-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Anticipating Steady Fed at Next FOMC

- MNI FED WATCH: On Hold But Shifting To Neutral Guidance

- MNI UST Issuance Deep Dive: Feb 2024 - Refunding Preview

- MNI INTERVIEW: LNG Export Delay To Chill Investment - Ex-FERC

- MNI ECB Review - January 2024: Inching Closer To Cutting Rates

- MNI US DATA: Pending Home Sales See Surprise Jump To End 2023

- MNI US DATA: Consumption Sees A Late Boost By A Renewed Decline In The Savings Rate

US

MNI FED WATCH: On Hold But Shifting To Neutral Guidance.

The Federal Reserve is expected to hold rates at a 23-year high rate of 5.25%-5.5% range for a fourth straight meeting Wednesday and shift its forward guidance to more neutral language in anticipation of lowering rates later this year.

- Several former senior Fed officials told MNI the central bank will likely wait until summer to start an easing cycle, in light of robust growth and solid employment data. However, with inflation fast declining, more dovish officials are sure to argue March would be a live debate on a first quarter-point cut.

- The FOMC "could soften its language on inflation a little bit and they could make the discussion of the future path of policy essentially neutral, not still point toward policy firming," William English, former director of the Fed's division of monetary affairs, told MNI. (See: MNI INTERVIEW: Fed Can Wait Until Summer To Cut Rates-English) The policy statement currently states the FOMC is "determining the extent of any additional policy firming that may be appropriate."

NEWS

ST Issuance Deep Dive (MNI): Feb 2024 - Refunding Preview

Treasury’s Quarterly Refunding process for the Feb-Apr quarter begins with borrowing estimates released on Mon Jan 29 (0830ET), followed by the refunding announcement itself on Wed Jan 31 (also 0830ET).

INTERVIEW (MNI): LNG Export Delay To Chill Investment - Ex-FERC

The U.S. pause on new export approvals for liquefied natural gas to study climate change impacts will be enough to chill future investment and risks antagonizing allies, former FERC commissioner Bernard McNamee told MNI.

US (MNI): Border Security Text To Be Released Next Week, No Clear Path In Congress

Senate negotiators Kyrsten Sinema (I-AZ) and Chris Murphy (D-CT) told reporters yesterday a final bill text of the US-Mexico border security policy overhaul will “absolutely” be released next week with Murphy adding that “90%-plus” is already written.

ECB Review (MNI) - January 2024: Inching Closer To Cutting Rates

The ECB left policy unchanged at the January meeting and although there were no material surprises in the press conference, the underlying messages were notably dovish. The words “domestic prices pressures remain elevated” from the December press statement were removed, President Lagarde sounded optimistic on inflation trends and, despite stating that it was premature to discuss rate cuts (presumably as of the January meeting), she did not forcefully push back against the possibility of a policy rate cut in the spring.

ISRAEL (MNI): ICJ Ruling Could Complicate Diplomatic Landscape

The UN's International Court of Justice has issued its interim ruling regarding a genocide case brought by South Africa against Israel for the latter's actions in Gaza as part of its war against Hamas. The ruling does not order a ceasefire.

SECURITY (MNI): US State Department Approval For Turkish F16 Deal Could Come Today

Al-Monitor reporting that US State Department approval of a major F-16 fighter jet sale to Turkey could come as soon as today after multi-year delays due to US objections to Turkish foreign policy and defense ties with Russia.

US-CHINA (MNI): Sullivan And Wang To Discuss Red Sea Security In Bangkok Meeting

White House National Security Advisor Jake Sullivan is meeting top Chinese diplomat Wang Yi today and tomorrow in Bangkok, Thailand. The meeting is likely to include discussions on China’s role in diffusing tensions in the Red Sea by applying pressure on Iran, the primary backer of the Yemini Houthis.

INTERVIEW (MNI): Peaking BOC Rate Rekindles Housing-Royal LePage

Canada’s housing market is rebuilding momentum alongside the central bank shifting its message towards potential rate cuts this year, Royal LePage Real Estate Services Chief Operating Officer Karen Yolevski told MNI.

NORTH KOREA (MNI): Talks Held w/Chinese MoFA Amid Rising Regional Tensions

The Chinese Ministry of Foreign Affairs has released a statement following Vice Foreign Minister Sun Weidong's visit to Pyongyang for talks with his North Korean counterpart Park Myung Ho.

