forceful" language surrounding future hikes. If this was taken out of the statement the MNI Markets team thinks there could be a dovish market reaction, potentially even if the 75bp hike (that isn't fully priced in is) is delivered.

- 50bp hike probably will have a larger dovish market reaction than a 75bp hike. Only 3/23 analysts look for a 75bp hike but markets are pricing around 65bp at writing - around a 60% probability of a 75bp hike. However, it is not just about now - there is 205bp priced in for the remainder of 2022, so if we didn't get a 75bp hike today, we would need 2x75bp hikes in the remaining meetings - and if the BOE isn't willing to do 75bp now, why would it be more likely to later? Market pricing is also looking for a cumulative 322p of hikes by June 2023 - so almost fully pricing Bank Rate at 5.00%.

- Active gilt sales: We think if these go ahead at the GBP10bln/quarter planned pace there will probably be only a very minor reaction in gilts (that would be dominated by the move on Bank Rate). However, if the decision is delayed until November, there is potential for a smaller overall programme, or even further delays to the BOE selling gilts - this would therefore be positive for gilts.

- Vote split on Bank Rate: Much less important this time than in other meetings, in our view, other than if we see a 50bp hike with 3-4 members voting for 75bp. If we were to one more member than just Tenreyro voting for 25bp or less this probably wouldn't move markets too much. 3 members voting for 25bp or less would be notable, however.

NORGES BANK: New Rate Path Sees Earlier Rate Peak, Before Cuts Possible From Q2'24

- The Norges rate path has dropped notably from Q1'24 onwards - the first time the path has seen downward revisions for a number of meetings:

- Peak rate now seen in Q3 next yeah (brought forward by one quarter) at 3.11%

- First rate cuts now seen possible from Q2'24 onwards with the terminal rate at end-2025 dropping 12bps to 2.56%

Bank Raises Policy Rate by 75bps, Introduces Threshold For Sight Deposits

- Swiss National Bank raises the headline policy rate by 75bps, to 0.50%, as expected.

- The introduction of a threshold to sight deposits is a new element here for SNB policy - the unspecified threshold effectively means sight deposits will be treated differently above / below a certain level, with differing rates applied to below the threshold (+0.5%) and above the threshold (0.0%).

- The level of this threshold will be a focus, with implementation notes likely to take attention if released.

- On inflation forecasts - CPI path only sees a minor bump higher this year and the next, and GDP marked down - both inline with expectations.

- Full statement is here: https://www.snb.ch/en/mmr/reference/pre_20220922/s...

FOREX: USD/JPY Crushed as Intervention Confirmed

- A frantic morning session for G10 FX was rounded off by confirmation of intervention in currency markets by the Japanese authorities - moving to strengthen the JPY for the first time in 25 years. The results were immediate: USD/JPY has now posted a daily range of over 500 pips, having been sold aggressively off the Y145.90 high.

- Prices appear to be stabilising at around the Y141.00 handle, but price action remains very volatile. Attention turns to an imminent press briefing at 1030BST with the Japnese finance minister Suzuki and the top currency diplomat Kanda.

- Elsewhere, central banks have been busy, with both the Norges Bank and Swiss National Bank raising interest rates. Norges Bank raised rates by 50bps for possibly the last time this cycle, while the Swiss National Bank exited negative rate policy, but introduced tiered rates for sight deposits, implementing a new policy tool in the process.

- Unsurprisingly, JPY is comfortably the best performer across currency markets, with CHF the weakest. The CHF/JPY cross is 2.5% lower on the day and has traded as much as 4.7% off the intraday high.

- Focus turns to the BoE rate decision, at which the bank are expected to raise rates by 50bps to 2.25%. Rate decisions for the Turkish and South African central banks are also due. Data highlights include the weekly US jobless claims data and leading index for August.

FX OPTIONS: Expiries for Sep22 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900(E1.7bln), $0.9950-55(E963mln), $1.0000(E4.2bln), $1.0050(E1.2bln)

- USD/JPY: Y137.00($1.0bln), Y143.45($570mln)

- GBP/USD: $1.1490-05(Gbp1.2bln)

- USD/CAD: C$1.3150($840mln), C$1.3200($665mln), C$1.3420($740mln), C$1.3450($613mln)

- USD/CNY: Cny7.00($2.5bln)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/09/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 22/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 22/09/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 22/09/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/09/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/09/2022 | 1400/1000 |  | US | Leading Index | |

| 22/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 22/09/2022 | 1500/1100 |  | US | Kansas City Fed Manufacturing Activity | |

| 22/09/2022 | 1500/1700 |  | EU | ECB Schnabel Keynote at Network Luxemburg | |

| 22/09/2022 | 1500/1600 |  | UK | BOE Tenreyro on Climate | |

| 22/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 22/09/2022 | 1830/1930 |  | UK | BOE Haskel Panellist at Lecture | |

| 23/09/2022 | 2300/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 23/09/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 23/09/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/09/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/09/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/09/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/09/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/09/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/09/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/09/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/09/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/09/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/09/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 23/09/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 23/09/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/09/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/09/2022 | 1800/1400 |  | US | Fed Listens Event |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.