-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Monday, November 25

MNI ASIA OPEN - Eyeing Large OPEC+ Production Cuts

NEWS

US (MNI): Daly Eyes Global Trends To Avoid Fed Over-Tightening

San Francisco Fed President Mary Daly said Tuesday she's watching for strains in global economies and markets to ensure U.S. monetary policy doesn't become too restrictive, while noting inflation remains the dominant problem. “We have to acknowledge and understand the impact that raising the interest rate or dollar appreciation against other currencies has on global growth, and on global financial conditions,” she said in answering an audience question about potential fallout from a stronger U.S. dollar.

US (MNI): Fed Can Take More Steps To Slow Inflation, Jefferson Says

Federal Reserve Governor Philip Jefferson in his first public speech Tuesday said he and his colleagues are resolute about bringing inflation back down to 2 percent, noting restoring price stability may take some time and entail a phase of below-trend growth.

ECB (MNI) ECB Rates Near 2% By Year End: BdF's Villeroy

ECB interest rates should reach a neutral interest rate of “below or close to 2 per cent” by the end of the year, Banque de France governor Francois Villeroy de Galhau said in an interview published Tuesday, followed by “a second part of the journey, a more flexible and possibly slower one.” “I don't say that rate hikes will stop there, but we will have to comprehensively assess the inflation and economic outlook,” Villeroy added, noting that “without excluding a recession, we rather expect at this stage a significant slowdown.”

GERMANY (MNI): Germany Faces Permanent Loss of Competitiveness

Germany’s economy could perform worse than expected as interest rates rise, a leading economist told MNI in an interview, heralding difficult choices for government as it prioritises the immediate social and economic impact of rising energy prices even as the country faces a permanent loss of competitive advantage. While a joint economic forecast by four leading think tanks sees Europe’s largest economy growing 1.4% this year before contracting 0.4% in 2023, this may be over-optimistic if the European Central Bank tightens policy more than hoped, said Oliver Holtemoeller, from the Halle Institute for Economic Research (IWH), which contributed to the projection.

UK (MNI): Truss: Cabinet Behind Growth Plan

UK Prime Minister Liz Truss has told Times Radio that her cabinet is "all unified behind the growth plan and behind what we have to do to get this country back on track." Comes as Home Secretary Suella Braverman blames a Tory coup for forcing a government U-turn on lowering the top rate of tax.

OIL (BBG): Oil Extends Rally As OPEC+ Mulls Largest Output Cut Since 2020

Oil surged after OPEC+ said it was considering cutting its production limit by as much as 2 million barrels a day, double what was previously anticipated. WTI closed at a three-week high Tuesday after posting the biggest advance since July on Monday. OPEC’s decision could result in the cartel’s largest output reduction since the deep cuts at the outset of the pandemic, but the actual impact on global oil supply could be significantly smaller because several members already are pumping far below their quotas.

OIL (BBG): US Not Weighing Fresh Oil Reserve Release Despite OPEC+ Move

The US isn’t considering an additional release from the Strategic Petroleum Reserve despite expectations that OPEC+ nations could cut production by as much as 2 million barrels per day as they meet in Vienna on Wednesday.

US (BBG): Musk Revives $44 Billion Twitter Bid, Aiming to Avoid Trial

Elon Musk revived his bid for Twitter Inc. at the original offer price of $54.20 a share, potentially avoiding a courtroom fight over one of the most contentious acquisitions in recent history. Musk made the proposal in a letter to Twitter on Monday, according to a filing with the Securities and Exchange Commission that confirmed a Bloomberg report. Shares of Twitter climbed as much as 23% when they resumed trading following a halt on the news. San Francisco-based Twitter said it received the letter and intends to close the deal at the original price, without commenting specifically on how it will respond to Musk.

UKRAINE (BBG): Zelenskiy Aide Sees War Over in Months Not Years

The war in Ukraine will probably be over in months, rather than years, Mykhailo Podolyak, an adviser to Ukrainian President Volodymyr Zelenskiy’s chief of staff, said in an interview.

BRAZIL (BBG): Bolsonaro, Lula Duel for Key Endorsements Ahead of Brazil Runoff

President Jair Bolsonaro and his leftist challenger Luiz Inacio Lula da Silva are rushing to secure endorsements from key political players from across Brazil as they gear up for the second stretch of the presidential campaign ahead of a Oct. 30 runoff.