US TSYS Personal Spending, Pending Home Sales Higher Than Expected

Tsys looking weaker after the bell, but off late session lows, Mar'24 10Y futures currently -7 at 111-03 vs. 111-00 low, yield at 4.0523% (+.0540). Curves bear flattened on the day: 2s10s -3.150 at -21.048 vs. -17.415 high.

- Busy session to end the week with Tsys extending lows after PCE and Personal Spending data:

- PCE Deflator MoM (0.2% vs. 0.2% est, -0.1% prior), YoY (2.6% vs. 2.6% est)

- PCE Core Deflator MoM (0.2% vs. 0.2% est), YoY (2.9% vs. 3.0% est).

- Personal Spending higher than expected w/ up-revisions to prior: 0.7% vs. 0.5% est, prior upped to 0.4% from 0.2%; Real Personal Spending: 0.5% vs. 0.3% est.

- Tsys extended lows yet again after higher than expected Pending Home Sales MoM a whopping 8.3% increase vs. 2.0% est (prior down-revised to -0.3% from 0.0%), YoY: -1.0% vs -4.3% est, while prior down revised to -5.5% from -5.1%.

- Looking ahead: focus is on the FOMC policy annc on Wednesday, followed by employment data for January on Friday. Treasury’s Quarterly Refunding process for the Feb-Apr quarter also begins with borrowing estimates released on Mon Jan 29 (0830ET), followed by the refunding announcement itself on Wed Jan 31 (also 0830ET).

OVERNIGHT DATA

US DATA: Consumption Sees A Late Boost By A Renewed Decline In The Savings Rate: Nominal personal income growth was as expected in Dec at 0.3% M/M after an unrevised 0.4% M/M, and with the same path on a disposable income basis.

- Nominal consumer spending meanwhile beat expectations at 0.7% M/M (cons 0.5) after an upward revised 0.4% (initial 0.2) although it’s less surprising after yesterday’s strength in Q4 data.

- Similarly, real consumption was seen at a solid 0.54% M/M after 0.46%. Service consumption is solid (0.26% after 0.38%) but strength recently has really been driven by goods (1.12% after 0.62%).

- With solid income growth being surpassed by an acceleration in consumption, the household savings ratio fell 0.4pps to 3.7% in Dec, pushing below September’s 3.8 for its lowest since Dec’22.

- On a quarterly basis, the 4.0% averaged in Q4 follows 4.2% in Q3 and 5.1% in Q2, i.e. a minor tailwind for consumption in Q4 after the stronger boost in Q3 (recall real consumption increased 2.8% in Q4 after 3.1% in Q3).

- The savings rate remains above mid-2022 sustained lows of around 3%, but remains far lower than pre-pandemic trends.

US DATA: Pending Home Sales See Surprise Jump To End 2023: Pending home sales were far stronger than expected in December, jumping 8.3% M/M (cons 2.0%) after -0.3% in Nov (revised marginally lower from 0.0%).

- The strength isn’t simply from one region either: west (+14% after 3.3), south (+11.9% after -2.5), midwest (5.6% after 0.5) and northeast (-3.0% after 0.5).

- It just surpasses the 8.1% increase in Jan’23 for the strongest monthly increase since May’20.

- Directionally, pending home sales typically lead existing home sales by 1-2 months, although have been running below existing home sales for some time now when comparing with pre-pandemic levels (a gap that has been closed by this jump).

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 69.31 points (0.18%) at 38115.04

- S&P E-Mini Future down 1.25 points (-0.03%) at 4921.5

- Nasdaq down 34.8 points (-0.2%) at 15474.45

- US 10-Yr yield is up 4 bps at 4.1585%

- US Mar 10-Yr futures are down 9/32 at 111-1

- EURUSD up 0.0012 (0.11%) at 1.0858

- USDJPY up 0.43 (0.29%) at 148.09

- WTI Crude Oil (front-month) up $0.63 (0.81%) at $77.98

- Gold is down $3.66 (-0.18%) at $2017.15

- European bourses closing levels:

