-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Balancing Pause With Higher for Longer

- MNI INTERVIEW: Fed Right To Pause; Fiscal Boost Offsets Rates

- MNI INTERVIEW: Fed Defacto Hiked Via SEP, Maybe Too Much-Sahm

- MNI BRIEF: Fed's Goolsbee Sees Rates Near Peak

- MNI Chicago Fed National Index Surprise Decline Led By Production & Consumption

- MNI Dallas Fed Mfg Keeps To Less Volatile But Firmly Negative Trend

US

FED: The Federal Reserve was right to hold rates in place last week but in the medium-run its job of containing inflation is being made harder by excessive government borrowing, former St. Louis Fed economist David Andolfatto told MNI. “It did the right thing to pause. I was worried all along that they were moving a little too aggressively,” he said in an interview. “Who knows if it went a little too far.”

- Andolfatto said warnings that the Fed would need to inflict significant pain on consumers and businesses had thus far proven misguided as inflation has fallen to just over 3% from peaks above 9% even as the jobless rate hovers near historic lows at 3.8%.

- “Chris Waller is looking pretty good here,” he said referring to his former St. Louis Fed colleague who is now a Fed board governor, and who has argued the Fed can achieve better balance in the job market without a major hit to employment. For more see MNI Policy main wire at 1149ET.

FED: Federal Reserve officials are using the forward guidance embedded in their interest rate and economic forecasts as a way to effectively raise borrowing costs, making an already imprecise process more prone to possible overshooting, former Fed board economist Claudia Sahm told MNI.

- The U.S. central bank held interest rates steady last week but officials on median penciled in one more rate increase for 2023 and, importantly, cut in half the number of rate cuts expected next year to two from four in the June projections. Bond markets sold off, with 10-year note yields extending their recent spike to hit new 16-year highs around 4.5%.

- “The FOMC did not raise interest rates but their Summary of Economic Projections raised rates,” said Sahm, who is also a former White House staffer. “Forward guidance is a very powerful tool. Time and again it’s clear that it’s too powerful. They are going to overdo it.” For more see MNI Policy main wire at 0915ET.

FED: U.S. interest rates are near their peak and soon the debate will shift to how long they'll stay there, Federal Reserve Bank of Chicago President Austan Goolsbee said Monday.

- "It's certainly possible" rates won't need to go any higher, he said. "Pretty soon the question is going to stop being how much more are they going to raise and it's going to transform into how long do we need to hold rates at this kind of restricted level to feel convinced that we're back on this path to 2%."

- The FOMC last week opted to wait for more data before deciding whether a last quarter-point increase in the cycle might be needed to tame inflation. A majority of officials saw rates ending the year slightly higher at 5.5%-5.75% and just 50 bps of rate cuts next year. For more see MNI Policy main wire at 0854ET.

US TSYS New 16Y High for 10Y Yld: 4.5436%

- Treasury yields climbed to new multi-year highs late Monday, 30YY 4.6604% (+.1359) - highest since late June 2011, while 10YY overtook last Fri's 16Y high of 4.5064% to 4.5436 (+.1099).

- Treasury curves bear steepened on the day, finishing near highs after the bell (3M10Y +12.286 at -94.341, 2Y10Y +8.861 at -59.173).

- Fed indexes weaker than expected: Chicago Fed national activity index came in weaker than expected in August at -0.16 (cons +0.10) after a downward revised +0.07 (initial +0.12). The Dallas Fed manufacturing index fared slightly worse than expected in September as it dipped to -18.0 (cons -14) from -17.2.

- Federal Reserve Bank of Chicago President Austan Goolsbee said U.S. interest rates are near their peak and soon the debate will shift to how long they'll stay there. "It's certainly possible" rates won't need to go any higher, he said. "Pretty soon the question is going to stop being how much more are they going to raise and it's going to transform into how long do we need to hold rates at this kind of restricted level to feel convinced that we're back on this path to 2%."

- Meanwhile, MN Fed Kashkari will attend a moderated discussion at Wharton later this evening at 1800ET, livestreamed.

- On another note, next week's scheduled market data (NFP on Oct 6) may be postponed if lawmakers are unable to come up with stopgap funding measures to keep the US Government open past this Friday. Stay tuned.

OVERNIGHT DATA

- CHICAGO FED AUG. NATIONAL ACTIVITY INDEX AT -0.16

US DATA: Despite being a composite of known measures, the Chicago Fed national activity index came in weaker than expected in August at -0.16 (cons +0.10) after a downward revised +0.07 (initial +0.12).

- It meant a return to negative readings for the index, with only three positive figures in the eight months of the year to date.

- Recall: “A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units)”

- The main two drivers for the latest decline came from production-related indicators (contributed –0.02 in Aug from +0.12 in July) and the personal consumption and housing category (-0.08 in Aug from +0.03 in July).

- Elsewhere, there was little change from the contribution of the sales, orders, and inventories (-0.03 after -0.04) and employment-related indicators (unchanged at -0.04).

US SEPT. DALLAS FED MANUFACTURING INDEX -18.1; EST. -14.0

- The Dallas Fed manufacturing index fared slightly worse than expected in September as it dipped to -18.0 (cons -14) from -17.2.