DATA

MNI: US BLS: JOLTS OPENINGS RATE 10.053M IN AUG

US AUG DURABLE ORDERS -0.2%

US AUG FACTORY ORDERS +0.0%; EX-TRANSPORT NEW ORDERS +0.2%

EUROZONE AUG PPI +5% M/M, +43.3% Y/Y

MNI RBNZ Preview - October 2022: Another 50bp Hike In Store

EXECUTIVE SUMMARY

- There is broad consensus that the RBNZ will raise the Overnight Cash Rate by 50bp in the fifth consecutive move of that magnitude, pouring more cold water on domestic price pressures at this week’s interim (non-MPS) Monetary Policy Review.

- Inflation pressures remain acute despite some preliminary signs of reprieve on that front and employment remains above the maximum sustainable level. A sharp depreciation in the exchange rate will amplify to imported inflation, raising pressure on the Monetary Policy Committee to keep tightening at pace.

- In a recent speech, Governor Orr recognised that the tightening cycle is “very mature, it’s very advanced,” even as the central bank still has “a little bit more to do before we can drop to our normal happy place, which is to watch, worry and wait for signs of inflation up or down.”

- With a 50bp rate hike fully baked in for this week, the main focus will fall on forward-looking comments amid ongoing adjustments to terminal rate pricing. Forward-looking comments will be scrutinised for any signs of imminent moderation in the Reserve Bank’s hawkish resolve.

Click here to see the full preview: MNI RBNZ Preview October 2022.pdf

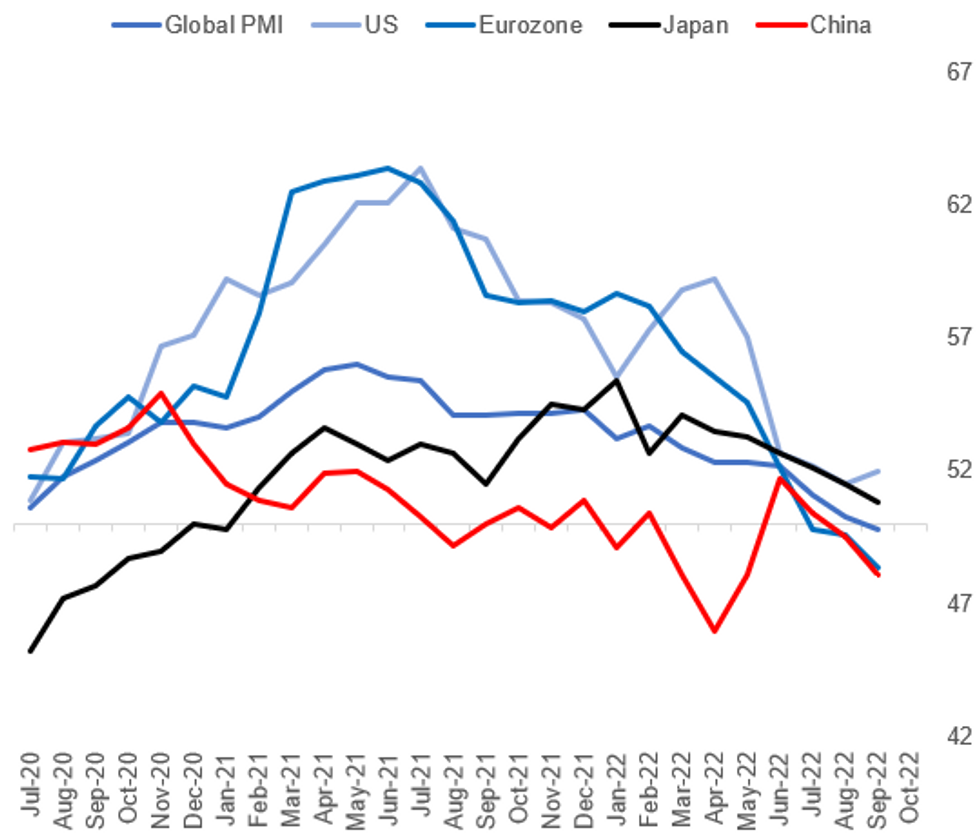

GLOBAL: US Stands Out In Global Manufacturing Contraction

Global manufacturing activity slipped into contraction in September, with the JPM Global PMI falling to 49.8 - the first sub-50 reading since June 2020. The sub-categories showed a continued contraction in new orders, production, and backlogs, and falling international trade.