- EuroStoxx 50 up 53.21 points (1.16%) at 4635.47

- FTSE 100 up 105.36 points (1.4%) at 7635.09

- German DAX up 54.47 points (0.32%) at 16961.39

- French CAC 40 up 169.94 points (2.28%) at 7634.14

US TREASURY FUTURES CLOSE

- 3M10Y +3.727, -120.847 (L: -129.112 / H: -120.201)

- 2Y10Y -2.792, -20.69 (L: -22.189 / H: -17.415)

- 2Y30Y -5.092, 2.233 (L: 0.709 / H: 8.316)

- 5Y30Y -4.559, 32.502 (L: 32.327 / H: 37.828)

- Current futures levels:

- Mar 2-Yr futures down 3.5/32 at 102-18.375 (L: 102-18.25 / H: 102-23.75)

- Mar 5-Yr futures down 6.25/32 at 107-20.75 (L: 107-20 / H: 108-01)

- Mar 10-Yr futures down 9/32 at 111-1 (L: 111-00 / H: 111-18)

- Mar 30-Yr futures down 7/32 at 119-19 (L: 119-12 / H: 120-12)

- Mar Ultra futures down 5/32 at 125-16 (L: 125-06 / H: 126-16)

US 10Y FUTURE TECHS: (H4) Bear Cycle Remains In Play

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 111-20/112-26+ 20-day EMA / High Jan 12

- PRICE: 111-13+ @ 11:05 GMT Jan 26

- SUP 1: 110-26 Low Jan 19

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11 and a key short-term support

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

The trend needle in Treasuries continues to point south despite the latest bounce, with sights on 110-26, the Jan 19 low. A break of this level would confirm a resumption of the current bear cycle and highlight a clear break of the 50-day EMA, at 111-03+. This would set the scene for a move towards 110-16, the Dec 13 low. Firm resistance is 112-26+, the Jan 12 high. Initial resistance is at 111-20, the 20-day EMA.

SOFR FUTURES CLOSE

- Mar 24 -0.010 at 94.870

- Jun 24 -0.040 at 95.280

- Sep 24 -0.060 at 95.685

- Dec 24 -0.075 at 96.020

- Red Pack (Mar 25-Dec 25) -0.085 to -0.065

- Green Pack (Mar 26-Dec 26) -0.06 to -0.035

- Blue Pack (Mar 27-Dec 27) -0.03 to -0.025

- Gold Pack (Mar 28-Dec 28) -0.025 to -0.02

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00012 to 5.33647 (+0.00053/wk)

- 3M -0.00216 to 5.31743 (+0.00225/wk)

- 6M -0.01485 to 5.15740 (-0.00193/wk)

- 12M -0.02070 to 4.79898 (+0.00049/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.768T

- Broad General Collateral Rate (BGCR): 5.31% (+0.01), volume: $667B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.01), volume: $662B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $101B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $271B

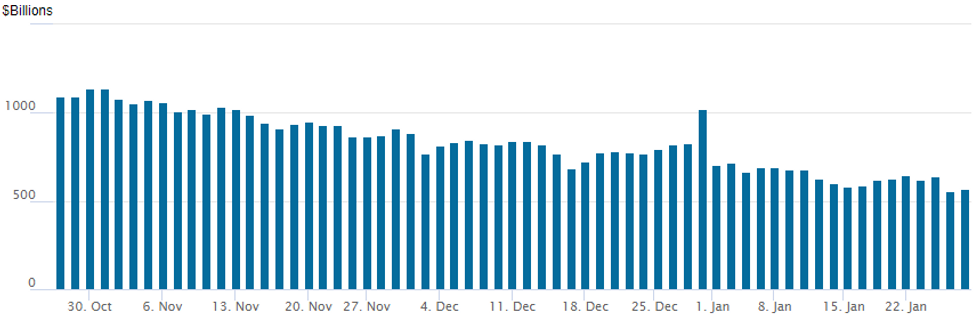

US FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

- After falling to new cycle low of $557.687B on Thursday, RRP usage climbs to $570.828B Friday. Compares to $583.103B on Tuesday, January 16 - prior lowest level since mid-June 2021.