- The index has kept to a tight range in recent months, between -17 and -23 since June, at still solidly contractionary levels but not signalling any further deterioration for a series that been negative since May 2022.

- It compares with some volatile readings from the Empire and Philly Fed conflicting latest developments (Empire bouncing 21pts to +2, Philly Fed falling -26pts to -13.5), as well as a small increase for the preliminary manufacturing PMI from 47.9 to 48.9.

- The level of the index offers the most negative of the regional Fed manufacturing indicators, although we are yet to see Richmond or Kansas for September, whilst Friday’s MNI Chicago PMI also awaits.

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA down 89.18 points (-0.26%) at 33876.43

- S&P E-Mini Future down 3.5 points (-0.08%) at 4357.75

- Nasdaq down 12.9 points (-0.1%) at 13199.51

- US 10-Yr yield is up 10.4 bps at 4.5375%

- US Dec 10-Yr futures are down 16.5/32 at 108-5.5

- EURUSD down 0.0065 (-0.61%) at 1.0588

- USDJPY up 0.44 (0.3%) at 148.81

- WTI Crude Oil (front-month) down $0.26 (-0.29%) at $89.75

- Gold is down $9.49 (-0.49%) at $1915.73

- European bourses closing levels:

- EuroStoxx 50 down 39.79 points (-0.95%) at 4167.37

- FTSE 100 down 59.92 points (-0.78%) at 7623.99

- German DAX down 151.8 points (-0.98%) at 15405.49

- French CAC 40 down 60.94 points (-0.85%) at 7123.88

US TREASURY FUTURES CLOSE

- 3M10Y +12.082, -94.545 (L: -105.296 / H: -93.728)

- 2Y10Y +8.873, -59.161 (L: -66.781 / H: -58.753)

- 2Y30Y +11.565, -47.387 (L: -57.501 / H: -46.587)

- 5Y30Y +7.103, 3.537 (L: -3.413 / H: 4.815)

- Current futures levels:

- Dec 2-Yr futures down 0.125/32 at 101-9.5 (L: 101-08.875 / H: 101-11.25)

- Dec 5-Yr futures down 5/32 at 105-9.25 (L: 105-08.25 / H: 105-17.5)

- Dec 10-Yr futures down 16/32 at 108-6 (L: 108-04 / H: 108-25.5)

- Dec 30-Yr futures down 1-31/32 at 114-30 (L: 114-25 / H: 117-00)

- Dec Ultra futures down 2-24/32 at 119-29 (L: 119-23 / H: 122-19)

US 10Y FUTURE TECHS (Z3) Trend Condition Remains Bearish

- RES 4: 111-12+ High Sep 1 key resistance

- RES 3: 110-23+ 50-day EMA

- RES 2: 109-22/110-07+ 20-day EMA / High Sep14

- RES 1: 109-03/109-25+ Low Sep 13 / 20-day EMA

- PRICE: 108-13 @ 11:43 BST Sep 25

- SUP 1: 108-08 Low Sep 21

- SUP 2: 108-00 Round number support

- SUP 3: 107.23 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 107-05+ 1.382 proj of the Jul 18 - Aug 4 - Aug 10 price swing

Treasuries maintain a softer tone and gains are considered corrective. Last week’s move down resulted in a breach of 109-03, the Sep 13 / 19 low. This cancels a recent reversal signal - a hammer candle on Sep 13, and reinforces a bearish theme. A continuation lower would open 108-00 and 107-23, the 1.236 projection of the Jul 18 - Aug 4 - Aug 10 price swing. Key short-term resistance has been defined at 110-07+, Sep 14 high.

SOFR FUTURES CLOSE

- Dec 23 +0.005 at 94.535

- Mar 24 +0.005 at 94.615

- Jun 24 +0.005 at 94.785

- Sep 24 steady00 at 95.040

- Red Pack (Dec 24-Sep 25) -0.02 to -0.01

- Green Pack (Dec 25-Sep 26) -0.06 to -0.03

- Blue Pack (Dec 26-Sep 27) -0.095 to -0.065

- Gold Pack (Dec 27-Sep 28) -0.135 to -0.105

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00006 to 5.31745 (-0.00953 total last wk)

- 3M -0.00869 to 5.39112 (-0.00197 total last wk)

- 6M -0.01025 to 5.46926 (+0.01367 total last wk)

- 12M -0.01875 to 5.46688 (+0.06419 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $94B

- Daily Overnight Bank Funding Rate: 5.32% volume: $252B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.511T

- Broad General Collateral Rate (BGCR): 5.30%, $579B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $563B

- (rate, volume levels reflect prior session)