- While well off the heady pace of 2021 or even early 2022, US manufacturing has held up better than its counterparts, and actually accelerated slightly in September vs August. Meanwhile, Eurozone and China PMIs were below 50 for the 2nd consecutive month.

- So while the ISM PMI and MNI Chicago Business Barometers have disappointed in the past week, the US manufacturing sector still looks like one of the healthiest in what appears to be a broader global contraction.

- However, expect US activity to be dragged down by broader global weakness in the months ahead.

Source: JPM, S&P Global, MNI

Source: JPM, S&P Global, MNI

US TSYS: Ultimately Broad Consolidation Of Yesterday's Sizeable Rally

- Cash Tsys sit with a 2.5-4.5bp rally across 2-10Y tenors and a smaller cheapening in the very long end, broadly consolidate yesterday’s significant belly-led rally albeit after some volatility.

- JOLTS openings implied a faster than expected decline in labor demand but the move lower in Fed hike pricing was short-lived. There were few catalysts for the move higher in yields with Jefferson and Daly broadly keeping in line with other member commentary although breakevens bounced further after their September slide and with oil up strongly ahead of expected OPEC+ cuts tomorrow.

- That drove a range for 2YY of 3.99-4.11%, currently nudging the top of that, with 2s10s now little changed from yesterday’s close at -48bp (-1bp) after flattening through the US session.

- TYZ2 at 113-14+ has pulled back off highs of 113-30, with the corrective bounce next opening resistance at 114-31+ (38.2% retrace of the Aug 2 – Sep 28 bear leg).

- Tomorrow’s session likely sees focus on ISM services after the mfg miss along with final PMIs, ADP and lone Fedspeak from Bostic (’24 voter).

FOREX: Dollar Slide Extends as Rate Hike Pricing Fades

- The dollar slide extended Tuesday, putting the USD Index lower for the fifth consecutive session as rate hike expectations in the US faded. The moves follow further signs of weakness in the domestic labour market, as JOLTS data showed characteristics of a looser jobs market - supporting theories that the Fed could be approaching a pivot point.

- The main beneficiary of dollar weakness was the single currency, putting EUR/USD on course to erase the entirety of the late-September downtick. The real test for the pair will be the 1.0020 50-dma which, if pace is maintained, will be tested in the coming sessions.

- AUD remained among the poorest performers for the day, following the smaller-than-expected RBA rate hike overnight. EUR/AUD printed multi-month highs at 1.5359, narrowing the gap with key resistance at the early July highs of 1.5398.

- Focus Wednesday turns to the final services and composite PMI data from across Europe and North America.

- The US ISM Services index is also on the docket, with markets watching carefully for any repeat performance of Monday's manufacturing number, which belied particular weakness in the employment sub-component. ADP Employment Change data is also on the docket.

COMMODITIES: Crude Oil Surges With OPEC+ Cuts Eyed, Supportive Backdrop

- Further USD weakness and modestly lower Tsy yields again provide a supportive backdrop for commodities, further boosted in the case of oil by OPEC+ delegates reporting consideration of a production cut as much as 2mbpd at tomorrow’s meeting.

- At the margin, the Biden administration says there is no consideration of new SPR releases whilst the WSJ reports that the EU is likely to approve a G-7 cap on Russia oil in two steps with final approval holding off until the rest of the G-7 is ready.

- WTI settles +3.5% at $86.52 for a three-week high and +8.8% over two sessions for the largest two day gain since Apr 13. It moves close to testing resistance at the 50-day EMA after which would lie $92.26 (Aug 30 high).

- Brent is +3.3% at $91.79, having earlier probed above resistance at the 50-day EMA of $92.11.

- Gold is +1.5% at $1725.2, through resistance at the 50-day EMA of $1713.8 and establishing a short-term bull cycle having earlier first traded above trendline resistance. Next resistance is eyed at the key level of $1735.1 (Sep 12).

EU OPTIONS: Bund Vol Selling, Euribor Call Structures Tuesday

Tuesday's Europe rates / bond options flow included:

- RXX2 142^ sold at 390 in 10k

- ERZ2 97.875/98.00/98.125c fly, bought for 1.5 in 4.5k

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/10/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/10/2022 | 0100/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 05/10/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 05/10/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 05/10/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 05/10/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 05/10/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/10/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 05/10/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 05/10/2022 | 1230/0830 | * |  | CA | Building Permits |

| 05/10/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 05/10/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/10/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 05/10/2022 | 2000/1600 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.