- Meanwhile, the number of counterparties recedes to 77 vs. 82 on Thursday (65 Tuesday last Tuesday, the lowest since July 7, 2021)

PIPELINE $1.25B Huntington Bancshares Debt Issue Lanched

- Date $MM Issuer (Priced *, Launch #

- 1/26 $1.25B Huntington Bancshares 11NC10 +155

- $7.55B Priced Thursday, $51B running total on the week

- 1/21 $2.2B *NGL Energy $900M 5NC2 8.125%, $1.3B 8NC3 8.375%

- 1/25 $2B *Lockheed $650M 5Y +53, $600M +10Y +68, $750M 40Y +83

- 1/25 $1B *Swedish Export Credit 5Y SOFR+50

- 1/25 $1B *Comerica 6NC5 +195

- 1/25 $850M *Ashtead Capital 10Y +172

- 1/25 $500M *Tampa Electric WNG 5Y +87.5

- 1/25 $Benchmark Hyundai Capital investor calls

- Expected next week: $1B Rakuten 3NC

EGBs-GILTS CASH CLOSE: Constructive Start Fades With BoE / Fed In View

Gilts gained while Bunds weakened Friday.

- European bonds enjoyed a constructive start to the session, with softer-than-expected Japanese inflation data setting the tone overnight.

- A Reuters post-ECB meeting sources pieces indicated the possibility of a dovish tweak in language at the March meeting, but the associated bid faded as most subsequent speakers came from the more hawkish end of the Governing Council spectrum.

- Global core FI fell in the afternoon following US data which showed the PCE price index roughly in line, alongside consumption strength. Bunds continued to fade into the close, while Gilts eventually recovered from near session lows.

- The German curve finished slightly bear flatter, with the UK's bull steepening, though there were few obvious headline/macro drivers to the latter's performance - with perhaps an eye to the Bank of England meeting next week.

- Periphery EGB performance was mixed, with BTP spreads tightening and Greek widening.

- Next week's schedule is very busy, including the BoE decision Thursday following the Federal Reserve's Wednesday, and flash January Eurozone inflation data alongside.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.6bps at 2.633%, 5-Yr is up 1.1bps at 2.198%, 10-Yr is up 0.9bps at 2.299%, and 30-Yr is up 1.5bps at 2.514%.

- UK: The 2-Yr yield is down 3.3bps at 4.352%, 5-Yr is down 2.2bps at 3.894%, 10-Yr is down 1.9bps at 3.964%, and 30-Yr is down 0.6bps at 4.588%.

- Italian BTP spread down 1.3bps at 152.4bps / Greek up 1.9bps at 102.1bps

FOREX USDJPY Tracks US Yields Higher, Set to Close Back Above 148.00

- Mixed data in the US this week gave markets little further clarity on the potential path for Fed policy and as such the USD index stands very modestly higher on the week. Early gains however, did see the DXY print a fresh six-week high, keeping short-term momentum bullish at this juncture.

- It was a volatile week for USDJPY following the Bank of Japan decision, and despite briefly trading down to 146.66, the pair looks set to close back above the 148.00 handle, broadly unchanged for the week. On Friday, some well behaved inflation data from the US saw a very brief selloff to 147.46 lows before a grind higher ensued into the close.

- The USDJPY trend outlook remains bullish, and sights are on 149.16 next, a Fibonacci retracement. Initial firm support to watch lies at 146.00, the 50-day EMA.

- The January ECB was unable to garner any significant momentum for the Euro, with EURUSD largely respecting the 1.0820/0920 range, leaving both major pairs to await the FOMC meeting and next week’s US employment data.

- EURUSD’s bearish theme remains in play for now. A clear break of 1.0822 support would resume the current downtrend, opening 1.0793, a Fibonacci retracement. On the upside, a break of 1.0932 would instead signal scope for a stronger recovery and expose key short-term resistance at 1.0998, the Jan 5 high and a reversal trigger.

- As well as the aforementioned event risk, the Bank of England meet next week which could test GBP’s relative resilience this year. A clear break of 1.2827 would resume the uptrend and open 1.2881, a Fibonacci retracement. For bears, clearance of 1.2597 would highlight a S/T reversal and signal scope for weakness towards the 1.2500 handle, the Dec 13 low.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/01/2024 | 0700/0800 | *** |  | SE | GDP |

| 29/01/2024 | 0700/0800 | ** |  | SE | Retail Sales |

| 29/01/2024 | 1200/1300 |  | EU | ECB's de Guindos on Investment Outlook | |

| 29/01/2024 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 29/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 29/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/01/2024 | 2330/0830 | * |  | JP | labor forcer survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.