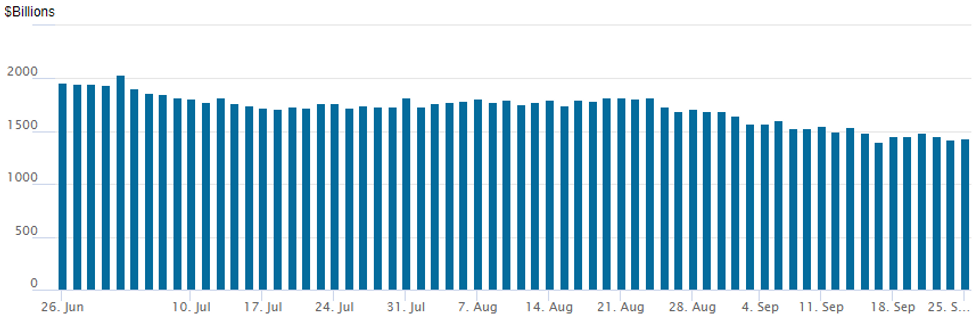

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation climbs to 1,437.310B w/99 counterparties, compared to $1,427.575B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE $1.65B ANZ Bank, $1.75B Credit Agricole Launched

- Date $MM Issuer (Priced *, Launch #)

- 09/25 $1.75B #Credit Agricole 6NC5 +170

- 09/25 $1.65B #ANZ Bank $1B 2Y +55, $650M 2Y SOFR+64

- Expected later this week:

- 09/26 $Benchmark SFIL 5Y SOFR +50a

- 09/26 $Benchmark Swedish Export Credit (SEK) 7Y SOFR +70a

- 09/26 $Benchmark Islamic Development Bank Sukuk 5Y SOFR +57a

- 09/?? $Benchmark Korea Land & Housing 2Y +100a

- 09/?? $Benchmark First Abu Dhabi Bank 10.5NC5.5

EGBs-GILTS CASH CLOSE: Long-End Rout

The German curve twist steepened while the UK's bear steepened Monday, with standout sell-offs at the long end.

- Higher energy prices (including a jump in European gas futures) and the continuation of the "higher for longer" theme for global rates continued to weigh, with steepening evident across European curves.

- The 30Y segment underperformed with yields up double-digits across the space: Buxl had one of its biggest selloffs this year and yields touched 3% for the first time since 2011. Gilt 30Y yields remain below the 2022 mini-budget highs though.

- BTPs underperformed EGB periphery peers, with the 30Y yield at a decade-high.

- Data had little apparent lasting impact. September German IFO was slightly better than feared but still pointed to a recessionary end to Q3.

- ECB Pres Lagarde repeated many of the talking points of last week's decision, while Schnabel explored the debate about what signal the growth and subsequent collapse in money supply aggregates were sending to central bankers.

- Tuesday's data docket is thin, but we get plenty of ECB speakers including Lane, Simkus, Muller, and Holzmann, with Eurozone CPI data eyed later in the week (MNI's preview will be out Tuesday).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.1bps at 3.237%, 5-Yr is up 1.5bps at 2.765%, 10-Yr is up 5.9bps at 2.798%, and 30-Yr is up 10.5bps at 2.998%.

- UK: The 2-Yr yield is up 1.3bps at 4.816%, 5-Yr is up 3.7bps at 4.401%, 10-Yr is up 7.4bps at 4.323%, and 30-Yr is up 11.3bps at 4.796%.

- Italian BTP spread up 0.9bps at 186.4bps / Spanish bond spread down 0.8bps at 107.2bps

FOREX USD Index Continues Ascent, Prints Fresh 2023 Highs

- The USD index has risen a further 0.35% on Monday, continuing its impressive upward trend and reaching fresh 2023 highs in the process alongside the bear steepening move along the treasuries curve which saw the 10 year yield rise 10bps to 4.53%.

- The key underperformer across G10 was the Euro, declining 0.6% and trading below the 1.06 handle for the first time since March 16. The recent clearance of 1.0632, the Sep 14 low, confirmed a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. Sights are on 1.0551 next, the Mar 16 low.

- Elsewhere, USDJPY continues to grind higher following Bank of Japan Governor Ueda sticking to a dovish script in his post-meeting address last Friday. The pair has narrowed in on 149.00 and market participants will be wary of any comments from the MoF as we make headway towards 150,00, a point of reference for some sell-side institutions regarding the potential for intervention.

- Interestingly, Ueda spoke again today and said it is important for foreign exchange rates to move stably reflecting economic and financial fundamentals.

- The Swedish Krona remains the G10 outperformer, defying weakness seen elsewhere amid the broad USD strength. As noted throughout the day, drivers for the SEK strength are the SBB cash injection from the weekend and the beginning of Riksbank FX hedging today.

- In emerging markets, the risk sensitive HUF was a notable laggard alongside the majority of Latin American currencies. With positioning likely playing a key part in today’s unwind, the Mexican Peso (-1.17%) and the Colombian peso (-1.81%) are the worst performers.

- A fairly light docket on Tuesday sees US consumer confidence and new home sales data cross. Later in the week, Eurozone CPI figures will be in focus.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/09/2023 | 0600/0800 | ** |  | SE | PPI |

| 26/09/2023 | 0700/0900 |  | EU | ECB's Lane speaks at CEPR conference | |

| 26/09/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/09/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/09/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/09/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/09/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/09/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 26/09/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/09/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/09/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 26/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/09/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/09/2023 | 1730/1330 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.